Williams Companies (WMB) is one of the largest publicly-traded midstream MLP companies, with a market capitalization of more than $15 billion and a double-digit dividend yield. The company, as we will see throughout this article, is one of the safest MLPs in the United States, as a result of the company’s COVID-19 actions and financial portfolio.

Williams Companies – Williams Companies

Williams Companies – By Design

Williams Companies has been focused, by design, on building up an incredibly strong and reliable portfolio of assets.

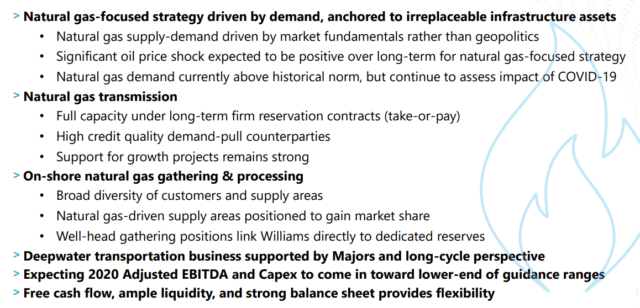

Williams Companies COVID-19 Overview – Williams Companies Investor Presentation

Williams Companies is a natural gas-focused company anchored to irreplaceable infrastructure assets such as the company’s Transco pipeline. As the company so clearly highlights, “Natural gas supply-demand driven by market fundamentals rather than geopolitics”. What this means is the company isn’t subject to the effects of COVID-19 or OPEC+ failing to reach a deal.

At the same time, the connection of the company’s assets to population centers means that the company has high credit quality customers, continued opportunities for growth, and the company has long-term reservations under take-or-pay contracts. The company controls every step in this value chain from gathering the natural gas to delivering it to population centers.

Other of the company’s businesses, such as its deepwater transportation business, is supported by the oil majors that have a long-cycle perspective. This is important because unlike shale oil, production in many different oil fields cannot just be turned off without risking damage to the field. One other important thing here, despite the liquidity we’ll discuss later, is that the company still expects to come in at the lower end of its guidance, so the company is not changing its guidance despite all this panic.

The company’s share price has dropped more than 40% YTD, however, the company is still expected to come in within its guidance range. This is prime evidence the market has overreacted.

Williams Companies Market Changes

The reason Williams Companies’ strength has continued is that the natural gas markets are not tied to the oil markets directly.

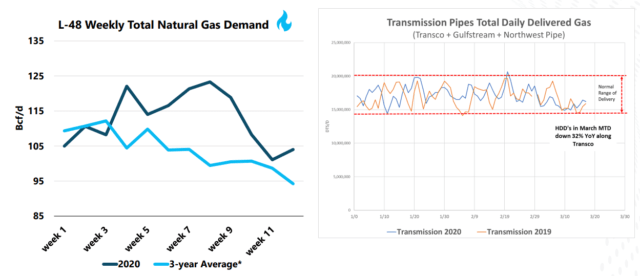

Williams Companies Natural Gas Demand Changes – Williams Companies Investor Presentation

The above image highlights total natural gas demand along with the company’s delivered natural gas along with its major pipelines. The company has, in fact, continued to perform above the 3-year average. That performance highlights how the oil industry isn’t intrinsically tied to the natural gas industry. More so, despite difficulties, it highlights the company’s business should continue to perform well.

Another important thing worth highlighting is that despite some near-term natural gas fluctuations, overall curves have actually increased. Oil curves have declined significantly, however, a significant part of Williams Companies’ business is isolated from this.

Williams Companies Market Exposure

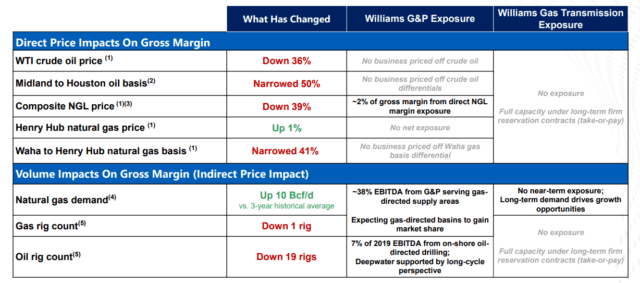

Taking a look at the company’s market exposure, we can see how the company’s portfolio is fairly isolated from the recent market movements.

Williams Companies Market Exposure – Williams Companies Investor Presentation

The above image shows what has changed along with the company’s exposure. Natural gas demand has actually gone up, with gas rigs decreasing slightly. The company has seen oil rigs drop significantly, which is to be expected, however, only 7% of the company’s 2019 EBITDA is from this. More importantly, the company’s deepwater is focused by longer term cycles.

The company has also seen NGL liquids drop significantly, and only 2% of the company’s gross margin is from direct NGL margin exposure. Putting this together, the company should only see, worst case, roughly a 3% decrease in the company’s EBITDA. That is still within the lower end of the company’s guidance, something the company has highlighted above.

This highlights how the company will be able to continue performing going forward.

Williams Companies Diversified Income and Customers

One area of potential concern, however, is that many of the company’s customers operate in both the oil and natural gas businesses.

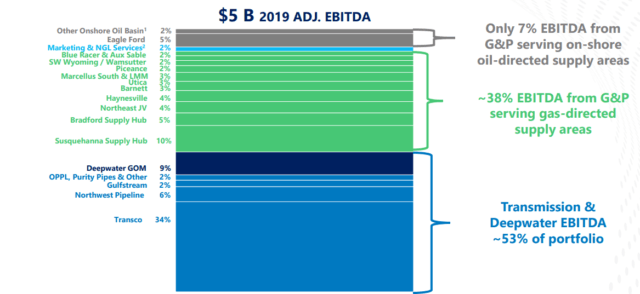

Williams Companies EBITDA Breakdown – Williams Companies Investor Presentation

The above highlights the components of the company’s $5 billion in 2019 adjusted EBITDA. As we discussed above, only a small part of the company’s EBITDA (9%) is at risk from the crash, especially when you account for the fact that all of that, not even the majority of it will disappear. At the same time, we can see the company has 38% of its EBITDA from G&P serving gas supplied areas (which have continued to do well).

Lastly, we can also see that a significant % of the company’s EBITDA comes from transmission-based assets. These transmission assets are incredibly important to the company’s EBITDA and performance.

Williams Companies Fee-Based Ratio – Williams Companies Investor Presentation

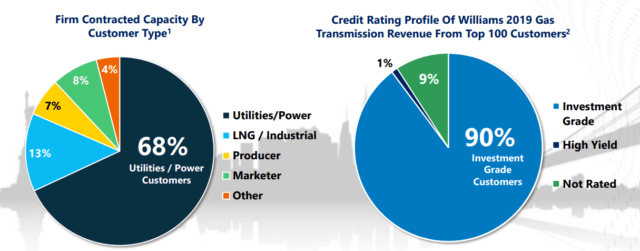

The company’s businesses paying this EBITDA, even if they have a difficult time, are incredibly strong. The company has a 98% fee-based capital, with 90% investment-grade customers. 9% is not rated (likely private companies) however, as is clear, the company’s overall portfolio and its ability to earn from customers are both strong. This is worth paying attention to.

At the same time, the company’s customers are incredibly strong and mostly isolated from the oil crash. 81% of the company’s customers are LNG, industrial, utilities, and power companies. Some small % of these industrial companies will have some difficulties due to the shutdown. However, utilities and power customers continue to be heavily in demand, as we saw above, natural gas demand has gone up.

The company’s diversified income and customers during this downturn are very strong, which will support the company’s EBITDA and earnings.

Williams Companies Liquidity

Lastly, if something unexpected does happen, Williams Companies has strong liquidity to manage the downturn.

Williams Companies Ample Liquidity – Williams Companies Investor Presentation

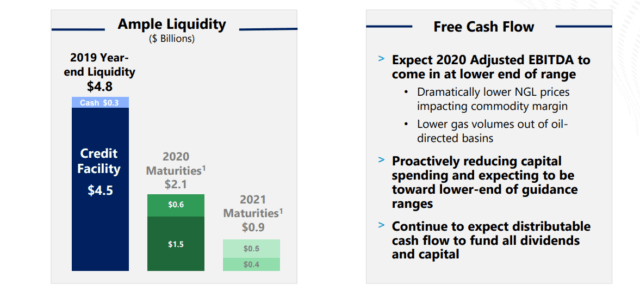

Williams Companies has a mere $3 billion in debt maturities from 2020-2021 and has $4.8 billion in total liquidity. The company can easily cover all of these maturities, while still having a significant $1.8 billion left. More importantly, this is a worst-case scenario where the company can’t roll over any debt. Even in a difficult market, given the company’s size, there will continue to be demand for its debt.

The company is expecting adjusted EBITDA to come in at the lower end of its range, as a result of dramatically lower NGL prices and lower gas volumes. However, in one of the worst and unprecedented crashes of all time, the company is still expecting to operate in its guidance, highlighting management’s strength. As a result, the company expects to continue to be able to cover all dividends and capital spending, something that indicates its financial strength.

At a double-digit dividend, even with no capital returns, the company is still a quality long-term investment.

Williams Companies Risk

Williams Companies is one of the lowest risk midstream companies, something worth paying close attention to. There is some risk here, namely in terms of lower production from customers that have tie ins to oil businesses, along with the company’s ties to deepwater production. However, as discussed above, and seen through the company’s COVID-19, the company’s risk is minimal.

Conclusion

Overall, Williams Companies’ guidance during the crash is just one more reason to be a big fan of the company. We already were confident about the company’s ability to handle the COVID-19 response, however, this recent guidance confirms that. Despite the recent uncertainty, the company still expects to come in in its guidance range, albeit on the lower end.

What’s most important here, and what we expected, is that the oil price collapse hasn’t quashed the oil markets, in fact, over the past few weeks, natural gas demand and pricing have actually increased. Worst case, Williams Companies has ~9% of its EBITDA at risk, although any losses will only be a percentage. The strong double-digit dividend and financial position make this company a quality investment.

The Energy Forum can help you build and generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Managed model portfolio to generate you high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic overviews of the oil market.

- Technical buy and sell alerts.

Disclosure: I am/we are long WMB. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment