Galeanu Mihai/iStock via Getty Images

This article first appeared on Trend Investing on March 15, 2022; but has been updated for this article.

2022 has been quite a shock to investors so far, with the S&P500 down about 7% from its peak and the NASDAQ down ~14%. A lot has changed in a short amount of time. Just as we appeared to be coming out of the COVID-19 pandemic, on February 24, 2022, Russia invaded Ukraine thereby starting the Russia-Ukraine war. My article is worth reviewing:

Feb. 14, 2022 – A Look At Some Winners And Losers If We Get A Russia-Ukraine War

If you moved fast you could have benefited from many short-term trends caused by the war. Key changes since the war began are higher prices for oil, uranium, nickel, palladium, iron ore, wheat and almost any commodity at risk of a major supply disruption from Russia and/or Ukraine. This opportunity may still be there for some months; however, the easy gains have already been made. Plus, there is risk of a price collapse if the war suddenly improves or resolves.

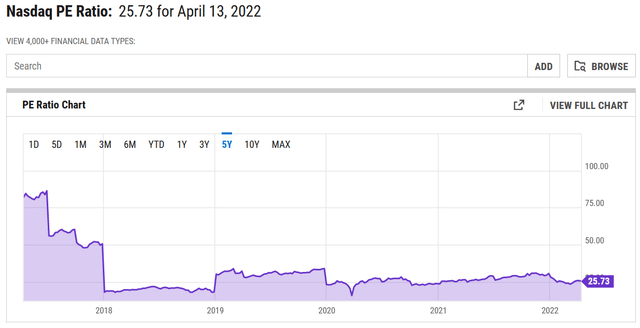

The Bloomberg Commodity Index (BCOM:IND) is up ~32% in 2022, now at 131.12

Bloomberg

Looking further ahead as to what may come next. The war impacts will lead to an overwhelming response from the West. The response will be to get ‘INDEPENDENCE FROM RUSSIA’ and to a lesser degree from China. Furthermore, to build up secure supply lines at home and from ally countries where needed. With this in mind below are my top 5 trends for 2022 and beyond.

Top 5 trends for 2022 and beyond as the West seeks to gain independence from Russia and other risky countries

For investors, the wisest opportunities are those trends that are likely to continue in 2022, even if we see an end to the war. Some of these may not be as popular as oil right now, but that means better buying prices. The following are some of those trends.

1. Rapid adoption of EVs and a huge demand wave for EV metals such as lithium, graphite, nickel, cobalt, manganese, magnet rare earths (Nd, Pr, Dy). Secure supply chains.

The best thing about the electric vehicle (“EV”) trend is that it gets stronger and stronger each year. The bonus is that the EV trend does even better if oil prices move higher as consumers are more incentivized to switch from an ICE vehicle to an EV.

EV demand in 2022 is growing stronger by the day, which is causing EV waiting lists of 1 year or longer.

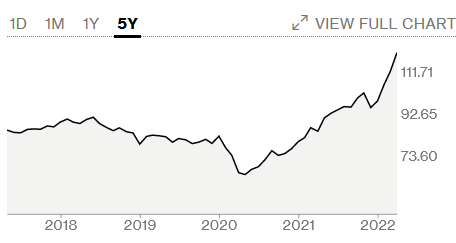

Stronger EV demand means more demand for EV metals. We have seen lithium prices almost double in 2022 and nickel prices double in the past year.

Further reading

Stocks/ETFs to consider

- Tesla (TSLA), BYD Co [HK:1211] (OTCPK:BYDDF) (OTCPK:BYDDY), XPeng [HKG:9868] (XPEV), Global X Lithium & Battery Tech ETF (LIT), Amplify Lithium & Battery Technology ETF (BATT), VanEck Vectors Rare Earth/Strategic Metals ETF (REMX).

- For EV metal miner stocks see my recent articles in Trend Investing, particularly “Top 5 North American Lithium Miners To Consider” and “European Junior Lithium Miners To Consider“.

- The IEA Forecasts 2020 To 2040 Total Demand Increases Of Lithium 13x To 42x, Graphite 8x To 25x, Cobalt 6x To 21x, Nickel 7x To 19x, Manganese 3x To 8x, Rare Earths 3x To 7x, And Copper 2x To 3x

Nickel prices surged initially on concerns of loss of Russian supply and a short squeeze that caused the LME to halt nickel trading

2. Renewable energy and energy security & independence (to help get the world off fossil fuels and being dependent on oil nations such as Russia)

Perhaps the number one concern globally right now for consumers is oil/gasoline prices rising. It leads to higher cost inputs and inflation. That leads potentially to rising interest rates, which then leads to mortgage stress and can lead to a recession as consumers slow their discretionary spending.

This means the number one thing the world can do to help is accelerate the transition to green energy and EVs, ideally securing a safe and secure supply chain. Green energy adoption will mean massively and rapidly ramping up solar, wind, geothermal, hydro and other forms of green energy. Energy storage is also a key driver in helping make intermittent energy work.

Countries such as many of those in Europe, such as Germany, will likely move rapidly towards new energy sources to diversify away from their dependence on Russian supply.

ETFs to consider

- iShares S&P Global Clean Energy Index ETF (ICLN), Invesco Solar ETF (TAN), First Trust Global Wind Energy (FAN), Global X Renewable Energy Producers ETF (RNRG)

Further reading

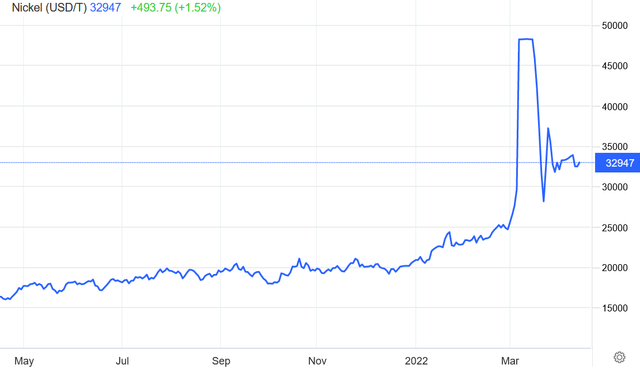

3. Base load energy will require nuclear & uranium to get off polluting coal ASAP

Apart from hydro, arguably the best base load energy is small nuclear plants. If we agree nuclear energy is needed to get off coal and gas then the next issue is uranium. Russian largely controls the uranium market (41% of supply from Kazakhstan and 6% from Russia). This means the western world needs to build up its own safe and secure supplies of uranium.

The U.S. is quite reliant on uranium with 19% of the electricity grid and a significant part of its navy being nuclear powered. The USA has made some preliminary moves over the past 2 years to support a domestic uranium supply and to build up a uranium reserve.

I think uranium demand will be strong this decade supporting uranium contract prices at or above US$50/lb, and there is opportunity for western miners to fill the supply gap. Today the price is US$64.50/lb due to supply disruption fears. Of course, if Russia/Kazakhstan were to ban exports we may see prices over US$100/lb.

Stocks/ETFs to consider

- Global X Uranium ETF (URA), North Shore Global Uranium Mining ETF (URNM), Cameco Corporation [TSX:CCO] (CCJ), Energy Fuels (UUUU), Ur-Energy [TSX:URG] (URA), Western Uranium & Vanadium Corp. [CSE:WUC] (OTCQX:WSTRF).

Number of operable nuclear reactors worldwide as of October 2021, by country

4. Adequate food supply for the world

Regardless of what happens next in the Russia-Ukraine war, the world will need an ever-increasing amount of food each year to feed an ever increasing population. If the war deteriorates, we can expect a potential shortages of grains, especially wheat, as Russia-Ukraine produce about 25% of global wheat production. One option to invest into an ETF that invests into the wheat futures market is Teucrium Wheat Fund (WEAT).

I would be more inclined to take a broader view and invest in the Teucrium Agricultural Fund (TAGS) to gain exposure to the four key global staple foods – Wheat, corn, rice, and soybean.

One company that is a large US producer of both wheat and soybeans is Archer-Daniels-Midland (ADM) on a PE of 17.88.

For those wanting to take more of a niche approach then take a look at new food technology companies, seed companies, natural herbicide/pesticide companies, fertilizer companies and even water related stocks/ETFs. The countries with the most water are (in order) Brazil, Russia, and USA. Water is key for agriculture and also for hydro-electricity, making it twice as important.

Stocks/ETFs to consider

- Invesco DB Agriculture ETF (DBA), Agriculture Total Return Sub-Index ETN (JJA), Teucrium Agricultural Fund (TAGS), Teucrium Wheat Fund (WEAT), Teucrium Corn ETF (CORN), Teucrium Soybean Fund (SOYB), Invesco Water Resources Portfolio ETF (PHO), Invesco S&P Global Water Index ETF (CGW)

Further reading

5. Technology to continue to thrive in a modern world.

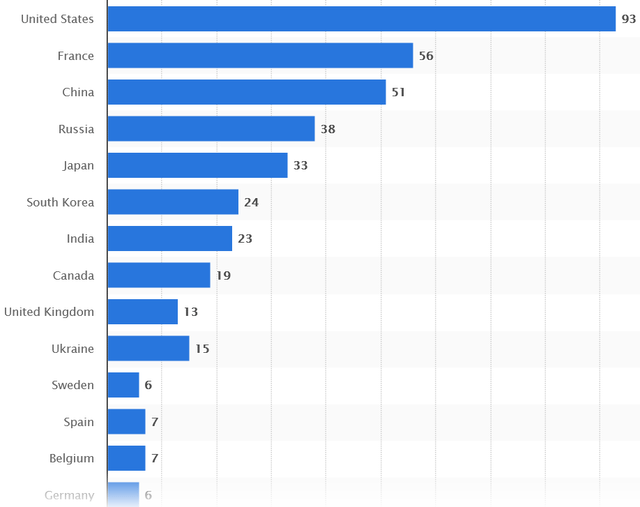

Generally speaking, the technology sector has not been directly impacted yet by the war, except indirectly via the crash in technology stocks. Tech stock valuations in 2022 have fallen dramatically as sentiment collapsed and high inflation looks set to cause interest rates to rise.

Wars generally lead to new advancements in technology and can be good for the sector.

I have written previously on numerous technology trends such as Artificial Intelligence (“AI”), 5G, IoT, cloud computing, etc (see linked articles below).

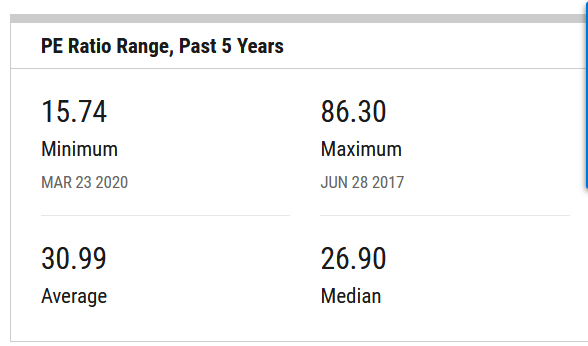

What has changed the most recently is the valuation of tech stocks has absolutely plunged. Yes many SaaS companies were wildly overvalued, but looking at the NASDAQ index today valuation is far more appealing than even just 2 1/2 months ago. Back on December 31, 2021 the NASDAQ average PE was 29.79, and is now 25.73. The NASDAQ Index has fallen 14% from its recent all time high when the PE was 31.02 on Nov. 5, 2021. If we look at the past 5-year average for the NASDAQ PE it is 30.99, making today’s figure of 25.73 look more attractive.

The core fundamentals of the U.S technology sector have not significantly changed and the strong longer-term growth outlook remains. Some smaller issues that are impacting tech are privacy concerns notably for social media giant Meta Platforms (FB) and some concern that President Biden will introduce higher company tax rates.

The NASDAQ PE has fallen significantly in 2022, now well below its past 5-year average and just below its 5-year median

The technology sector always seems to bounce back very strongly after a correction so investing in the NASDAQ is one way to potentially capture this. It should be noted that the NASDAQ is really a tech heavy index, but it also gives exposure to other sectors/stocks listed on the NASDAQ exchange.

The NASDAQ Index encompasses 2,500 stocks. Wikipedia explains: “The composition of the NASDAQ Composite is heavily weighted towards companies in the information technology sector.”

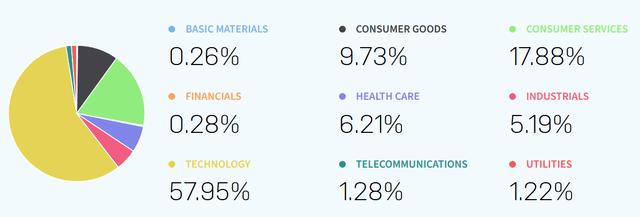

Many investors choose the biggest NASDAQ stocks – the Nasdaq-100, which includes 100 of the largest non-financial companies in the NASDAQ Composite, and accounts for over 90% of the movement of the NASDAQ Composite. The NASDAQ-100 is about 59% tech stocks and stocks from other sectors.

NASDAQ-100 sector breakdown

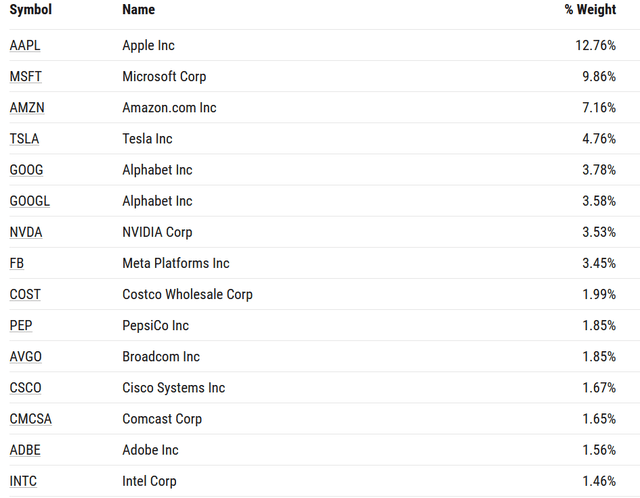

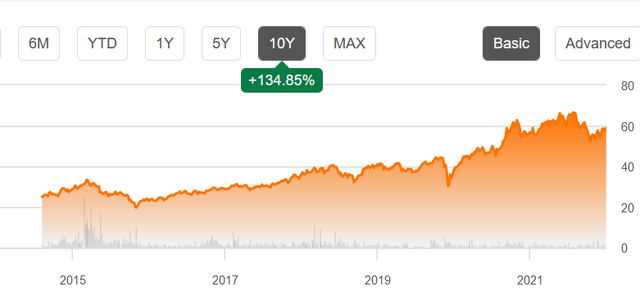

The Invesco QQQ ETF is the most popular way to invest in the NASDAQ-100. QQQ currently has a PE of 28.19. As shown in the chart below buying QQQ after a dip has always been very well rewarded in the past 10 years.

Invesco QQQ ETF – NASDAQ-100 (QQQ) 10-year price chart – Price = USD 346.35

QQQ ETF – Top holdings

Looking ahead in 2022, perhaps the cybersecurity sector will get a boost due to the Russian risk. Interestingly the ETFMG Prime Cyber Security ETF (HACK) has not jumped higher yet on Russian hacking fears, so some potential there to benefit even if Russia goes on an all out hacking attack on the USA and the Western allies. HACK trades of a PE of 24.9. Another is First Trust Nasdaq Cybersecurity ETF (CIBR) which trades on a PE of ~28.

ETFMG Prime Cyber Security ETF (HACK) 10-year price chart – Price = USD 58.97

Stocks/ETFs to consider

- Invesco QQQ ETF – NASDAQ-100 (QQQ), Defiance Next Gen Connectivity ETF (FIVG), ROBO Global Artificial Intelligence ETF (THNQ), Global X Robotics & Artificial Intelligence Thematic ETF (BOTZ), ETFMG Prime Cyber Security ETF (HACK), First Trust Nasdaq Cybersecurity ETF (CIBR)

Further reading

Other trends – Secure supply chains and closer sources of supply

A key new trend is security of supply chains across all trends mentioned above. The West increasingly wants secure, safe, and reliable supply chains from their own country or an ally country. The other new trend is to get supply chains as close as possible to the production/factory location.

We have seen Tesla do this in China. Tesla is looking to build local EV metals supply chains for their USA factories with deals such as the lithium supply deal with Piedmont Lithium [ASX:PLL] (PLL) and nickel supply deal with Talon Metals [TSX:TLO] (OTCPK:TLOFF). An ally deal was Tesla’s recent lithium supply deal with USA ally Australian lithium junior Core Lithium [ASX:CXO] (OTCPK:CXOXF) as well as a recent lithium supply deal with Australia’s Liontown Resources [ASX:LTR] (OTC:LINRF). Also the nickel supply deal with Australia’s BHP Group (BHP). Volkswagen Group [Xetra:VOW](OTCPK:VWAGY) (OTCPK:VLKAF) did a lithium supply deal with Vulcan Energy Resources [ASX:VUL] who has a Germany based geothermal lithium project.

The lesson from the above is that it is now safer and wiser to choose EV metal miners or battery/cathode/anode manufacturers that offer secure supply, ideally near the EV manufacturing factory.

Choosing EV metal miners from high risk countries such as Russia or DRC carries much higher risk now than ever before. It also means EV metal miners in safe countries (Australia, Canada, USA, parts of Europe, UK) will carry a premium.

Further reading

- White House: FACT SHEET: Securing a made in America supply chain for critical minerals

- Senators urge Biden to invoke Defense Act for battery materials

Safe havens

For those wanting to consider investing into a safer area just in case the Russia-Ukraine war gets much worse, consider the following:

- Cash, gold ETFs or companies, commodity ETFs (Invesco DB Commodity Index Tracking Fund (DBC), iron ore miners (BHP Group (BHP), Vale (VALE), Rio Tinto (RIO), and Fortescue Metals Group [ASX:FMG] (OTCQX:FSUGY)), and countries that do well if commodities rise such as Canada, Brazil, and Australia.

Note: Most commodity funds are heavy energy (particularly oil) which may fall heavily if we get a sudden Russia-Ukraine peace deal.

Note: Vale in particular looks appealing given their exposure to iron ore and being the world’s largest nickel producer. Vale trades on a very attractive 2022 PE of 4.75. Fortescue Metals Group [ASX:FMG] also looks attractive on a 2022 PE of 8.26.

Further reading

Conclusion

Trend Investing is more an art than a science and timing is a key factor to consider. Sometimes if you are quick you can capture a new short-term trend such as many of those caused by the current war in Ukraine. This would mean buying into oil and commodities the day the invasion began on February 24, 2022, or in the weeks beforehand. This is certainly worthwhile but timing has to be spot on and you must move fast.

Other trends take a decade to play out and require some patience and you usually get several great buying opportunities when the market has crashed or temporarily lost interest in the trend.

In this article I have attempted to discuss trends that should not collapse the moment the war is over or fades from the headlines. Also, in many cases some of these trends have fallen to the background as war, security of supply chains, and investor pessimism and fear (48.4% bearish) have recently taken over.

My top 5 trends for 2022 and beyond are:

- Rapid adoption of EVs and a huge demand wave for EV metals.

- Renewable energy and energy independence.

- Base load energy will require nuclear & uranium to get off polluting coal ASAP.

- Adequate food supply for the world.

- Technology to continue to thrive in a modern world.

The other key trend that we are now seeing is secure supply chains and closer sources of supply.

Most of the trends are now impacted by the Russia-Ukraine war and the need to become independent from Russia. Global supply chains and goods & services are rapidly being disrupted and redirected. The winners will be those countries that can offer safety and security, with stable governments enforcing the rule of law.

Welcome to the new world which began in 2022! As usual all comments are welcome.

Be the first to comment