nito100/iStock via Getty Images

Overview

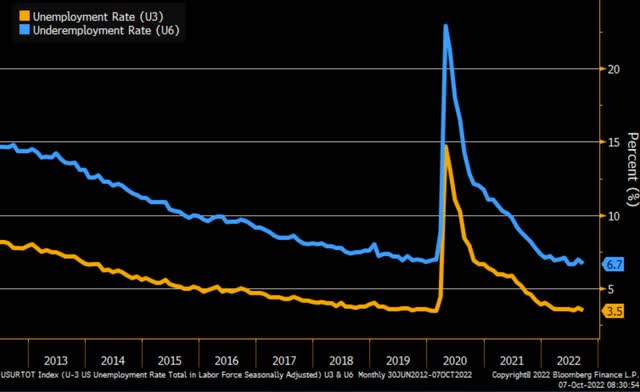

I began writing this piece before Friday’s Jobs Report, anticipating figures in line with forecasts of the addition of 260,000 jobs and a 3.7% unemployment rate. Despite 4.2 million separations and 1.5 million layoffs, according to the Bureau of Labor Statistics (BLS) data, the market took a blow on hotter-than-expected numbers, including a slight uptick, with 263,000 jobs and a fall in unemployment claims, for a 3.5% rate.

Unemployment Chart (Bloomberg Finance L.P.)

With stocks plunging, the Fed should maintain its hawkish stance, consistent with a 75-basis point hike. However, with a one-month lag in reporting and the November 2 FOMC meeting around the corner, it’ll be interesting to see if the lag in unemployment claims is likely to increase and close the gap in the number of jobs for September. In anticipation of this and a market that has already crushed tech and growth stocks, I believe now is a good time to focus on these stocks with strong analyst upward revisions in hopes of taking advantage of a rally. Notably, many investors are investing for the long term and taking advantage of the market dip. According to SA Senior Quantitative Strategist Zach Marx, CFA,

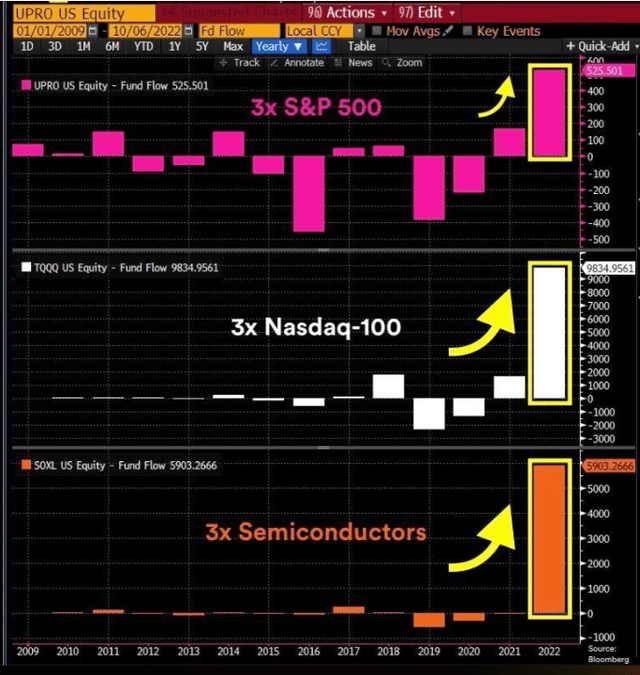

“Three of the biggest 3x Leveraged ETFs have already taken in more money (net inflows) this year than ever before. And we still have 2+ months to go. What is this telling us? Despite record levels of short selling, we are seeing a MASSIVE amount of money going into long leveraged products – meaning investors continue to buy (what they think is) the dip.”

3x Levered ETF Fund Flow Comparison (UPRO, TQQQ, SOXL)

3x Levered ETF Fund Flow Comparison (Bloomberg)

November Mid-term Elections: What Now?

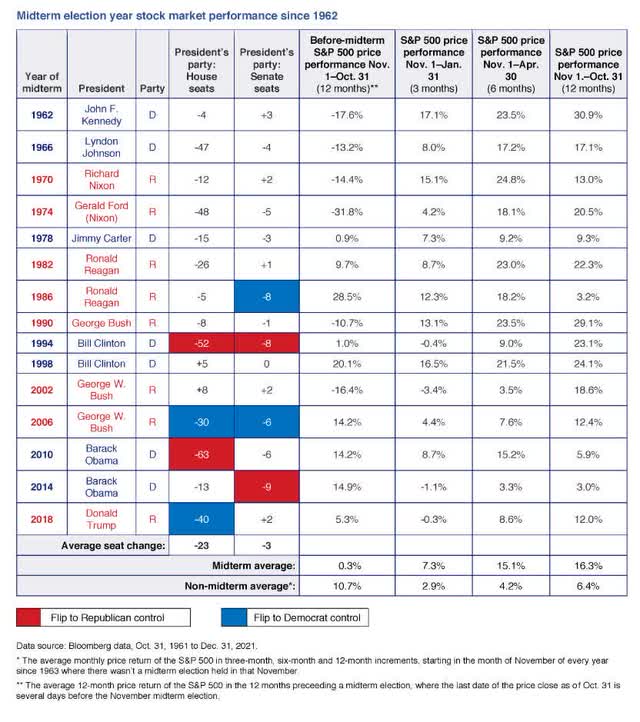

Although the markets are responding negatively to the jobs report, reactions are in line with an anticipated hawkish response by the Fed, given better-than-expected numbers. And while September and October live up to their historically seasonal trend of volatility, September’s ‘worst month of the year for stocks’ reputation superseded expectations, closing the month with the DJIA -9.2%, down nearly 3,000 points, with the S&P 500 and Nasdaq with a 10% loss for the month. As it currently stands, the indexes are on track for one of their worst years, with the DJIA, S&P, and Nasdaq down YTD 20%, 24%, and 33%, respectively. But November is approaching, a month that historically sees a rally, particularly in an election year.

With almost daily changing macroeconomic conditions and midterm elections around the corner, the markets hope to see a strong end of the year following election results, as has been the case in the past. According to CFRA Research, in midterm years since 1945, the S&P 500 has experienced an average gain of 2.5% for October, 2.4% in November, and 1.4% in December. “Therefore, history says, but does not guarantee, that we could see an extended rebound from the current downturn,” says Sam Stovall, CFRA’s chief investment strategist. And while monetary policy has little impact on economic growth, it mostly impacts the prices of assets by inflating them. With the midterm election expected to tilt both the House and Senate to the GOP, an indication of little to no fiscal stimulus over the next two years, one of the biggest influences on stock market performance during midterm elections has been the health of the economy. Given the current bear market environment and recessionary outlook, many factors affect the markets. The table below showcases midterm election S&P 500 performance since 1962.

Midterm Election Year Stock Performance Since 1962 (Bloomberg Data – U.S. Bank)

U.S. Bank analysis states, “The late 1960s and 1970s were a time of slow economic growth marked by high unemployment, rising energy prices, and significant inflation. If you exclude the five midterm elections in the 1960s and 1970s, the average S&P return for pre-midterm election years is 8.1%—roughly in line with the average annual S&P 500 performance. Since then, the economy has grown steadily, with accommodating central bank policy keeping inflation low. This suggests that a healthy overall macroeconomic environment carries greater weight than any policy uncertainty.”

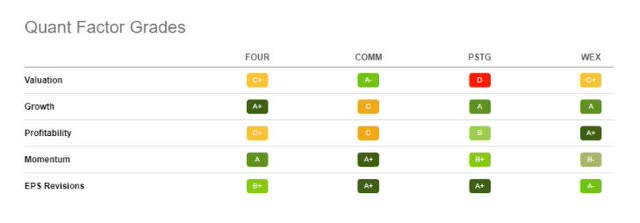

We may not be able to predict what will move the markets, what will trigger a rally, or if there will be one on the heels of midterm elections. But Seeking Alpha’s Quant Ratings and Factor Grades System provide powerful cues to help investors quickly identify stocks with strong fundamentals, improving growth and rising analysts’ confidence. Stocks with shared traits of value, growth, profitability, rising earnings revisions, and momentum are best equipped to withstand a pullback and help investors to minimize risk.

Quant Grades Display Strong Fundamentals On A Sector Relative Basis

Quant Grades Display Strong Fundamentals On A Sector Relative Basis (Seeking Alpha Premium)

Earnings expectations are crucial when determining whether a stock’s price may rise or fall when it comes to actual reported earnings because the market is forward-looking. Stocks with upward analyst revisions are expected to outperform, versus analysts revising a stock down. As I’ve written in the past, heed the warnings. Stocks that have been downgraded by analysts may turn out to be the Biggest Losers. I have selected four stocks that offer tremendous analyst upward revisions, outperforming their benchmarks and possessing solid SA Quant Revisions and EPS. Check out our top four tech stocks below.

4 Software and Cloud Computing Stocks for a Potential Rally

Technology makes the world go-’round, and while one of my favorite tech industries is semiconductors which have been recession- and inflation-resilient over the last year, the latest news restricting China from developing and exporting semiconductors is showcasing the industry’s downside. And while chips are essential components for countless industries, diversification is key when investing, especially when selecting growth and tech stocks in a rising rate environment. What better opportunity than software and cloud-based stocks to limit some of the geopolitical risks involved with supply chain constraints, potential inventory build-up, export restrictions, and the strengthening dollar?

The strengthening dollar is attractive if you own U.S.-based companies, but falling currencies abroad impact business. Technology requires parts that are becoming more costly as we see pricing parity no more. But software requires fewer people and moving parts to profit, so I have selected five software and cloud computing stocks as the way to go. The return on these stocks compared to the overall IT sector and broad market are a sign they have stronger fundamentals for the current environment.

Sector and Market Beating Total Returns

Sector and Market Beating Total Returns (Seeking Alpha Premium)

A focus on U.S.-based software and cloud-based companies will not have nearly the amount of inventory build-up problems posed by inflation or supply chain constraints posed by the strengthening dollar, which, as we’re already seeing, plans to decrease exports. Companies are likely to cut costs by seeking out similar tech products and services at cheaper prices that tend to be foreign-based that may lack quality. The cost savings will be attractive to them since they won’t have to compete with the dollar. Because software-as-a-service (SaaS) and cloud computing deliver applications and services via virtual or electronic means through the internet, investing in these types of companies can help limit the overhead and negative impacts of macroeconomic headwinds. By focusing on companies with solid growth, profit margins, and strong analyst upward revisions, stocks like my four picks may prove lucrative for your portfolio.

1. WEX Inc. (WEX)

-

Market Capitalization: $6.35B

-

Analyst Up Revisions (last 90 days): 16

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/10): 42 out of 640

-

Quant Industry Ranking (as of 10/10): 5 out of 69

Fintech company WEX Inc. operates through three segments to simplify the running of businesses by streamlining how you pay and receive payments. Its three segments include Fleets, Corporate Payments, and Health & Employee Benefits. From WEX fuel cards to automate fleet management, spending, and the integration of electric vehicle (EV) management, to B2B payments and other corporate payment solutions, to aiding third party administrators for easy reimbursement and billing of employee benefits, WEX is a global leader in financial technology.

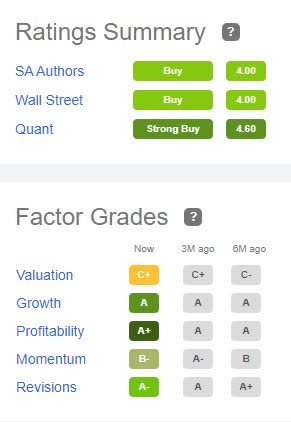

WEX comes at a discount, with a forward P/E ratio of 10.89x and a forward PEG of 0.99x, both more than a -25% difference to the sector, the stock’s other factor grades are very attractive.

WEX Stock Ratings & Factor Grades (Seeking Alpha Premium)

Factor grades rate investment characteristics on a sector-relative basis. WEX’s Profitability Grade is an A+, its growth a solid A, and Revisions are a B-, indicating the stock has a tremendous outlook.

WEX’s business model offers long-term contracts that allow it to generate consistent revenue growth. As JP Research writes:

“WEX is one of the best fintech plays out there, offering investors exposure to a highly scalable platform at the epicenter of the cash-to-card migration trend…WEX’s pricing power also allows it to take annual 1% to 2% price increases with limited resistance from clients – a particularly crucial element given the current inflationary backdrop. Plus, WEX operates a payment network that scales.”

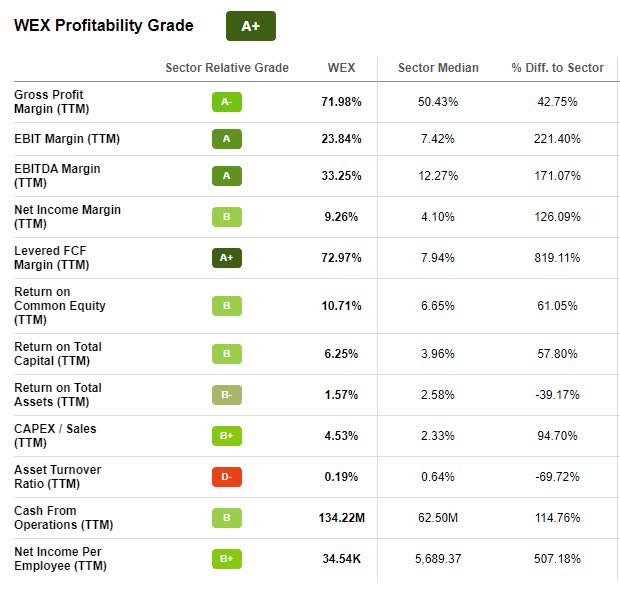

WEX Stock Profitability Grade (Seeking Alpha Premium)

With excellent financials and $134.22M cash from operations, trailing gross profit margins of 71.98%, and four quarters that have +$2B in revenue, it’s clear that WEX is focused on growing and increasing its footprint, as it benefits from digital tailwinds. EPS of $3.71 beat by $0.25, and revenue of $598.24M beat by more than 30% YoY. Purchase volume increased 77% YoY to $37B, and the tremendous results led to the company raising full-year guidance by $90M at the midpoint and authorizing up to a $150M share repurchase program.

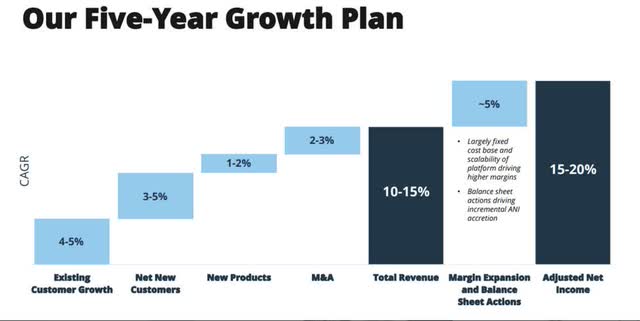

WEX Five Year Growth Plan (WEX Investor Deck 2022)

With a five-year growth plan in place and tremendous figures, its Strong Buy quant rating should be no surprise. Following the latest earnings results, 16 analysts revised earnings up, with zero downward revisions. With its diversified business model that allows it a competitive advantage, a cash hoard for targeted M&A, and pricing power, this stock has all the characteristics of the perfect storm of a SaaS company offering payment solutions in the money-making channels people love to invest. If interested in another software-as-a-service company that’s a global leader in Fintech, check out this next stock.

2. Shift4 Payments, Inc. (FOUR)

-

Market Capitalization: $3.72B

-

Analyst Up Revisions (last 90 days): 11

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/10): 39 out of 640

-

Quant Industry Ranking (as of 10/10): 3 out of 69

Another software company offering cloud-based solutions that integrate payment processing, mobile wallets, and point-of-sale (POS) solutions anywhere in the world is Shift4 Payments, a global leader in FinTech.

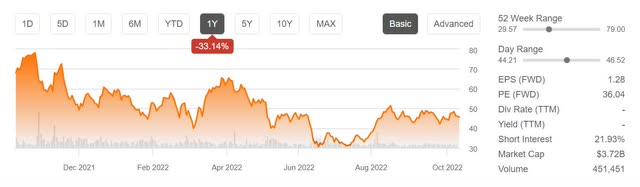

Shift4 Payments 1yr Price Performance

Shift4 Payments 1yr Price Performance (Seeking Alpha Premium)

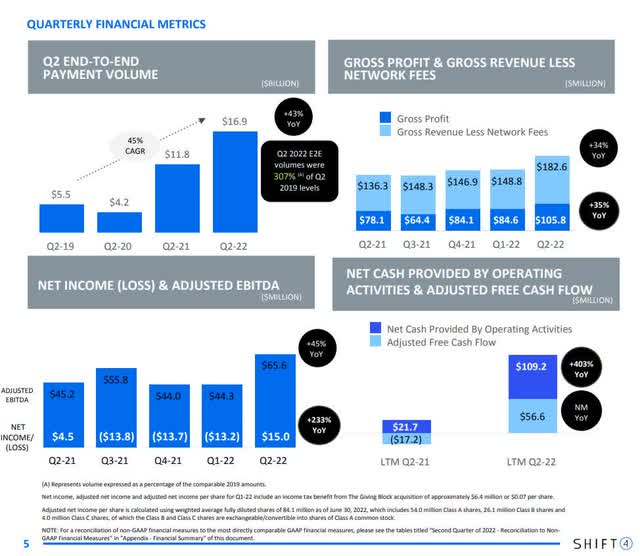

Like much of the tech sector, FOUR stock has experienced declines, including -23% YTD and -33% over the last year amid macro uncertainty. Despite its fall in share price, the stock has managed to maintain strong financials that showcase robust (A+) growth and an adjusted EBITDA margin for 2022 Q2 that increased by 36%. YoY operating cash flow growth is an A+ at 403.23%, a more than 12,000% difference to the sector. With nearly $110M in cash from operations and robust 43% YoY volume growth, the company has managed to be relatively unaffected by macro factors.

Shift4 Payments Q2 2022 Financial Results

Shift4 Payments Q2 2022 Financial Results (FOUR Q2 2022 Investor Presentation)

Although FOUR competes against larger payment processors like PayPal (PYPL) and Square (SQ), their shrinking earnings, coupled with PayPal’s backlash over its misinformation policy, could lead customers to find an alternate payment processor, benefitting the likes of FOUR. Over the last 90 days, 11 analysts have revised up. Second quarter EPS of $0.33 beat by $0.09, and revenue of $506.70M beat by $30.36M.

“I want to emphasize our belief that unlike some of our peers, we are not completely at the mercy of the broader economy, our gateway and software-only merchants provide a highly unique asset and that we can grow exponentially without even adding a new customer…Our growing library of software integrations results in more links in the value chain to deliver a lower effective cost of service to our customers…they no longer need to depend on a multitude of other costly vendors to attempt to achieve a comparable solution,” said Jared Isaacman, FOUR CEO.

Despite market uncertainty, FOUR is globalizing its business through acquisitions and allowing its platform to enter new popular and diversified verticals and take advantage of the ever-changing virtual environment. The stock comes at a relative discount with an overall C+ valuation grade, offering a forward PEG of 0.32x, a -76.49% difference to the sector. Despite many cloud-based and software stocks tanking at the beginning of the year as investors feared high interest and inflation, some investors capitalized on bargain basement prices. Suppose you haven’t gotten in on the action and want in on some action now, despite the cloud index -50% YTD. In that case, the demand for services amid digital transformation for businesses may prove fruitful for investors willing to consider this Strong Buy pick, along with others throughout this article.

3. Pure Storage, Inc. (PSTG)

-

Market Capitalization: $8.45B

-

Analyst Up Revisions (last 90 days): 18

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/10): 38 out of 640

-

Quant Industry Ranking (as of 10/10): 3 out of 30

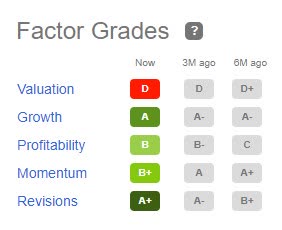

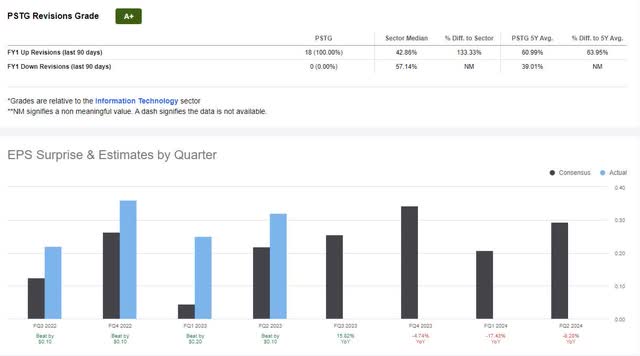

Innovative and cloud-based technology platform Pure Storage, Inc. offers software-driven storage solutions using artificial intelligence and pure technology. PSTG’s overall factor grades are attractive despite trading at a relative premium.

PSTG Factor Grades (Seeking Alpha Premium)

Although its share price is -14% YTD, the stock is trading at $27.30 per share, with strong momentum that outperforms its sector peers quarterly. Over the last year, the stock is +8% and has beaten top and bottom line results for 11 consecutive quarters, resulting in the company raising FY 2023 revenue guidance.

PSTG Revisions & EPS (Seeking Alpha Premium)

The latest earnings resulted in an EPS of $0.32, beating by $0.10, revenue of $646.77M being by more than 30% YoY, and gross margins of 70.4%, resulting in 18 FY1 Up revisions.

With its unique storage-as-a-service model across multiple clouds, PSTG’s modern applications, operations, and infrastructure have allowed it to continue its customer acquisitions and helped drive growth, giving better-than-anticipated results for Q2. Product gross margins resulted up 69% for the quarter, and subscription services gross margins by nearly 73% without passing on higher prices to consumers, given the inflationary environment.

“Our U.S. business continues to deliver strong revenue growth, growing 31% with particular strength this quarter in both commercial and public sector. Revenue growth of 29% from our international business was also strong, even with FX headwinds due to the strengthening of the U.S. dollar. We continue to be pleased with meaningful contributions from new business,” said Kevan Krysler, Pure Storage CFO.

Although Pure Storage may experience some headwinds amid rising prices, inflation, and a strong USD, there is still a secular opportunity for Pure Storage to capitalize on. As it’s ~14% decline YTD already showcases a major beat compared to the broader markets, especially tech and the fact that PSTG is largely software-driven, which limits the number of parts and potential headwinds it may face that eat into the growth and profits for many tech companies. If you want a more hardware-focused tech stock, consider the next pick, or you can find small and mid-cap quant ranked Top Communication Equipment Stocks.

4. CommScope Holding Company, Inc. (COMM)

-

Market Capitalization: $2.39B

-

Analyst Up Revisions (last 90 days): 10

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/10): 1 out of 640

-

Quant Industry Ranking (as of 10/10): 1 out of 51

My final stock pick is on a bullish trend and experienced a 10% share price jump after Credit Suisse upgraded the stock citing ‘multi-year tailwinds’ ahead of it. CommScope Holding Company is a Strong Buy rated communications equipment stock worth considering for a portfolio. Offering wireless and broadband technologies, CommScope offers advanced networks that design, manufacture, install and support the hardware and software intelligence for our digital society. With end-to-end solutions, where technology has experienced a -32% YTD decline (XLK), COMM has managed a mere -4.18% decline.

Technology Select Sector SPDR ETF (XLK) vs. (COMM) YTD Performance

![Technology Select Sector SPDR ETF [XLK] vs. [COMM] YTD Performance](https://static.seekingalpha.com/uploads/2022/10/10/50113560-16654590327574904.jpg)

Technology Select Sector SPDR ETF [XLK] vs. [COMM] YTD Performance (Seeking Alpha Premium)

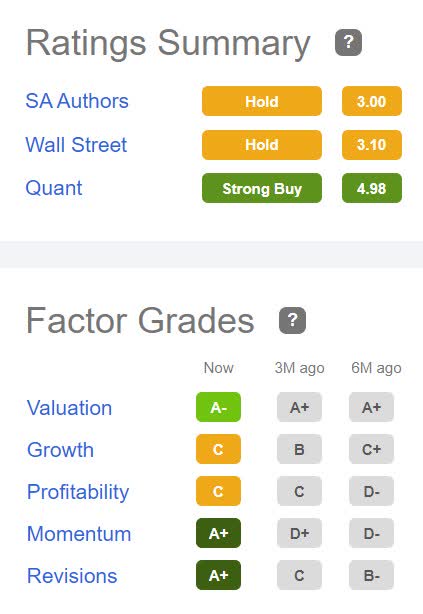

Ranked #1 in its sector and industry, in addition to stellar EPS revisions, COMM also comes at an attractive valuation and has solid growth and profitability.

COMM Ratings & Factor Grades (Seeking Alpha Premium)

With three consecutive earnings beats, I’ve selected COMM as one of my top 4 tech stocks, given the rise of remote work and the greater need for broadband infrastructure.

“When combining the dollar amounts of announced government programs, we find that ~$2.2B/year will be made available over each of the next 5 years for broadband infrastructure equipment providers…We conclude that COMM is likely the key multi-year beneficiary of this funding due to their product set relevance to broadband projects…it’s likely that CommScope Holding is able to generate 3.4% and 4.7% revenue growth in fiscal 2023 and 2024, with earnings growth of 42.4% and 24.5%, respectively,” writes Sami Badri, senior equity analyst at Credit Suisse.

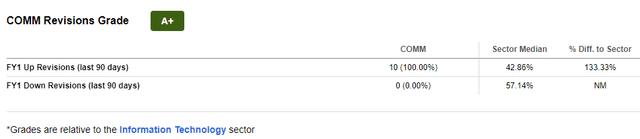

COMM’s A- valuation is attractive, with a forward P/E ratio of 6.89x, a -59.14% difference to the sector. Although it’s trading near its 52-week high, COMM’s PEG ratio of 0.30x is a -77.81%, a clear indication of its discounted price. Additionally, solid growth, A+ momentum, stellar revisions, and Q2 earnings offer hope of raised guidance. With a 2022 Q2 EPS of $0.41 beating by $0.12 and revenue of $2.30B beating by 5.26% year-over-year, ten analysts gave FY1 Up revisions over the last 90 days.

COMM Revisions Grade (Seeking Alpha Premium)

Despite the selloff in tech stocks and some inflation pressures that are affecting costs, margins, and operating efficiencies, demand for CommScope products remains high, with a backlog that has grown 5% since Q1. With strong sales that included Connectivity and Cabling Solutions or CCS +18% and fiber business net sales +39% for Q2, analysts see positive results, hence upward revisions. Revisions offer investors important forward-looking cues about whether a stock’s price may rise or fall. With tremendous market tailwinds to support COMM’s growth, and Strong Buy rating, now may be the time to get in on the potential action. Where many companies in this environment can come with depressed valuations and risk, beaten-down stocks that trade at a relative discount possessing upward revisions, solid gross margins, and strong cash flow still present attractive opportunities. Consider the FOUR, COMM, PSTG, and WEX.

We Could See a Tech Turnaround After November Midterms

November midterms are right around the corner, and the negative sentiment surrounding monetary policy, inflation, and recession has contributed to this year’s bear market. Historically, we could see a turnaround after the elections, and where tighter monetary and fiscal policies and geopolitical issues around the globe have resulted in declines in the major U.S. indexes, namely tech, consider our top four tech stocks with strong analyst upward revisions for a rally, FOUR, COMM, PSTG, WEX. All indications from the professional analysts covering these stocks are that results will be better than expected.

These recommendations possess more robust fundamentals than some of the beaten-down tech stocks driving the Nasdaq and S&P 500. While their valuations are not stellar, most have strong growth rates, excellent analyst upward revisions, and strong fundamental tailwinds.

Be the first to comment