Torsten Asmus

Introduction

Even though the tragic loss of life in Eastern Europe is certainly anything but positive, it nevertheless left the gas-focused Antero Midstream (NYSE:AM) looking bullish following the phase out of Russian gas, as my previous article highlighted. Quite unsurprisingly, this fundamental backdrop is only growing stronger with the Nord Stream pipelines damaged and Russian gas supplies dropping to never-before-seen lows. Back at home, excitingly for income investors, they are now on the cusp of a new era for their high dividend yield of 9.34%, as discussed within this follow-up analysis.

Executive Summary & Ratings

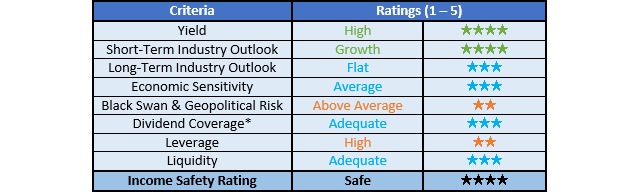

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

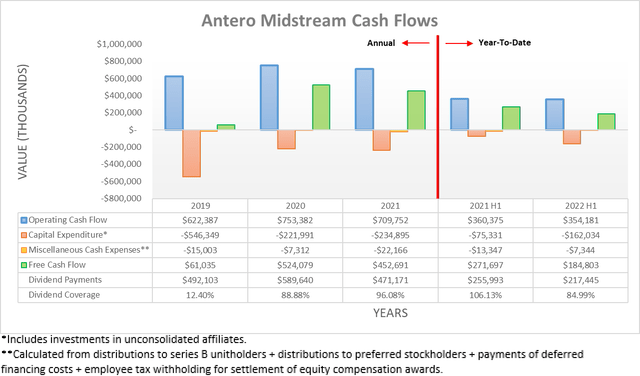

Following a slightly bumpy start to 2022 during the first quarter, their operating cash flow ended the first half at $354.2m and thus only down immaterially year-on-year versus their previous result of $360.4m during the first half of 2021. Although fairly business-as-usual, similarly with the first quarter of 2022, their higher capital expenditure year-on-year during the second quarter left their free cash flow at only $184.8m for the first half and thus below their dividend payments of $217.4m, thereby leaving weak dividend coverage of 84.99%. Once again, this resulted in a slight cash burn to sustain their dividend payments but thankfully, this era is finally ending, as per the commentary from management included below.

“Looking to the back half of the year and beyond, we expect to generate increasingly positive free cash flow after dividends. This is driven primarily by declining capital as we completed some key growth projects such as the Castle Peak station in the first half of the year.”

-Antero Midstream Q2 2022 Conference Call.

After always leaning upon debt funding to bridge the gap between their free cash flow and dividend payments, they are now on the cusp of a new era whereby their dividend payments are completely covered by free cash flow and thus going forwards, their dividend coverage should be adequate for the first time. When it comes to income investing, companies that internally fund both their capital expenditure and dividend payments on a consistent basis are generally more desirable than those reliant upon debt markets.

Not only does being internally funded remove risks of becoming overleveraged, it also removes reliance upon debt markets remaining supportive, which is especially important right now as central banks rapidly tighten monetary policy, thereby pulling liquidity out of the system that risks throwing the proverbial spanner in the works for debt-reliant companies. Since they expect to generate free cash flow after dividend payments going forwards, it naturally raises the question of whether higher dividends are inbound, which certainly appears the case in the medium-term but alas not in the short-term, as per the commentary from management included below.

“Looking to 2023, we expect the EBITDA growth and declining capital to result in significant free cash flow after dividends. This trajectory is expected to continue further into 2024 and beyond as volume grows, the fee rebate with AR expires and capital declines. The increasing free cash flow after dividends will result in increased debt paydown and reducing our leverage towards our 3x target. We expect to achieve this 3x leverage target in 2024, at which point we will evaluate further return of capital strategies.”

-Antero Midstream Q2 2022 Conference Call (previously linked).

It was positive to see management speaking clearly regarding their capital allocation priorities instead of the generic “the board reviews the dividend every quarter” line often seen elsewhere. At least their shareholders know they face a circa two-year wait before enjoying higher dividends, as they focus on meeting their deleveraging target, which they expect during 2024. Whilst we have a tendency to want everything now, thankfully their existing dividends already provide a high 9%+ yield, thereby leaving this wait easily manageable.

After waiting, shareholders can look forward to far higher dividends in the coming years post 2024 as management expects to see ample free cash flow from their capital expenditure winding down and even more importantly, higher earnings. Despite not necessarily providing exact guidance for future years thus far, their indicative guidance still shows free cash flow after dividend payments reaching circa $100m during 2023 before growing onwards to circa $200m per annum by 2025-2026, as per slide fifteen of their August 2022 company presentation. If annualizing their dividend payments of $217.4m from the first half of 2022, it equals $434.8m and thus their circa $200m per annum of excess free cash flow provides capacity for total growth of circa 40%+.

Obviously, it remains to be seen how much of this excess free cash flow after dividend payments is eventually directed towards dividend growth, although this nevertheless highlights their impressive capacity for growth as they enter this new era. Admittedly, the future is uncertain by nature but if anything, they are more likely to see better than expected financial performance given the strong fundamental backdrop for gas in the United States following the Russian-Ukraine war, as discussed within my previously linked article.

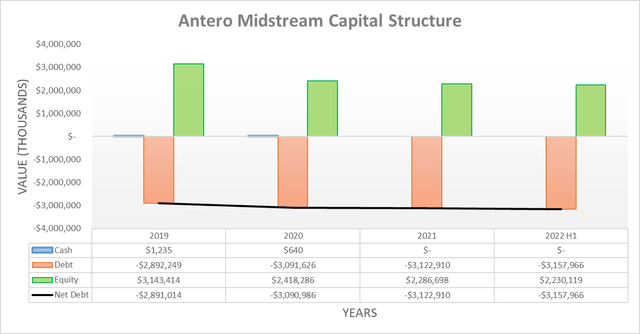

Following their slight cash burn to sustain their dividends during the second quarter of 2022, their net debt increased slightly to $3.158b versus its level of $3.133b when conducting the previous analysis following the first quarter. If set on autopilot, their net debt would obviously decrease during the second half but given their $205m upcoming acquisition in the fourth quarter, this will likely see their net debt still increase a little further before the year ends. Thankfully, this is not necessarily negative because it relates to new assets and more so, it is relatively immaterial in the grand scheme, especially given the outlook for their net debt to steadily decrease during 2023 and 2024.

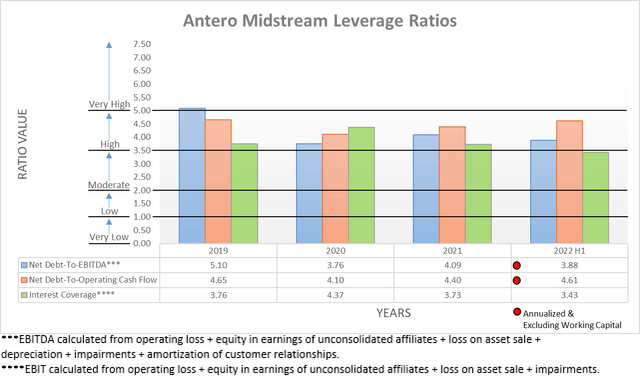

Despite their net debt increasing slightly, the second quarter of 2022 actually saw their leverage decrease slightly with their net debt-to-EBITDA down to 3.88 versus its result of 3.95 when conducting the previous analysis following the first quarter. Meanwhile, their net debt-to-operating cash flow also saw a similar decrease to 4.61 versus 4.73 across these same two points in time, which similar to its former accrual-based brother, sits within the high territory of 3.51 and 5.00.

When looking ahead, there will likely only be a relatively small change during the second half of 2022 but further afield into 2023 and beyond, decreasing net debt and simultaneously increasing earnings is a very powerful combination for deleveraging. Upon considering the current state of their financial position, it seems quite realistic they meet their leverage ratio target of 3.00 during 2024 and thus will see their leverage pushed comfortably into the moderate territory of between 2.01 and 3.50. Apart from obviously providing more safety, thanks to the resilient nature of the midstream industry, they will not require nor necessarily benefit from further deleveraging past this target, which bodes very well to see their dividends grow far higher.

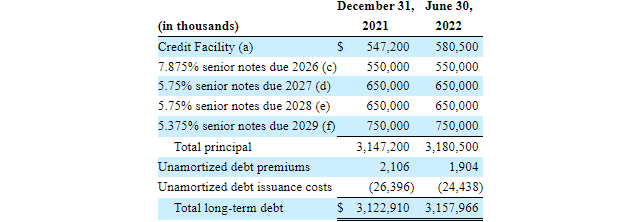

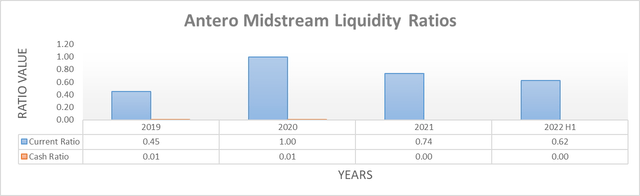

Quite unsurprisingly, their liquidity remained adequate following the second quarter of 2022 with their current ratio sitting at 0.62 and thus a little higher than its result of 0.58 when conducting the previous analysis following the first quarter. Meanwhile, their cash ratio remains at 0.00 given their non-existent cash balance and not that it should be required in their new era but if needed, their credit facility still carries another $669m of availability, which does not mature until October 2026. Since they do not see any other debt maturities beforehand, it provides ample time to arrange repayment and refinancing, whilst also largely providing a shield from the rapidly increasing interest rates, as the table included below displays.

Antero Midstream Q2 2022 10-Q

Conclusion

Following years of leaning upon debt funding to cover a portion of their dividend payments, they are now on the cusp of a new era whereby they should consistently see their free cash flow exceed their dividend payments. Whilst very positive, do not expect higher dividends for another two years as they prioritize deleveraging but thankfully, it is easy to be patient when already bringing home a high 9%+ dividend yield. Since I expect their new era of internally funded dividends to help their share price rerate higher as they become safer, I believe that upgrading to a strong buy rating is now appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Antero Midstream’s SEC filings, all calculated figures were performed by the author.

Be the first to comment