Olivier Le Moal/iStock via Getty Images

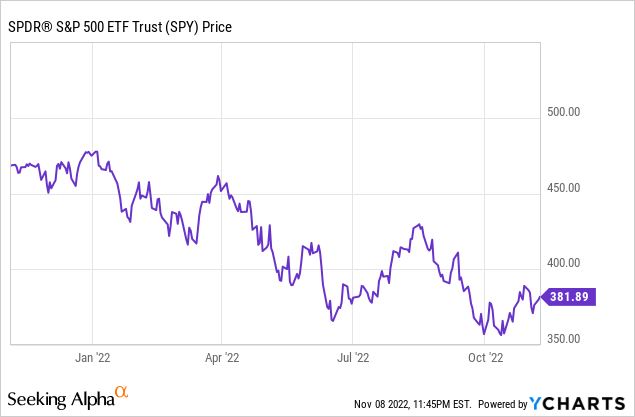

The market continues to have a very high level of uncertainty and volatility in spite of gaining some ground in recent weeks. In recent months, the market has been mostly about the Fed policy. Earlier this month, the Fed raised the short-term interest rates by 75 basis points for the fourth consecutive time, which was already baked into the expectations. However, what changed were the expectations on the Fed Pivot, which has proved to be elusive. Also, most market participants now expect the terminal rate to be higher than previously expected, even though the pace of interest rate increases should slow down.

We believe that no one can accurately predict how the market is going to behave in the next week or the next six months, especially in the current market environment. That said, irrespective of the market’s short-term movements, as long-term DGI investors, we need to pay attention to the quality of companies that we invest in and the price we pay. In this article, our focus is on selecting and highlighting stocks that have been growing their dividends at a rapid pace and, more than likely will continue to do so in the future for at least the next 3-5 years.

We believe in keeping a buy list handy and dry powder ready so that we can use the opportunity when the time is right.

Note: Please note that the stocks shortlisted and highlighted in this article are not buy recommendations per se but rather candidates for further research. Please use your due diligence, considering your personal goals and risk tolerance, before making any investments.

Why High Growth Dividend Stocks?

There are two types of dividend stocks that a DGI investor can choose from depending upon their individual situation and goals:

- High Growth Low Yield [HGLY]

- Low Growth High Yield [LGHY].

As the names suggest, the HGLY category would have stocks that offer a high rate of dividend growth but usually a low current yield. These stocks would normally have low payment ratios, manageable levels of debt, and rapidly rising earnings.

On the other hand, LGHY-type of stocks would offer a high current yield (generally 3% and higher) but a lower rate of dividend growth. Generally speaking, these companies are more mature and stable businesses that have their hyper-growth period in the rearview but still grow modestly over time to support a low but stable growth in dividends.

Obviously, there will be stocks that fit somewhere in between these two categories, for example, medium growth and medium current yield.

So, who should own HGLY-type stocks? Basically, anyone who is in the accumulation phase and does not need the income currently and/or in the next five years should own some high-growth dividend stocks. In addition, folks, including retirees, who have a large investment capital that generates more income than they need currently (for example, 1.5x or 2x their income needs) should invest at least partially in HGLY type of stocks.

Selection Criteria

We will draw upon our original November data set of nearly 400 stocks, taken from our other DGI series (5 Relatively Safe and Cheap DGI). We will then apply additional criteria to filter out stocks that have provided a high rate of dividend growth in the recent past and are likely to continue on that path for the foreseeable future.

For the month of November, the above dataset contains 363 stocks. To get a complete spreadsheet of this dataset, please see our November 5th article, “5 Relatively Safe and Cheap DGI.” For the sake of clarity, we will list the original filtering criteria below:

- Market cap > $10 billion ($9 billion in a down market)

- Dividend yield > 1.0% (some exceptions are made to include high quality but lower yielding companies)

- Daily average volume > 100,000

- Dividend growth past five years >= 0.

- Preferably, a minimum of 5-year of dividend growth.

A vast majority of these stocks have raised their dividend payouts for five years or more. However, now we will filter out stocks that have increased their dividend payouts by an annual rate of 8% or more. In addition, we will also consider stocks that may not have provided a consistent increase but overall have provided a cumulative 40% increase in payouts in the last five years.

We will now use the following additional criteria to filter out stocks that would fit the mold of High Growth DGI stocks.

- The payment Ratio is less than 70%

- 5-Year Dividend growth is at least 8% or greater. This is in line with the growth rate of the benchmark fund, Vanguard Dividend Appreciation ETF (VIG).

- Chowder number (5-YR Dividend-growth plus the Dividend-yield) >= 10.

After we apply these criteria, we are left with 168 stocks on our list.

Note: All tables in this article are created by the author unless explicitly specified. The stock data have been sourced from various sources such as Seeking Alpha, Yahoo Finance, GuruFocus, IBD, and CCC-List (dripinvesting).

Narrowing Down the List to 40 Stocks

We know that for a stock to grow its dividend rapidly, it must grow its earnings at a very high pace as well. Without growth in earnings (earnings per share – EPS), the company cannot grow its dividends for long. Sure, some companies may try to do it by taking on more debt or by cutting costs, or spending less on R&D, but that cannot be sustained very long before it starts causing wider issues. So, our focus ought to be on earnings growth.

In our spreadsheet, we will add four more columns of data for each of the stocks:

- EPS (earnings per share) Rating

- Last Qtr EPS change % (actual)

- Current Qtr EPS change % (est.)

- Current year EPS change % (est.).

We will now assign weights to these four sets of data for each stock and add them to the original Quality Score to come up with a modified Quality Score tilted in favor of high dividend growth stocks. We will call this column a High-Growth Quality-Score [HGQS]. We will also import the 5-Yr Average Dividend Yield for each stock.

Note: The Original Quality Score was calculated and taken from the original spreadsheet, as attached in our previous article (5 Relatively Safe and Cheap DGI Stocks for Nov 2022).

The factors and data that were considered to calculate the original Quality-Score were:

- Current Yield

- Dividend growth history (number of years of dividend growth):

- Payout ratio – Preferably based on Free Cash Flow.

- Past five-year and 10-year dividend growth

- EPS growth (average of previous five years of growth and expected next 3-5 years’ growth)

- Chowder number – the sum of the 5-yr dividend growth rate and the current yield

- Debt/equity and Debt/asset ratios

- S&P’s credit ratings (Standard & Poor’s Global Ratings)

- Distance from 52-week high (current price minus 52-wk high price)

- Sales or Revenue growth for the past five years.

From the above list, we will select 40 stocks based on the following methodology:

- Top 10 stocks based on the highest HG-Quality-Score

- Top 10 stocks based on the highest 5-yr Dividend Growth

- Top 10 stocks based on the excess yield over and above 5-YR Average Dividend Yield.

- Top 10 stocks based on current discount from 52-week highs.

First, we will remove any stock that has an HG-Quality Score of less than 70 (we remove 11 entries of AEM, BALL, INTC, NKE, NRG, NEM, and SSNC ). We will now remove the duplicates from this list as many stocks qualify based on multiple criteria. After removing duplicates (AAP, AVGO, BBY, CI, EOG, LEN, ODFL, SWKS), we are left with 20 stocks.

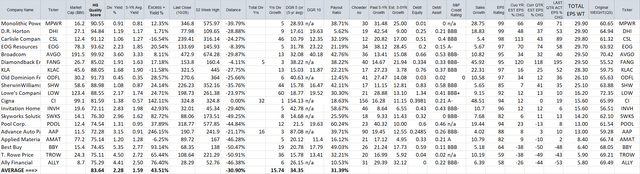

For final elimination, we will remove any multiple stocks that belong to the same industry segment. For example, we have DHI (DR Horton) and LEN (Lennar) from the home-building industry; we will keep DRI as it scores slightly better in the HG-Quality Score. We are finally left with 19 names, which are presented in the table below:

Table 1: Top 19 High Growth DGI Stocks of the month:

Final Step: Selection of Top 10 High Growth DGI Stocks

To a certain extent, this step is a bit subjective and, to that extent, is based on our perceptions. The readers could certainly differ from some of our selections, and they may come up with their own set of ten companies appropriate for their goals, but they should try to keep the group diversified among different sectors or industry segments. Nonetheless, we describe below how we go about selecting these ten stocks for the month of November 2022.

-

- As a first step, we will sort out our list of 19 stocks on the basis of the highest quality scores and select the top 5.

- Second, we will select two names from the highest 5-yr dividend growers and two stocks from the highest excess yield (current yield minus 5-yr-average-yield).

- Third, we will select at least one name that has the highest discount from its 52-week high.

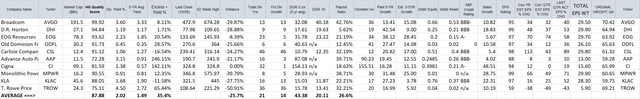

Here is the final top 10 list:

(AVGO), (DHI), (EOG), (ODFL), (CSL), (AAP), (CI), (MPWR), (KLAC), (TROW).

Table 2:

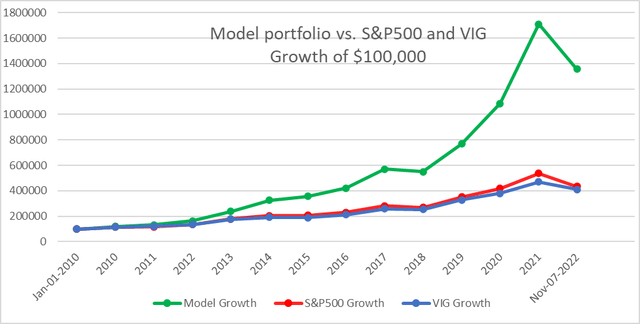

Past Performance:

If we were to compare the performance of these ten stocks and compare with the S&P500 and benchmark ETF VIG, the results would be quite encouraging. We assume that our model portfolio was invested equally in the ten selected stocks from Table 2. The performance comparison is for the period from Jan-01-2010 to Nov-07-2022. However, please keep in mind that past performance is no guarantee for the same level of success in the future.

Chart-1:

Conclusion

In the first week of every month, we publish a broader list of DGI stocks that we think would be relatively safe and appropriate for most DGI investors. We provide three lists targeted for different yield goals. The above lists include all three types of dividend stocks, for example, high yield low growth, moderate yield moderate growth, and low yielding high growth stocks. However, in this article, we will mainly focus on High-growth dividend stocks, which are likely to offer a high rate of dividend growth but may not offer high current yields.

In our rule-based filtering process, we narrow down to 19 stocks at this time. As a next step, we subjectively select ten stocks that form a diversified group and will likely offer high growth at reasonable values.

The top 10 list yields 2.02%; however, it is still 35% higher than the 5-year average yield for the group. It is about even with 1.96% for the benchmark Vanguard fund VIG. However, the 5-yr dividend growth for this group is much higher (>40%) compared to 8% for VIG. The larger group of 19 stocks yields slightly higher at 2.28%. Both groups are highly diversified into many sectors and industry segments.

Be the first to comment