Scott Olson/Getty Images News

Rising rates, high inflation, weakening consumer confidence, recession fears, and worsened affordability are just a few of the headwinds facing the housing market that have soured investors on the sector. Toll Brothers, Inc.’s (NYSE:NYSE:TOL) stock has not been immune to these pressures, with shares down 24% over the past year, wiping away all of the gains of the past five years. However with shares now trading at a discount to book value, the stock offers attractive value, particularly given the company’s defensive characteristics.

Seeking Alpha

First, it is important to emphasize that shares have been battered by concerns about the future because the company is still performing at a high level today. In Q3, the company earned $2.35, which was up 26% year on year. Revenue was up 1%, though volumes down 7% with prices up 8%. Higher prices and moderating commodity costs helped gross margins expand 230bp to 27.9%, driving the profit growth. The company is on track to deliver about $9 in EPS excluding one-time items this year for a P/E below 5x.

Now. while current results are strong, the signs of a slowdown are apparent. New contracts signed totaled $1.7 billion, down 44% from last year. That gives the company an $11.2 billion backlog; while that is up 19% from a year ago, it represents a roughly $700 million sequential decline. With the company delivering 3,200 homes this coming quarter but signing just about 1,200 new contracts, the company’s backlog would last five quarters at that pace.

This backlog provides some insulation from declining demand; it exists to be drawn down during downturns, and as the backlog declines, cash flow will build as the firm monetizes its working capital and inventory position. In practice, we will see the company moderate deliveries below the 3,200 delivery pace if orders remain low, lengthening the backlogs duration. As a 2,500 quarterly delivery pace, the backlog would last two years. At the 27.5% gross margin, that would result in about $2.4 billion in gross profits each of the next two years and about $900 in net income or $7-7.50 a share, giving the stock a forward multiple of just 6x in this moderate housing recession. Now for investors who fear a more severe housing contraction, there are several reasons to expect Toll to be relatively resilient.

First because Toll Brothers targets the higher-end of the housing market, its customers are a bit less interest rate sensitive when buying a home. In fact, 20% of buyers pay all cash, and those with a mortgage typically put 30% down, much more than the 20% norm. Higher rates are a headwind for the industry, and Toll will not be entirely immune of course. Still, buyers paying in cash are not going to see demand fall as much as those with barely enough to make the monthly payments and are more “aspirational” homebuyers.

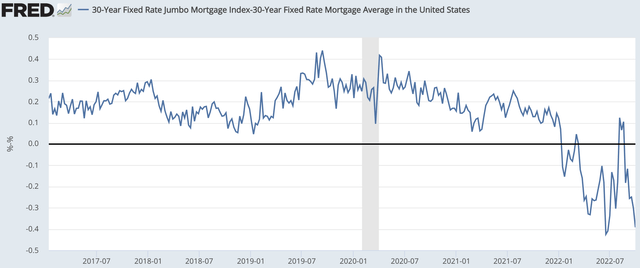

Beyond this, mortgage rates for Toll’s homes have not risen quite as much. The conforming loan (these are mortgage backed by Fannie and Freddie) limit is $647,200, and loans bigger than that are in the “jumbo” market. Because jumbo loans don’t have a government guarantee, they are typically more expensive, normally by about 0.25%. However as rates have risen and the Fed has stopped buying conventional MBS, jumbo loans are now about 0.4% lower than conventional loans. So yes, rates have gone up, but the relative outperformance of the jumbo loan market is another favorable factor for the market Toll operates in, given an average selling price of about 875k.

St. Louis Federal Reserve

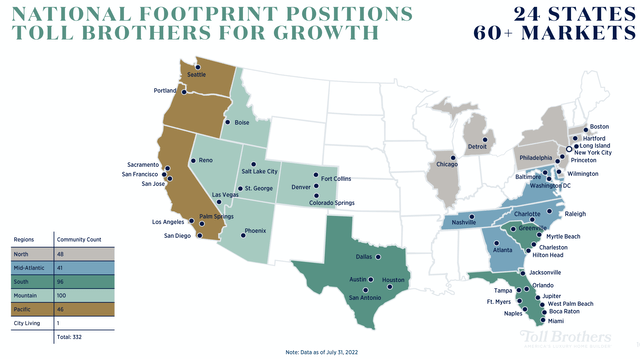

Additionally while Toll operates across much of the nation, its presence is focused on higher growth markets in the Sunbelt and Mountain-West, areas that have benefitted from population inflow from the West Coast and Northeast. About 70% of its communities are in these fast growing regions, meaning Toll should see outperformance vs the overall housing market over the medium term.

Toll Brothers

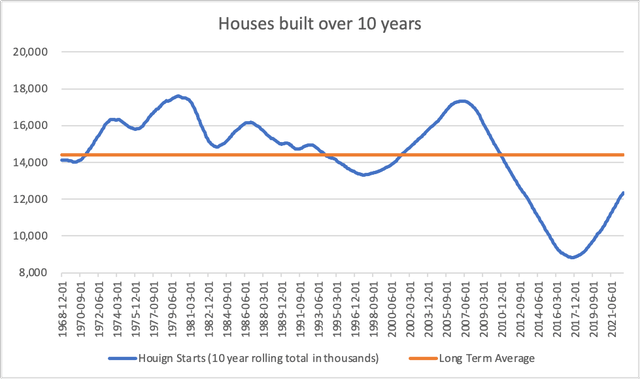

One reason why I am not as bearish on home prices as other might be is that we are starting from a position of low supply. Historically, this country has built 14-15 million homes a decade. We overdid it during the 2000s, building 17 million homes and contributing to the housing market crash, but that crash so damaged homebuilders that we built just 9 million in the 2010s. Even with the surge in homebuilding the past year, we remain below trend.

St. Louis Federal Reserve

Overall, since 2000, we have built 2-3 million too few homes, and that tight supply is apparent in many markets, particularly in the fast-growing Sunbelt where Toll is focused. Ultimately, people do need somewhere to live, and while affordability concerns may limit price appreciation, it should minimize price declines.

Additionally, 2020 and 2021 saw an extraordinary amount of refinancing, about $6 trillion. With many of these refinances occurring below a 4% mortgage, homeowners will be very reluctant to sell their home unless they absolutely have to because the new house they buy will come with a 6.5-7% mortgage, leading to a much higher monthly payment at the same home price. The fact many are functionally “trapped” in their home by higher rates will likely further suppress the supply of existing homes on the market, forcing buyers to look at new homes, a positive for builders like Toll.

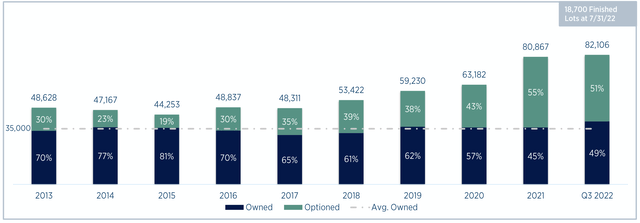

Homebuilders really get into trouble when they overextend themselves during the boom years, borrowing money to buy land, which then becomes worth less when the housing market turns. This was a major problem for many builders during the 2006-2010 period. Because Toll’s total lot count has risen from 53k five years ago to 82k today, you may be concerned they are making that mistake again. Fortunately, management has been shifting its strategy, optioning rather than buying lots outright. Like a call option on stocks, it pays a small amount for the right to buy and build on the lot, but if land prices fall, it can just walk away. As you can see below, its total owned lot position has not moved much the past 10 years with essentially all of its lot growth coming through options. This mix gives Toll plenty of upside if prices rise but much more resilience during downturns.

Toll Brothers

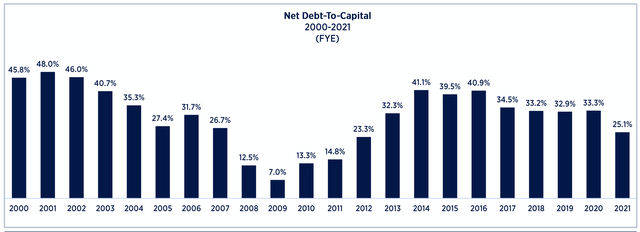

Because of its land strategy, Toll has been able to de-leverage its balance sheet. As profits have been strong the past few years during a buoyant housing market, TOL has steadily reduced its debt to capital down to 25% from 40% a few years ago. So during the housing boom, TOL has shifted from buying land to buying options and used cash flow to make its capital structure less reliant on borrowed money. That counter-cyclical conservative approach is exactly how to manage such a cyclical business and enable it to perform during downturns.

Toll Brothers

Impressively, it has done this while returning capital to shareholders, buying back $380 million in stock so far this year, $380 million last year, and $634 million in 2020. Over the past six years, it has reduced its share count by 32% to 120.5 million shares, which has helped contribute to strong book value gains, with the measure now at $48.74. Management has emphasized that share repurchases are an “important part of our capital allocation priorities,” and with the stock below book value, these repurchases are very accretive. At $7+ in earnings, Toll will have the capacity to repurchase at least $500 million in stock per year, reducing the float by over 10% per year, adding to medium-term EPS potential.

The housing market faces headwinds, but Toll has a large backlog, which will lead to strong free cash flow generation and capital returns. Its customer mix leaves it better to withstand higher rates while its strong balance sheet and land strategy give it the ability to weather a downturn. Being able to purchase shares below book value offers a very attractive entry point. Given the cyclicality of its business, TOL will always trade at a discount to the market, but as the market grows comfortable with the ongoing free cash flow, I am looking for shares to trade at least 8x earnings or 1.1-1.2x book value, resulting in a $56 target.

With 30% upside, TOL is a good buy opportunity. The longer the stock stays low, the more accretive the ongoing buyback will be, creating even greater long-term upside. For investors in TOL, patience will be rewarded.

Be the first to comment