Nikada

I would like to acknowledge my fellow Seeking Alpha contributor and coauthor of this analysis, Badsha Chowdhury, for contributing his time, perspective and expertise. I believe this analysis is both more complete and more finely nuanced than it would otherwise be without Badsha’s efforts.

Background: A Tough Bear Market

On Friday September 30, the Nasdaq Composite fell 1.5% to finish the quarter with a decline of about 5%. Year to date, Nasdaq has declined more than 32% and closed the quarter at its lowest level since 2020.

The current mood in the broader market is fear. Inflation is the dominant concern with the Federal Reserve responding with quantitative tightening and by raising benchmark interest rates. In late September, the Federal Reserve approved its third consecutive interest rate increase of 0.75% and signaled additional large increases were likely even at risk of driving the economy into recession. Stock markets have responded with increased volatility and sharp declines.

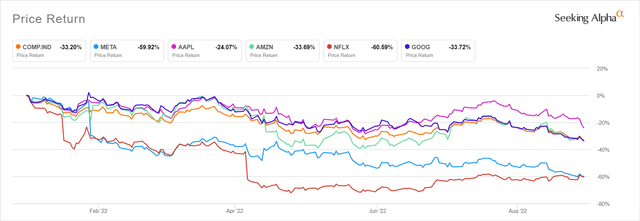

Apple and FAANG Peers: YTD Performance

Year to date, Apple Inc. (NASDAQ:NASDAQ:AAPL) has outperformed both FAANG peers and the Nasdaq Composite while falling over 24%. AAPL’s outperformance can only be described as painful, and some analysts are predicting still more pain. On September 29th, Bank of America downgraded AAPL from Buy to Neutral, citing worries over weaker consumer demand. BOA analysis forecasts FY 23 revenues $379B or 8% below the consensus estimate of $412B.

Current Valuation is Based on Growing Revenue and Expanding Price/Sales Ratio

AAPL: 3-Yr Price Return

Over the last 3 years, AAPL has returned almost 147% while outperforming NASDAQ by 113%. However, current valuation is a result of both revenue growth and expanding price/sales ratio.

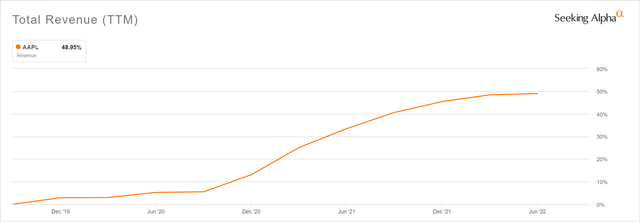

AAPL: 3-Yr Revenue

Over the last 3 years, AAPL revenue has increased almost 50% to $365.8B (TTM).

Over the same period, AAPL price/sales ratio has also increased almost 50% from about 4 to 5.82. Currently, AAPL Price/Sales ratio is highest among its FAANG peers and also near its own historical high.

Apple Comparables Valuation and Share Price Estimates

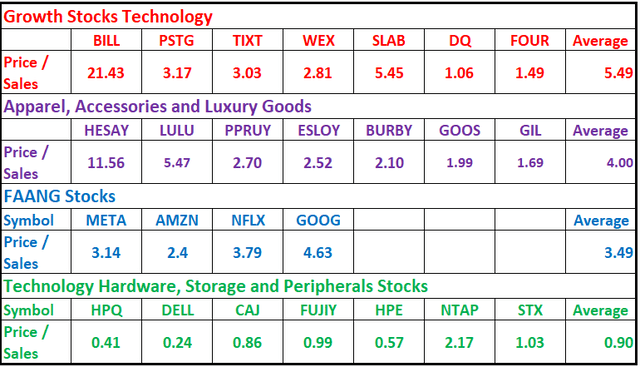

Price/sales ratios are most useful when comparing valuations of similar companies. For the sake of this analysis, AAPL price/sales was compared to several peer groups.

Comparable Peer Groups: Price/Sales

Several peer groups were selected, including technology growth stocks, luxury goods, FAANG stocks, and technology hardware industry peers. Average price/sales ratios for these peer groups ranged from 5.49 for technology growth stocks to 0.90 for technology hardware peers.

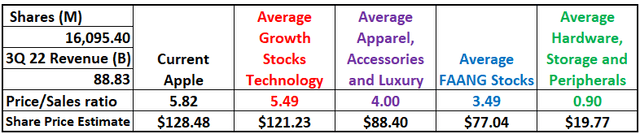

AAPL Share Price Estimates

AAPL share price estimates assume share count remains constant at 16,095.4 million and 3Q 22 consensus revenue estimates of $88.83B. Forward share price estimates are calculated based on current AAPL price/sales ratios and averages for peer groups. The highest forward share price estimate of $128.48 is based on AAPL’s current price/sales ratio of 5.82. However, forward share price estimates based on average peer group ratios are all lower at between $121.3 (technology growth stocks) and $19.77 (technology hardware).

Current Valuation is Largely Based on Growth and Market Sentiment

Based on comparable ratios, the market is currently valuing AAPL as a technology growth stock. However, given current economic conditions, AAPL revenues could level off or even decrease. Although price/sales ratios are based on empirical data, the ratios largely reflect market sentiment and expectations. AAPL’s ratio is higher than the average for any peer group examined and could contract sharply if market sentiment shifts.

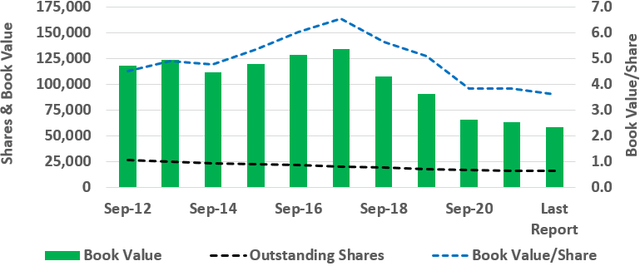

AAPL: Book Value

Some investors may argue that AAPL valuation is grounded on fundamentals rather than revenue growth and market sentiment. However, book value/share peaked in 2017, declined until 2020, and has remained flat in the last three years. At the same time, share price has increased 150% over the last 3 years.

Conclusions and Recommendation

This analysis has focused on price/sales ratio and comparable peers approach on valuation. Reasonable efforts were made to select representative and relevant peer groups. However, another analyst could select a different group of peers and perhaps support different results. Further, some analysts and investors may be tempted to cherry pick peers to support a higher AAPL share price; I would advise against such a practice

Some investors may argue that AAPL is unique based on the devotion of those who buy AAPL products or some other metric. They could be correct. Others could rightfully point out that AAPL is the biggest position of Warren Buffett’s Berkshire Hathaway; currently AAPL comprises about 42% of Berkshire’s portfolio. We are neither foolish nor boastful enough to claim that our analysis outweighs that of Warren Buffett.

We would urge those investors who hold AAPL to carefully review their positions in light of their own investment goals and risk tolerance. I would suggest investors seek out analysis beyond this one and conduct their own due diligence. Nonetheless, share price estimates based on average price/sales ratios of peers indicate current AAPL share price is difficult to support. Therefore, I recommend investors sell AAPL at current market prices.

I insist on a lot of time being spent, almost every day, to just sit and think. That is very uncommon in American business. I read and think. So I do more reading and thinking, and make less impulse decisions than most people in business. – Warren Buffett

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment