z1b

Buying great American dividend paying companies is generally a good idea for U.S. investors. That’s because most American companies pay dividends on a quarterly basis, versus annual or semi-annual for many international and British stocks, respectively. Plus, U.S. dividends aren’t subject to currency risk, and therefore don’t fluctuate after they are declared.

I don’t know about you, but I’d rather be paid four smaller chunks over the course of a year, than having to wait a full year for one big piece. You wouldn’t wait a full year for an employer to pay you, so why should you have to wait a full year to be paid from a company that you are one of the rightful owners of?

This brings me Raytheon Technologies Corp. (NYSE:NYSE:RTX), which I believe fits the mold of a great American company that’s trading at a value price. This article highlights why RTX is a wonderful company currently that can be had at a bargain, so let’s get started.

Why RTX?

Raytheon is a moat-worthy aerospace and defense company that provides advanced systems and services for military, government, and commercial customers worldwide. It came to its current form through its merger with United Technologies two years ago, and is comprised of four primary business segments, Missiles & Defense, Intelligence & Space, Collins Aerospace Systems, and Pratt & Whitney. In the trailing 12 months, RTX generated over $65 billion in total revenue.

Like most defense contractors, Raytheon has built a wide-moat business model upon its specialized relationships with the U.S. government and patents around its technologies. This includes missiles, defense systems, space warfare systems, and IT services for the government. Given geo-political tensions around the world, many analysts expect heightened spending in each of these areas. This was noted by Morningstar in its recent analyst report:

We are expecting the military’s increased focus on defending against great powers conflict to drive material investment in each of these exposures, excluding government IT services. The fiscal stimulus used to support the U.S. economy during the COVID-19 pandemic dramatically increased the U.S. debt, and higher debt levels are usually a forward indicator of fiscal austerity. We expect a flattening, rather than declining, budgetary environment as we think that heightened geopolitical tensions between great powers are likely to buoy spending despite the debt burden. We think that contractors can continue growing despite a slowing macro environment due to sizable backlogs and the National Defense Strategy’s increased focus on modernization.

This is supported by recent multiple wins by Raytheon with the US Navy and Air Force, including a $985 million contract last month from the U.S. Air Force to develop a Hypersonic Attack Cruise Missile. Meanwhile, RTX has continued to see sales growth amidst a tough economic backdrop, with 3% YoY sales growth (4% organic growth) during the second quarter. This was driven by heightened consumer travel demand and resilient end-market demand with $24 billion of awards. Importantly, RTX maintains robust shareholder returns, with $1 billion in share repurchases during Q2 alone.

Potential headwinds to RTX include the potential for an economic downturn, which may affect consumer travel and demand for RTX’s commercial business. However, I see this as being more than offset by robust defense spending on the horizon, driven by geopolitical tensions. This is reflected by RTX’s $65 billion defense backlog, which is up $2 billion since the beginning of the year. Moreover, Congress recently upped defense spending for fiscal 2023 by a meaningful amount, as noted by management during the recent conference call:

We are also encouraged by the markets that we’ve seen in Congress. The House Arm Services Committee has proposed a $37 billion increase to the administration’s request, that’s a 9% increase over fiscal ‘22, excluding the supplementals. On the Senate side, the Senate Arm Services Committee went even higher proposing a $45 billion mark, resulting in a DoD budget increase of 10% over fiscal ‘22, bringing the fiscal year ‘23 budget to over $815 billion. It’s a lot different than what we expected 2 years ago.

We are encouraged by the support of our programs with the authorizing committees recommending significant increases in spend over the President’s budget request, including increases for Stingers, Javelins, next-generation jammers, Tomahawk cruise missiles, just to name a few. And as I have said, our key programs in technologies and space cyber, missiles, missile defense and non-kinetic effects are also well aligned with the U.S. and our allies’ defense priorities.

Meanwhile, RTX sports a very strong A- credit rating and has a low long-term debt to capital ratio of just 31.8%. The recent price volatility has driven the dividend yield up to 2.7%, and it comes with a very safe 45% payout ratio combined with 28 consecutive years of growth, making RTX an all-weather type of stock that’s survived multiple economic adversities and downturns.

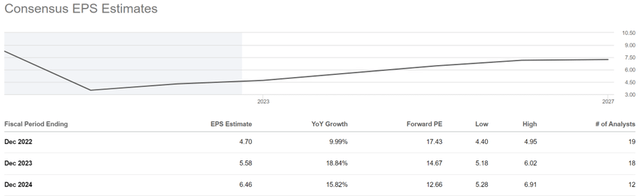

Given the above, I find value in RTX at the current price of $83.11 with a forward PE 17.7, sitting well below its normal PE of 27.5 over the past decade. While the current valuation doesn’t scream bargain from a traditional valuation standpoint, one must also consider the moat-worthy nature of the business and the 16% to 19% annual EPS growth rate that analysts expect over the next 2 years. As seen below, this puts RTX well within value territory should these growth estimates be realized.

RTX EPS Estimates (Seeking Alpha)

Investor Takeaway

Raytheon Technologies is a high-quality defense contractor with a wide economic moat. The company is well-positioned to benefit from increased defense spending, both in the U.S. and abroad, as well as from the ongoing modernization of military forces. RTX also sports a very strong balance sheet and has a long history of rewarding shareholders. While the stock is not cheap on an absolute basis, it nevertheless appears to be a good value at the current price given its long-term growth potential.

Be the first to comment