visualspace/E+ via Getty Images

Investment Thesis

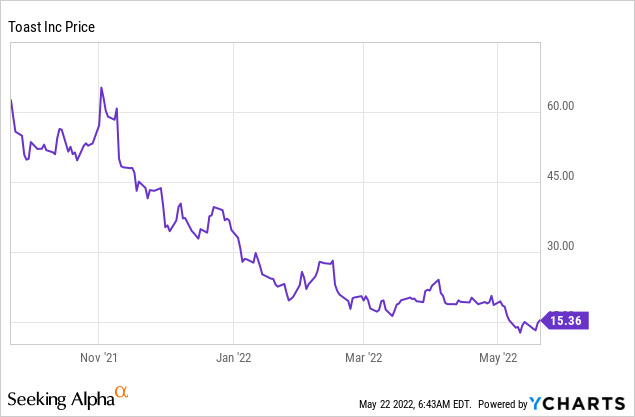

Toast (NYSE:TOST) is a company that provides POS (point of sale) and software solutions for restaurants of all sizes. The company went public last September at an IPO price of $55.78 but has been dropping non-stop since. It is currently trading at $15.36, representing a 76% drop from its all-time high. Unlike most SaaS (software as a service) companies that operate horizontally, Toast is a vertical SaaS company. This means it focuses solely on one industry, and in this case, it is the restaurant industry, which is one of the largest and under-penetrated vertical markets. This presents a huge TAM (total addressable market) for Toast to grow into with its full suite of offerings. After the huge drop, the current valuation seems fair compared to peers and other SaaS companies. The company has strong potential and high revenue growth; however, margins and profitability remain a huge issue. Therefore, I believe the company is a hold until it is able to show a clear path to profitability.

Why Toast?

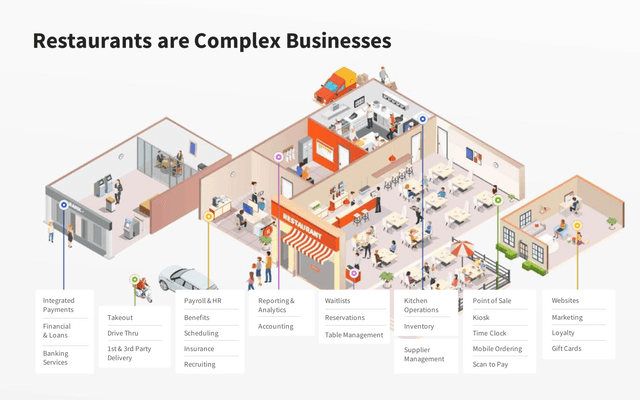

Toast is a cloud-based restaurant software company founded in the US in 2011. The company provides an end-to-end platform for restaurants to efficiently operate and manage their business. The restaurant industry is one of the largest vertical markets as there are many layers to it. This ranges from POS, websites, marketing, payments, Payroll, Inventory, analytics, Take out, and a lot more. As a result, a lot of restaurants are using multiple products from different companies which makes their operation very complex. This is where Toast comes in and tries to disrupt the market by providing a platform with different products that fulfill all needs.

Toast’s main three products are POS, Toast Hardware, and Payment Processing. These three products are the heart of the company as every restaurant needs them. The company then offers 15+ elective products that restaurants can choose to deploy according to their specific needs. This includes products such as online ordering, payroll management, reporting & analytics, email marketing, loyalty program, customer financing, and more. More restaurants are deciding to use Toast as it is able to simplify their operation by reducing the vendors they need to use. Besides, as Toast is only focused on the restaurant industry, it is able to offer products with better quality and capability compared to other competitors.

The Potential

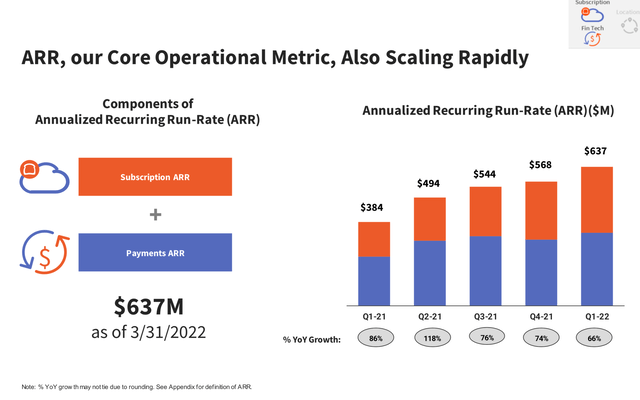

The TAM (total addressable market) for Toast is huge as the restaurant industry is one of the largest vertical markets in the US and globally. According to Toast, the annual sales for the US restaurant industry are $800 billion, representing 3% of GDP. The US TAM is estimated to be 50 billion while the global TAM is estimated to be $110+ billion. This is huge compared to its quarterly ARR (annual recurring revenue) of $0.6 billion. Besides, the company has a strong land and expand strategy. Most companies start off only using the base products from Toast. As they grow and get more comfortable with its solution, they will start deploying more products. This creates a strong network effect for the company allowing them to accelerate growth very quickly. For instance, in Q1 20, 40% of its customer uses 4+ elective products, the percentage increased by 200 basis points to 60% in Q1 22.

The company has a few competitors which include Square (SQ), Lightspeed (LSPD), and PAR (PAR). All of these companies offer a POS system but none of them has the same product breadth that Toast has. Square and Lightspeed are not hyper-focused on restaurants as their POS system are made for all types of customer-facing industries including apparel, sports, etc. While they also offer features like payments, delivery, and analytics, they are missing some important features such as Kitchen display systems or self-ordering kiosks, which are tailor-made for restaurants. PAR’s Brink POS is another platform that focuses only on restaurants; however, it is inferior compared to Toast. Toast is able to offer a free starter plan for small restaurants while PAR’s cheapest plan charges $90 USD per month. It also offers a tailored plan for enterprise customers with custom pricing according to their needs. This results in Toast winning market share in the enterprise restaurant market.

Financials And Valuations

The company is continuing its strong growth across the board. For the first quarter of 2022, the company reported a revenue of $535 million a 90% increase compared to $282 million a year ago. Subscription service revenue increased 103% from $31 million to $63 million while financial technology solutions increased 93% from $227 million to $438 million. GPV (gross payment volume) increased 98% YoY (year-over-year) to $17.8 billion. ARR grew 66% YoY to $637 million and total locations increased 45% YoY to approximately 62,000. Top-line growth is strong but the bottom line is still struggling significantly.

Gross profit only increased 29% YoY from $69 million to $89 million, much lower than the revenue growth of 90% mentioned above. This is largely due to the gross margin dropping from 24.5% to 16.6%. Besides, adjusted EBITDA went from a positive $4 million last year to a negative $(45) million this quarter, and loss from operation widened from a negative $(5) million to $(101) million. Free Cash Flow also widened from negative $(13) million to negative $(50) million.

The gross margin drop is not my biggest concern as this is largely due to the current revenue mix. Financial technology solutions, hardware, and professional service combined currently account for 88% of Toast’s revenue. These revenue streams all have very low margins, financial technology solution accounts for 81.9% of total revenue with a margin of only 20.8%. If we look at the margin of subscription services it is currently standing at 60.3%. I believe the portion of subscription services revenue will increase over time as the company converts free users into paying users while existing users are starting to deploy more products as well. Thanks to the economy of scale and revenue mix improving margins should increase over time.

However, operating expense seems out of control. The company’s gross profit is only $89 million but already has an operating expense of $190 million, more than 2x its gross profit. The company’s sales and marketing expenses increased by over 120%, higher than the revenue growth of 90%. G&A and R&D increased by over 200% which is unreasonable even for a high-growth company. Stock-based compensation is also abnormally high increasing over 10-fold from $5 million to $53 million, resulting in operating cash flow decreasing from negative $(5) million to negative $(47) million. The company currently has around $1.1 billion of cash in hand after debt which allows it to afford the current cash burn but in the long run, it will have to get its expense in line and improve profitability.

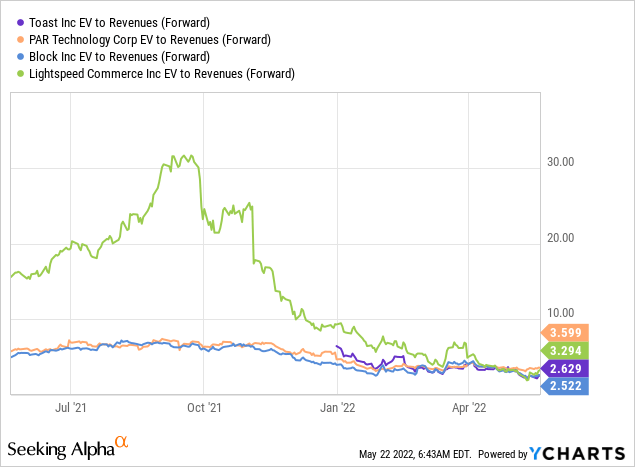

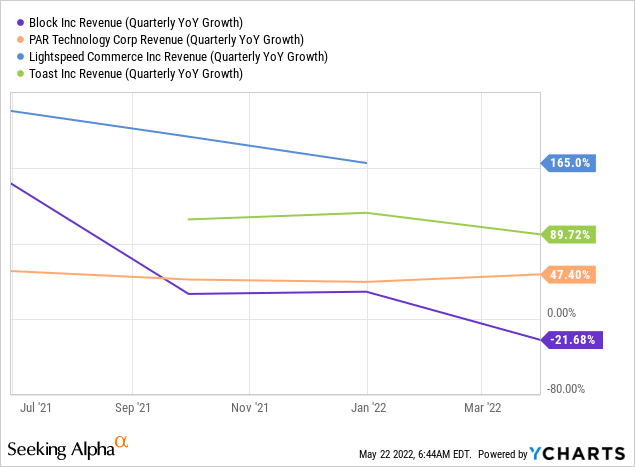

The company is currently trading at an EV/sales of 2.63, which is in line with its peers. From the chart below, you can see that other companies are also trading at a similar EV/sales ratio of around 2.5–3.5. Toast has the highest revenue growth among all companies, Lightspeed’s revenue growth for the latest quarter is 78% (the second chart below hasn’t been updated yet). Both Square and Lightspeed operate in other industries such as crypto and retail therefore I believe PAR should be the best comparison out of all. PAR is trading at an EV/sales ratio of 3.6 which is almost 40% higher than Toast. It is also growing much slower at 47.4% compared to Toast’s 90% (it is also worth noting a portion of PAR’s revenue growth is due to its acquisition of Punchh). I believe the current valuation is quite fair when compared to its peers and factoring in its strong growth and SaaS business model.

Conclusion

Toast is operating in a large vertical market with a huge TAM. The current cloud penetration for the restaurant industry is still very low and restaurants are also seeking a one-in-all platform that allows them to minimize the number of vendors used. This provides a strong tailwind and market for Toast and it has been growing rapidly. Its land and expand strategy is working well with revenue increasing by 90% YoY and subscription service revenue increasing by 103%. After the 70%+ drop in stock price, the company is also now trading at a fair level and is slightly discounted when compared to its peers. However, profitability remains a huge issue. The company’s negative cash flow and net loss keep widening while expenses and stock-based compensations are increasing substantially. The company is also likely to see some headwinds from the macro environment as customers may spend less time eating out (which reduces their GPV) and restaurants may be more reluctant to upgrade their plans. Therefore, I believe the stock is a hold for now and will upgrade it to a buy once the company is able to control its expense and improve its profitability.

Be the first to comment