Nattakorn Maneerat/iStock via Getty Images

The market appears to be convinced that we are headed into a recession.

The S&P 500 (SPY) dipped into a bear market last Friday and retail stocks dropped particularly heavily.

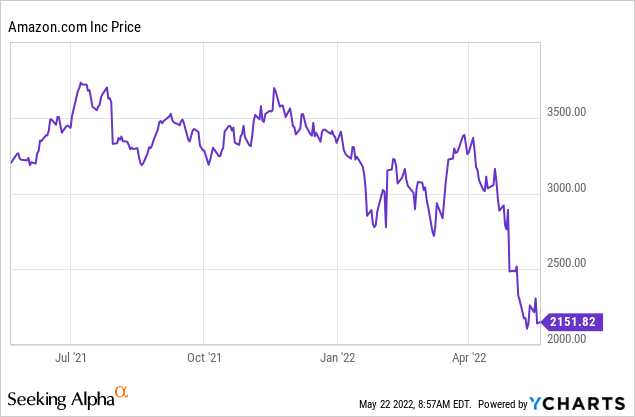

To give you a few examples: Abercrombie & Fitch (ANF) dropped by 14% in a single day, Urban Outfitters (URBN) dropped 12%, Dollar General (DG) dropped 19%, and worst of all, Target (TGT) dropped by 29% following its earnings bombshell. Even Amazon (AMZN) fell by another 5% during the past week… after already losing 20%+ earlier this year:

Is this a market overreaction?

Well, it is a tough question to answer because it really depends on what you are looking at.

On one hand, some of these companies deserve to trade at a lower valuation given that we are quite possibly headed into a recession, their fundamentals are deteriorating, and their valuations didn’t leave much room for error.

But on the other hand, there are also plenty of companies that shouldn’t have been affected by the recent sell-off and yet, they dropped regardless.

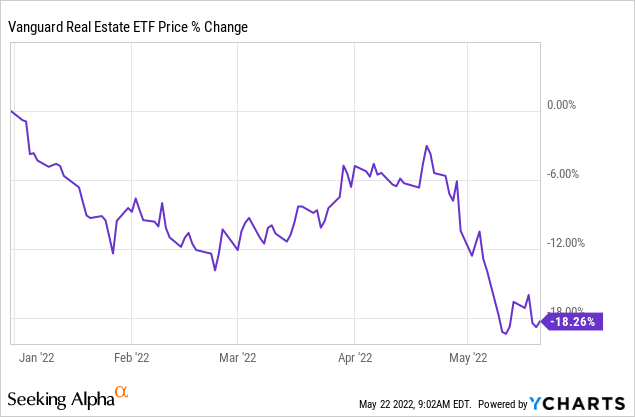

REITs (VNQ) are a great example of that.

A lot of them are recession-proof and benefit from inflation, but their share prices weren’t immune to the recent volatility as you can see from the below chart:

Of course, some REITs deserve to drop. Hotels, offices, and malls are negatively affected by recessions.

But contrary to what you might think: most REITs don’t invest in these property sectors these days. Instead, most of them invest in defensive sectors that are recession-resistant. Good examples include:

- Self-storage

- Manufactured housing

- Affordable apartment communities

- Farmland

- E-commerce warehouses

- Triple net lease properties

- Data centers

- Cell towers

- Medical office buildings

- Hospitals

- Life science buildings

And I pass on others. The point here is that these property sectors are not materially affected by a recession, and yet, the REITs that own these properties are now a lot cheaper, providing attractive entry points for investors.

At High Yield Landlord, we have been accumulating more shares of these companies, and in what follows, we highlight a few of our favorite picks for today’s environment:

Medical Properties Trust (MPW)

MPW is the only pure-play hospital REIT in the world, and also the 2nd biggest non-governmental hospital owner.

People will still get sick and need to visit hospitals whether we are in a recession or not, and MPW is protected from all operational volatility because it is the landlord and not the hospital operator.

Generally, it leases its properties on a “triple-net-basis”, which results in highly consistent and predictable cash flow:

- Very long leases: typically 15-20 years

- Pre-agreed rent increases: rents go up each year by 2%

- CPI adjustments: if inflation is high, rent increases also take it into account

- No property expenses: the tenants are responsible for them

- High rent coverage: typically, rent coverage is around 3x, which means that the tenant earns ample profits to pay its rent.

Hospital investment (Medical Properties Trust)

Despite that, the recent market volatility has taken it down by 25%, and as a result, the company’s valuation is quite steeply undervalued.

Right now, MPW is priced at just 12x cash flow and it pays a 6.5% dividend yield. The yield is safe and growing. With such a high yield, MPW only needs to achieve 3.5% annual growth to reach double-digit total returns to its shareholders. Historically, it has achieved a lot more than that.

That makes MPW a very good place to hide if you fear a recession!

Big Yellow Group (OTC:BYLOF/BYG)

Self-storage is another great hiding place if you fear a recession. That’s because you will still need somewhere to store your extra stuff, and it is often even cheaper to downsize your residence and/or office and rent storage space for the extra stuff.

Recessions may also cause more people to move from one place to another as they seek new job opportunities, return to studies, move back to their parent’s place, or simply move to a cheaper location. Whenever people move, there is more demand for storage space to help in the transition.

Self storage investment (Big Yellow Group)

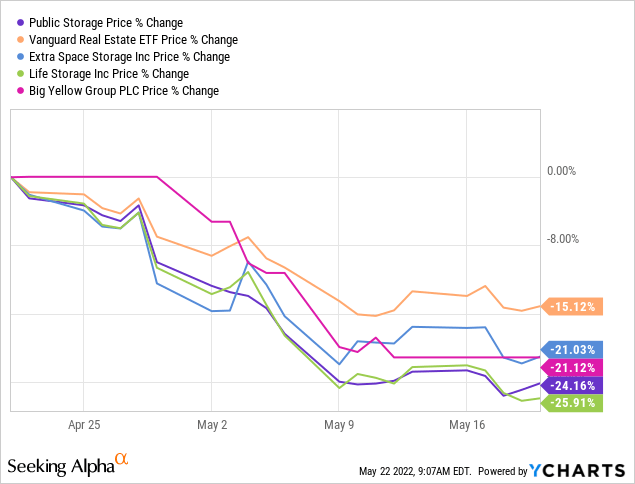

Despite that, most major self-storage REITs like Public Storage (PSA), Extra Space (EXR), Life Storage (LSI), and Big Yellow (OTC:BYLOF/ BYG) are down significantly. They are actually down even more than the broader REIT sector:

Our favorite pick here is Big Yellow because it is the leader in Europe and the European market has a much longer runway of growth. Today, there are about 10 square feet of storage space per capita in the US, but only about 1 in Europe.

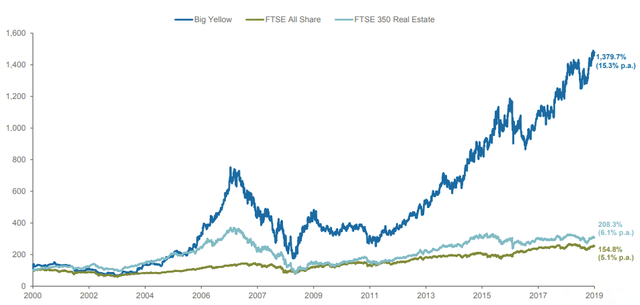

It is still a relatively new concept in Europe but it is rapidly growing in popularity and Big Yellow is there to fill this market void. It has been a massive outperformer since its IPO and we expect more of the same over the coming decade:

Big Yellow Group track record (Big Yellow Group)

Priced at a 3% dividend yield and growing at 10%+ per year, Big Yellow has a clear path to double-digital annual total returns, and that’s very attractive coming from a recession-resistant blue-chip REIT. We think that its fair value is 20-30% higher so there is also extra upside potential in future multiple expansion.

UMH Properties (UMH)

Finally, affordable housing is also notoriously resilient to recessions and it is easy to understand why.

Housing is one of our biggest expenses so that’s where you can have the most impact if you want to reduce your spending. Skipping the guac at Chipotle (CMG) simply isn’t going to move the needle as much.

And as increasingly many people decide to downgrade from an expensive Class A apartment building to a more affordable option, the demand for these affordable communities increases.

At the same time, the new supply of these communities also declines during recessions as developers scale back new construction projects. As a result, the landlords of affordable housing may suddenly enjoy growing demand and declining supply, allowing them to grow occupancy rates and rents.

UMH is one of our favorite picks in this sector because it owns a portfolio of affordable manufactured housing communities that have a lot of upside potential in their occupancy rates and rents.

Manufactured housing community investment (UMH Properties)

Its current occupancy rate is 86%, leaving plenty of room for growth, and it is able to pass large rent hikes. In the first quarter of the year, its same property NOI rose by nearly 10%.

UMH is also supplementing this organic growth by acquiring new communities, developing new ones, and expanding existing ones.

Here’s what the CEO commented a few weeks ago:

“We have significant internal upside that can be realized through the infill of vacant sites, development of our vacant land and increased sales profitability. We also have a strong acquisition pipeline of both existing communities and development opportunities that will allow us to grow externally. We have a proven business plan designed to create long-term value for our shareholders.” [emphasis added]

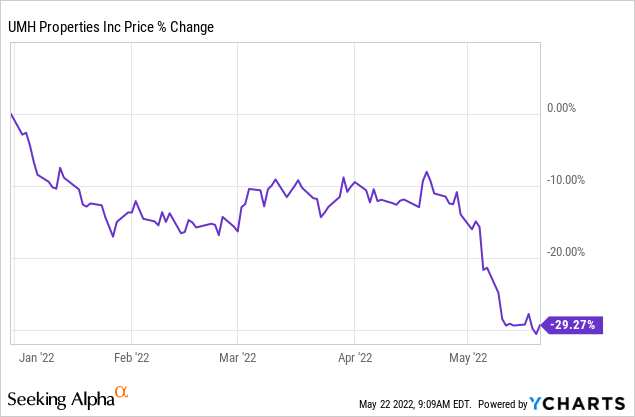

Clearly, if we are headed into a recession, UMH will be quite resilient to it, but despite that, its share price is down nearly 30% over the past few weeks:

As a result, it is now priced at just 19x normalized cash flow and a 4.2% dividend yield, which is very reasonable for a defensive company that’s growing at this pace. The yield and growth combined together should surpass 10% in the years ahead, and the company has another 20% upside as its valuation multiple expands closer to 25x cash flow, which is where it should be.

Bottom Line

The market is fearful right now.

We are quite possibly headed into a recession and it has pushed most stocks into a bear market.

But just because we are headed into a recession does not mean that all businesses will perform poorly. On the contrary, there are plenty of businesses that are recession-resistant and yet, they are now discounted due to the recent market volatility.

REITs are particularly compelling right now because they also offer inflation protection in addition to recession-resilience and discounted valuations.

That’s what I am accumulating at the moment.

Be the first to comment