jetcityimage

The iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (BATS:TLTW) is the first buy/write strategy ETF I have seen that are based on fixed income products. Looking at the performance of other buy/write strategies like the XYLD, I believe it is possible for the TLTW ETF to yield over 10% in distributions. However, investors should look beyond the monthly distribution and understand that buy/write strategies trade off a significant part of the underlying asset’s upside for premium income. Over the long run, they tend to vastly underperform, since they capture most of the downside but only a portion of the upside. I would personally stay away from buy/write strategies.

Fund Overview

The iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (“TLTW”) tracks the investment returns of a strategy of holding the iShares 20+ Year Treasury Bond ETF (TLT) and writing one-month covered call options to generate income.

The TLTW is a new fund, having only been in operation for a few months. However, the idea of selling covered calls to generate income is well known and has been popularized by funds like the Global X S&P 500 Covered Call ETF (XYLD) and the JPMorgan Equity Premium Income ETF (JEPI) that have garnered billions in investor assets.

The TLTW contractually charges a 0.5% expense ratio. However, iShares has agreed to waive certain fees until 2028 thus lowering the net expense ratio to 0.35%.

Strategy

Although covered call funds and ETFs have been around for a long time, to my knowledge, TLTW is the first instance I have seen the strategy applied to the fixed income asset class.

The TLTW ETF tracks the Cboe TLT 2% OTM BuyWrite Index (“Index”), an index designed to measure the performance of a strategy of holding the TLT ETF and selling one-month call options on the TLT ETF to generate income.

The index utilizes ‘European’ call options (i.e. the option can only be exercised at expiry) with strike price closest to 102% of the closing value (2% out-of-the-money or OTM) of the TLT ETF one day prior to the roll date. On the roll date, the index closes out the call option by purchasing offsetting call option positions and subsequently write new call options that will expire the following month. The roll date is the business day preceding the expiration of the options.

Although the index will write options that are closest to 102% of the closing value, in the event that the target option will generate less than 5 basis points of the closing value of TLTs in premiums, the fund will select a call option with strike closest to 100% of the closing value (at-the-money or ATM) of TLTs in order to avoid writing options for less than the transaction costs.

Portfolio Holdings

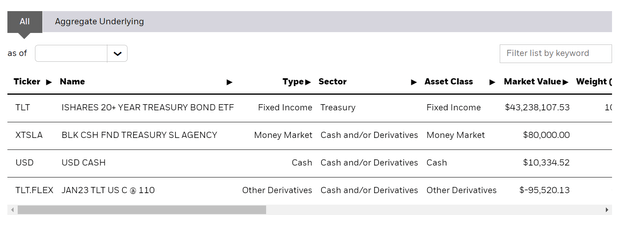

The holdings of the TLTW ETF is very straightforward. It holds the underlying ETF, TLT, cash, and a short position in calls that have been sold (Figure 1).

Figure 1 – TLTW holdings (ishares.com)

Returns

TLTW is a very young fund, with inception date of August 18, 2022, so it does not have meaningful historical returns for analysis.

Distribution & Yield

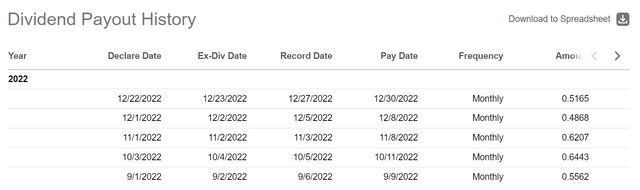

The main selling point of a buy/write strategy is enhanced yield potential. On this point, the TLTW hasn’t disappointed, having paid out $2.82 / share in distributions in the 5 months since inception (Figure 2).

Figure 2 – TLTW distributions (Seeking Alpha)

Investors should note that the trailing 12 month yield figure of 8.0% on Seeking Alpha is misleading, as it takes the 5 month/$2.82 distribution and treats it as a trailing 12 month distribution. If TLTW’s distribution rate is annualized, the trailing 12 month yield should be 19.3% ($2.82 x 12 / 5 to get annualized distribution, divided by current price of $35.28).

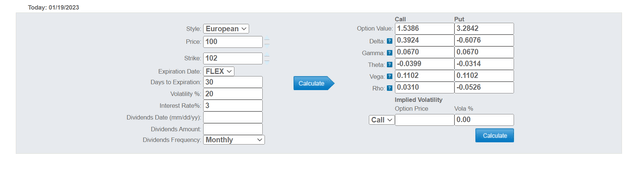

A 1-month 2% OTM call option on a ~20% implied vol asset like TLT (TLT’s implied vol has ranged from 15% to 29% in 2022) should net investors ~1.5% in premiums, so an annualized 19% yield on TLTW is theoretically possible. (Figure 3). Actual premiums received could be higher or lower, depending a number of factors such as implied vol when the option is written.

Figure 3 – Illustrative value of a 1 month 2% OTM call option (optionseducation.org)

However, there are reasons to believe the TLTW’s distribution yield will not be as high as 19.3%. This is because the TLTW must mechanically buy back the call options it sold the day before expiration. If the underlying has rallied significantly like it did in November 2022, the premiums TLTW collected when it sold the November calls would be insufficient to buy them back. So the TLTW must hold back premiums in reserve to smooth out cash flows.

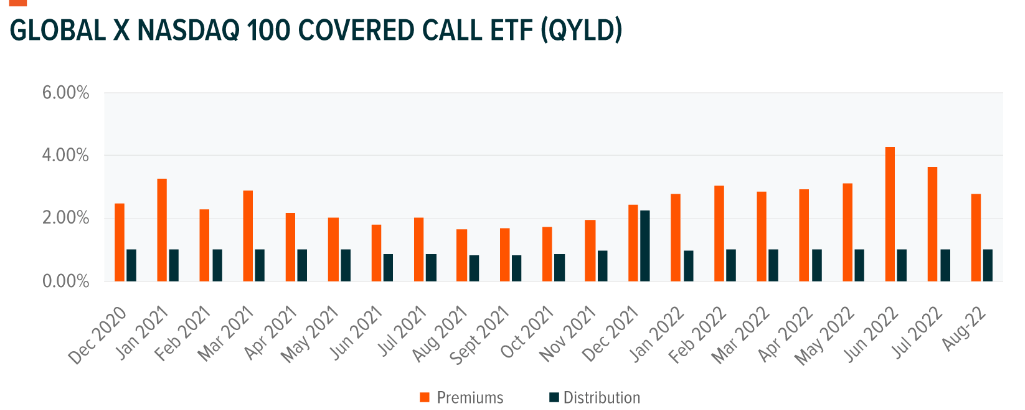

Figure 4 shows illustratively the premiums the QYLD ETF receives and the distributions it pays out. I expect a similar pattern will occur with the TLTW ETF.

Figure 4 – Illustrative cash flows of QYLD ETF (globalxetfs.com)

Trade Off Upside For Premiums

I have written about the tradeoff between upside vs. premium income for funds that employ call writing strategies, for example, the Global X Nasdaq 100 Covered Call ETF (QYLD). The main problem I have with these strategies is that it trades off upside for call premiums.

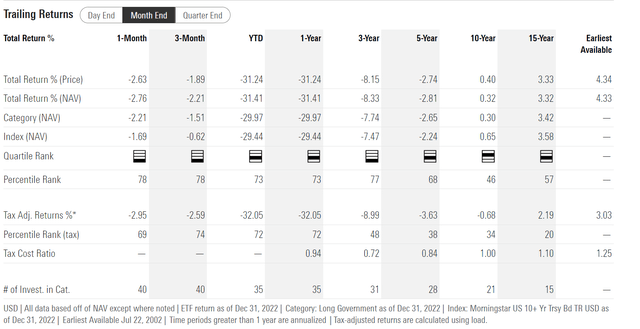

Conceptually, selling monthly 2% OTM calls on TLTs make sense. Figure 5 shows the historical returns of the TLT ETF. TLT has generated average annual total returns of 4.3% since inception, so the likelihood that the buy/write strategy will be called away appears slim at first glance if it targets monthly 2% OTM options.

Figure 5 – TLT historical returns (morningstar.com)

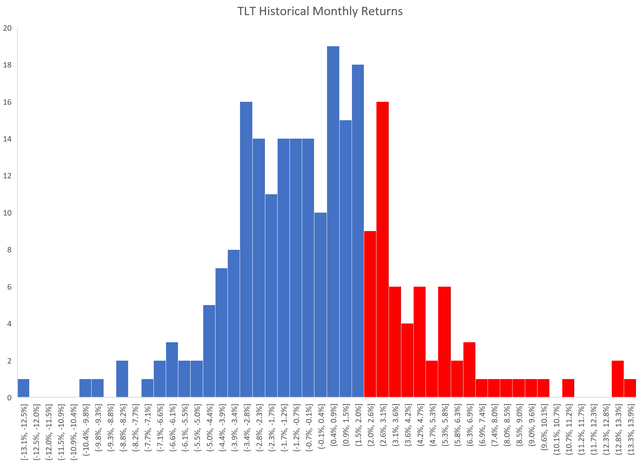

However, in practice, the TLT buy/write strategy suffers from the same statistical weakness that I have highlighted on the QYLD ETF. An ‘average’ annual return encompasses a statistical ‘distribution’ of monthly returns. If we look at the historical monthly performance of the TLT ETF, the fund has been around since 2002 and has accumulated 244 monthly returns to December 31, 2022. In the historical data-set, we can see that 64 of the 244 1-month returns have been over 2% (Figure 6).

Figure 6 – TLT monthly returns histogram (Author created with data from Yahoo Finance)

This means that for the buy/write 1 month 2% OTM call strategy, 26% of the time the strategy would have given up significant ‘upside’.

Buy/Write Strategies Tend To Underperform

Buy/write strategies only outperform when the underlying asset is in a bear market or long downtrend. This is because the premium income received can supplement part of the capital loss.

While it is too early to conclude, early signs point to the TLTW strategy significantly underperforming the TLT ETF in the long-run because it has given up a significant part of the upside in exchange for premiums. Since inception, we see the TLTW has already underperformed TLT by approximately 80 bps in total return (Figure 7).

Figure 7 – TLTW has underperformed TLT by 80 bps in 5 months (Seeking Alpha)

This is because since long-term treasury yields peaked in November, we have seen TLTs return 6.9% in November 2022 (note this is price return only). TLTW’s strategy would have capped November returns at 2%, plus any premiums received.

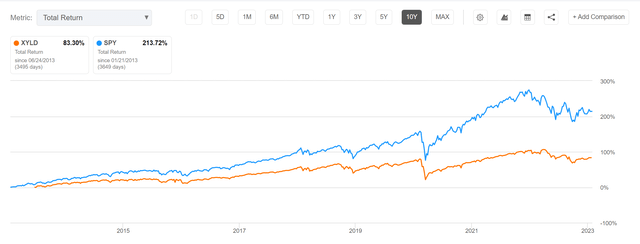

Over a long period, buy/write strategies are almost guaranteed to underperform because statistically, they have given up a portion of their upside returns distribution. For example, if we look at the XYLD ETF, popular among yield hungry investors, we can see it has underperformed the SPDR S&P 500 Trust ETF (SPY) by 130% over a decade (Figure 8).

Figure 8 – XYLD has underperformed SPY by 130% over a decade (Seeking Alpha)

Similarly, the QYLD ETF underperformed the Invesco QQQ ETF (QQQ) by 287% over a decade (Figure 9).

Figure 9 – QYLD underperformed the QQQ by 287% over a decade (Seeking Alpha)

Conclusion

The TLTW ETF is the first buy/write strategy ETF I have seen that are based on fixed income products like the TLT ETF. Looking at the performance of other buy/write strategies like the XYLD, I believe it is possible for the TLTW ETF to yield over 10% in distributions. However, investors should look beyond the monthly distribution and understand that they are trading off upside for the high yield. Over the long run, buy/write strategies vastly underperform the underlying asset as seen by the XYLD/SPY and QYLD/QQQ examples above. I would personally stay away from TLTW.

Be the first to comment