paulprescott72

Africa Oil Corp. (OTCPK:AOIFF) has been a standout performer in today’s economy with its share price up almost 70% YTD. The company is one we’ve supported for years now, with its low valuation. It’s finally gotten its financial position to a point where it can start to aggressively drive shareholder returns making it a valuable investment.

Africa Oil Corp. Share Repurchases

Among the biggest news to come out of Africa Oil Corp. is the company’s share repurchases.

Starting in late September, the company launched an aggressive share repurchase program. Under the most recent 1 week program, the company repurchased almost 2 million shares, and since September 27, the company has repurchased almost 14 million shares. For reference, the company’s total buyback program enables it to repurchase ~40 million shares.

The company’s market capitalization is currently just under $1.2 billion USD with roughly 500 million shares outstanding. The company’s share repurchase program enables it to repurchase 8%, which as we see, it can comfortably afford. The company has so far managed to reduce its outstanding shares by 3% in just over a month.

These share repurchases will be a significant part of the company’s future shareholder returns.

Africa Oil Corp. Asset Overview

Africa Oil Corp. is an incredibly well positioned company financially with a unique portfolio of assets.

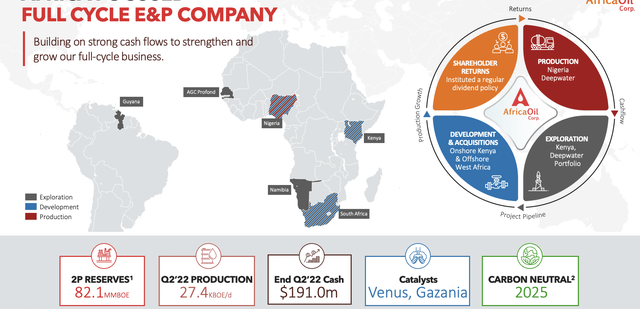

Africa Oil Corporation Investor Presentation

Africa Oil Corp. is a full cycle E&P company with an impressive portfolio of assets, especially off of the coast of Nigeria. The company has 82.1 million barrels of 2P reserves with production at 27.4 thousand barrels / day. That implies a more than 8-year reserve life at the present time although the company has done a good job of replacing those assets.

The company currently has $191 million in cash, not counting the roughly $30 million in share repurchases that have happened. The net cash position even counting Prime Oil and Gas debt is strong, with the company net cash positive overall. However, the company has substantial room to leave that debt and keep repurchasing.

More so, the company continues to get dividends from Prime Oil and Gas. The company continues to have substantial other assets entering development and exploration status that can enable future returns. It’s also worth noting that Africa Oil and Gas has continued to have a respectable hedging strategy to protect revenues from the next year.

Africa Oil Corp. Financial Position

The company has an incredibly strong financial position that we expect to continue improving.

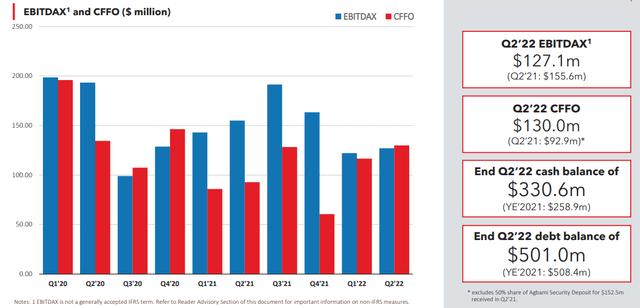

Africa Oil Corporation Investor Presentation

The company’s 50% portion from its cash flowing asset has been substantial. The company’s annualized EBITDAX is more than half a billion and the company’s CFFO is roughly $500 million annualized, which is massive for a just over $1 billion company. The company can improve that spread by paying down debt more to save on interest.

Given strong oil prices, we’d like to see the company focus on share repurchases below a level of roughly $3-4 / share, ideally becoming the sole buyer at that level. We’d like to also see the company focus on more long-term growth opportunities through Kenya etc., which can provide a reliable production source for decades.

Africa Oil Corp. Growth Potential

The company’s inventory also provides the company with substantial future growth potential.

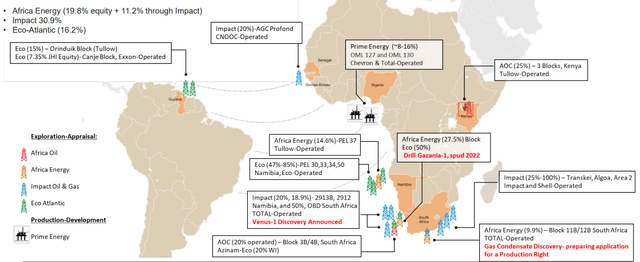

Africa Oil Corporation Investor Presentation

Africa Oil Corporation has substantial growth potentially, heavily through its stakes in Africa Energy, Impact, and Eco-Atlantic. The company recently announced the Venus-1 discovery, indicating the potential of a new producing assets. We expect several of these assets to start producing soon, providing new production. That could start with cash flow in the next few years.

The company also still has its 25% stake in the Kenya blocks which is already producing low volume production with expensive trucking. We expect that this can ramp up accelerating shareholder returns and the resulting growth potential while providing a multi-decade time period of flowing oil.

Africa Oil Corp. Shareholder Returns

Our perspective is the company continues to have the potential to generate substantial shareholder returns.

The company currently has a 2% dividend costing it just over $20 million per year, one that it can comfortably afford. We expect that to continue for the long-term. The company has been aggressively repurchasing shares, which has shown up in its share price, and we expect that to continue increasing over the coming months. The company has ~2.5 months left.

We’d like to see the company because a major buyer of shares below $3-4 per share given its current price and valuation, where there’s a substantial opportunity to drive returns. The company also has reasonable growth potential so we’d like to see it continue focusing there to drive long-term returns where they’re opportunistically available.

Let us know your thoughts on returns in the comments below.

Thesis Risk

The largest risk to the company’s thesis is oil prices. The company is incredibly profitable with Brent crude prices at just under $96 per barrel. However, at $80 / barrel or less the company’s current valuation becomes more overvalued which changes the thesis on the validity of the investment. We see that as less likely in the current environment with underinvestment.

Conclusion

Africa Oil Corp.’s share price has continued to outperform with its aggressive portfolio of share repurchases. The company’s impressive share price performance can be expected to continue. On top of this, the company has a dividend yield of 2% one that it can comfortably afford for the long run that we expect to continue increasing.

The company has an impressive portfolio of assets one that we expect to be able to continue expanding. Its core assets have substantial production and an almost 1 decade time period on reserves, assuming no reserve replacement. Going forward, we expect this combination to support substantial shareholder returns along with enabling continued growth.

Be the first to comment