niphon

Investment Thesis

Titan Machinery’s (NASDAQ:TITN) stock has surged over ~20% post its strong Q3 earnings. The company’s sales benefited from the strong demand in the agriculture and construction segment along with acquisitions in its Agriculture business. I believe we are still near middle of the agriculture upcycle and the prospects of construction end markets also look good with infrastructure funding ramping up. So, the company can continue posting strong growth in the coming years. The valuations are attractive as well with the stock available at a steep discount compared to its historical valuations.

Business Basics

Titan Machinery is an authorized dealer of CNH Industrial (CNHI) and sells Agriculture and Construction equipment in North America and Europe. The company operates in three segments; Agriculture, Construction, and International with four principal business activities – equipment sales, parts sales, repair and maintenance services and equipment rental. In fiscal 2022, CNH Industrial supplied approximately 76% of the new equipment sold in its Agriculture segment, 66% of the new equipment sold in its Construction segment, and 70% of the new equipment sold in its International segment. In addition to CNHI brands, the company sells and services equipment made by other brands in niche markets, which accounts for its remaining sales. The company’s second biggest supplier after CNH accounted for only about 2% of its revenue.

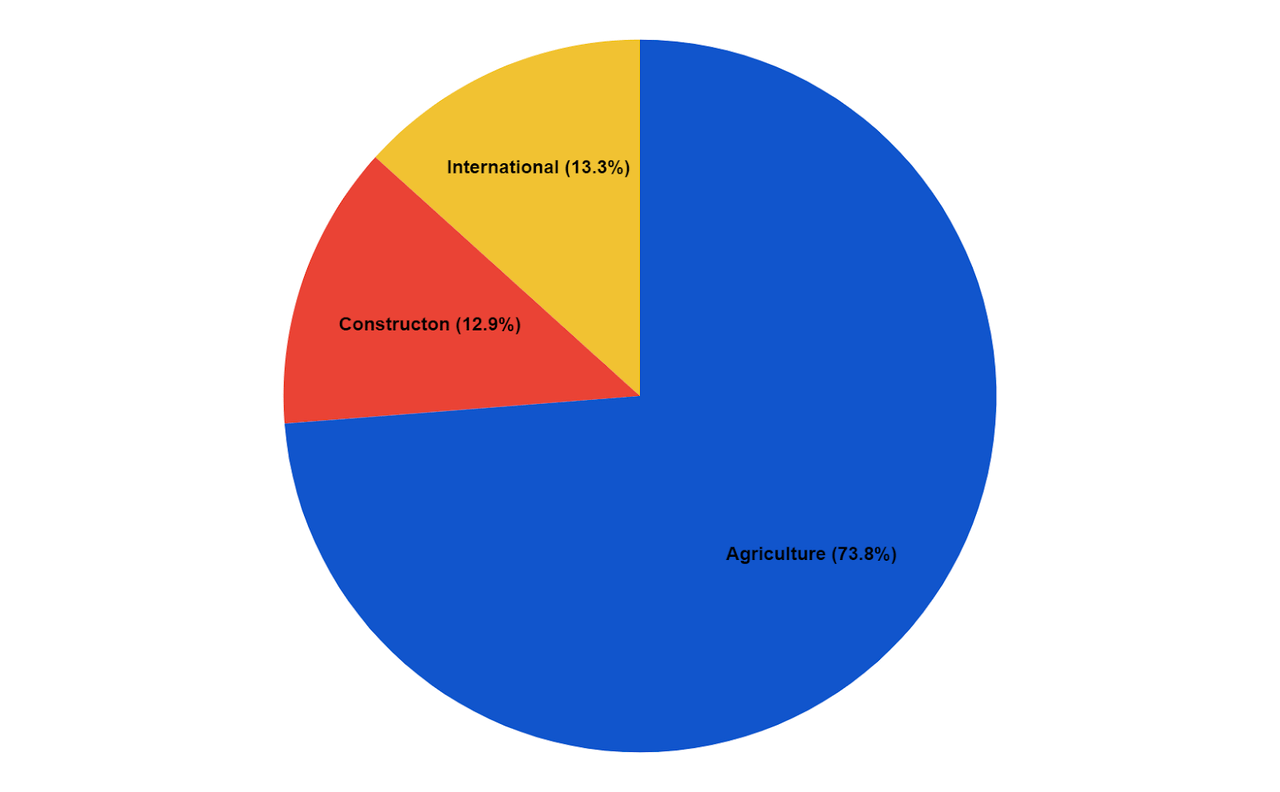

TITN’s Segment Revenue Distribution (Company data, GS Analytics Research)

Equipment sales account for approximately three-fourths of the company’s sales, and parts, services and rental combined account for approximately a quarter of the company’s revenue. However, the parts, services and rental are comparatively more profitable businesses and account for ~60% of the company’s total gross profit. These businesses are also recurring in nature and relatively less cyclical.

Titan Machinery Q3 FY23 Earnings

TITN recently reported better-than-expected third-quarter FY23 financial results. The revenue in the quarter was up ~47% Y/Y to $668.77 mn (vs. the consensus estimate of $597.37 mn). The diluted EPS in the quarter increased ~88% Y/Y to $1.83 (vs. the consensus estimate of $1.16). The revenue growth was due to the strength in the agriculture sector and sales growth in the equipment, parts, and service segments. The adjusted EBITDA margin in the quarter grew 170 bps Y/Y to 9.5% due to the sale of higher-margin products and higher operating expense leverage. This benefited the year-over-year growth in the adjusted EPS.

Revenue Analysis and Outlook

The Agriculture segment sales in Q3 FY23 increased 75.2% Y/Y to $493.3 mn due to the strong demand in the agriculture sector. The Construction segment’s sales increased 8.4% Y/Y to $86.4 mn driven by increased equipment demand, partially offset by lost sales contributions from divestitures. The same-store sales in the Agriculture and Construction segments grew 46.4% Y/Y and 34.4% Y/Y. In the International segment, revenue decreased by 4% Y/Y reflecting disruption within the TITN’s Ukraine business and a 14% negative FX headwind due to the weakening Euro.

In Q3 FY23, the equipment business’s sales increased 54% Y/Y driven by strong same-store sales in the Agriculture and Construction segments as well as the acquisitions of Jaycox, Mark’s Machinery, and Heartland Ag. The parts and services businesses also saw good growth and revenue increased 35% Y/Y and 21.7% Y/Y, respectively in the quarter.

The inventory levels for equipment have increased by $150 mn from January 31, 2022, to $474 mn, driven by the increase in new equipment inventories coming from its suppliers as well as acquisitions. The inventory level for parts has also increased in the quarter from $96 mn at the end of the fiscal year 2022 to $150 mn due to the company’s efforts to ensure the availability of parts for its customers as well as the acquisitions of Mark’s Machinery and Heartland Ag Systems. Given the strong sales in the quarter, the equipment inventory turn increased to 3.6x vs. 3.1x in Q3 FY22.

The customer demand for new and used equipment is continuing to outpace the supply, given the increase in net farm income. Also, the new generation of equipments is much more efficient and becoming essential for farmers given the rising input costs. Furthermore, the current aging fleet is benefiting the company’s parts and services business. All these factors are driving the company’s organic growth. TITN is also doing well on M&A front. On July 2022, TITN acquired Heartland Ag Systems, which is the largest Case IH application equipment distributorship in North America. Post this acquisition Titan Machinery has the distribution rights for the entire North American Case IH, New Holland, and Case Construction product portfolio.

The Construction segment is witnessing healthy consumer demand. Also, energy-related construction activity at its oil and gas-producing markets in the Colorado Front Range and West North Dakota Bakken Fields remains strong. The company should also benefit from infrastructure funding-related projects from IIJA and other acts.

While the company’s Agriculture and Construction segments are doing very well, international segment performance is somewhat weak. The International segment represents TITN’s business with countries such as Bulgaria, Romania, and Ukraine. The company’s European customers are benefiting from the higher global commodity prices. Further, the company is experiencing strong performance in Bulgaria and Romania and is seeing improvements in Germany given its operational initiatives. However, the company’s Ukrainian customers are facing higher risk of interruptions and increased transportation and logistics costs. Also, dollar appreciation has been a significant headwind for this segment.

Looking forward, the management has raised its FY23 revenue growth guidance range for the Agriculture segment from the previous 50% to 55% increase to the current 55% to 60% increase. The segment growth is benefiting from the acquisitions of Jaycox, Mark’s Machinery, and Heartland Ag and increased demand in the sector. Management also increased the Construction segment’s revenue guidance range from previous 5% to 10% decline to the current flat to negative 5% due to the better than expected third-quarter results. The decline in the Construction segment’s revenue is due to the divestitures of five construction equipment stores in Montana, Wyoming, and North Dakota in January and March of 2022. According to management, excluding these divestments, the same-store sales should be up 25% in FY23. The revenue in the International segment is expected to be between flat and negative 5% due to the currency headwind and uncertainty in Ukraine.

I am optimistic about the company’s prospects given higher soft grain prices, U.S. infrastructure funding ramp-up, improving the supply chain, and higher farm income. These tailwinds should offset the slowdown in residential construction. The company’s higher inventory level should also support in meeting this demand.

One thing which many investors are concerned about is where we are in the agriculture cycle and can this strong demand continue in the long term. Looking at the past cycles, I believe we are in the middle of the cycle and there is still a good chance of continued upswing. In the past cycle, industry equipment sales peaked at ~39.9 thousand units in FY13-14 while trough occurred at ~14.8 thousand units in FY17-18. We are currently close to 22.6 thousand units, which gives me conviction about the company’s medium to long term growth prospects.

Margin Outlook

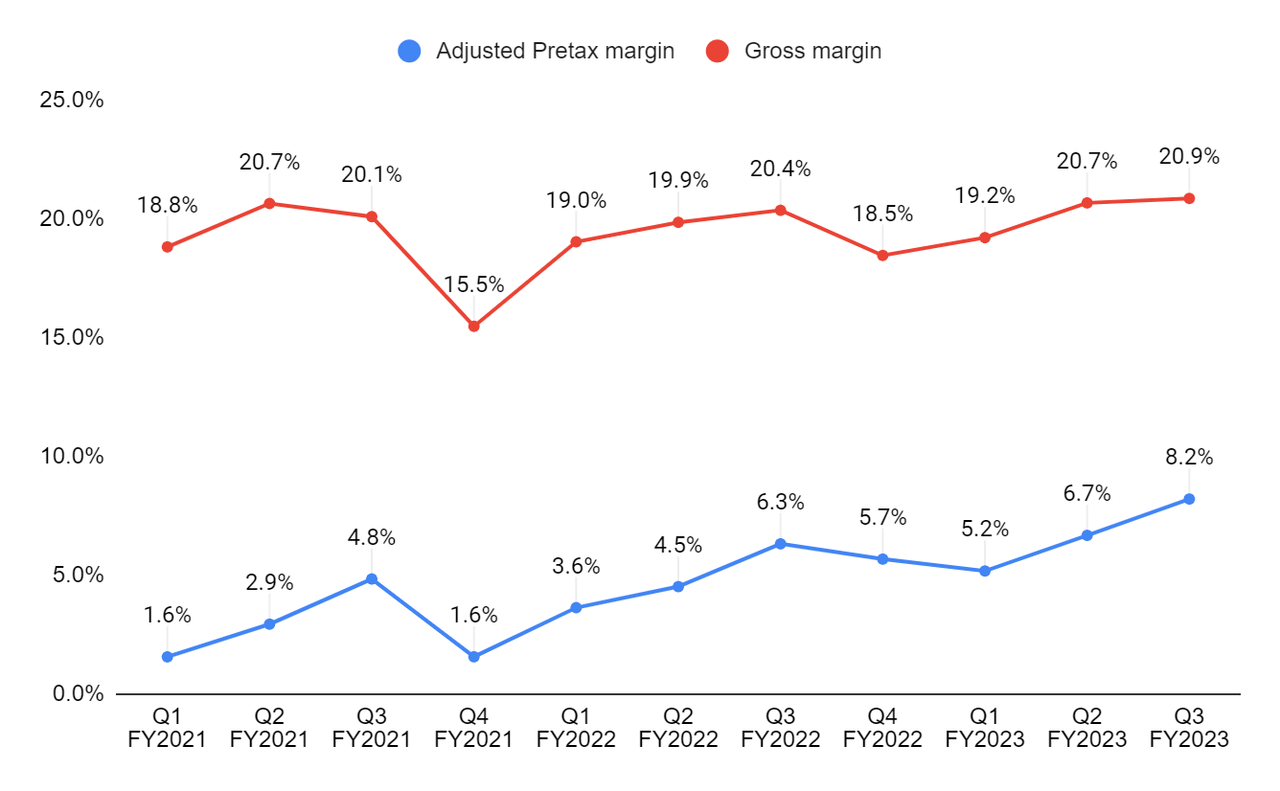

In Q3 FY23, the gross margin improved by 50 bps Y/Y to 20.9%, driven primarily by stronger equipment and parts margins. Equipment margin was supported by a $2 mn benefit from the annual manufacturer incentives, healthy inventories, and favorable end markets. The pretax margin in the quarter improved by 190 bps Y/Y to 8.2% due to improved gross margin and operating leverage due to higher levels of sales. The pretax margin in the Agriculture segment improved by 150 bps Y/Y to 8.5%, driven by operating leverage and the recognition of manufacturer incentives. The Construction segment’s pretax margin improved by 250 bps Y/Y to 7%, driven by continuous improvement in the segment. The adjusted pretax margin of the International segment improved by 300 bps Y/Y to 9.8% due to improved margins across equipment, parts, and service.

TITN’s gross margin and operating margin (Company data, GS Analytics Research)

Looking forward, the company’s margin should benefit from another $2.5 mn in manufacturer incentives along with the sales of higher margin parts and services in Q4 FY23. The margins should also benefit from higher operating leverage given higher sales in the coming quarters. However, from a longer-term perspective, gross margins are currently higher than 5-year historical average and may correct a couple of hundred bps over the next few years to return to more normalized levels.

TITN Stock Valuation & Conclusion

The stock is currently trading at an 8.67x P/E FY23 consensus EPS estimate of $4.90, which is at a significant discount to its five-year average forward P/E of 23.14x. The company’s revenue should benefit in 2023 from the easing of the supply chain constraints, higher farm income, and an infrastructure funding ramp-up. In the medium to long term, I believe the agriculture up cycle should continue over the next few years helping the company’s growth. On the construction side as well, the company should benefit from improved infrastructure funding environment. While there are some concerns around the sustainability of the current margins, I believe they are already priced in given the stock is available at steep discount to its historical P/E multiple. Hence, I have a buy rating on the stock.

Be the first to comment