jetcityimage

The SPDR Bloomberg Barclays 1-10 Year TIPS ETF (NYSEARCA:TIPX) is usually seen as an instrument that protects investors from all sorts of risks. But in the current environment it is actually rather exposed to forces that are likely to move against it rather that with it. TIPX allocates to TIPS which are inflation indexed bonds. The coupon rate is constant but inflation causes the principal upon which the coupon is paid to adjust. It moves upwards in nominal terms during inflation, and downwards with deflation, so that in real terms it stays the same. That is all well and good, but rates are rising now, and it is still exposed to duration risks. However, there is a perplexing spread between the TIPS and a normal treasury, with TIPS yielding surprisingly high. Still, while relatively interesting we don’t want to take a trade that goes against the direction of rates.

Key Elements

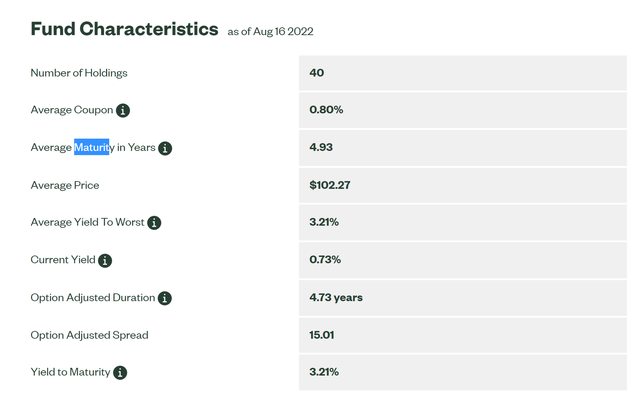

Everything you’d need to know about a bond ETF can be found in its summary characteristics.

The YTM of 3.21% is a little higher than a new-era reference rate of 3%, which indicates that markets are already selling TIPX and pricing in a whole lot of disinflation which would affect the trajectory of growth in principal values and therefore coupons. While the notion is realistic given that this is the Fed’s objective, the difference implies not disinflation but actually deflation, assuming the obvious which is the credit risk of a TIPS and a treasury are the same. This is obviously not very realistic, where we are essentially guaranteed some amount of inflation due to cost-push effects.

While inflation implications certainly sell a TIPS short, after all a 3.2% YTM that is inflation hedged is actually not bad at all, the direction of rates is what worries us. While TIPS are inflation protected, they are not duration protected and this is likely the main reason why TIPS with these longer maturities have gotten cheaper. This ETF contains 1-10 year TIPS in terms of maturity and the weighted average maturity is almost 5 years. That means that for every 1% increase in rates, the value of the average bond in the TIPX declines by 5%. 5 years is quite a long effective maturity.

Conclusions

A 3.2% yielding TIPS is actually quite remarkable, and with 10-year treasuries yielding a little less, this is a relatively good pick through TIPX in the current market. However, the duration and rate sensitivity is there, and those rates are going up, probably a lot more than they already have. Maybe as a pair trade, shorting a similar maturity treasury ETF and going long TIPX might be a great play, but as a unidirectional bet it is not attractive.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment