alvarez/E+ via Getty Images

The Timken Company’s (NYSE:TKR) core product – engineered bearings – is essential for various applications across numerous industries, which is why investors should look at Timken. The company serves diversified end markets and generates revenue from across the globe. It has performed exceedingly well in revenue growth and profitability in 2022. But storm clouds are gathering across the global economy. Much anticipated economic data, such as the Consumer Price Index, will be released by the U.S. Federal Government that may set the tone for future interest rate increases. We are entering a critical earnings season this month, during which we will learn about the state of the U.S. and the world economies. If you own Timken, it may be best to hold it for the long term. It may be best to wait if you are looking to buy or add to your existing holdings after the company’s earnings and after learning more about the direction of the interest rate increases.

Timken has Many Long-Term Revenue Drivers

There are three long-term revenue drivers for this company. The first is the reshoring efforts underway across the globe. Geopolitical tensions coupled with the supply chain disruption caused by the pandemic have forced countries and companies to rethink the location of their manufacturing plants. The second factor that could drive Timken’s revenues is more uptake of robots in manufacturing and other industries. There is a labor shortage across many developed nations, and workers are using this shortage to bargain for higher wages. This labor shortage will not disappear soon. Companies are looking to invest in robotics to replace some of the labor in their plants.

Good Pricing Power Helps Increase Profits in 2022

The company has performed well and delivered excellent revenue growth and earnings. Total sales for second-quarter 2022 [released on July 28] rose by 8.5% compared to the same quarter in 2022 to a record $1.15 billion. The company achieved a record adjusted EPS of $1.42 compared to $1.36 for the same period in 2021 – an increase of 4.4%. Excluding special items, the diluted EPS grew by an astounding 21%. The company’s stock buybacks of 750,000 shares during the quarter helped increase the EPS. The company’s Process and Mobile Industries segments performed well. The Process Industries segment saw sales growth of 7.3%, while the Mobile Industries segment saw sales increase by 10%.

Since 2012, the company has averaged a gross margin of 28.6% and an operating income margin of 12.16%. For the fiscal year 2021, the company had a lower gross and operating margin of 26.8% and 13.2%. Since the end of 2021, the company has improved its margins. The company’s quarterly gross margins for the March and June quarter of 2022 were above 29%, and its operating margins were above 15%. The improved profitability at Timken may be attributed to better pricing. The company’s CEO, Richard Kyle, said the following about pricing in the Q2 2022 earnings call:

Price realization improved sequentially from the first quarter, and we expect it to continue to improve modestly through the year’s second half.

It is good news for the stock if it can maintain its pricing. But, the global economy is seeing storm clouds in the demand environment that may damage Timken’s sales and profitability. The company generates revenue globally and is not immune to an economic slowdown. For example, the company generates 45% of its revenue from North America, 6% from Latin America, 25% from Europe, the Middle East, and Africa, and 24% from the Asia-Pacific region.

The U.S. GDP shrunk in Q1 and Q2 2022 by modest amounts, and consumer consumption and confidence may take further hits if the interest rates continue rising. Europe is grappling with an energy crisis as it tries to wean itself off Russian oil. Many Asian countries are grappling with the effects of a strong dollar, higher energy import bills, and high inflation. Even though Asia continues to be the fastest-growing region globally, its economic growth rate is slowing. This global economic slowdown could spell trouble for Timken over the next year.

Timken’s Stock Price Volatility

Timken’s stock has high volatility compared to the S&P 500 Index ETF. According to Yahoo Finance, the stock’s monthly volatility is 1.54. A linear regression of the monthly returns of Timken and the Vanguard S&P 500 Index ETF (VOO) yields a beta of 1.48. But, during this current market downturn, the stock has performed well since I rated it a buy in my Seeking Alpha article in March 2022. Timken has returned a negative 1.03% since March, while the S&P 500 index has lost 22% during the same period [as of October 3, 2022].

Small Dividend Yield and Subpar Financial Returns in Current Rate Environment

The stock has a dividend yield of 1.95%, similar to the 1.74% offered by the Vanguard S&P 500 Index ETF. It is not worth owning Timken for the dividend, but it is worth owning for the diverse industries in which the company generates its revenues and the megatrends that can drive its growth. The company’s payout ratio is a reasonable 24%. Over the past decade, the company has grown its dividends at a compound annual growth rate [CAGR] of 2.9%.

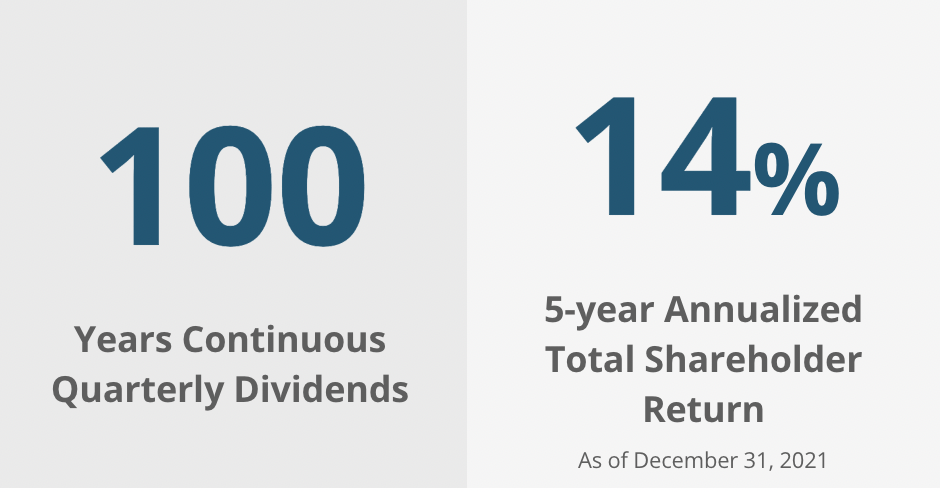

Over the past five years, the company has returned 14% and has continuously paid quarterly dividends over the past 100 years [Exhibit 1]. In August, prices increased by 8.3% [Consumer Price Index] compared to the same period in 2021. As measured by the Personal Consumption Expenditure [PCE], the inflation rate increased by 6.3% in August 2022 compared to the same period in 2021. There is a 200 basis points difference in the inflation rate as measured by the two indexes. Either way, inflation is high as measured by both indices. If it does not moderate in the coming months, Timken’s modest growth in dividends may not compensate investors for the loss in purchasing power, especially if the stock does not appreciate enough to provide a good annual return.

Exhibit 1: Timken’s Exceptional Dividend Record

Timken’s Exceptional Dividend Record (Timken Investor Relations)

The company’s return on invested capital is 9.45% [Source: Seeking Alpha/YCharts], low compared to its weighted average cost of capital [WACC]. Based on a 10-year Treasury rate of 3.94% [October 11, 2022], I estimate the cost of capital at 10%. I calculated this capital cost based on the loan’s current interest payments. The company’s interest payments could increase in the coming years since it is paying an interest rate of less than the current 10-year Treasury rate on some of its debt. For example, the company is paying a 2.02% interest rate on a $157 million note expiring in 2027. It is paying a 4.5% interest rate on $397 million in unsecured notes expiring in 2028. The company cannot get these same rates at current levels of U.S. Treasury rates.

It is safe to assume that the company’s cost of capital is much higher than 10%. It is a concern that the company’s return on capital does not exceed its capital cost. In the short term, the company may focus on increasing its efficiency by reducing its cost structure to improve its financial returns. The company may also pause or retool its acquisitions strategy to ensure it can drive good financial returns from its acquisitions.

Timken Looks Cheaply Valued

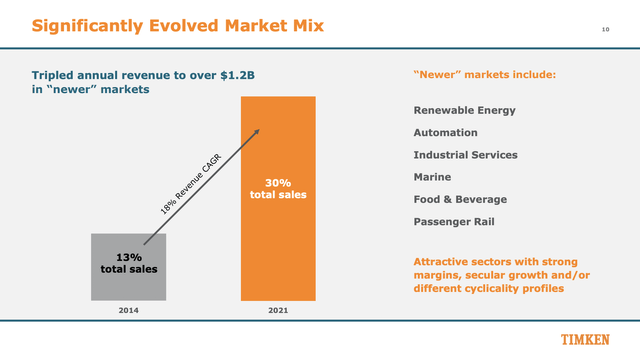

The company is trading at a forward EV-to-EBITDA multiple of 7.7x and a forward price-to-sales multiple of 1.06x. Timken is trading at a cheap valuation for a company with a geographically diversified revenue stream with products serving numerous industries. The company generated 30% of its sales from, what it defines, as ‘newer’ markets, such as renewable energy, automation, passenger rail, and others [Exhibit 2]. Automation continues to be a focus area for many manufacturing plants to increase efficiencies and profits. These ‘newer’ markets have the potential to continue growing for a long time.

Exhibit 2: Timken’s Revenue Generated From Renewable Energy, Automation, and other Newer Markets

Timken’s Revenue Generated From Renewable Energy, Automation, and other Newer Markets (Timken Investor Day 2022)

Conclusion

I own shares at an average cost of $63.70, but I would wait to add more shares to my holdings. We are entering the earnings season this month, which should offer clues on the state of the economy. September’s Consumer Price Index is set to be released on October 13. It will provide clues to the direction of the Federal Reserve’s interest rate hikes. Timken should release its earnings for the third quarter of 2022 in October. Given all these upcoming market-moving news and the company’s third-quarter earnings, it may be best to wait before buying Timken.

Be the first to comment