mikkelwilliam/iStock via Getty Images

Introduction

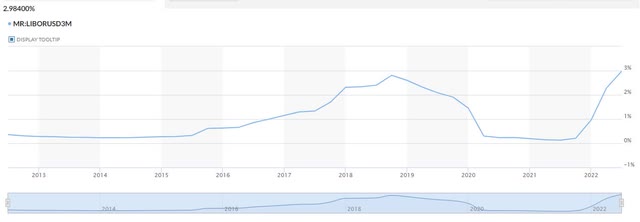

Fixed-To-Floating rate preferred and baby bond securities became common issuances primarily in the 2016-17 period. The concept was to provide the investor with some security that in a low interest rate environment that appeared to be rising, the floating rate component would entice companies to call in their securities reducing the risk to the investor of getting stuck with a perpetually declining principal piece of paper. This sounded like a good deal as 3-Month Libor had been set around 1/4th a percent for a number of years following the financial crisis of ’08-’09, but was now rising to 1-2% in the ’16-’18 time period. However, rates turned back down in 2019 even before the Covid lockdowns hit the world economy, and suddenly these securities looked more likely to reset in the future to floating rates well below their initial fixed coupons.

3M-Libor, 10 Year Chart (www.marketwatch.com/investing/interestrate/liborusd3m)

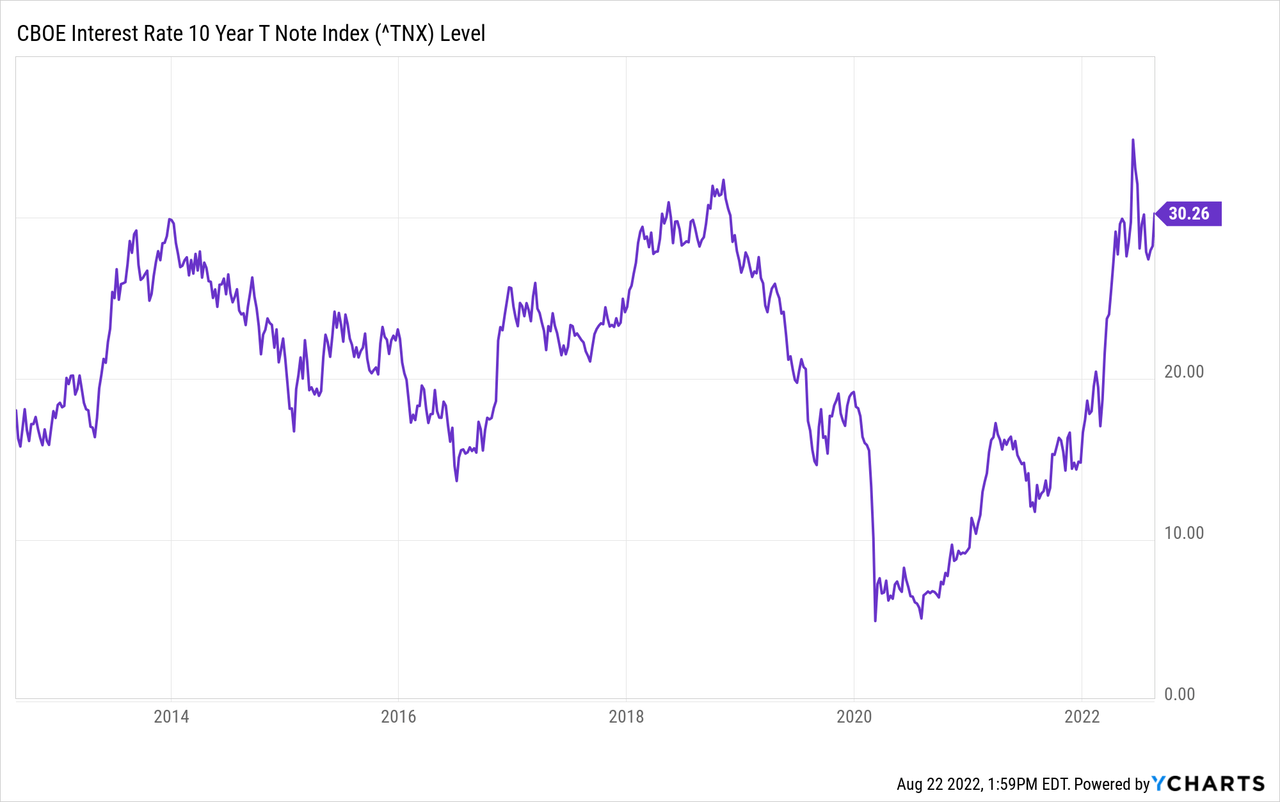

The inflation equation this year has changed that outlook materially, and the current basket of these securities is now generally about a year and a half away from their first potential call dates and resets to floating rates. This time, however, 3-Month Libor is higher and just under 3% currently. This is creating an interesting dynamic in the preferred and baby bond market. The path of higher rates has certainly pushed all rate sensitive securities lower in principal to reflect the appropriately changing yield requirement demanded by the market. These securities are still fixed coupons after all, but now with the move up to near 3% in the adjustment most commonly used for the floating component, more than 90% of these securities by my calculation will have a floating rate higher than their initial fixed coupon assuming all variables remain fixed from here.

The interesting part is that a little over half of these issues are trading below par due to the rise in the yield demand from the market. This suggests that at least some of these issues may be called when the opportunity arises for these companies. Every issue and business will have to be analyzed independently to determine how likely such an event is, but the implication is that there may be an opportunity in these issues to also gain some decent principal appreciation in the process producing significant potential Yield-To-Call returns.

The fact that the majority of these issues are about 18 months away from their first call dates is also what interests me here, as in general I’ve noticed the market in preferred and baby bonds tends to react in terms of price about 12 months in advance to call risk. Hence, an investor in these securities, (if one has judged correctly the potential opportunity and ability in a company to call), could start to bear fruit in about another six months as a generalization.

This strategy could also provide a decent hedge against continued rising rate risk to an income generating portfolio. I made some investments in Canadian 5-Year rate reset preferred securities in the fall of 2020. They’ve done well to appreciate in that time, but they peaked earlier this year and are effectively trading at the same price as they were in mid-2021. This despite the US 5-Year yield going from about 90 bps to over 3% during that time frame. Markets tend to discount well in advance, so it’s hard to find these kinds of opportunities for securities to benefit from higher rates that haven’t already discounted it.

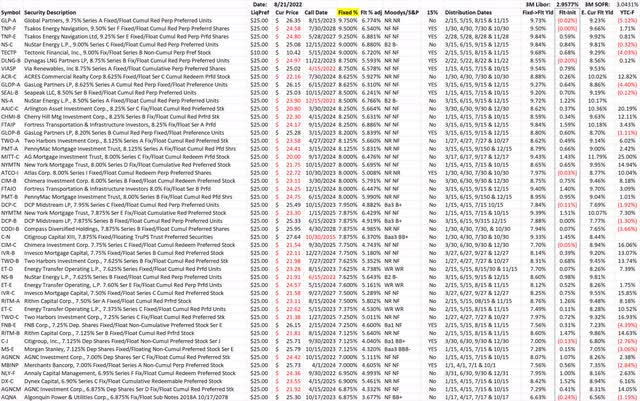

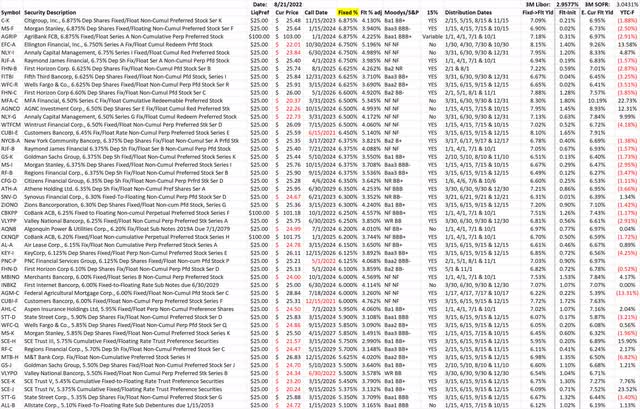

Fixed-To-Floating Rate Securities Data

The first and primary point of this article is to highlight that the basket of Fixed-To-Floating rate securities in the non-institutional market are effectively ‘in-the-money,’ in terms of where the current 3-Month Libor rate resides and where the future floating rates will adjust to once they reach their first call dates. Below you can find a large, but not complete, list of such available securities. The prices are as of the close from Friday August 19th 2022. They are sorted from highest to lowest by their initial fixed coupon. The few securities that have already passed their call dates are listed in red, and securities that are trading below par have their prices colored in red. Next to the initial fixed coupon, I’ve included the 3-Month Libor floating rate adjustment for each security as provided by Quantumonline.com. The four columns I added on the right side provide the following information: Fixd->Flt Yld provides what the coupon rate will be once the security begins to float at the given 3-Month Libor rate. FLT-Init provides the difference between the future floating rate and the initial fixed rate. E. Cur Flt Yld provides the estimated current yield assuming the security was floating right now, and YTC-F is really just the Yield-To-Call. Don’t quote me on that last calculation as it’s a complex formula to simulate in a spreadsheet, and it tends to get a little wonky when closer to call periods. Hence, as a standard disclaimer, please check all calculations here as it’s a lot of data that I entered by hand so errors are possible. Please consider this a primer to look for potential securities of interest to begin your due diligence.

Quantomonline.com

Quantumonline.com

It is readily apparent, there are very few issues that will adjust to a rate below its initial fixed coupon at this point. There are also a significant number of issues trading well below par that offer potential double digit Yield-To-Call returns. A lot of them are from Mortgage REIT related issuers, but there are some other financials and even utility issuers in the mix here. Again, please due your work on each name. For example, some of these that look interesting are priced that way due to pending acquisitions that may leave the securities orphaned in the ‘Professional’ OTC markets that are restricted to retail trading.

One other legal issue that had been overhanging these securities to some degree has been resolved earlier this year. On March 15th, as part of the Omnibus Spending Bill, the Adjustable Interest Rate LIBOR Act laid out the foundation for legacy contracts tied to Libor to legally use Secured Overnight Financing Rate SOFR plus an adjustment determined by the Federal Reserve. There are a number of spot and term rate SOFR indexes out there which could cause confusion, but I take the reading of the document to mean that they will use a comparable 3-Month Term SOFR plus 0.26161% which does get you very close to the current 3-Month Libor rate. This should eliminate the risk of these securities getting frozen at the last Libor rate in June of 2023.

Conclusion

I do have some exposure to a few of these securities already, but to be fair, most of them came during previous markets when opportunities were present for different reasons. Nevertheless, I do find some of these potential Yield-To-Call opportunities very interesting. Each investor will have to make one’s own risk-reward calculations of course, but the key variables in my mind are the following: 1.) Solvency risk (always), 2.) How likely is the issuer’s ability to call and issue a new fixed rate security with a lower coupon than the floating rate, 3.) Future inflation and interest rate environment at the time of the first call period.

The retail preferred and baby bond market has tended to see adjustments in pricing around callable issues once the given security gets to a year out from the call date. We have very few current issues past call date already in this bucket, but out of the eight I have on this list, five are trading just above par now and two of the remaining three are issued by the same company. There’s another 15 within a year away from callable that are split evenly between above and below par. Hence, this is not a definitive call that the market is missing something with this basket of securities. Some of these issues are appropriately priced due to their inherent company specific risks. However, I do think it’s worth picking through this pile as I suspect there will be a number of issues that get called in the future by higher credit quality companies if rates continue to stay here or move higher, despite the fact that some of them are currently trading below par to various degrees.

Having a few of these issues in a greater income oriented portfolio can help to mitigate the risk of another leg higher in interest rates in the future, but the key then will be to gain some principal return by buying below par before the eventual call. Good luck out there to all income investors.

Be the first to comment