Foreword

This article is based on one Fortune.com magazine article aimed at revealing 5 dividend stocks to beat a turbulent market, by Shawn Tully:

Today’s tumultuous climate strongly favors… long-distance champions. To understand why, it’s important to analyze the profile of a typical dividend stalwart. These are mature, generally stable businesses that don’t have a big need for capital to invest. Their top growth stage is behind them. The best use of their earnings is channeling the cash to investors. A trademark of dividend stocks is that they’re cheap compared with the overall market, and never more so than today. They offer high earnings relative to their share prices, the formula that enables them to pay chunky yields.

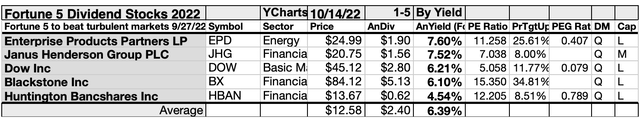

We zeroed in on five stocks that hit four important boxes: a dividend yield of at least 4.5%; a P/E of around 16 or lower (versus around 20 for the S&P 500); a history of consistent earnings; and fourth, beaten-down stock prices not justified by their fundamentals.

Any collection of stocks is more clearly understood when subjected to this yield-based (dog catcher) analysis, these five Fortune stocks projecting ‘top’ reliable dividends for investors are perfect for the dogcatcher process.

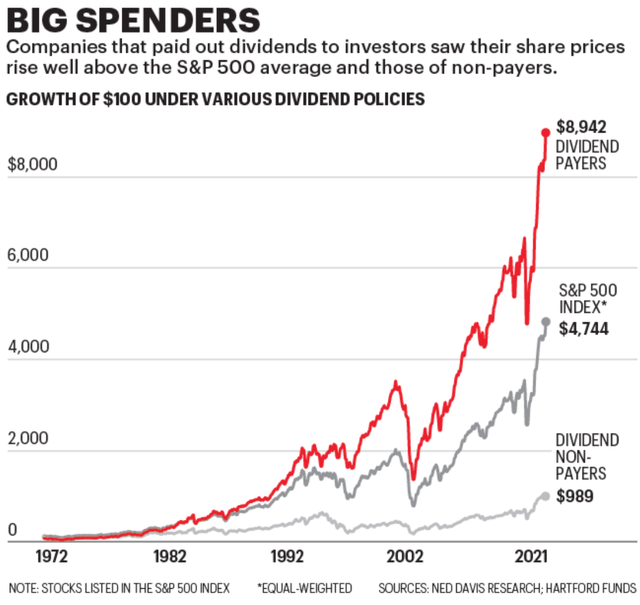

Here is the October 14 data this Fortune collection. One sidebar notes that $100 invested in dividend stocks over the last 40 years beat both non-dividend payers and the S&P 500 by nearly ten times and two times, respectively.

Source: Fortune.com OCT/NOV pg 48

Note that the Ides of March 2020 plunge in the stock market took its toll on stocks over two years and seven months ago. Thereafter the escalation in prices for dividend stocks made the possibility of owning productive dividend shares from any collection more remote for first-time investors.

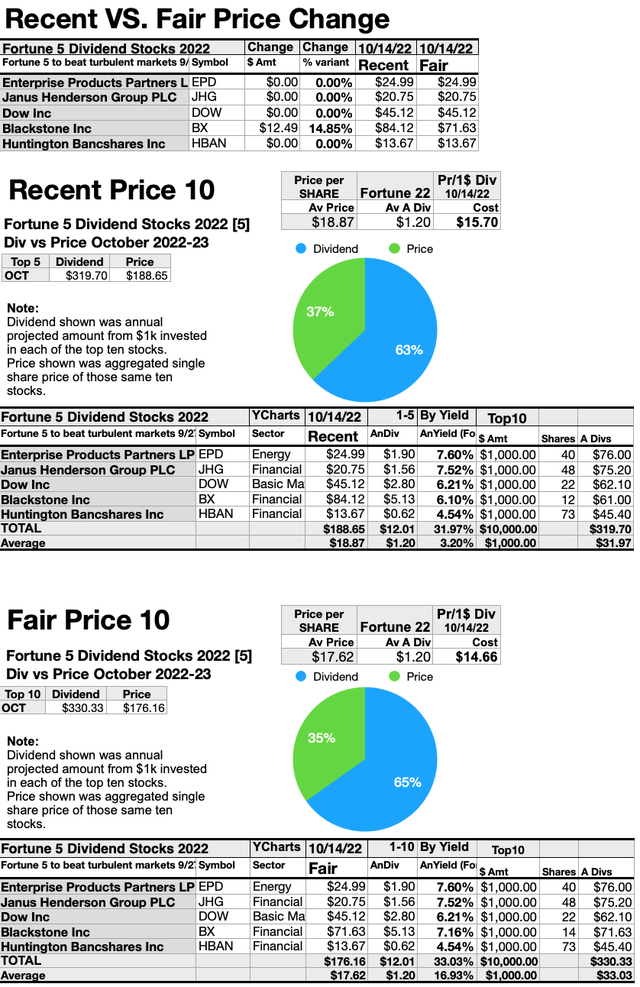

October, 2022 shows a glimmer of light from the four of the five stocks emerging as Fortune turbulent time candidates. The four are: Dow Inc. (DOW); Enterprise Products Partners (EPD); Huntington Bancshares (HBAN); Janus Henderson (JHG). Their prices settled between $17 and $52 below the annual dividend payout from a $1K investment. The fifth stock, Blackstone Inc (BX) has yet to reach parity with share price at or below the dividends rallied from $1k invested. BX price needs to drop $12.50 to join its peers. (See Recent vs. Fair Price charts in the Afterword to this article.)

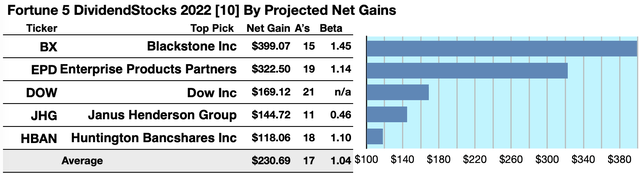

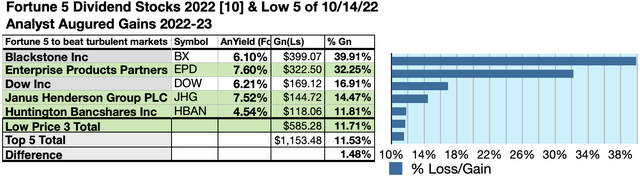

Actionable Conclusions (1-5): Brokers Estimated Five Fortune Turbulent-Times Dividend Stocks Could Net 11.81% to 39.91% Gains By October 2023

Estimated dividend-returns from $1000 invested in each of the five stocks and their aggregate one-year analyst median-target prices, as reported by YCharts, created the 2022-23 data points. Estimated profits-generated from Fortune turbulent time stocks projected to October 14, 2023, by that reckoning, were:

Blackstone Inc netted $399.07 based on estimates from 15 analysts, plus dividends less broker fees. The Beta number showed this estimate subject to risk/volatility 45% greater than the market as a whole.

Enterprise Products Partners LP netted $322.50 based on dividends plus a median target price estimate from 19 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 14% more than the market as a whole.

Dow Inc. netted $168.12 based on the median of target estimates from 21 analysts, less broker fees. A Beta number sis still not available for DOW.

Janus Henderson Group netted $144.72 based on the median of target price estimates from 11 analysts plus dividends less broker fees. The Beta number showed this estimate subject to risk/volatility 54% less than the market as a whole.

Huntington Bancshares Inc. netted $118.06 based on the median of target estimates from 18 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 10% greater than the market as a whole.

The average net-gain in dividend and price was 23.07% on $5k invested as $1k in each of these five Fortune turbulent time stocks. This gain estimate was subject to average risk/volatility 4% greater than the market as a whole.

The Dividend Dogs Rule

The “dog” moniker was earned by stocks exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More specifically, these are, in fact, best called, “underdogs”.

Top 5 Fortune Turbulent Times Dividend Stock Picks By Broker Targets

This scale of broker-estimated upside (or downside) for stock prices provides a scale of market popularity. Note: no broker coverage or 1 broker coverage produced a zero score on the above scale. This scale can be taken as an emotional component as opposed to the strictly monetary and objective dividend/price yield-driven report below. As noted above, these scores may also be taken as contrarian.

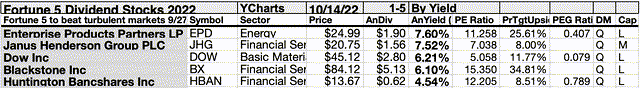

Top 5 Fortune Turbulent Times Dividend Stock Picks By Yield

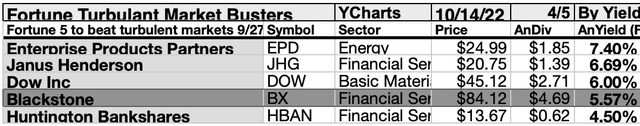

Actionable Conclusions (6-10): Five Top Stocks By Yield Are The October Fortune Turbulent Times Dividend Dog Pack

Top five Fortune selected Dividend Stocks 10/14/22 by yield represented just three of eleven Morningstar sectors. First place was secured by the lone energy representative, Enterprise Products Partners LP [1].

Second place went to the first of three financial services representatives, Janus Henderson Group PLC. The other financials paced fourth and fifth, Blackstone Inc (4), and Huntington Bancshares Inc (5).

Finally, third place was secured by the lone basic materials concern, Dow Inc [3], to complete the Fortune Dogs for turbulent times.

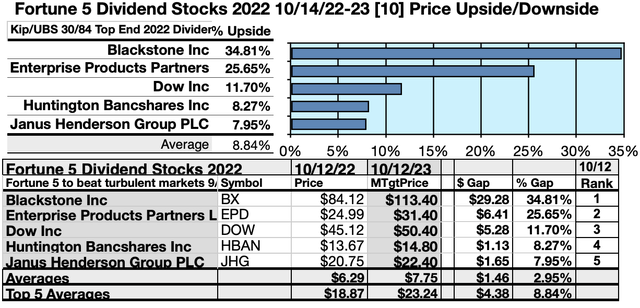

Actionable Conclusions: (11-15) Five Fortune Turbulent Times Dividend Stocks Showed 7.95% To 34.81% Upsides To October, 2023, With (16) No Losers

To quantify top-yield rankings, analyst median-price target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, analyst median price target estimates became another tool to dig-out bargains.

Analysts Estimated A 1.48% Advantage For 5 Highest Yield, Lowest Priced of Top-Ten Fortune 5 Dividend Stocks To Beat a Turbulent Market To October, 2023

Ten top Fortune dividend stocks were culled by yield for this monthly update. Yield (dividend/price) results verified by YCharts did the ranking.

As noted above, top-ten Turbulent Times Dogs selected 10/14/22, showing the highest dividend yields, represented three of eleven sectors in the Morningstar scheme.

Actionable Conclusions: Analysts Estimated The 3 Lowest-Priced Of Five Highest-Yield Fortune Turbulent Times Dividend Stocks (17) Delivering 11.71% Vs. (18) 11.53% Net Gains by All Five by October, 2023

$3000 invested as $1k in each of the three lowest-priced stocks in the top ten Fortune -turbulent times dividend pack by yield were predicted by analyst 1-year targets to deliver 1.48% more gain than $5,000 invested in all five. The highest-priced Fortune top-yield stock, Blackstone Inc , was projected to deliver the best net gain of 39.91%.

The three lowest-priced top-yield Fortune turbulent times dividend stocks for October 14 were: Huntington Bancshares Inc; Janus Henderson Group PLC; Enterprise Product Partners LP, with prices ranging from $13.67 to $24.99

The two higher-priced top-yield Harvest-Time dividend stocks for October 12 were: Dow Inc, and Blackstone Inc; Innovative Industrial Properties Inc, whose prices ranged from $45.12 to $84.12.

This distinction between three low-priced dividend dogs and the general field of five reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 20% to 90% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

Afterword

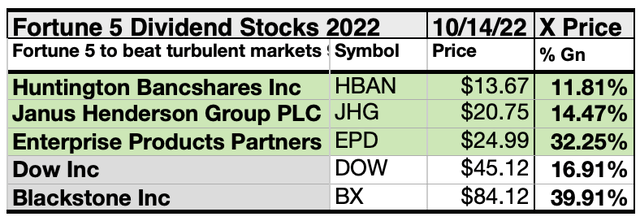

If somehow you missed the suggestion of the four stocks ripe for picking at the start of the article, here is a repeat of the list at the end:

In the current market advance, dividends from $1K invested in the four stocks listed above met or exceeded their single share prices as of 10/14/22.

As we are seven months past the second anniversary of the 2020 Ides of March dip, the time to snap up those four top yield Fortune dividend dogs is now… unless another big bearish drop in price looms ahead. (At which time your strategy would be to add to your holdings.)

To learn which of these four ideally-priced opportunities are “safer” to buy (namely which have ready cash to pay their dividends). Use the last bullet in the Summary above to navigate to my dividend dogcatcher follow-up article after October 24 in the SA Marketplace.

Recent Vs. Fair Top Five Fortune Turbulent Time Stock Prices

Since four of the top-five Turbulent Time Fortune Dividend shares are priced less than the annual dividends paid out from a $1K investment, the following charts compare the one at recent price with the break-even pricing of all five. Starting with the dollar and percent variants to all five top dogs conforming to (but not exceeding) the dogcatcher ideal in the top chart, the recent prices are documented in the middle chart and the fair prices calculated in the bottom chart.

The top chart is an indicator of how low the one non-ideal stock must adjust to become fair-priced. Which means conforming the standard of dividends from $1K invested exceeding the current single share price.

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Stocks listed above were suggested only as possible reference points for your Harvest-Time dog stock purchase or sale research process. These were not recommendations.

Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. Prices and returns on equities in this article except as noted are listed without consideration of fees, commissions, taxes, penalties, or interest payable due to purchasing, holding, or selling same.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from www.indexarb.com; YCharts.com; finance.yahoo.com; analyst mean target price by YCharts.

buchsammy/iStock via Getty Images

Be the first to comment