AnthiaCumming/E+ via Getty Images

Introduction:

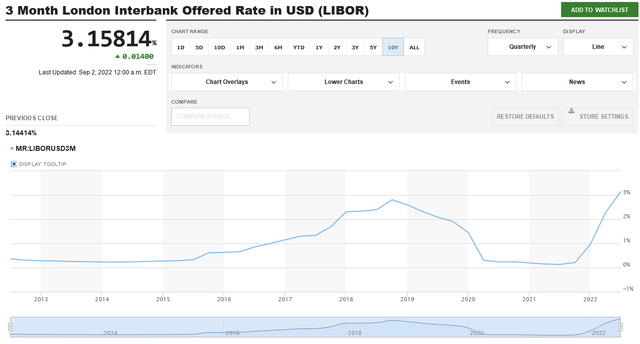

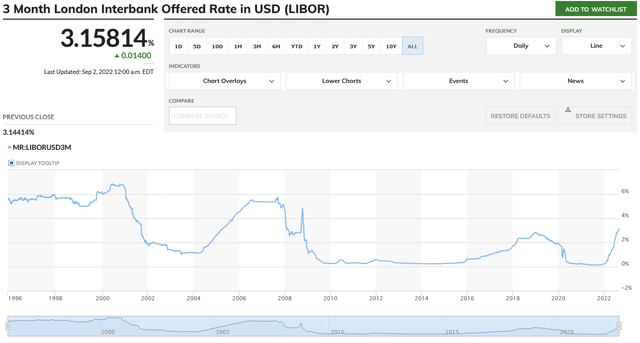

This is a bit of a follow-up to an article I wrote a little over a week ago about the Fixed-To-Floating rate securities in the market. It’s slightly different as the previous article was looking for viable securities trading below par that might get called back in the future once they begin to float. I don’t think that’s as likely a scenario with this smaller pool of securities, but I do think they’ve reached interesting levels for the same reason as the former. That is due to the significant and continuing move higher for 3-Month Libor and 3-Month SOFR rates.

Back before the financial crisis of 2008-2009, there were a number of similar preferred securities issued by a handful of financial companies into the market. Their defining characteristics were that they had a minimum fixed coupon until after their call dates when they would turn into floating rate securities based off of 3-Month Libor plus an adjustment that ranged from 35 basis points up to a full percentage point. At that time rates had been rising through 2006-2007 from what seemed like a very low point, and likely investors found this concept attractive thinking it would protect them from getting stuck with a low coupon perpetual. As we all know, that’s not what happened and rates went markedly lower. Instead, these preferred securities have all turned into very low coupon fixed perpetuals that trade way below par currently.

These issues we’re going to take a look at in this article, all had call dates starting in 11/28/2009 to 12/15/20011. What that means is that despite having been in the market for around 15 years, they’ve never seen 3-Month Libor rates this high in their post-call periods. For the first time in their history, some of these securities have their adjusted floating rates trading above their minimum coupons on a forward looking basis, and the other issues are all very close to doing so based on current market rates.

The Data:

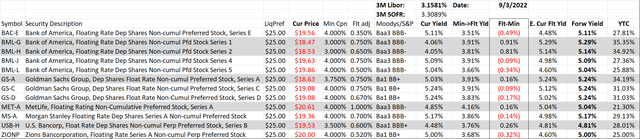

Personal Spreadsheet, Yahoo Pricing, Quantum Online

The twelve securities above are the group I’m interested in. The “Flt adj” column shows the number of basis points that the issue is to have added to 3-Month Libor in order to float above the minimum fixed coupon. The current yield is the minimum coupon divided by current price. The “Min -> Flt Yld” shows what 3-Month Libor plus the floating adjustment is as a coupon. The “Flt-Min” column shows the difference between that effective floating rate and the minimum coupon. Note, I’ve greyed all of the security rows where this calculation is now above the minimum coupon. The “E. Curr Flt Yld” displays what the floating yield would be based on current security pricing. Finally, the most important column is the “Forw Yield” for what the current forward yield should be based on pricing and rates. Note how closely these are all trading together. Imagine that, market efficiency! The last column is the potential yield to call return. Although, as I stated before, I think this is a less likely scenario without short term rates moving materially higher, but analysis of call potential has to incorporate the current market environment in terms of what coupon the issuer would have to pay for a new fixed security. The higher quality bank fixed issuers recently have been coming out with 6+% coupons. Hence, that would require 3-Month Libor to be massively higher than the current rate to compare.

These issues have always been a bit unusual. In the past I’ve seen comments regarding the puzzling levels they will trade at in terms of yield. Specifically, they seem to trade at levels too low for their credit risk, suggesting the market had been overpaying for the potential upside protection from higher rates. To be fair, I tend to agree with those sentiments, but I’ve had a lot of success trading these issues in terms of principal appreciation. Multiple times I’ve bought them in the teens, and sold them in the low 20’s. I haven’t had the gumption to hold on for those times when they’ve traded to par, but generally buying when they yielded over 5%, and selling for mid-20% gains in a preferred security, has made for a nice boost to the total return of the income portfolio.

istockphoto.com

Theoretically, these issues should have an unusual bell curve in the manner that they trade relative to the direction of interest rates. Most of their history has occurred with 3-Month Libor well below the key levels that would allow them to float. Hence, despite the few periods when rates moved up from very low levels, they responded by trading down in price as the market demands higher yields. Now for the first time we’re reaching a period where the floating rate adjustment protection is starting to have an effect. There are a number of these issues tied to Bank of America (BAC). Four of them come via the old Merrill Lynch that BAC acquired some time ago, but now they all are tied to the same institution with the same credit risk etc…. Two of the issues, (BML.PG) (BML.PH) have a 3% minimum which means they’ve been floating on a forward basis the longest when 3-Month Libor breached 2.40%. That’s not that long ago in early July. In fact, none of these issues have paid a distribution based on a floating rate yet, but markets are forward looking. Can we see any impact yet from these issues floating in the current market?

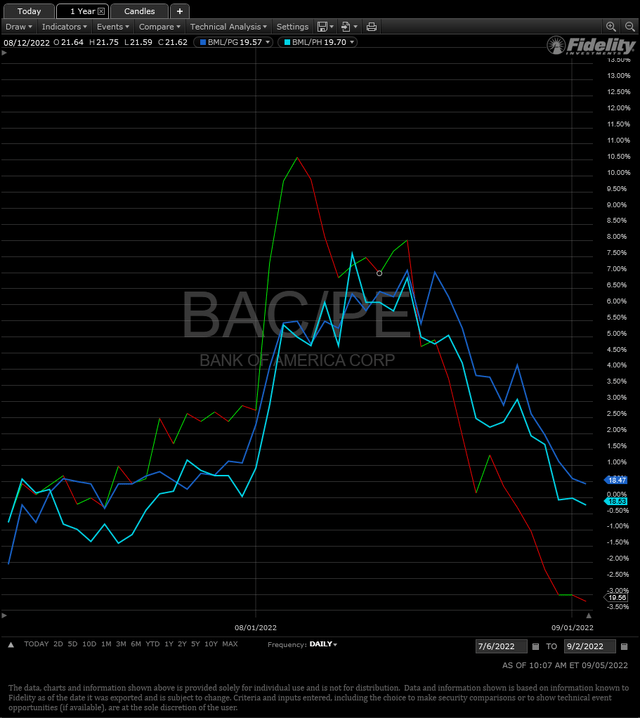

BAC.PE, BML.PG, BML.PH since 7/6/22 (Fidelity Trader Pro)

First off, let’s just state for the record that this is not gospel. It’s more like reading tea leaves at this point. We only have a few issues that have been trading on a floating forward basis for just over a month. Hence, the above chart could be worthless as a guide for what to expect for the rest of the issues. What I have done is chosen three issues all tied to BAC. The (BAC.PE) is the furthest from trading on a floating rate, as it has a 4% minimum coupon with only 35 basis points of rate adjustment. The other two have been effectively floating since around the start of the chart. When the income securities turned down due to the market’s response to higher rate risk in the second half of August, it does appear that the floating issues resisted the decline to a greater degree than the same issue from BAC that still traded on a fixed minimum coupon basis. This could be useful as part of a portfolio if what these tea leaves suggest proves to be valid.

Conclusion:

We have very little history of these issues actually trading on a forward floating rate basis, but intellectually it would make sense for them to begin bucking the general market trend for their commensurate fixed rate companions at some point. We have little to go on so far, but there may be reason to believe this is a valid assumption when looking at the BAC issues. Considering that the whole basket on a forward-looking yield basis is trading closely to one another just over 5% right now, would also lend more support to the basic thesis that the floating rates will begin to act like real floaters resisting principal loss if rates continue to move higher.

I’ve labeled these last two articles “Time To Pay Attention” for a reason. They’re not definitive, but there are both theoretical and observable reasons that make these issues interesting now that 3-Month Libor rates have finally reached levels that can turn them into floating securities. An investor can go to an ETF like iShares Floating Rate Bond (FLOT), and get something close to the current 3-Month Libor rate. That’s still well below 5+% that these issues are currently paying. This basket will trade with a lot more volatility, and you can get much higher yields if you venture into the fixed segment of the market, but I admit I like having some of these mixed into the overall income portfolio. It might be due to my historical success with these issues biasing my sentiment, but even considering that, I’m finding reasons to own some as a tool to help resist rates if they rise materially further. If rates don’t move much higher, then they should generate a decent return in principal in the future as they’ve done in the past.

One issue I discussed in the last article that I’ve neglected here in sake of brevity, is about the change from 3-Month Libor to SOFR in 2023. If you’d like to see more discussion about the legal changes from the omnibus bill earlier this year, and what it will likely mean for investors going forward, I encourage you to check out the discussion on the Innovative Income Investor blog, which is always a great source for income investors.

Hope you find this data useful, and good luck in your investing.

Be the first to comment