NirutiStock/iStock via Getty Images

The carbon allowance trade was hot in 2021 as the energy crisis in Europe unfolded. Amid soaring natural gas and power prices, energy providers scurried to scoop up carbon offset credit that would allow for more fossil fuel-based energy production. KraneShares launched a Global Carbon ETF (NYSEARCA:KRBN) in 2020 to capitalize on some of these markets. Investors were quickly rewarded with solid returns that were also uncorrelated to stock and bond investments.

For background, according to KraneShares, the KFA Global Carbon ETF is benchmarked to IHS Markit’s Global Carbon Index, which offers broad coverage of cap-and-trade carbon allowances by tracking the most traded carbon credit futures contracts. The index introduced a new measure for hedging risk and going long the price of carbon while supporting responsible investing. The ETF has more than $900 million of assets and features an expense ratio of 0.78%. The fund company points out that: According to IHS Markit, as of December 31, 2021, the global price of carbon was $51.45 per ton of CO2. It is estimated that carbon allowance prices need to reach $147 per ton of CO2 to meet a 1.5°C global warming limit.

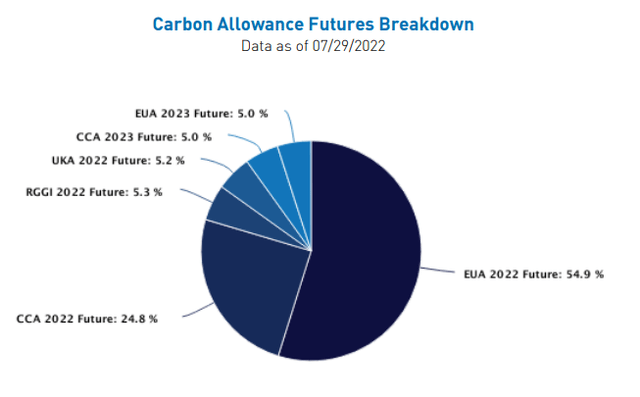

The index covers several regions, so there is diversification versus just owning carbon allowances from Europe, though the majority of the fund’s carbon allowances are based in the EU market. Recently, though, what’s happening in Europe is getting a lot of attention. Moreover, some investors might be baffled by the price discrepancy between energy prices across the pond and KRBN’s price.

KRBN: Heavy Exposure To The EU Market

KraneShares

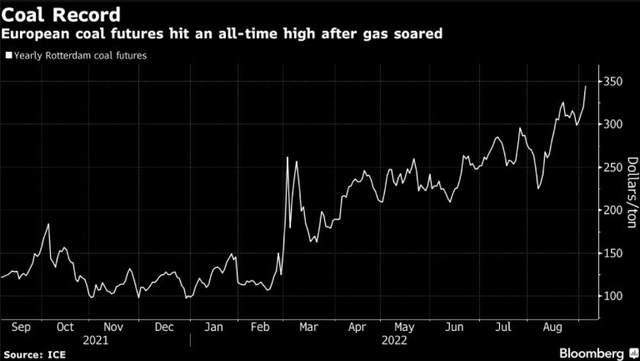

Over the weekend, it was reported by Bloomberg that the EU is in talks to enact price caps in an attempt to rein in skyrocketing gas and power costs across the continent. Bloomberg mentioned that the Czech presidency will likely look to make changes to the carbon market that would allow for more fossil fuel energy production. More carbon offset sales, at presumably lower prices, could help the crisis.

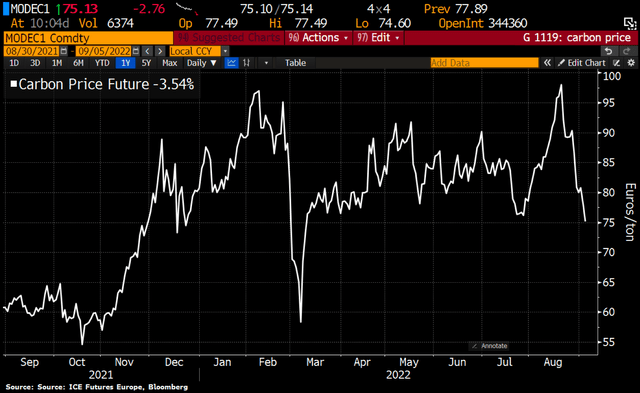

Those changes that could be announced appear to already be hitting shares of KRBN. A great Twitter follow, Holger Zschaepitz @Schuldensuehner, noted that “fears of political intervention and the deindustrialization of Europe” are sending the price of carbon futures down big just as coal, natural gas, and oil rally.

Carbon Prices Down 25% From The August Peak

Holger Zschaepitz, Bloomberg

European Coal Futures Soar To Record Highs

Bloomberg

Another risk to consider is what’s going on with the euro. KraneShares discloses that the fund is 52% exposed to the euro and 34% to the U.S. dollar. Downward moves in the euro will negatively affect the share price, all else equal.

EURUSD: A Steady Slide Over The Last Year

TradingView

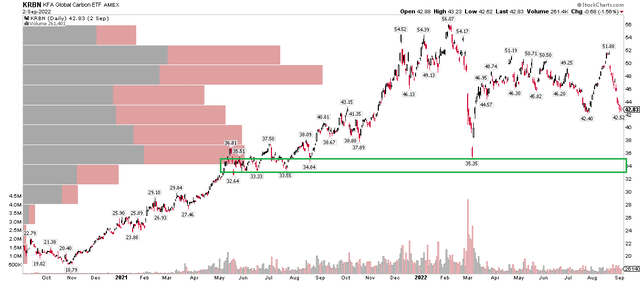

The Technical Take

I think it’s prudent to avoid KRBN for now, but it could be an opportunistic play once shares dip 10% to 15% from here. Like all investments, though, it’s important to know when to get out. There appears to be good support on KRBN down through the mid-$30s. If we break below $32-$34, there could be a swift move lower based on the technicals. An investor could go long right now or wait to see if KBRN dips further toward the mid-$30s. On the upside, the ETF obviously found sellers in the mid-$50s. Also notice the high volume of trades in the $48 to $52 zone – that could be a particular area of bearish supply.

KRBN: Support In The Mid-$30s

StockCharts

The Bottom Line

Watch out for volatility in KRBN as the European energy crisis continues to unfold. After being dinged by the euro’s decline and talk of price caps on energy, including carbon offsets, KRBN could see further downside but then be an interesting long-term portfolio diversifier for risk-seeking investors.

Be the first to comment