Onfokus

As a person who has moonlighted as a writer on Seeking Alpha since 2014 and then made the leap to full time since May 2020, it is crystal clear that far and away the largest and among the most engaged segments of SA’s audience is the retiree cohort as well as folks rapidly approaching retirement. Without having access to any of SA’s statistics on its vast and wide readership base, I’m guessing its number of retirees as well as folks approaching retirement very well might be in the low millions. So if you take a step back, this explains this group’s fascination with REITs, dividend stocks, CEFs, and even most puzzlingly, those highly questionable – high yield – dividend stocks. And this explains why seemingly pedestrian articles, at least to me, as I have read many of these articles, about investment instruments containing the all-important ‘yield feature’ are constantly trending as most popular on the digital pages of the SA ecosystem.

If I had to guess, perhaps only a small percentage of avid readers are familiar with the late Clayton Christensen, the famous Harvard professor and business consultant that did some groundbreaking work on disruptive innovation and then on later on understanding the customer and ‘what is the need’. To paraphrase and oversimplify some of his work, Clayton constantly talked about ‘who is the customer? and what are their needs?, etc. In today’s piece, I want to explore this topic and provide an actionable and high-quality solution to this dilemma.

Before we do that, and sticking with opening phrase of the last small paragraph, ‘if I had to guess’, my perception is there is an unquenchable thirst for high quality, safe, and reliable income amongst large swaths of the retiree readership. Given the demographics of the baby boomer generation (people born between 1946 and 1964), a group of people estimated by north of 76 million people, statisticians tell us upwards of 10,000 of these people turn 65, every day. And when you turn 65, chances are, the topic of retirement has been dancing around your mind for quite some time, as after all, there are many other aspects of life besides working a 9 to 5 (or working 8 to 6 in this day and age). As the 1950s and early 1960s were a high time to be Gerber, given the sheer demographics and millions of babies being born, today it’s the golden age for people in the financial world that can actually devise solutions to attempt to quench that once unquenchable thirst for income.

Unfortunately, and this is why I really haven’t written on this topic and why I have stayed away, confined to my swimming vigorous laps in the small-cap value and special situation stocks pool, as it has been nearly impossible to really help. The reason was there simply haven’t been a number of very good solutions available. Or let me rephrase, up until recently, as in the last few weeks, I would argue there weren’t very many high-quality and low-risk income streams readily available ‘for hire’ or for ‘purchase’ if you were going shopping at the financial supermarket, in search of safe, healthy, and reliable income.

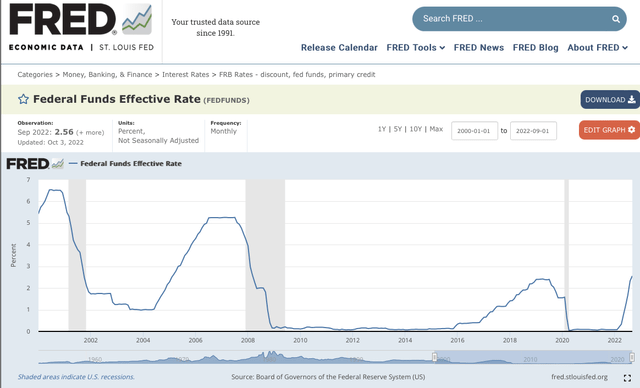

The genesis of this problem is that the Federal Reserve kept its Federal Funds rates pinned at or very close to zero from 2009 – 2015 (see below). Although they gradually started to normalize the cost of money, albeit very gradually, from 2016 to 2019, they had to rapidly reverse course, and return to a near-zero policy from early 2020 until March 2022, with the onset of Covid.

Now, in today’s piece, I’m not going to waste any bandwidth arguing the counterfactual on whether the Fed’s policies were misguided or whether they stayed way too loose for way too long. The bottom line here is this is what actually happened, in terms of where the rubber met the road, think mainstream America, was that the Fed’s policies and therefore Federal Funds rates were pinned under 1% from 2009 – 2015 and savers were forced to spend down principal or chase various forms of yield. Again, there is no point in arguing the counterfactual or whether or not the Fed saved the country from a depression or at least a severe and prolonged recession. It is unknowable and simply mental gymnastics, perhaps better left for an ambitious academic scholar, as a future Ph.D. thesis topic, at a place like the University of Chicago.

(Incidentally, and as a quick aside, for any eager beavers out there, folks that are super intellectually curious, feel free to read Simon Johnson’s article – The Quiet Coup – published back in May 2009, in The Atlantic. Moreover, mutual fund manager, John Hussman, wrote extensively on this topic during that time period, as well).

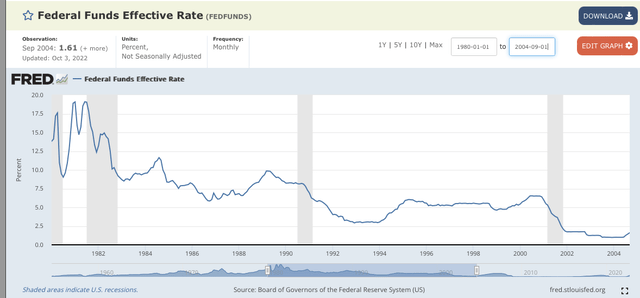

Either way, any way you slice it, the unfortunate byproduct of these Fed policies meant that savers and seekers of safe and reliable income had the rug pulled out from under them. If you look back on the 1980s and throughout many portions of the 1990s, the Federal Funds rate was at least 5%. Back then, high-quality and safe investment bond portfolios were easy to locate and assemble.

Therefore, hardworking retirees, folks that put themselves through college, or learned a trade, or started a business got hurt when it was time for retirement. These are the folks that woke up every day, went to work, for the better part of forty years, many of whom juggled raising a family and encountering many of life’s unexpected twists and turns. Unfortunately, rightly or wrongly, the folks that actually played by the rules, that didn’t try and keep up with the Joneses, got dinged by the Fed’s policies.

Again, it is neither here nor there whether this was the wrong or right policy by the Fed. It happened! And since the financial industry is massive, great at marketing, and very clever at inventing and packaging shiny new products and financial vehicles to meet the ever-changing and formidable landscapes its customer base faces, it became a cottage industry to devise clever ways to purportedly create bond proxies. Yet, if you get past the gloss and the packaging, many just weren’t very good bond proxies.

Just as Howard Johnson’s invented 31 flavors of ice cream, instead of only the traditional vanilla, chocolate, and strawberry, all of these fancy bond proxies sprung up, and yet, I would argue that the vast majority of Clayton Christensen would call ‘customers’ just wanted a high-quality investment grade portfolio that churned out 5% per year, in safe and reliable income, where retirees didn’t have worry about risking loss of their principal to credit or equity risks. Frankly, what many of these folks wanted was to reallocate their bandwidth into other, far more enjoyable, ventures instead of worrying about stock prices, volatility, inflation, and working out where we are in the economic cycle.

After all, remember, these same hard-working retirees, the folks that went to work every day, for the better part of forty years, saved, and played by the rules, needed those safe and reliable income streams. I’m guessing many dabbled in stocks, some might have even had some success in stocks and I’m sure others, on balance, might not have done so well in the stock market. Either way, what the vast majority of retirees really and truly wanted and still want is a real SWAN (sleep well at night) portfolio.

Well, I have great news for folks, lo and behold, as of very recently, it is high time to be an investment grade fixed income invested. For the first time, really since 2008, outside of a brief window in early 2019, retirees can build a portfolio of high-quality and safe bonds. Incidentally, just yesterday, I put to work $255,000 of fresh capital for my parents. This was excess savings that had been parked, vaulted away actually, in a money market fund, for years, as I advised that bond yields were unattractive and my parents were too smart to chase or get involved in purportedly bond proxies that actually had much more risk than was popularly advertised.

Therefore, just yesterday to be exact, I purchased twenty-three different investment grade bonds, consisting of twenty-two different companies. The portfolio is diversified, very high quality, and has moderate duration. Speaking of duration, I only ventured out between five and seven years on the maturity date ladder and the current yield of the blended portfolio is 4.23% and its blended yield to maturity is 5.19%. This is literally a Buy and Hold portfolio, something that my parents don’t need to look at or really spend much time thinking about. Moreover, I weighted and sized the higher-quality companies with a larger allocation. Again, though, this is an investment grade portfolio, so we aren’t talking about taking any big credit risk here. This isn’t trying to outsmart really sophisticated junk bond investors (HYG) and I’m sure as heck not chasing any yield here.

Putting It All Together

Depending on the response and reader engagement/ appetite, I’m considering publishing a number of future articles sharing two bonds, at a time and per article, revealing the underlying bonds contained within this very high-quality and safe bond portfolio. That said, a big driver of the attractive yields here has been the Fed’s decision to take up its Federal Funds rate to a range of 3% to 3.25%. Quite simply, the underlying credit quality and therefore spread to treasuries here is somewhat low, these credit spread usually are, and the overall attractiveness of the all-in yields is driven by the relatively high 5-year U.S Treasury rates. In fact, the north of the 5% YTM yield was largely achieved as a result of the 5 YR U.S. Treasury bond trading just north of 3.90%, when I put this $255,000 of capital to work, just yesterday.

Taking a step back, let’s face it, it has been a brutal year to be long almost any financial asset. Perhaps, one of the few exceptions is some commodity stocks, notably in the energy sector (XLE).

Moreover, if we are keeping it real, the year-to-date through September 30, 2022, the S&P 500 (SPY) was down 25%, the Nasdaq Composite down 32% (QQQ) and even purportedly safe ETF, like the Vanguard Real Estate Index Fund (VNQ) is down 26.2% (including dividends). Inclusive of dividends, the VanEck Mortgage REIT Income ETF (MORT) was down 27.7%. In fact, purportedly bond proxies REITs, such as Simon Property Group, Inc. (SPG), are down 37.9% and Prologis, Inc. (PLD) is down 37%. That said, high-quality names like Realty Income Corporation (O) and W. P. Carey Inc. (WPC) have held up better, and are only down 13.6% and 7.6%, respectively.

In closing, hard-working retirees, folks that played by the rules, socked and squirreled away money for retirement despite life’s invariable ups and downs and twists and turns have had to weather a literal ‘fixed income winter’ for the better part of the past 13 years. Lo and behold, from 2009 until 2019, it was almost impossible to build a safe, low beta, and reliable investment bond portfolio that actually had any yield that was attractive. Fast forward to today, and as of October 6, 2022, a balanced investment grade bond portfolio, that yields a blended 5% YTM, can be achieved. In fact, I did exactly that, just yesterday, when I put to work $255,000, into this strategy, on behalf of my parents.

Be the first to comment