As I have explained repeatedly, COVID-19 is a catalyst, not a cause, of the global financial panic now unfolding. This is no time for irrational responses, but neither is it a time to passively watch risk-exposed life savings plunge. It is never too late for sober review and wise choices.

Years of undisciplined monetary and fiscal policy have enabled the worst financial habits and highest debt abuse the world has ever known, and the payback period is now weighing on the world economy and asset prices.

The masses are woefully unprepared for the downturn now at hand, and yet it’s here all the same – because reckless behaviours and policies have earned it.

For those who believe that central banks remain all-powerful and that a switch back to looser policies in the months ahead will be enough to stop asset prices from deflating, my partner Cory Venable offers the below chart of the S&P 500 since 1999 (20 years of the most notorious ‘easy money’ in history). He notes that while rate cuts start when stock markets decline, they do not prevent the losses.

Even when the US Fed slashed more than 5% off policy rates in the last two declines (compared with the minuscule room they have today), stocks lost 50%+.

It is important not to lose the plot here: economic downturns start because demand cycles are driven by credit, and credit expansions cannot continue indefinitely any more than trees can grow into outer space.

Market bottoms do not occur until sentiment that was far too optimistic at the top becomes far too pessimistic near the bottom and asset prices finally fall to levels that attract prudent cash investors once more. We are nowhere close to that point yet.

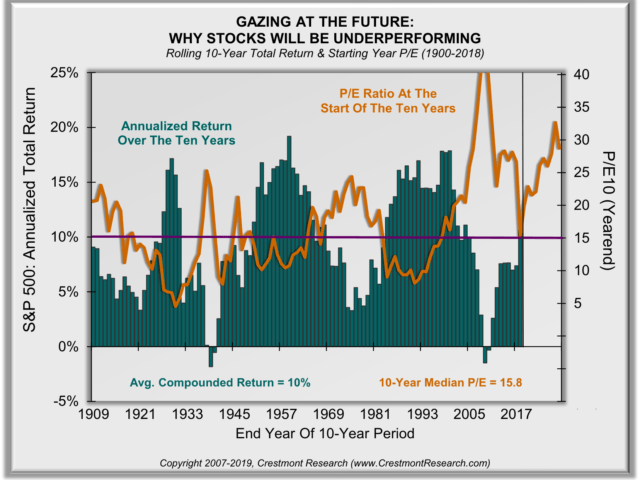

It is also critical to understand that as shown in the chart below from Ed Easterling at Crestmont Research, the very rare times that stocks entered a downcycle as dramatically over-valued as we entered 2020 (orange line below) the total annualized returns (including dividends) from those levels were negative for a decade after that (in green). See Serious Implications: forecast skew over the next decade and Gazing at the future:

The starting valuation matters! When P/Es start at relatively lower levels, higher returns follow – paying less yields more. When investors have P/Es that start higher, subsequent returns are lower. This graphical analysis presets the compounded returns that follow over the subsequent ten years based upon the starting P/E ratio. It’s compelling, primarily because it’s fundamental – starting valuations directly impact subsequent returns. From the current above-average valuations, below-average returns are likely to follow for the next decade or longer.

Negative results are not inevitable, however. It is possible to minimize the correction/loss cycle, preserve liquidity and our mental strength, so that we are able to deploy cash after prices have mean-reverted. Only then will we be able to buy assets, in a meaningful way, with attractive yield and return prospects.

What we decide to do in response to present facts will impact our financial progress for years to come. None of us are helpless. A generational-style investment opportunity is coming in the months ahead, but only for those who prepare for it.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment