AdrianHancu

Dear readers/Followers,

In this article, we’re going to be reviewing Societe Generale (OTCPK:SCGLY), one of Europe’s and the world’s largest banks. SocGen is one of the oldest banks in France and offers investors a potentially impressive upside, yield, and fundamentals if invested at the right valuation (fundamentals for the price).

This bank has a storied history. Since the mid-1860s, the bank has existed throughout France as one of the major credit institutions in the nation. Despite facing some difficulties, such as the 1920s-1950s, given wars and depressions, this bank has survived in one form or another. It nationalized in 1945 under a single shareholder – the French state – and up until 1958 was characterized by extreme recovery. It was one of the banks that were able to really take advantage of the Marshall Plan.

Let’s review and see what we have here.

Updating On Societe Generale

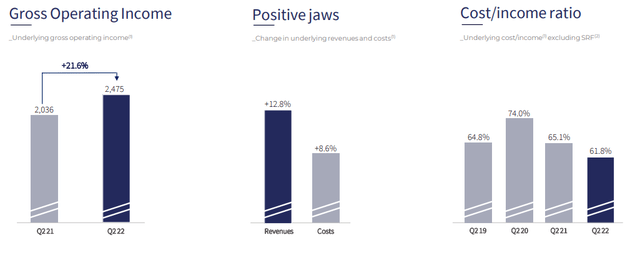

Let’s get the basics out of the way first. This is a well-capitalized bank with an extremely robust set of fundamentals. The company has a running cost/income ratio of 61.8%, a close to 13% CET-1 ratio, and very impressive recent revenue trends.

Why do I say this?

Because Societe Generale has been able to get things “right” in terms of revenues, income and cost. Revenues have been rising faster than costs.

And this trend is now solid enough to really showcase. Take a look.

SocGen today is active in three areas primarily. These are:

- Retail Banking, France

- International Banking, Insurance & Corporate Financials

- Global Banking & Investor Solutions

You will find the bank represented across the entire world. SocGen has an S&P rating of A, a Moody’s rating of A1, and a Fitch rating of A+, as well as many other high credit ratings. This bank, despite the pressure, is one of the safest financial institutions in all of France. Despite seeing very impressive EPS in 2021, the company’s valuation did not reflect in truth in terms of normalized P/E how the bank has been earning and promptly dropped back down to, and below the levels, we’re seeing today.

If you start looking through the bank’s material, you’ll find a great deal of focus on compliance training, staff education, and how the bank intends to work with its management to ensure not only good, but safe performance going forward. Given the bank’s 7-year history, this focus is understandable.

The company has one of the lowest costs of risks out there and has a ratio of NPLs (Non-performing loans) that’s lower than it was during any time in COVID-19, now down to 2.8%. The cost of risk for 2022 is estimated at no more than 0.35% at the highest point.

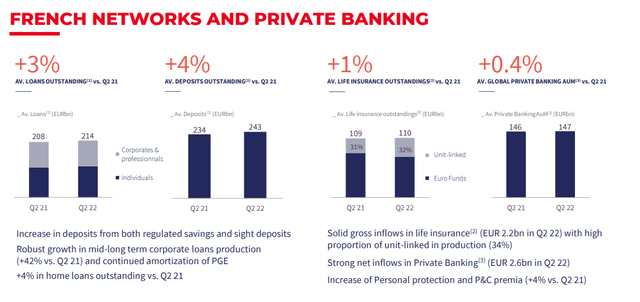

The recent business performance also continues to perform well – with every single business area showing positive top-line trends.

Even international retail, including Africa, is showing very good dynamics and strong deposit increases and fee-driven business growth. Since I last wrote about SocGen, the company has driven excellent execution towards a simplified structure. Its business model has been improved, with less volatile exposures, and the top-line growth we’ve seen since the financial crisis has been sustainable, with double-digit profitability now as very stable around 10.5% in terms of ROTE.

Following COVID-19, SocGen guides for a dividend of 50% EPS payout, or of the underlying group income for the year. The police is currently well-covered, and the recent dividend is confirmed, with an estimated dividend of €1.74 in total for the fiscal of 2022, which comes to over 7.5% at the current share price. An excellent yield, and one covered by EPS on a normalized/adjusted basis, if not necessarily on GAAP.

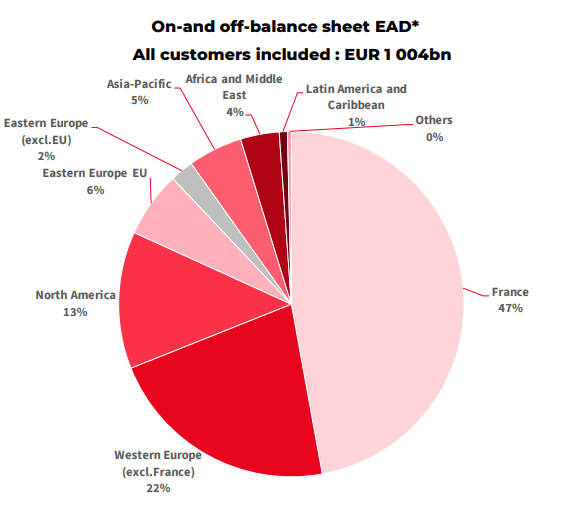

While international business does exist for the bank, as I mentioned, I believe you should see SocGen as primarily a French and NA/EU bank, with entries into several appealing markets – because nearly 50% of the bank’s business is France.

SocGen IR (SocGen IR)

SocGen as a bank also doesn’t have especially heavy exposure to at-risk loans or assets. Exposure to sensitive sectors is considered less than 0.3% of the group’s exposure at default, or EAD, individually, with Accommodation, Catering, Leisure, Airlines, Shipping, and Commercial Real Estate all together representing around 5% of the group EAD. The bank has already worked to reduce this, and as of the latest results, this continues.

SocGen is still a solid, French bank – as solid as they come, in fact.

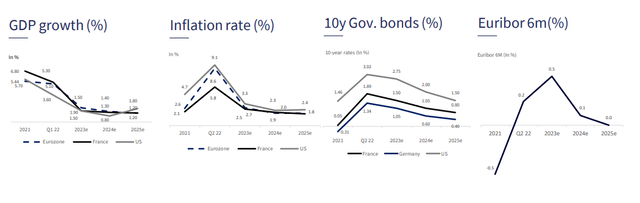

The assumptions for 2025E guide its forecast. Here are those current assumptions.

These assumptions, as I see them, are on the low side. My own assumptions for inflation and EURIBOR are for the curves to be significantly less “sudden” – I believe we’re going to be at higher rates and inflation for some time – so keep that in mind when I share my valuation of the company with you.

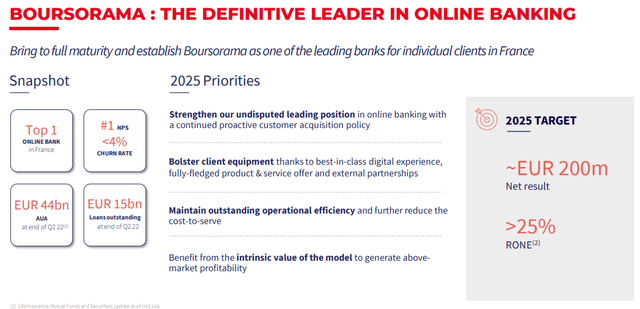

The company already meets all of its 2025E targets and expectations, and SocGen also owns the #1 Online bank in all of France, with a continued target to strengthen its relationships and markets even further.

On a high level, SocGen is probably one of the best financial institutions in all of France, combining the appeal of local, regional, national, and global banking as well as ancillary financial services very attractively. It has a high dividend, a good credit rating, and fundamentals – and more importantly, it’s set to grow going forward.

So, let’s see what we should be paying for this bank’s earnings as we move forward in this macro situation.

Valuation For Societe Generale

So, the valuation for this bank is dictated by a number of factors and expectations. When looking at Societe Generale, we have historical performance working against us at this time. The dividend payout and stability are a joke – compared to other banks and insofar as general dividend stability and safety goes. It really doesn’t exist. One year it’s there – the next it isn’t.

This illustrates either a lack of faith in its own performance or a diligent adherence to only paying out in line with profits. When it comes to this company, I would say it is the latter. A common question I get from investors even in Europe is, therefore, what value there could be in investing in SocGen overall.

To this, I say that the company is now in the end of its 2-year long turnaround, and we’ve seen a year back just what heights and trends the company can climb to.

What we have on our side when investing are three things.

1. Recent-term results, which currently indicate positive change, and a, covered dividend that’s been very recently re-affirmed.

2. Solid fundamentals based on a strong economy and market-leading brands, including the #1 Online bank in all of France. This is neither small nor insignificant, as I see it.

3. Forecasts for future results, which are also positive.

I will also be clear here that analysts have done a horrible job of forecasting this bank. FactSet analysts should not even bother giving EPS or fundamental targets at failure rates of over 75% on a 1 or 2-year 10% MoE-adjusted basis, and the upside we see here needs to be considered extremely conservatively.

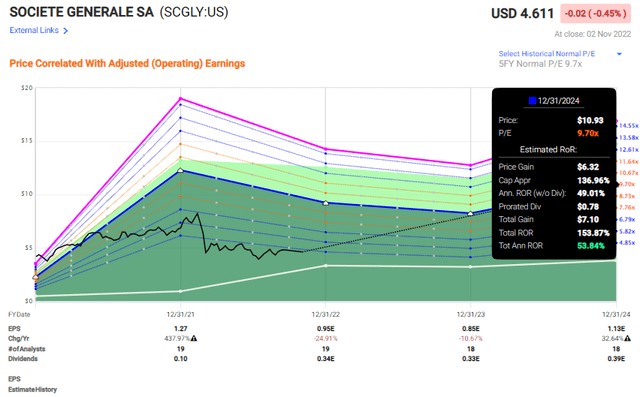

However, the bank upside at this time is superb, even if we stick to the below-10x P/E that SocGen typically trades at.

SocGen upside (F.A.S.T graphs)

So, we have a 50%+ theoretical upside with a 150%+ potential RoR in the case of normalization. I do believe this will remain a bit of a volatile investment given that we’re investing in a downward trend – 2022-2023 are expected to be lower than 2021, which was a bit of an outlier year. But the bank may just as easily start climbing, offering a near-inflation level yield at a safe credit rating. I believe these sorts of income plays will become key in the current macro, as investors are trying to safeguard their capital and their overall returns.

Even assuming a sub-normalized for the bank on a 2024E basis gives us superb growth%, resulting in near-triple-digit returns on a 4-year basis. Any reversion to the 10-year average of 11X P/E results in 4-year returns of over 170-190%, and such a valuation isn’t at all unusual for this bank.

Even in the case of this bank going to a 4.85X P/E, if these forecasts are even slightly indicative, you’d still be making more returns than the S&P500 is expected to generate at around 15% per year, or 35% 3-year returns.

That is, to me, a very good thesis and a solid trend to invest in.

And I am far from the only one viewing the bank like this. The company’s average valuation levels range from €17/share on the low side to €41/share on the high side. 22 analysts have a current average of €32.5, with 15 out of 22 analysts at a “BUY” or equivalent rating. This implies a PT upside of 40% from the analyst side of things.

Realistic? I would say so – the improvements SocGen has made are in no way temporary.

Because of a combined upside of improved results, and likely improvements going forward in an environment where rising interest rates will drive good returns for the bank, I view this one as a “BUY” at a conservative 6-8x P/E, which implies a capped upside at around €30/share normalized.

That’s my new PT for SocGen and the current basis of my thesis on the bank.

Thesis

My thesis for Societe Generale is:

- This is a class-leading French financial institution with absolutely stellar fundamentals – the sort of business I love investing in. I believe that at the right valuation, Alpha isn’t just possible for SocGen, it’s an absolute given based on the current rate environment and the company’s earnings trajectory.

- Recent results do more than imply that this is possible – these results more or less confirm the bullish view for me.

- At dirt-cheap valuations, I, therefore, give the company a “BUY” with a PT of €30/share.

Remember, I’m all about:

Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment