Sharamand/iStock via Getty Images

Brief Overview

Super computers are increasingly common. From gigantic byzantine processors of years past boasting less calculating nous than your BA2 Plus, to the modern-day microprocessor capable of trawling through trillions of data points in a second.

The machines are here to stay.

For brainiacs the world over, queue Rigetti Computing Inc (NASDAQ:RGTI)- the Silicon Valley’s premier quantum computing player. As part of my semi-conductor series, we take a closer look at the Berkley based technology venture crammed with Phds trying to solve the most complex planetary problems.

And while judgement day has passed and SkyNet has yet to take over the world, ruling on Rigetti Computing as a plausible investment looms. The firm’s goal is to unleash quantum computing via practical applications ranging from biotechnology, pharmaceuticals, to even energy saving.

Yet despite all accolades in tackling the most mind-boggling, complex, and breathtaking problems – one major corporate dilemma presages: the ability to make money.

Company website (Rigetti Corporate Presentation)

Rigetti Computing Inc. solves a diverse range of the most complex global problems.

Even as this hyper computer specialist toils away at the Holy Grail of PC power, everyday investors like you or I pray for the alchemy of gold. It seems a distant objective, specifically in a market environment peppered with risk-off sentiment, liquidity squeezes and more Hawks at the Fed than at Atlanta’s renowned basketball team.

Sure, it cannot be easy being a $220M technology venture turning over a paltry $9M per year. Regardless, let’s take pause and look under the hood of what could be super-computing nirvana.

What The Firm Is About

The firm’s premier product is its Forest cloud computing platform allowing developers access to cloud-based quantum computing firepower for algorithm writing and testing.

Coupled with the World’s first dedicated quantum fab, the enterprise supplies bag loads of innovation for development of quantum chips, testing infrastructure and supply chain, ideal for big government and academia.

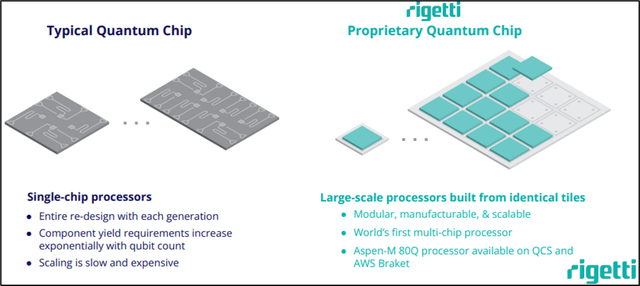

Rigetti Corporate Presentation

Proprietary Quantum Chip Profile – Rigetti Computing 2022

Its Quantum Chip – the World’s first multi-chip processor – provides scalability, modularity, and ease of manufacture.

However, the ultra-high technology product offering boasts a share of risks. Beyond the usual ones presently inflicting semiconductor carnage (China, heavily discretionary, big cyclicality), this more niche ticker brings augmented risk of government regulation, and trade protectionism given its ultra-high-tech bloodline.

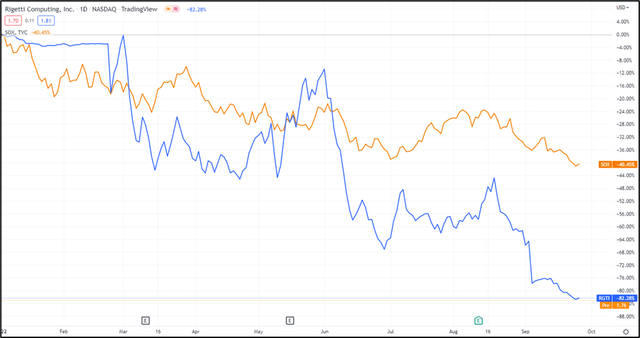

Price action for the 160-man quantum computing junior has been hardly anything to smile about. In its short life, gravity has pulled the stock price overwhelmingly back to Earth.

Year to date, the venture has lost -81.37% of its market cap, of which -54.39% in the last month alone. With the stock price now barely hovering above $1 per share ($1.79 to be precise) this ticker finds itself not far from the volatile kingdom of penny stocks.

Hardly a place to be as risk capital throughout the world unreservedly capitulates.

Price action for the quantum computer pure play has plainly found itself in Bearsville for most of the year having lost circa -82% of market cap to date.

While price action has been nothing but bearish all year, it has also provided a 2x leveraged proxy of the Philly Semiconductor index (SOXL). Perhaps useful if you want a synthetic way of getting mega-short on the ETF.

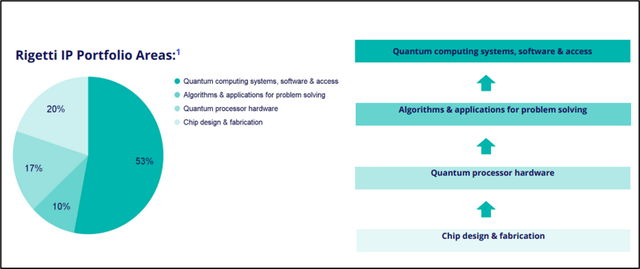

Rigetti Computing showcases an impressive 152 patents backed by an annual R&D spend of $40M

Patents are a corporate strength – with cutting edge R&D being a $40M-a-year spend. Nothing short of impressive for a firm with sales of barely $10M per year. To date, the firm’s IP portfolio showcases 152 patents and applications, predominantly in quantum computing systems, software & access (52%)

But for those scratching their heads trying to figure out how a firm spends $40M on IT geekdom with only $9.3M of sales, the answer is either through debt or equity, neither of which are massively cheap nowadays.

Simplified Income Statement

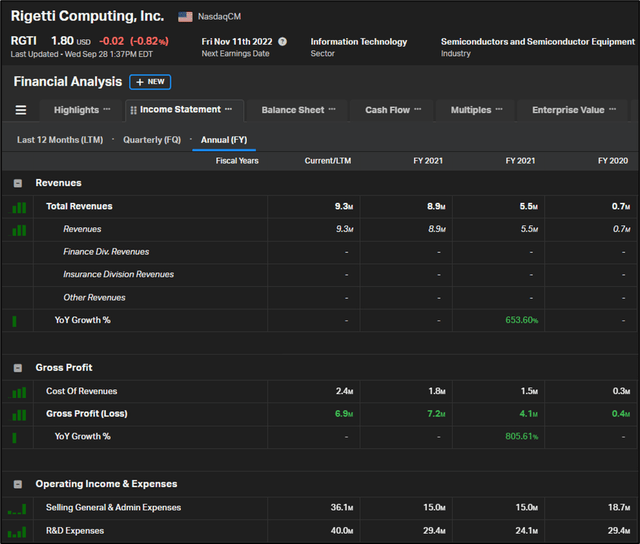

Nothing doing on the income statement. Granted, we have seen roughly 2x growth from FY2021 to FY2022, but we are talking about sales amounting to $9.3M on a company posting a $220M market cap. Valuation exuberance anyone?

If cost of revenues doesn’t scare you (they shouldn’t) then sales, general and administrative spend should, posting $36M LTM v $15M in FY2021.

R&D spend is rocketing to the moon also, but that is normal for a firm that prides itself on ground-breaking technology. The company has consistently posted losses since it started reporting, ranging from -$35M FY 2021 to -$70M LTM. Invariably, all those quantum computers are yet to find the secret to making money.

Simplified income statement Rigetti Computing

The net interest expense which has doubled since FY2021 should start sounding alarm bells (from -$2.7M to -$4.4M LTM) in an environment where raising capital is only going to become more costly.

The net EPS bleeding has stopped (-$1.90 FY2021 v -$0.84 LTM) but that still does not justify stock-based compensation of $23.3M over the last 12 months. Hard to justify that spend line, and the stock’s performance, if you are an equity holder.

Simplified Balance Sheet

The balance sheet is armed with $184M in cash and equivalents, perhaps enough to see the firm exist for several more years without another capital raise. That cash was raised through SPAC proceeds rather than additional equity or recourse to debt.

The merger posted $200M less than initially expected as investors perhaps grew tired of founder/marketer deal bias.

The company’s -$227M in retained earnings is indicative of the cumulative amount of cash the firm has burnt through. It provides an idea of just how capital intensive a money-losing quantum computing play can be. Total debt does not present too many worries presently at $29.4M.

Basic cash flow data – Rigetti Computing

Simplified Cash Flow Statement

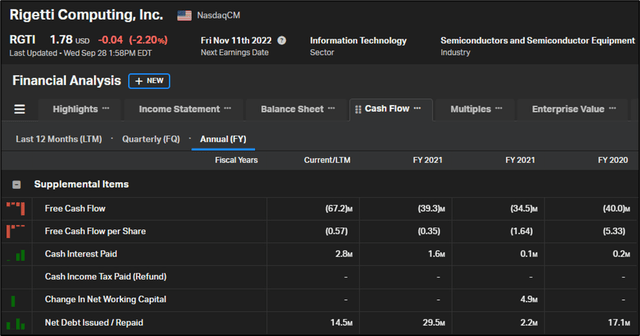

The cash flow statement looks worse for wear too, with losses generated by operating cash flow almost doubling (from -$31.7M FY2021 to -$52.7M LTM) Given that $23.3M is allocated to stock-based compensation, it remains a little tough to swallow.

Cash flow from financing shows $6M in stock issuance, $14.5M in debt issued and the proceed of $205M generated by the SPAC merger.

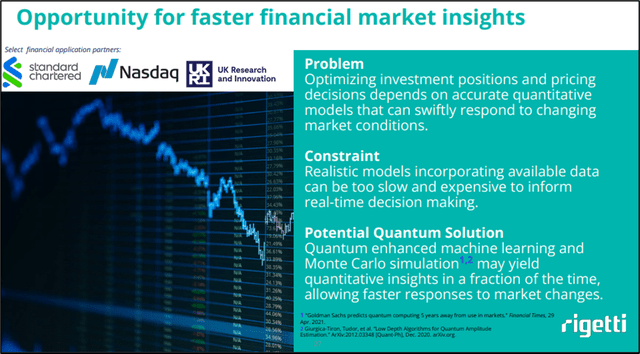

Applications such as using quantum computing for portfolio optimization has done very little for Rigetti Computing own stock price

Key Takeaways

Rigetti Computing – Quantum computing’s premier brand premises a compelling investment narrative: big data needs mammoth IT fire power to plug the gap on diminishing returns of classical processors.

It was the next frontier of computational power and married nicely into an investment pitch in full SPAC-mania.

But times have changed – the world economy is tanking, the semi-conductor industry whose core customers are mainly discretionary and highly cyclical are reeling, and cost of capital is mooning under restrictive monetary policy. The investment panorama has markedly evolved.

That leaves little room for a firm premised on future growth and cash flows when investors are increasingly clamoring for cash returns now. With negligible revenues, excessive SG&A, lavish stock-compensation for a ticker giving up ~80% of its value YTD, investors are fully in their right to be asking questions.

For early-stage investors holding losses as big as the firm’s futuristic ambitions, their sole consolation is perhaps kudos in holding a stake in cutting-edge geekdom. Unfortunately, despite all the heavy-duty computing fire power, those algorithms have yet to find the secret to delivering positive risk-adjusted returns.

Be the first to comment