Darren415

Thesis

Tilray Brands, Inc. (NASDAQ:TLRY) will report its FQ4’22 earnings release on July 28, as the stock has continued to hobble along with its near-term support. However, its buying upside has failed to gain momentum resolutely.

Market sentiments toward unprofitable stocks have continued to be tenuous as investors focus on the macro headwinds which could markedly impact consumer discretionary spending.

TLRY is at a critical juncture as it continues on its multi-year path toward profitability. However, the company is not projected to reach free cash flow (FCF) profitability until FY24 (quarter ending May 2024). In addition, given the heavy reliance on licenses, investors should consider the regulatory risks associated with its multi-year ramp.

Our valuation analysis suggests that TLRY could struggle to justify its current valuation. In addition, our price action analysis indicates that the market has continued to hamper further buying momentum as it struggles to retake its near-term resistance.

Therefore, we reiterate our Hold rating on TLRY, heading into its Q4 card.

Market Share Loss In Canada Is Not Helping

The worsening economic and inflation headwinds have impacted market sentiments in stocks that rely on consumer discretionary spending. Furthermore, Tilray appears to be dealing with further share loss in its critical Cannabis market in Canada. Roth Capital added in a recent note (edited): “We see ongoing macro and consumer headwinds and further share loss in the Canadian cannabis market.”

Despite the recent closure of its HEXO Corp. (HEXO) investment, the Street remains cautious, given Tilray’s exposure in Canada. Haywood Securities emphasized (edited):

Tilray remains a market share leader in the Canadian landscape, albeit with a declining market share. We are encouraged by the international opportunities, including the recently announced US transaction. However, we remain cautious about the overall Canadian landscape, which drives a significant amount of its revenue growth opportunity in the near term. – Cantech Letter

Tilray also highlighted the criticality of its Canadian exposure in its filings. The company added (edited):

We derive a significant portion of revenue from the supply contracts we have with 12 Canadian provinces and territories for adult-use cannabis products. Our revenues could fluctuate materially in the future and could be materially and disproportionately impacted by the purchasing decisions of the provincial or territorial wholesalers. (Tilray 10-Q)

Therefore, we urge investors to continue monitoring management’s commentary on its performance in Canada carefully during its upcoming earnings call.

Tilray’s Revenue Growth Could Reach Its Nadir Post-Q4

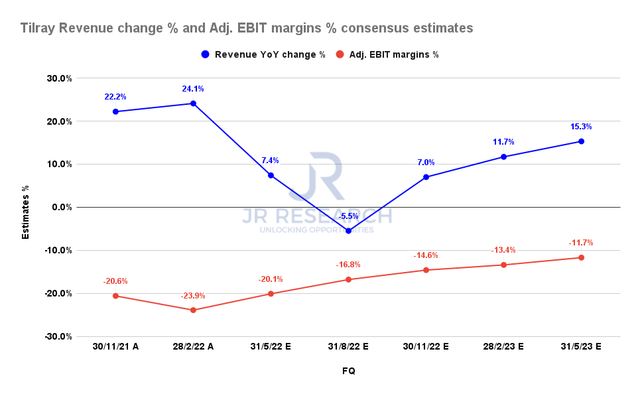

Tilray revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

The consensus estimates (neutral) suggest that Tilray could lap its challenging comps post-Aperia in FQ1’23 (quarter ending August 2022) as its revenue growth reaches a nadir.

Furthermore, Tilray is also projected to continue improving its operating leverage through FQ4’23. But investors should note that the company is not expected to reach FCF profitability until FY24. Therefore, they need to model for these uncertainties in their valuation models accordingly.

TLRY’s Valuation Still Poses A Significant Challenge

| Stock | TLRY |

| Current market cap | $1.52B |

| Hurdle rate [CAGR] | 25% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 2.5% |

| Assumed FCF margin in CQ4’26 | 4% |

| Implied TTM revenue by CQ4’26 | $2.56B |

TLRY reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a market-outperform hurdle rate of 25%, which we think is appropriate for speculative stocks like TLRY. In addition, we used an FCF yield of 2.5%, which we think is reasonable to model for its growth cadence.

However, given its weak FCF profitability (blended estimates of 4%, lower than the consensus estimates), we require Tilray to post a TTM revenue of $2.56B by CQ4’26, which is unlikely.

Therefore, we believe that TLRY could continue to struggle even at its current valuations.

Is TLRY Stock A Buy, Sell, Or Hold?

We reiterate our Hold rating on TLRY.

Even though TLRY has been massively battered, it doesn’t mean investors should consider it appropriate for a speculative bet. Investors must be circumspect in allocating capital for speculative stocks and demand an appropriate hurdle rate.

Therefore, we believe TLRY could continue to disappoint even if investors add at the current levels.

We urge investors to move to other growth opportunities, given the opportunities proffered by the current tech and growth bear market.

Be the first to comment