AlexLMX/iStock via Getty Images

The biggest issue with the Canadian cannabis market has been too much cultivation leading to oversupply. The new Tilray Brands (NASDAQ:TLRY) has attempted to consolidate the industry with the acquisition of Aphria, but the sector continues to struggle as much as prior. The new deal to help keep HEXO (HEXO) in business keeps our investment thesis Bearish on Tilray Brands.

Saving HEXO

At the end of January, HEXO wasn’t in compliance with positive adjusted EBITDA requirements for Senior Convertible Notes. The company was in dire straights with horrible EBITDA losses and the need to restructure the business, but Tilray decided to purchase the remaining $211 million worth of Senior Secured Notes to keep the business alive and prevent further dilution.

In the end, Tilray ends up with the right to own 37% of HEXO on full conversion of the convertible debt. The company is working with HEXO on efficiency measures of up to C$50 million in production savings within two years shared equally by both companies.

As with the HEXO deals to buy Redecan, 48North Cannabis and Zenabis Global and Tilray’s merger with Aphria, neither business ended up better at the end of the day. The best outcome for Tilray shareholders was for HEXO to close operations, not the company attempting to benefit from resuscitating the business in competition against Tilray products.

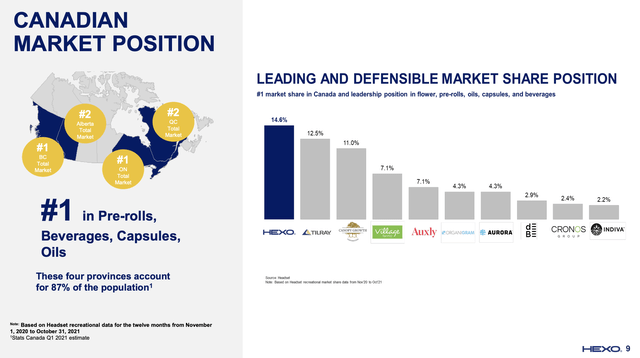

For the January quarter, HEXO reported net revenues of C$52.8 million, missing analyst targets of C$3.1 million. The company is still struggling to meet financial targets after acquiring Redecan with an expectation for Canadian flower market share to top 20% while the amount appears much closer to 10% now.

Along with the quarterly results, HEXO acknowledged the massive 33% decline in organic adult-use cannabis sales from the FQ2’21 levels. Even the crucial Redecan sales declined 29% to only C$13.6 million from the October quarter due to logistical issue

HEXO did cut the quarterly EBITDA loss to C$5.6 million, but the company is now embarking on a restructuring plan, The Path Forward, with a goal of improving free cash flow by C$135 million in FY23. The big concern is that every major Canadian cannabis LP has embarked on such a plan and most of the companies are still trying to turnaround the business and generate positive EBITDA.

HEXO Path Forward presentation

A big part of the problem is the need to cut employees and reduce manufacturing and production costs usually leading to unintentional problems. The company has already eliminated 180 positions for an estimated C$15.0 million in annual savings, but a lot of prior such restructurings lead to lower revenues and market share.

Also importantly, the deal with Tilray includes an agreement with KAOS for a three-year C$180 million equity backstop commitment. The company has the right to force KAOS to purchase C$5 million worth of common shares per month over the 36 month period. A primary requirement for these funds is paying the $20 million in annual interest payments to Tilray for the convertible notes acquired in this deal.

Execution Risk

On face value, the deal looks like a win-win for both companies. The problem is that HEXO has a tough restructuring ahead with the company trying to cut costs while boosting revenues leading to massive execution risks.

Tilray already has a Canadian cannabis business with $58.8 million in net revenues competing against HEXO in both the domestic cannabis markets and also in international markets. The company will ultimately have to pay $560 million in order to acquire the whole business after already spending ~$182 million on the convertible debt. Naturally, any such deal could face likely regulatory concerns

The better option was to continue taking market share from HEXO. The company had already seen massive declines in revenues after promoting last July that the combined HEXO and Redecan were generating ~C$52 million in quarterly revenues. The 48North Cannabis and Zenabis Global businesses were basically absorbed into HEXO following this report with no boost to revenues during the period from April 2021 till January 2022.

With all of the past execution problems in the Canadian cannabis market, Tilray keeping alive a top competitor in HEXO makes absolutely no sense. Based on trailing market share numbers, only Canopy Growth (CGC) was much of a threat to market share leadership and these companies could’ve grabbed organic growth from HEXO in the process.

HEXO Path Forward presentation

Takeaway

The key investor takeaway is that Tilray Brands isn’t appealing here with the company showing no ability to boost organic sales and take market share from a financially weak competitor. In addition, the stock remains expensive with a market cap of nearly $3 billion and actual cannabis sales only running at a $220 million annual clip.

Be the first to comment