karenfoleyphotography

Tilray Brands, Inc. (NASDAQ:TLRY)

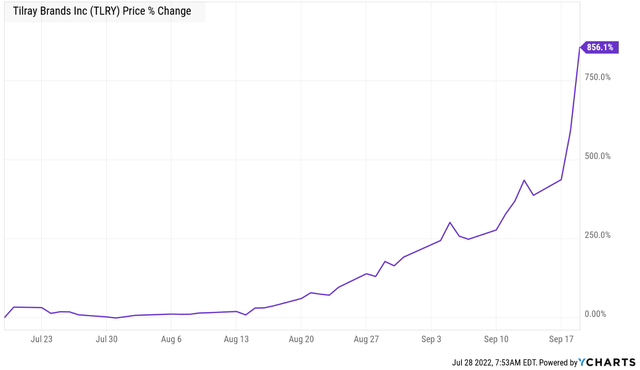

The company needs little introduction as everyone who has traded the markets over the last 5 years has likely learned of its business and the rather extreme short squeeze post-IPO.

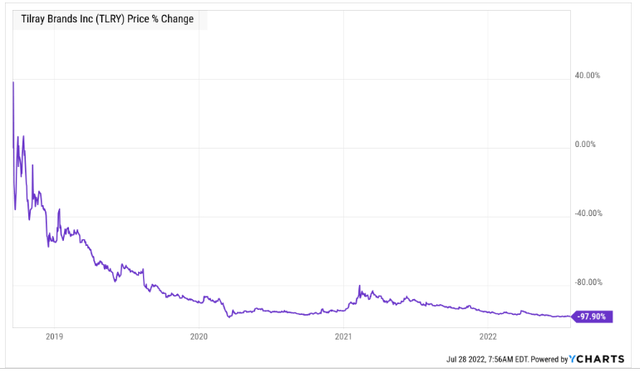

Of course, unlike the bubbles of today, this one happened 4 years back and a lot of time and tide has passed since then. If you were one of those that bought at the peak, you lost 98% of your capital.

But the company has not gone under and it is executing its turnaround plan. Turnaround stories take time. Often, the market is disgusted with the performance at that exact moment and disregards the potential just when it should be giving it the most credence. We examine the results released today and see whether Tilray may be on the brink of getting its act together.

Q4-Fiscal 2022

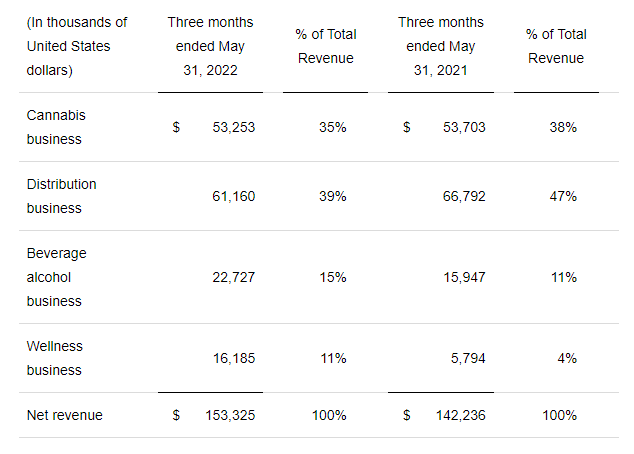

Keep in mind that Tilray’s fiscal year end is in May, so the results just released are their Q4 results from a fiscal standpoint. 2022 revenues grew 22% to $628 million compared to the prior year. Q4 revenue grew only 8% to $153 million versus last year. In both comparatives, Tilray faced rather strong currency headwinds from the US Dollar Strength. In Q4, for example, Tilray’s revenues would have jumped 14% if measured adjusting for currency changes.

While overall numbers were good, two out of the 4 segments contracted while the beverage alcohol and wellness areas grew briskly to lift the overall numbers.

Tilray Q4 Results

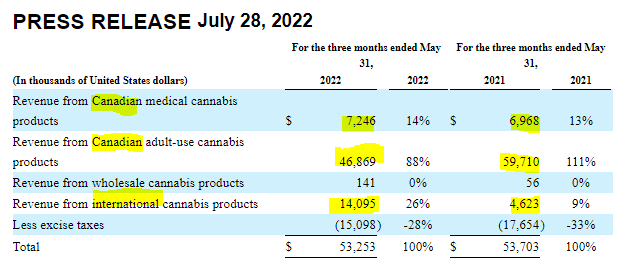

The contraction in Cannabis is not surprising at all. The bulk of its revenue is coming from Canada, and that market is one of the most difficult to make money in. Legalization led to widespread overcapacity and pretty much no one can make money here, thanks to massive overestimation of end user demand. Tilray’s struggles are rather acute here and the while the overall sales figures looked ok, Canadian revenues are contracting sharply.

Tilray Q4 Results

In our opinion, this market is still right sizing itself and there will be a lot of churn and capacity destruction in the months and years ahead. As we saw with Canopy Growth Corporation (CGC), the numbers here are likely to remain challenged as companies clear our inventories and figure out how they can “contract into profitability”. Yes, if that sounds like the exact opposite of what companies aim to do, you read it right. It is almost impossible to go from losses to profits while shrinking revenues, but that is the task ahead for all these Cannabis companies. You might be saying “wait a minute, didn’t Tilray just report a positive adjusted EBITDA number?”

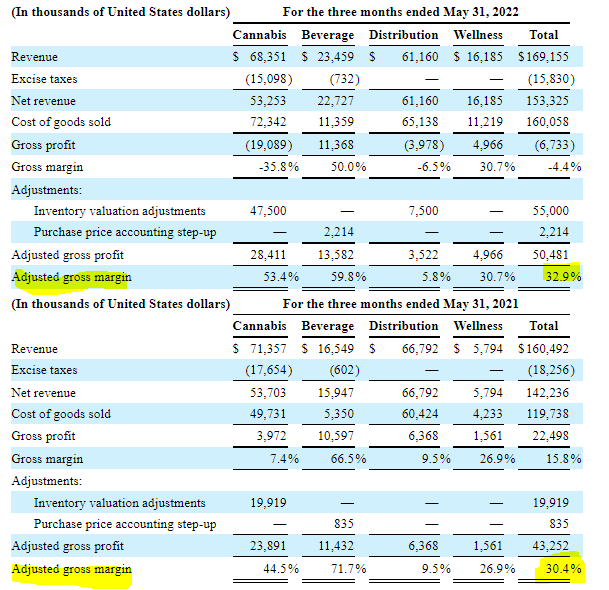

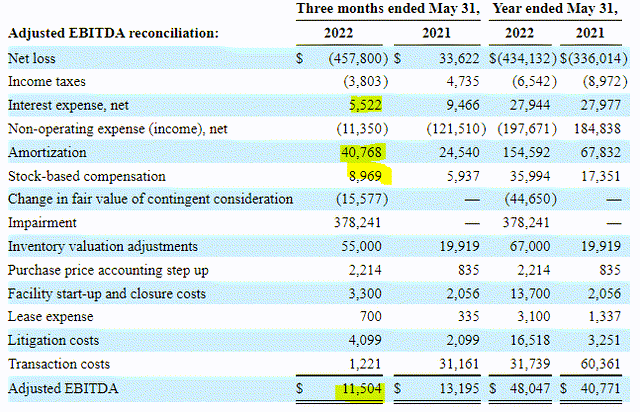

That’s a fair question. Tilray did have positive adjusted gross margins for the full year and in this quarter as well.

Tilray Q4 Results

Sometimes “adjusted numbers” take things too far, but it is fair to adjust for inventory valuations. Adjusted gross margins actually improved year over year and at 32.9%, these are actually 65% wide of CGC which reported negative 32% last quarter (See, Bankruptcy Risks Are Growing Like A Weed). We are fine with the adjusted gross margins, but we don’t equate that adjusted EBITDA as remotely resembling profitability. It is not hard to follow our logic if we see how the company works through adjusted EBITDA from net losses.

The $11.5 million in adjusted EBITDA this quarter was a prime beneficiary of multiple add backs. At a minimum we think that actual interest costs, depreciation and stock based compensation should be considered by investors looking to actually make money rather than getting seduced by promises of “growth”. Those 3 account for about $55 million of expenses in the last quarter versus the $11.5 million of adjusted EBITDA.

Some might argue that depreciation and amortization are not real costs, but for a manufacturing and distribution company, they absolutely are. While Tilray’s facilities might be up and running and maintenance costs might seem low, you can expect it to spend at least as much as the amortization line over the long run to upgrade these same facilities.

Outlook

Tilray’s success has come mainly from its growth in Germany where it is outselling the competition. In Canada, Tilray faces one of the most fiercely competitive markets and there are close to 800 licensed producers competing to go bankrupt before everyone else. Tilray is trying to lead some consolidation here and it recently acquired HEXO’s senior secured convertible notes. We will have to see how this plays out, but with 800 producers, we think it will take a long time before the industry sees economic profits. In our opinion, the two areas (international and Canada) look like they will offset each other for 2023 and we don’t see any large improvement in EBITDA in the next 12 months.

On the US side, Tilray had acquired Manitoba Harvest to distribute CBD. It also expanded its reach when it acquired some of MedMen’s outstanding convertible notes. Those areas set it up for future growth, when US Cannabis use is legalized at a Federal Level. None of that will help in the next 12 months though. SweetWater Brewing assets are likely to be a good source of gross margins, but they won’t be a game changer any time soon as the beer segment will grow slowly.

Verdict

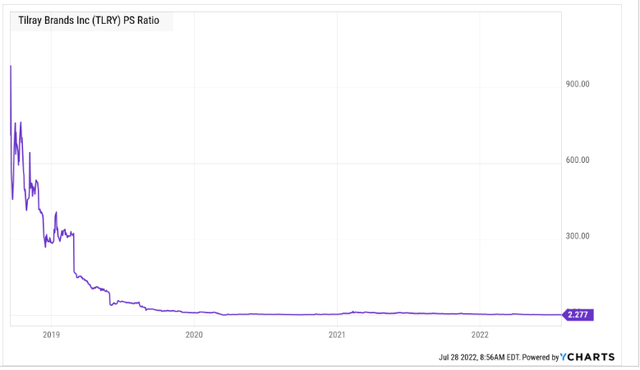

900 times sales. That is what “investors”, and we use the word with maximum disdain, paid for Tilray at its peak. Scott McNeely made fun of the idea that anyone would pay 10X revenues (for his company).

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?

Source: Bloomberg

He could not be reached for comment on what he thought about paying 900 times revenues.

Fortunately, we have fixed that problem by giving investors a 98% haircut alongside some good jump in revenues.

Current valuation is not too demanding for Tilray and it remains easily the leader in the Canadian space. Unlike CGC, another stock we cover, we will not give this a sell rating as its adjusted gross margins are good and balance sheet is far better. We are initiating coverage at neutral/hold and think this should be on investor watch lists for a longer term opportunity down the line.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment