Vladimir Koval/iStock via Getty Images

Tilray Brands (NASDAQ:TLRY) has been one of the most loved cannabis stocks, yet the company hasn’t produced any results warranting the love. The Canadian LP reported another weak quarter following a rally on the marijuana reforms announced by President Biden. My investment thesis remains Bearish on the stock, as investors continue to rush into the stock on unwarranted hype on U.S. legalization hopes.

Another Tough Quarter

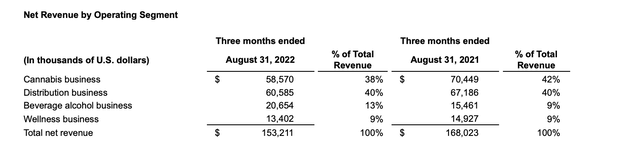

Tilray reported FQ1’23 revenues that yet again missed analyst targets with revenues of only $152 million. The combination with Aphria over a year ago has not led to any growth by the combined cannabis company despite a Canadian market that continues to grow.

As constantly highlighted in past research, Tilray appears unable to manage the far flung business operations. The prime cannabis business saw revenue dip $12 million YoY. The company only saw the beverage alcohol business grow revenues during the quarter ending in August.

Source: Tilray FQ1’23 earnings release

The other problem remains the distribution business still accounts for 40% of revenues and the largest segment despite the YoY weakness. Remember, Tilray only has $79 million in revenues from the cannabis and beverage businesses which offer gross margins in the 50% range.

Even the promising international cannabis segment only produced flat revenues YoY at $10 million. Tilray has done deals with Aphria and a strategic investment with HEXO (HEXO), yet the Canadian cannabis revenues in both the medical and adult-use markets were down YoY.

Due to all of these growth issues, Tilray only produced ~$14 million in adjusted EBITDA for the August quarter. The distribution business only has gross margins around 10% with the wellness business not helping much.

Investors have to value the stock based on just $79 million in quarterly revenues and annual revenues closer to $300 million now. The lack of growth is problematic for a business only generating $50 million in annual adjusted EBITDA, but the stock is worth nearly $2 billion.

Limited Access To U.S. Market

Being listed on major stock exchanges, Tilray isn’t legally allowed to own assets that are federally illegal like cannabis now. The company has minimal deals like a debt investment in MedMen Enterprises (OTCQB:MMNFF) providing limited access to the US market on legalization.

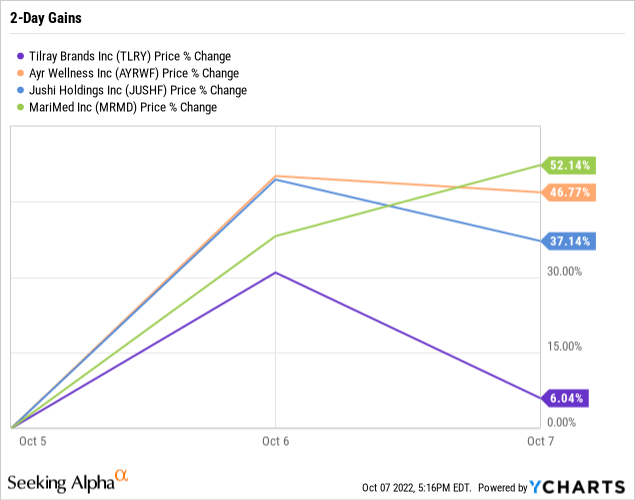

Tilray will be forced to purchase assets and licenses to enter the U.S. market following legalization where asset prices will soar prior to such news. Most of the multi-state operators (MSOs) soared over 30% on the Biden news from last week of pardoning Federal prisoners incarcerated for minor marijuana possession and de-scheduling the plant.

While Tilray gave back a lot of the gains from Thursday, partially due to weak earnings, smaller MSOs, possibly a target of the Canadians, held most gains on Friday. Ayr Wellness (OTCQX:AYRWF), Jushi Holdings (OTCQX:JUSHF) and MariMed (OTCQX:MRMD) were still up on average of around 45% over the 2-day period in a prime example of where an investor would want to play the U.S. legalization or de-scheduling of cannabis.

No doubt, Tilray will jump on any signs of U.S. legalization or just the de-scheduling of marijuana allowing a possible path to uplisting cannabis stocks. Such a move would allow Tilray into the U.S. market, but one has to wonder at what prices the Canadian will have to pay to acquire such assets. The 2-day returns of the smaller MSOs suggest which side of the investment stream should be preferable with Tilray only managing a 6% gain.

Also remember, Ayr has plans for annualized cannabis revenues in the $800 million range. Even Jushi has 2023 revenue targets topping $400 million to nearly match the actual key cannabis and beverage revenues produced by Tilray. A company like MariMed would be more manageable with revenue targets only topping $150 million.

One has to wonder if Tilray can even acquire some of these smaller MSOs leaving the company to buy much smaller license holders.

Takeaway

The key investor takeaway is that Tilray just isn’t the stock to own on a path to legalization in the U.S. Investors should look towards owning smaller MSOs in the U.S. where a Canadian like Tilray might look to acquire at a premium valuation from current levels.

Be the first to comment