Jay Roode/iStock Editorial via Getty Images

Introduction

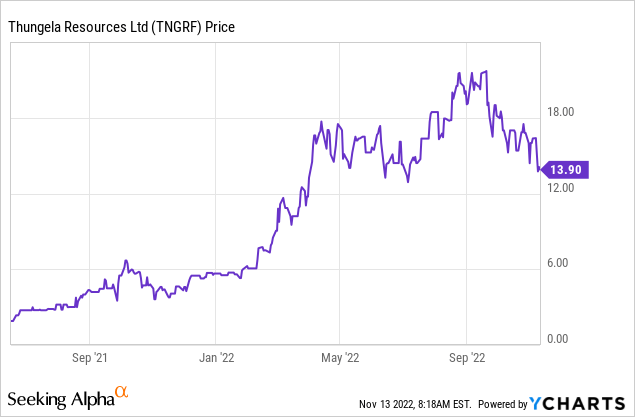

Thungela Resources Limited (OTCPK:TNGRF, TGA.L, TGA.JO) is a producer and exporter of high-quality, low-cost thermal coal with operations in South Africa. The company was born in June 2021 as a spinoff of Anglo American (OTCQX:AAUKF). The demerger left Thungela in possession of excellent thermal coal assets and a solid balance sheet.

The story immediately following the demerger is quite fascinating. When the new shares began trading on June 7 on the London Stock Exchange, they opened at 150 pence sterling and then went straight down 20%, trading around 120 pence by mid-morning. Downward pressure continued in the following days, sustained by forced selling from institutional investors, as well as short-selling from several hedge funds. One hedge fund that proved particularly vocal was Boatman Capital. Boatman published a report that stated that:

[…] Thungela’s environmental liabilities could be three times greater than currently reported and are more than the value of the entire company. Our financial model attributes zero value to Thungela.

Boatman claimed environmental liabilities costs stood around $1.36 billion, much in excess of Thungela’s provisions of around $350 million. Thungela criticized the report as “flawed,” based on the fact that the provisions were in fact above regulatory guidelines. In addition, according to Thungela, Boatman’s estimates were made on draft environmental regulations still under discussion by South Africa.

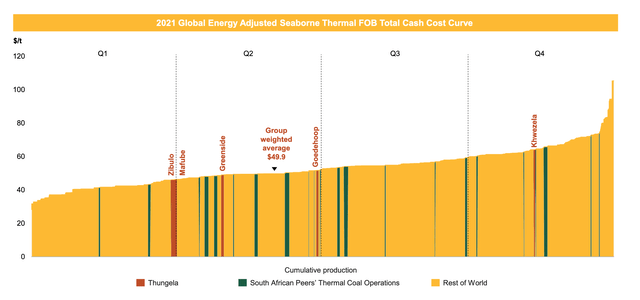

In any case, the company immediately pursued a strategy of optimizing current operations and returning capital to shareholders via a generous dividend policy. It could count on a strong balance sheet (including a cash injection of R2.5 billion from Anglo American) and low-cost, high-quality assets (in the lower half of the global cost curve).

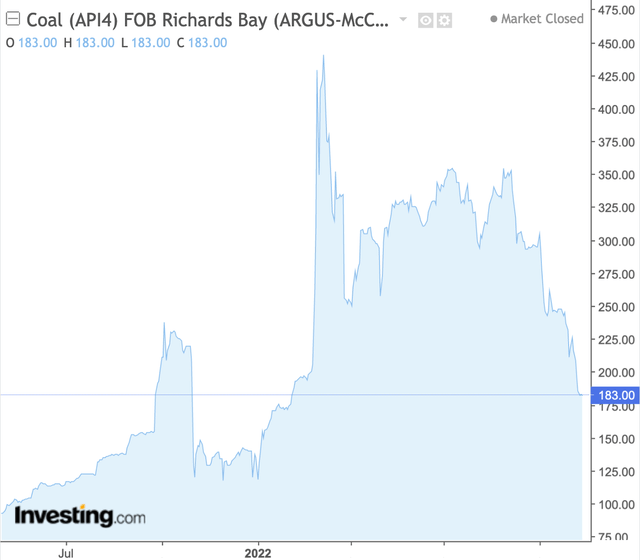

Crucially, the company received a powerful tailwind from the dramatic moves that shook the thermal coal market in the first half of 2022. First, the post-COVID reopening of the world economy, and then the geopolitical tensions linked to the war in Ukraine, spurred a historic bull run. In the 14 months following the demerger, the price of thermal coal (API4) went from $100 per tonne in June 2021 to a high of more than $400 per tonne in August 2022. The share price went from 150 pence to a high of 1900 pence, an 1100% return in slightly more than a year. Thungela became a symbol of the incredible source of alpha made possible by ESG madness.

Newcastle coal futures (investing.com)

However, sentiment has changed again in the last couple of months, with the share price now hovering around the 1150 pence region, down 40% from its all-time high. Macroeconomic fears related to a global recession, as central banks go on the war path to tame inflation and China sticks to its zero-COVID strategy, compounded by company-specific headwinds, including train derailments and clashes with local mafia groups. Is now the time to de-risk and take some chips off the table? Or to reload on some cheap shares and wait for the next huge dividend payment?

A cheap FCF machine

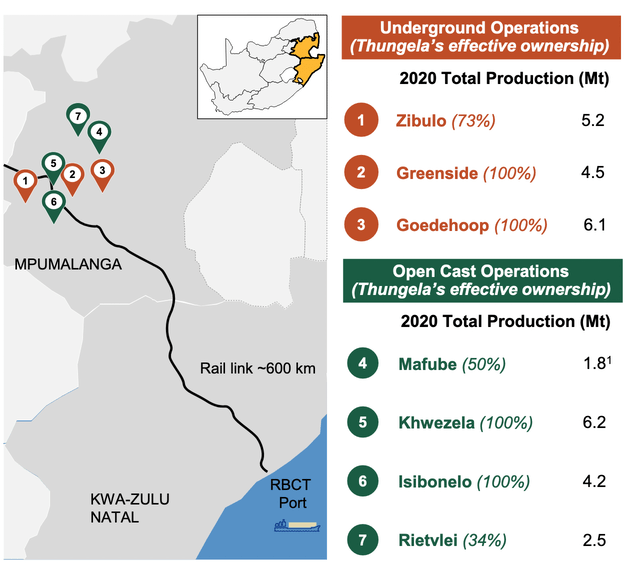

The company operates 7 mining projects, which are among the highest quality thermal coal mines in South Africa by calorific value (average calorific value: 5,500 kcal/kg). In addition, they are also some of the lowest-cost mines (FOB cost per export tonne: R1093).

Global cost curve for thermal coal (Wood Mackenzie data and forecasts) Mining operations (company’s presentation)

Calorific value is important as it impacts the average realized price: a higher calorific value commands a premium. Mining costs are important, as lower costs obviously imply a greater free cash flow.

The life-of-mine of most assets is not exceptional, but the company is engaged in replacing production volumes via life-extension programs (such as a new shaft at Zibulo), as well as new projects (such as the Elders project). The aim is not to expand production, but just to replenish reserves and keep capital expenditures to a minimum.

| Mining operation | Market | Mining method | Life-of-mine |

| Zibulo | export and domestic |

underground (bord and pillar) and opencast |

8 years |

| Greenside | export and domestic | underground (bord and pillar) | 6 years |

| Khwezela | export and domestic | opencast | 7 years |

| Isibonelo | domestic | opencast | 5 years |

| Rietvlei | domestic | opencast | 2 years |

| Mafube | export | opencast | 10 years |

| Goedehoop | export and domestic | underground (bord and pillar) | 4 years |

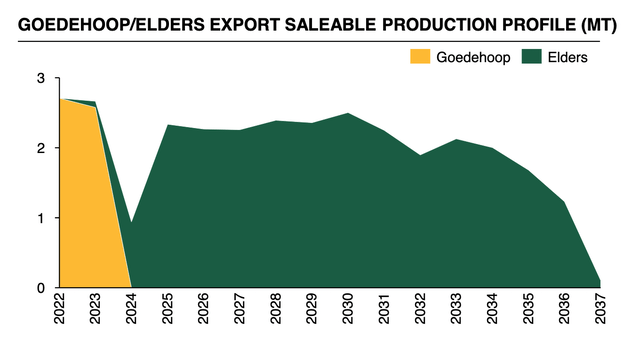

Elders is a replacement project in the Goedehoop region approved during H1 2022. Construction is set to start in Q3 2022, with first coal in Q4 2023.

Elders project (company’s presentation)

The company’s strategy is clear: sustain existing operations and return capital to shareholders via dividends (by targeting a minimum payout of 30% of free cash flow). The secondary objective is investing in selected projects that are low-risk and value-accretive, in order to extend life-of-mine and replace production.

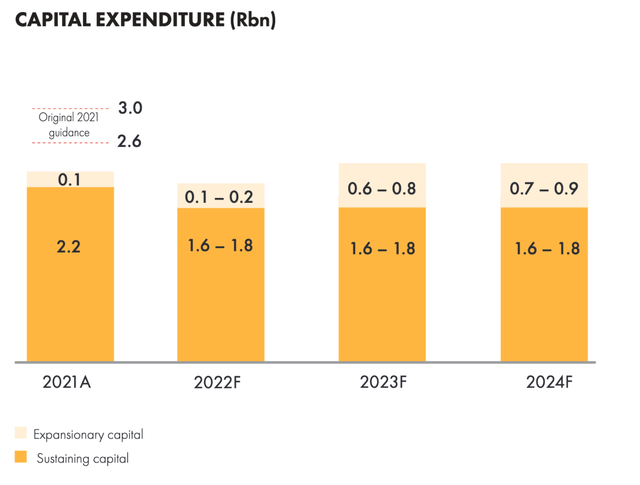

At the moment, expanding production would not make any sense anyway, since the company already has trouble to deliver its current volumes to the Richards Bay Coal Terminal for export, as we will discuss. This has even led to curtailment of some operations and postponement of capital investments. Capex guidance has been lowered compared to 2021 from the R2.6-3 billion range to around R2.3 billion. It is projected to remain fairly constant through 2024.

Capital expenditures guidance (company’s presentation)

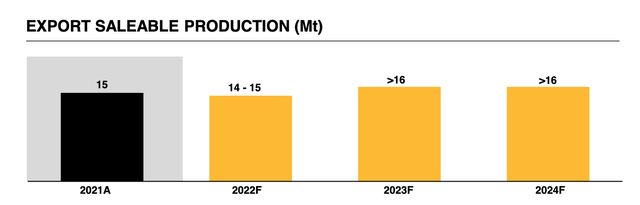

Production is forecasted to stay roughly flat, with export saleable production around 14-15 million tonnes for 2022 and above 16 million tonnes going forward.

Export saleable production (company’s presentation)

The fundamental point about Thungela is that it is incredibly cheap, while at the same a true money printing machine. This is true of course of many other thermal coal producers, but Thungela suffers from a particular country risk discount. We will discuss in the next sections what this risk entails, but first let’s see how cheap it really is.

A crucial number to keep in mind in the following is that the company has a market capitalization of around R34 billion. In addition, it maintains a R6 billions cash cushion. It has no debt, so the enterprise value is around R28 billion.

Thungela sells its production both in the domestic and in the seaborne export markets. However, the export business is really the most important one, representing approximately 80% of total revenues, so I will focus only on this segment. Export saleable production is projected to rise to more than 16 million tonnes in 2023 but again, to be conservative, I will take the lower end of the 2022 production guidance of 14 million.

Revenues are going to be a function of the realized price. The relevant benchmark for Thungela is FOB Richards Bay 6,000 kcal/kg thermal coal. It is currently trading around $150-200 per tonne, down more than 60% from its August 2022 highs. Futures prices are also trading in this range well into 2024.

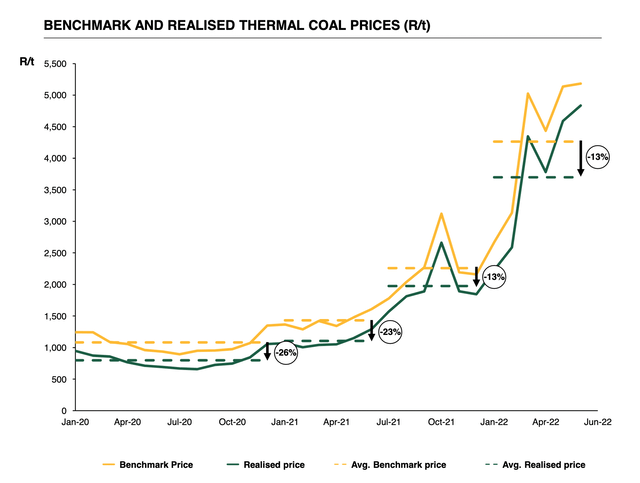

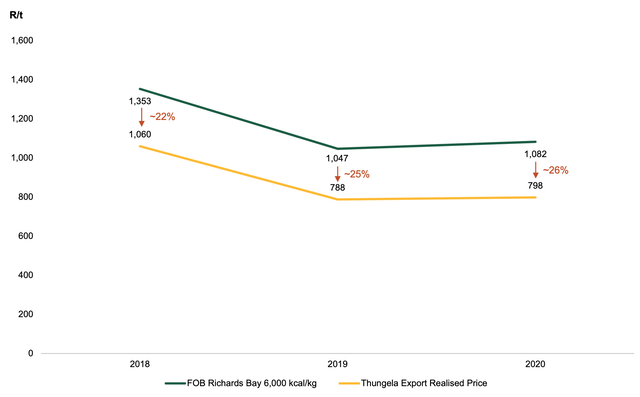

The average realized price however differs from the benchmark due to the lower calorific value of Thungela’s coal mix, quality discounts (impurities), and timing differences between contract and spot prices. The discount to benchmark achieved by the company in H1 2022 was around 13%. However, again to be conservative, I will use a higher discount of 25%, which is closer to the historical average.

Benchmark and realized thermal coal prices for H1 2022 (company’s presentation) Historical discount to benchmark from 2018 to 2020 (company’s presentation)

Let’s now move to costs. Unfortunately costs are being pressured by global inflationary forces, especially for oil and explosives. Costs have also risen compared to previous years because of TFR performance issues (Transnet, the rail company transporting the coal to the Richards Bay Terminal for export). There is also the variable effect of royalties, which are linked to the benchmark price. I estimate total FOB costs in the range R1000-1200 per tonne going forward.

Finally, taxation. The effective tax rate during H1 2022 was around 18%. However, this is also the result of deductions due to losses carried over from prior years. The tax rate will normalize closer to the statutory tax rate of 28% in the future. It is projected to be at 27% for 2023.

As already mentioned, Thungela is paying out basically all the cash it produces as dividends. The minimum payout is 30% of free cash flow (“FCF”). In the current environment, I especially like companies that pay high dividends since, with rising inflation and interest rates, long duration is going to continue getting killed. However, it should be remarked that dividends are subject to a withholding tax, which represents an additional cost lowering returns. South Africa has a withholding tax on dividends paid to non-residents. It varies from country to country (details here), and it equals 15% for U.S. investors.

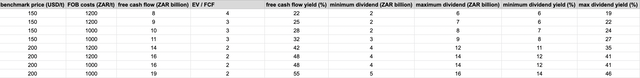

With all the above assumptions, and taking a 17.26 USD/ZAR exchange rate, we get the following numbers:

Forecast of free cash flow and dividend yields (author’s calculation)

The minimum dividend corresponds to what the company would pay if distributing only 30% of FCF, which is the absolute minimum according to its dividend policy. However, the company has already maxed out its cash cushion of R6 billion, which it aims to maintain under all circumstances, so I would expect it to actually distribute 100% of FCF to shareholders. The last column then shows the forward dividend yield (assuming a withholding tax of 15%). The dividend yield can vary from 13% to over 40%. Apply your relevant personal tax rate and subtract the inflation rate, and you are still likely to get a significant positive real return from dividends alone.

The last estimate is obtained under the most favorable circumstances under consideration, but still quite realistic. Let me remark that for H1 2022 production was 6.1 million tonnes, costs R1093 per tonne, and average realized price around $214 per tonne. There are of course many assumptions behind the numbers, but Thungela is clearly a very undervalued company. After all, the EV / FCF multiple is only 5x under the most pessimistic assumptions, and as low as 2x under the most realistic.

There are two important factors, however, which these numbers are extremely sensitive to. One is the coal price. Will it decline further? Will demand pick up with a China reopening? Will coal be replaced by other energy sources? The other is the great risk related to the South Africa jurisdiction. I discuss each of them in turn.

Thermal coal prices to stay elevated

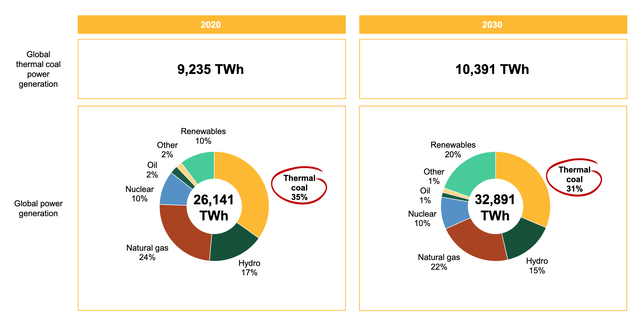

The outlook for coal remains surprisingly bright. I believe investors should avoid a western-centric approach according to which coal is a dying source of energy, destined to be phased out completely in the near future. The truth is that thermal coal is still responsible for 35% of global power generation, and its share will decline only marginally over the next decade.

Global power generation by energy source (Wood Mackenzie data and forecasts)

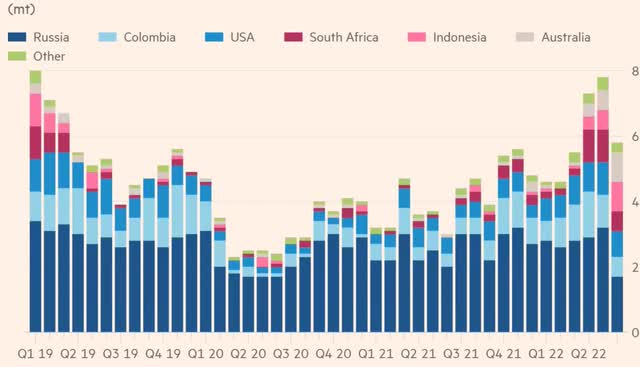

While the West has committed in theory to reduce its share of energy from coal, disruptions in the energy markets caused by the Russian invasion have forced different decisions. Europe in particular has increased its coal imports to new historic highs during 2022. The increase has mostly come from Australia, Indonesia, and South Africa.

EU seaborne thermal coal imports (Financial Times)

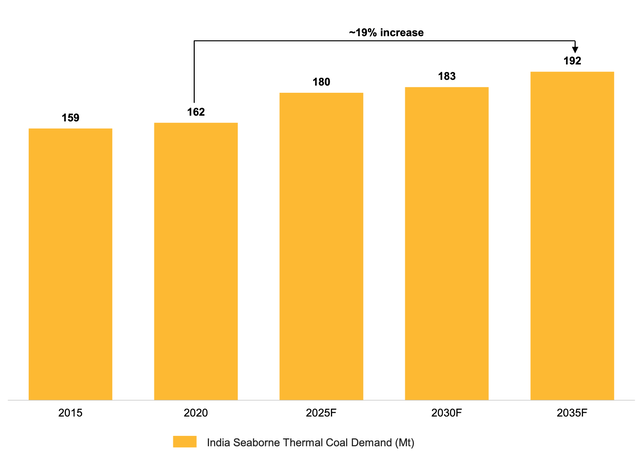

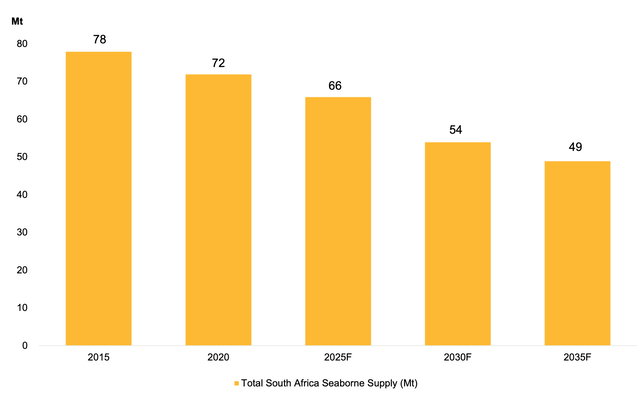

But even more relevant for Thungela is the growth coming from the South Asian region. South Asia requires large amounts of low-cost power to support economic development and there are few alternatives to thermal coal, with ambitious nuclear and renewable targets unlikely to be met. India for instance represents 17% of seaborne thermal coal demand and is the largest market for South African coal. Its demand is actually projected to grow over the next decade, while at the same time South African production is projected to fall, as mines are depleted and reserves are not replenished because of ESG policies.

India’s thermal coal demand (company’s presentation) South Africa thermal coal production (company’s presentation)

Another bullish factor for coal is that it will become more costly to transport it by sea, as the bulk fleet is subjected to more restricting environmental regulations and its orderbook is at historical lows, further challenging supply. All this creates a situation that is extremely supportive for coal prices over the coming years.

South Africa is a significant risk

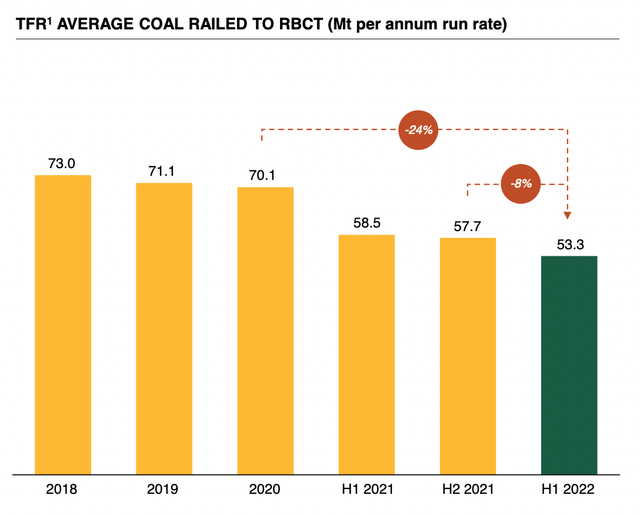

Unfortunately, South Africa has proven a constant source of problems for Thungela. As already mentioned, Thungela relies on Transnet to ship its volumes to the Richards Bay Terminal for export. Unfortunately, Transet is mismanaged and the victim of several accidents, which causes constant delays or outright interruptions along the line. Transnet has declared six times force majeure in the last 18 months to avoid penalties on its contracts with clients, including Thungela, that have a minimum delivery target. It has been impacted by acts of vandalism, sabotage, theft of copper cables, cyberattacks, fires, floods, strikes, lack of spare parts, mob fights and several derailments (the most recent just a few days ago).

The problem is that this is preventing Thungela from producing at full capacity. Over the last year, the company has been forced to curtail production and focus only on the highest grade operations because of these bottlenecks. This is equivalent to a loss to shareholders, because the company was not fully able to take advantage of the extremely strong pricing environment.

Despite efforts to cooperate with Transnet and the government, the situation does not seem to be getting better, as evidenced by the declining average volume railed to the terminal shown below.

Annualised run rate average coal railed to RBCT (company’s presentation)

Is the situation going to normalize from here? Can Thungela arrange for a logistical alternative? Unfortunately, I am not confident enough to express a strong opinion. I strongly believe that, even if the current uncertain situation continues, the company is a buy: the management is capable, the company is very cheap, and it will continue to produce massive amounts of free cash flow, as thermal coal remains in high demand due to lack of investments and geopolitical tensions. If the situation normalizes, the company would even be a strong buy. However, I find it difficult to quantify the tail risk that something goes really bad. Can South Africa disintegrate? Can the company be forced to reduce its production drastically?

Because of this risk, I rate Thungela Resources Limited a hold. Investors who have been riding it since last year are advised to reduce their Thungela Resources exposure, and re-invest it in selected coal producers who are currently almost as attractive in terms of valuation and don’t have the same country risk.

Be the first to comment