Editor’s note: Seeking Alpha is proud to welcome Nick Mishkin as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Deagreez/iStock via Getty Images

The looming recession scares investors. Traders hear Jamie Diamond’s cynical outlook and sell their stocks immediately. Historically, the market always recovers, but investors repeatedly overlook logic and panic sell.

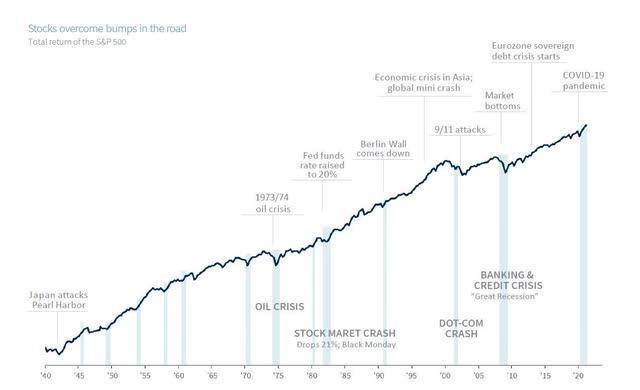

The S&P 500 increased 119-fold since 1969. As said in “The Psychology of Money” by Morgan Housel, “all you had to do was sit back and let your money compound.” Even with a variety of major global crises impacting markets, investors earned massive returns holding the S&P 500 index. The chart below explains that timing the market is almost impossible. As the famous quote goes: “Time in the market over timing the market.”

FactSet, 03/29/1940-03/31/2021

If time and compounding lead to automatic success, why do people sell too early?

As a behavioral economist, I train traders to stay emotionally resilient through economic turmoil. I help them find the strength to face volatility and the power to refrain from selling stocks prematurely. In this article, I share three tips that have helped traders of all sizes.

Why Do Investors Sell Too Early?

First, let’s discuss why traders fall into traps. Trading is an emotional game, not an analytical one. Research on behavioral finance and controlling emotions supports my claim. Traders often lose money, not because they overlook a flaw in Company X’s income statement, but because they need emotional discipline. They see Company X’s stock price drop and sell immediately.

Recessions and unfortunate events like wars and pandemics only temporarily hurt the market. The data shows that if you merely do nothing during these times, you will turn a profit.

Avoiding Losses

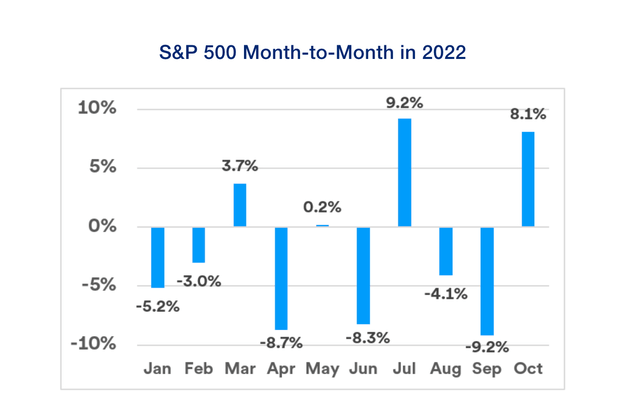

People let their loss aversion run wild. Staring at your portfolio and seeing red negative trends causes panic. Your heart races and your thumbs want to click the “sell” button. 2022 has seen many negative shifts, and your emotions probably swing like a yo-yo.

Does it ease your mind to learn that your feelings are normal?

Humans naturally want to improve uncomfortable situations. Behavioral economists call it the action bias. According to this famous study, soccer (or football) goalies would block more penalty kicks standing still than diving. Doing nothing saves more goals than trying, yet goalies continue to move in the penalty box. Their action bias kicks in and forces their brain to take action – the same is true with trading. You might feel compelled to trade against your negative portfolio, but don’t. You’re only hurting yourself. Take a deep breath and ride the wave.

Protect Yourself From Yourself

Richard Thaler, a Nobel Prize-winning economist, found that dinner guests spoil their appetites with finger foods. He had to remove a bowl of cashews from his living room to keep his guests hungry for the main meal.

In today’s world, trading stocks has never been easier – mobile applications provide “sell” buttons at your fingertips. To avoid a panic trap, you must protect yourself from your habits. Transforming your behavior includes both physical and mental improvements.

Tip No. 1: Trade Only on a Desktop Computer

Don’t eat when you’re not hungry and don’t sell when you shouldn’t. My first tip for eliminating impulse selling is to trade only on your desktop computer. Behavioral experts compare trading to gambling. Traders chase profit highs and will do anything to avoid “in the red” blues. The average person touches their phones about 2,617 times a day, many checking the latest stock prices. Even the slightest hint of turbulent markets triggers unconscious selling.

Tip No. 2: Hire a Wealth Manager

Do you manage all of your assets? My second tip is to give at least 80% of your portfolio to a wealth manager. Controlling all of your assets poses a significant risk. The media lures you into buying wobbly cryptocurrencies and selling premium companies like Alphabet (GOOG)(GOOGL) at the slightest hint of a sales slowdown.

Protect yourself from yourself. Unlike a self-managed portfolio, wealth managers often work for banks with systems in place to eliminate emotional trading. Keep a maximum of 20% of your cash as “play money” and give the rest to a professional.

Tip No. 3: Apply Simulation Theory

My last tip is an expansion on the simulation heuristic. I call it “applying simulation theory.” A pivotal approach to staying calm in a volatile market is managing expectations. If you can anticipate price fluctuations, you will be more likely to prevent impulse selling. Simulation theory says, “I know this stock will have a volatile journey over the next 10 years, and I’m ready for it.”

Morgan Housel recommends holding onto value stocks for up to 30 years. Many pessimistic events will occur within this time frame: recessions (on average every six years), pandemics, wars, and inflation. Acknowledging that there’s a 100% chance of volatility during your long investing career will prepare you emotionally for the roller coaster.

Here’s a volatility predictor that will surprise you. Do you own Meta Platforms (META) stock? If you do, prepare for a bumpy ride. One study found that companies with powerful CEOs incur more price volatility, and Zuckerberg controls over 54% of voting rights. That is not an excuse to sell META – it means you should apply simulation theory and expect volatility. I own META and plan to hold on to the stock for years, even during downtimes.

Conclusion

Taking the human element out of trading will prevent costly mistakes. Protect yourself from yourself and mentally prepare for volatility. My three tips eliminate human intervention in trading and help build emotional strength. By trading on a desktop computer, you stop impulse selling; by hiring a wealth manager, you evade emotional trading; and by applying simulation theory, you develop the mental strength to hold onto stocks in challenging markets. Warren Buffet once said: “My life has been a product of compound interest.” Like Buffett, you must sit on your investments and let them compound.

Be the first to comment