maybefalse/iStock Unreleased via Getty Images

This article was prepared by Ubaidulla Sathar, CFA in collaboration with Dilantha De Silva.

Alibaba Group Holding Limited (NYSE:BABA) stock has declined 34% since our last article, and over the last 12 months, the stock has declined a staggering 60% due to regulatory concerns and a host of negative narratives surrounding the company and the Chinese economy. In our last article, we covered the regulatory pressures on Alibaba and concluded things will eventually get better, but unfortunately, the decision by authorities to call a truce on the crackdown has taken much longer than we anticipated. In this article, we will discuss our thoughts on the potential future direction of the stock following a rerating in the market over the last few months.

The Chain Of Events

Alibaba stock has witnessed considerable volatility over the past couple of months and it is important to get an understanding of the sequence of events that have transpired to gauge a measure of what we are dealing with here. In our opinion, investors need to understand the sensitivity of Alibaba stock price to key developments (earnings, regulatory updates, etc.) to form a data-driven opinion of where the stock is headed in the future. In this segment, we will highlight the key developments briefly to help you quickly understand where we are at.

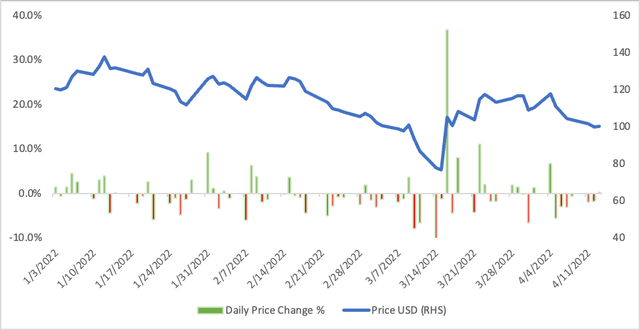

Exhibit 1: BABA stock price and daily percentage change

Author using Yahoo Finance data

Source: Author

|

Date |

News |

Market Reaction |

|

February 24 |

Alibaba posts non-GAAP EPS of RMB 16.87, beating analyst estimates for earnings. The company, however, missed the revenue guidance by more than RMB 3 billion. |

Alibaba stock declined just 0.7% on the earnings release day, but the stock had already declined more than 12.3% in the 3 days leading up to the earnings report. |

|

March 10 |

SEC hints at delisting actions. |

Alibaba stock declined 23.9% over 4 days. |

|

March 16 |

Chinese authorities confirm their support for Chinese IPOs abroad, calling for closure on the tech crackdown. |

Shares gained 36.8% on March 16 and the rally continued in the days that followed. |

|

March 22 |

Alibaba boosts its share buyback program to $25 billion from $15 billion. |

Shares gained 13% post announcement. |

Subsequent to the promising development with share buybacks, Alibaba shares yet again witnessed selling pressure due to strict lockdown measures imposed by the Chinese government to curb the spread of new COVID-19 cases and on the news that long-standing advocate of Alibaba, Charlie Munger, trimmed his position in half.

What To Look Out For?

Despite being plagued by a host of negative developments on the external front, the critical factor an investor needs to assess is the fundamental prospects for the company going forward. Since its IPO, Alibaba was accustomed to a high level of revenue growth averaging 30-50% YoY with various new initiatives and innovations driving the company. Going forward, in the post-crackdown era, we are now entering a subdued growth period for the company. This was evident in the most recent quarter as well, but to be fair, a slowdown in growth was always on the cards and it would have been irrational to expect Alibaba to grow at the same pace given the maturing nature of the company and the Chinese economy. That being said, investors were caught off-guard with the worse-than-expected deceleration of growth in the last quarter, and we believe it makes sense to determine whether Alibaba can reverse this trend or whether the company will continue to report lackluster revenue growth in the coming years, which does not bode well for growth investors.

Understanding The Revenue Drivers

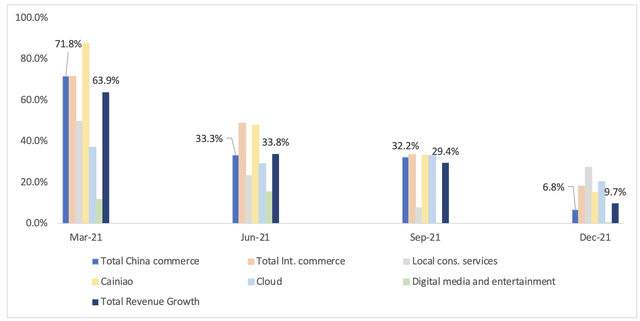

For the quarter ended December 31, 2021, Alibaba reported revenue of $38 billion, an increase of 10% year-over-year. Below is a breakdown of revenue growth by segment.

- China commerce segment: 7%

- Cloud segment: 20%

- Local consumer services segment: 27%

- International commerce segment: 18%

Exhibit 2: Alibaba revenue growth by segment (last 4 quarters)

Company financials

Source: Author prepared based on company financials

**Note: “Other” Commerce in historical periods has been included under the Cainiao segment.

Nearly 70% of company revenue is contributed by the China Commerce segment and it is the weakness in this segment that had the biggest impact on revenue growth in the December quarter. The company management views this deceleration of growth as a result of slowing market conditions as well as competition. With a closer look at the overall revenue growth of the company and historical user growth trends, we can infer that there was a significant drop in average spending by customers in the December quarter. This supports the above theory that revenue growth deceleration is a result of challenging market conditions.

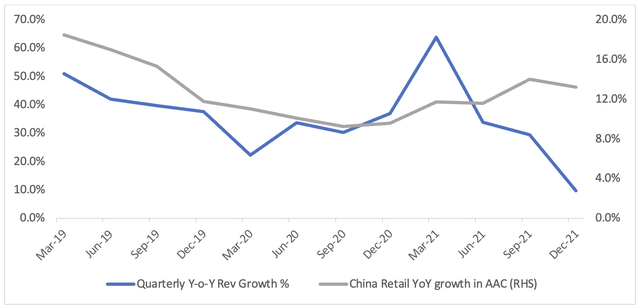

Exhibit 3: Alibaba quarterly revenue growth and user growth trends

Company financials

Source: Author prepared based on company financials

If we dig deeper, year-over-year growth rates of physical goods GMV for apparel and accessories and consumer electronic categories were slower than the overall average growth, while growth in the FMCG and home furnishing categories were better than the average. This granular detail also suggests that the slowdown in Chinese economic growth might have negatively impacted discretionary consumer spending, which brings us to the next segment of this analysis.

The Declining Private Consumption In China

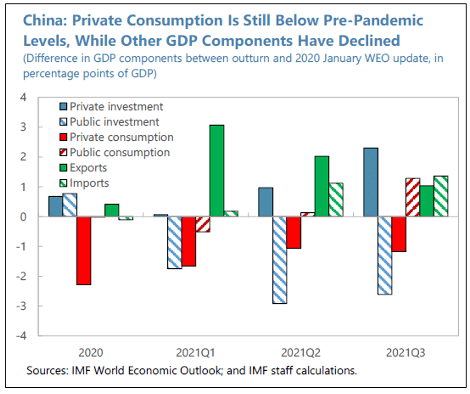

As per the latest IMF report on China, despite average sequential headline GDP growth reaching pre-crisis levels, the level of private consumption is currently well below its pre-crisis forecast. The weakness in consumption and elevated household savings are likely the result of prolonged uncertainty surrounding the virus and vaccine efficacy as well as a soft labor market as new urban job creation is still hovering below 2019 levels. Further, we believe the Zero-COVID approach adopted by the authorities has had a considerable impact on private consumption as it creates uncertainty about what the future holds for the Chinese economy. The strict measures imposed by the government from time to time have also created a stop-and-go business activity pattern, which is not ideal for economic growth.

Exhibit 4: Private consumption in China

The International Monetary Fund

Source: The International Monetary Fund

With lockdown measures imposed in Shenzhen and Shanghai in March and April, respectively, we remain cautious on the revenue prospects for Alibaba in the upcoming quarter, and we fear the company might once again disappoint investors with lackluster growth, and in the worst-case scenario, with a massive earnings miss.

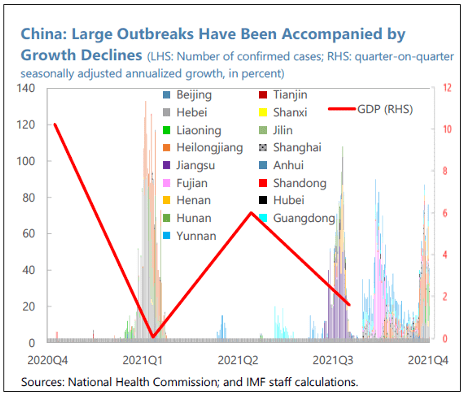

Exhibit 5: China economic growth and outbreaks of COVID-19

The International Monetary Fund

Source: The International Monetary Fund

As a tool to spur economic growth, China’s Central bank has been resorting to decreasing its policy rates in the past. We view the latest decision on April 15 to keep interest rates unchanged as unexpected. However, we believe further expansionary monetary policy decisions would have to be made eventually over the course of the year to support demand until private consumption recovers fully.

The Zero-COVID policy enacted by the Chinese government along with the already struggling private consumption leaves us with no doubt that Alibaba will find it difficult to grow in the next couple of quarters.

Takeaway

For close to a year, we have been monitoring Alibaba, and we have been eagerly expecting Mr. Market to focus on the fundamentals of the company instead of temporary external shocks. Today, we believe this is finally happening, aided by the Chinese regulators’ positive comments toward tech companies. The shift in focus from the tech crackdown to the company’s financials is a positive one, but then again, Alibaba is going through a difficult period financially, so this positive development will not yield positive results just yet. However, we believe Alibaba is deeply undervalued today and that handsome returns are in the cards for investors willing to stomach this volatility. For this reason, we remain invested in Alibaba.

Be the first to comment