Drew Angerer

This is likely the most critical week for our nascent market recovery

We have some of the largest companies in America by market cap reporting this week. With a number of the “Tech Titans” among them. Because of the sheer bulk of their market cap, they have an outsized sway when it comes to the most important indexes – the Nasdaq 100 and the S&P 500. The DJIA or known colloquially as the “Dow”, is actually less important, and it’s a price-weighted average. Even though the financial media still gives it pride of place, it is generally ignored by market participants. Perhaps it’s because of the large number the index has; currently just under 32,000 and the high was nearly 37,000, so it is more attention-getting. Or that it has always been this way so it continues. It is likely no coincidence that it is managed by the eponymous Dow Jones and Company which also publishes the Wall Street Journal, which in turn follows the DJIA, and keeps it top of mind. Back to my point, Apple (AAPL) is the largest company by market cap, then Microsoft (MSFT), Alphabet (GOOGL) and Amazon (AMZN) are all reporting this week.

The first shoe to drop is GOOGL

I blogged about what is likely to happen with GOOGL and how I might trade it. The quickest version is that I expect GOOGL to get sold going into the announcement since it has been weak all last week post-split, and if there is the slightest discrepancy to the downside of revenue and profits it could break through support since it is already just 3 or 4 points above it now. If you want more detail, click the link at the beginning of this paragraph. I have been trimming positions all last week using the Cash Management Discipline to have a slug of cash ready to snap up great stock at bargain prices. We may well have seen the cheapest GOOGL for the next decade by the time the fall is over. The same goes for many of the tech stocks that right now have been discarded like yesterday’s dinner scraps. They will soon be esteemed again, as growth slows and the secular growers are back on top.

The most important is AAPL

If AAPL somehow disappoints, it has quite a ways to drop. It is the most titanic of the titans and since the major indexes are market cap weighted it could take down the whole market, especially with what might be the biggest factor and that is the FOMC (more on this point below), I will chart AAPL and all of these other names to understand where we stand in regards to levels of support. Right now, I am focusing on AAPL for a reason, it is actually the most recovered of all these names. Perhaps that means AAPL as the largest and moving the highest is best equipped to chart this shoal-clogged sea we are about to enter. I am not an expert in AAPL, as I am not favoring any tech company that has hardware as its major revenue source. I do know a few basics, 19% of AAPL’s revenue comes from China and of course, China builds nearly 100% of the iPhone, and the iPhone has plenty of chips as well. Unless you are living under a rock, chips are in short supply and the ones that do get allocated to AAPL are much more expensive than they were when this newest iPhone was designed. There is also a recurring theme that I will use to indict the other “Tech Titans”, and that is the super-dee-duper US Dollar. The strong dollar still soaring until last week, has probably affected its bottom and top lines like it did MSFT. If you recall recently MSFT had to readjust its next quarter’s earnings estimates, only a few weeks since it released them the first time. Even the gargantuan revenues of AAPL outside of China’s lockdowns and war-torn Eastern Europe and the already recession-plagued Western Europe will counteract the effect of currency on earnings. It might be possible, like I said I am no expert on AAPL, but from my perspective, there is a better than even chance that either earnings or revenue misses. Let me add this little nugget, AAPL announced layoffs, not of their engineers but the in-store sales staff. This is likely because sales haven’t been all that hot lately. Does that mean Tim Cook isn’t expecting a big Christmas season? It’s too early to tell whether that’s what happens but it’s not too early for wagging tongues to make that deduction. AAPL has gone from 131-132 to 156+ just this week. Before I show you the chart below bear in mind that there is a possibility that all these earnings have good news or “better than feared”. We just need to keep the example of Netflix (NFLX), for that to make sense.

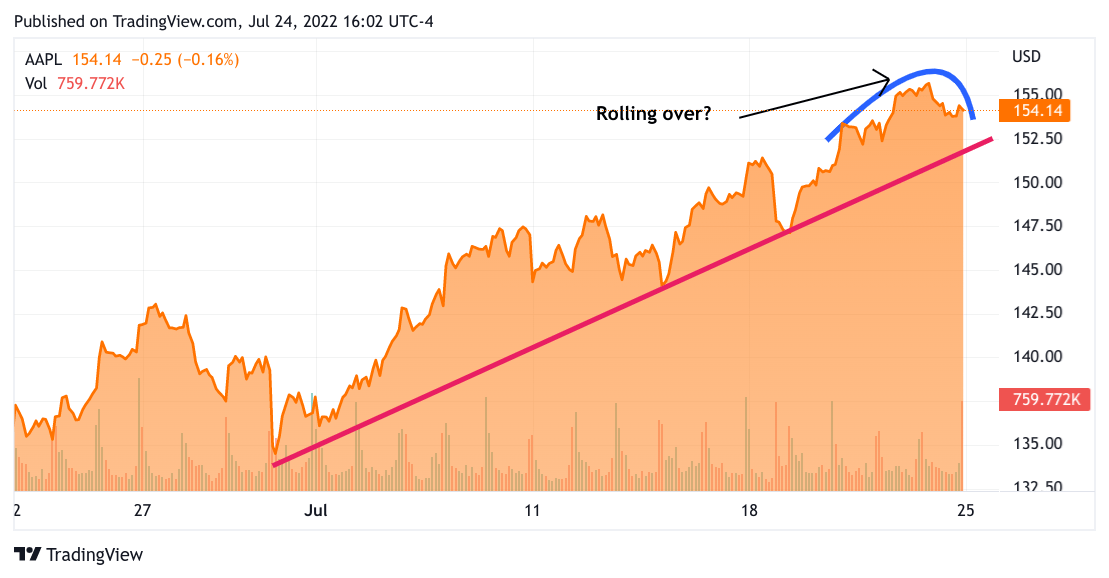

TradingView

This is the one-month chart, and really from this point of view, nothing is wrong. Even if it does roll over it has several points to find support from the trend line. It’s hard to have the nerve to call for AAPL to fall, clearly by many measures the best stock in the world. That said, let’s pull out to the sixth-month chart.

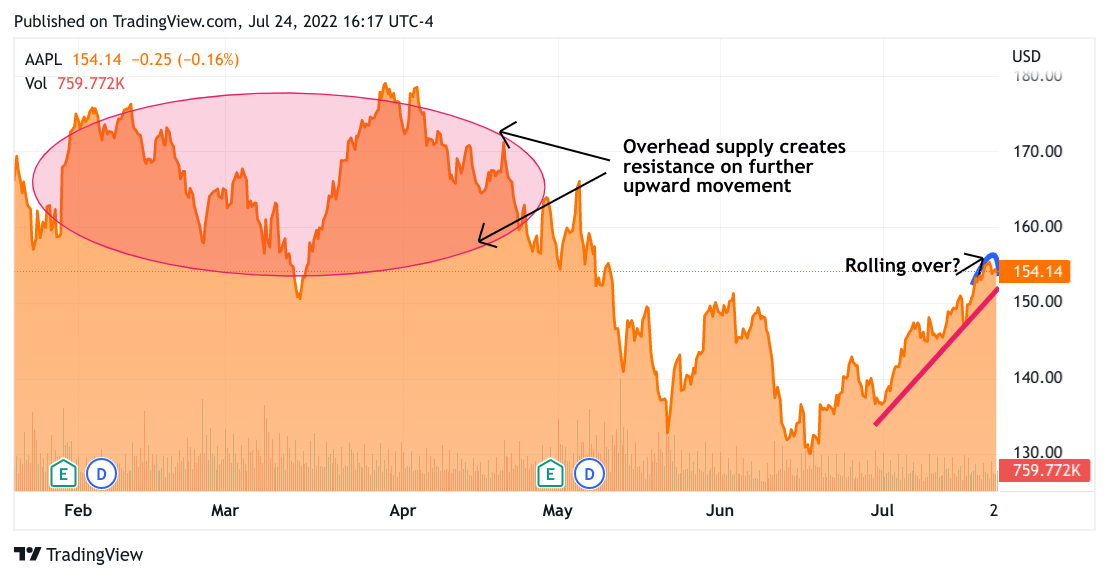

TradingView

Can I say with the utmost confidence that AAPL is selling off? No, of course not. What if there is an additional impetus to push the bearish view? That is another piece of this puzzle.

July 26 to 27 FOMC Fed announces rate raise

Everyone is expecting a rate rise of .75% to be announced at the Federal Open Market Committee announcement, so what could be bearish about that? It’s not the announcement, it is the color comments by Fed Chief Jay Powell. If he ignores all the progress in bringing inflation down, like commodities, including the price of oil. Also, evidence of the economy slowing down, and various large corporations announcing hiring freezes. Not only ignoring that progress but doubling down on hawkishness? What would your reaction be, GOOGL, and AMZN missing earnings or revenue, AAPL also having trouble, and Powell remaining hawkish? I can hear you saying, “come on David it’s not like you to be so bearish”, what are the chances? My answer is, yes, it’s not my usual positive outlook but after years of unexpected events, a giant pandemic, lock-downs and deserted city streets of the entire world, sky-high inflation, and a huge land war in Europe that could turn into WWIII don’t tell me this can’t happen. It doesn’t need to happen at all and still, the market could sell off out of fear that it could happen.

I haven’t heard of others making note of this but a sell-off this week conforms to a pattern

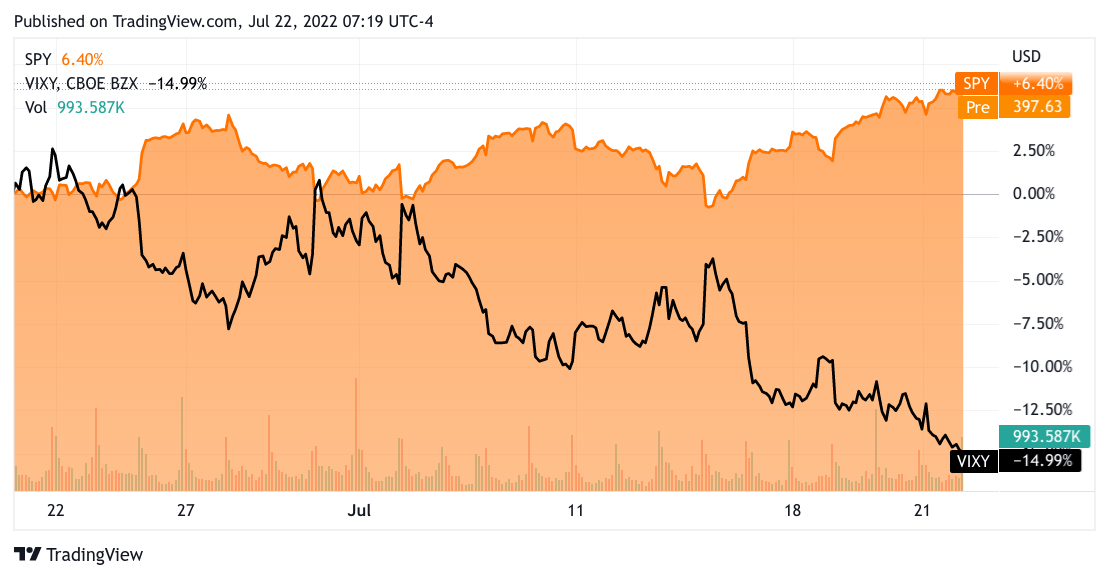

I’ve observed that the overall market will run up 4% to 6% in one week, and then sell off quite soon thereafter. It is a counter-trend to the VIX. Check out this chart:

TradingView

The orange is the SPY ETF which tracks the S&P 500, the VIX is the black line overlay. Right now, the spy was at its zenith before the Friday sell-off. One of the members of our DMR community illustrated it a bit better.

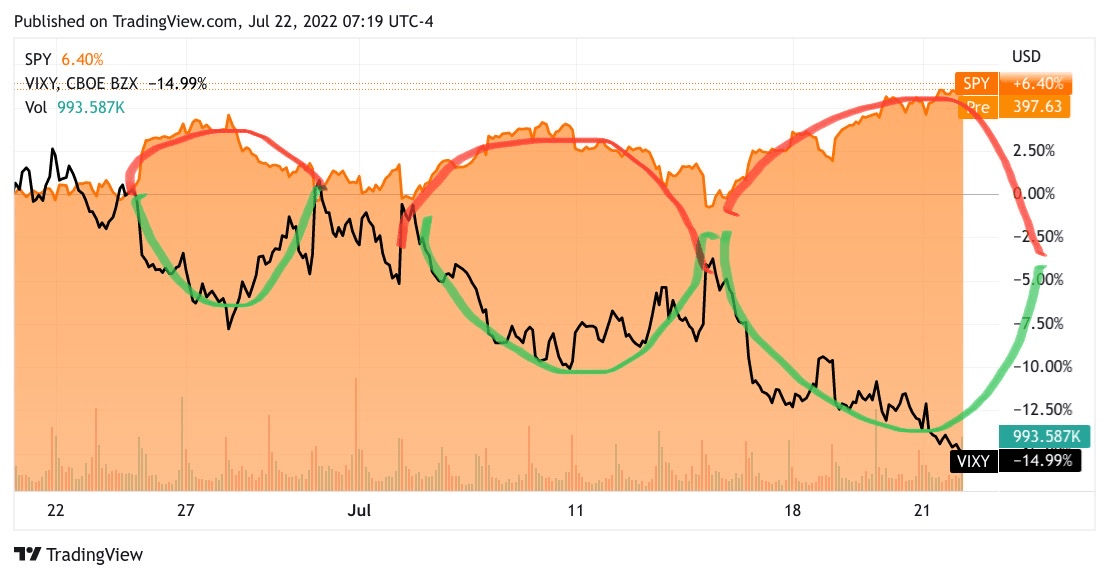

TradingView

The projection is that perhaps by the 27th the VIX pops up as the SPY falls. Again, maybe it all works out, I admit that this is one alternative. So what is my plan? Well, I have my shopping list and it’s the same as it has been for weeks. I am buying the biggest capitalized and best-known cloud software stocks, if AMZN falls close to or below 100 I am a buyer, the same for GOOGL, and even though I don’t expect it, I would be glad to pick up more shares in MSFT under 250. So let’s talk about my trades.

My Trades

So as I have already stated I have been picking up AMZN under 109, similarly, GOOGL at 108 and under, as with MSFT at 251 and under. I actually trimmed ServiceNow (NOW) at 460 and then bought it back at 444. I traded around that position, by selling high and buying it back lower. I am lowering the break-even and raising the profitability of that position. I also trimmed higher-priced shares of AMZN as it got above 120, and am hoping that AMZN falls back to 107 and lower. I trimmed Intuit (INTU), and Adobe (ADBE).

I also decided that I can now add some higher-risk lesser-known names; Bill.com (BILL), Workday (WDAY), Datadog (DDOG), and Taiwan Semi (TSM). I believe these are all new positions. All these are very small positions. My top priority is still AMZN, GOOGL, and MSFT.

In Summary, There are a multiplicity of ways that this market can sell off, whether it’s a hawkish statement from Jay Powell or AAPL and any of the other titanic market cap stocks underperforming earnings that could cause the market to pressure stock prices. There is also a recurring pattern that could reassert itself again this week. I am not peddling fear, in fact, if stocks on my shopping list fall into the lower prices I am looking for I would be thrilled. Even as Powell might maintain a hawkish stance the rate raise regime will come to a halt in September. The inflation data will continue to move in a beneficial direction. Of course, the economy can cool down too much and cause another sell-off, but that is a worry for the end of September, perhaps early October. In the meantime, enjoy the discounted stocks.

Be the first to comment