Bet_Noire/iStock via Getty Images

Introduction

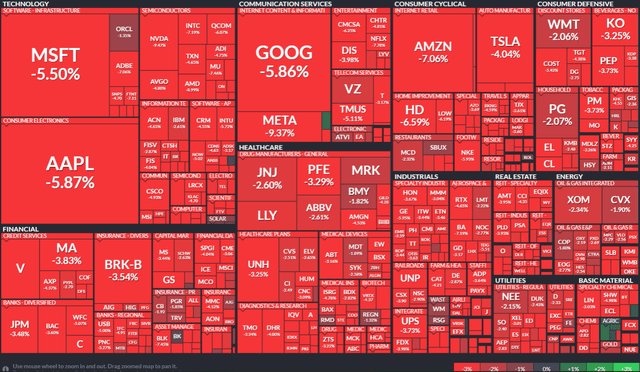

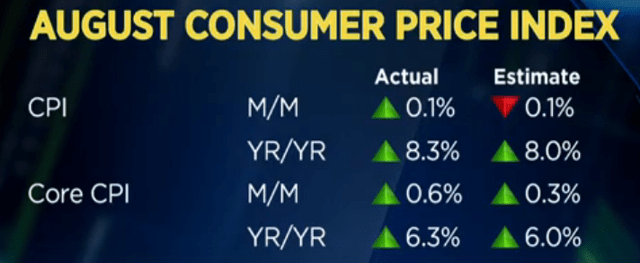

On Tuesday, Microsoft’s (NASDAQ:MSFT) stock got hammered down along with broader markets [S&P 500 down ~4%, Nasdaq-100 down 5%+] on concerns regarding a hotter-than-expected CPI print (8.3% in August 2022), and more so due to rising expectations of a ~75-100 bps rate hike from the FED at its September meeting next week.

After this latest price drop, Microsoft is staring at the prospect of retesting its 52-week lows of ~$240, last seen in June 2022. In my recent notes on Microsoft, I have rated the stock ‘Neutral / Avoid’, citing the sheer lack of risk premium. Furthermore, we have discussed the potential of a ~30-50% decline in Microsoft’s stock due to an inevitable normalization of trading multiples, given the current macroeconomic environment.

In today’s note, I would like to draw your attention to the ongoing insider selling, rising macro risk, worsening business fundamentals, and Microsoft’s excessive absolute valuation.

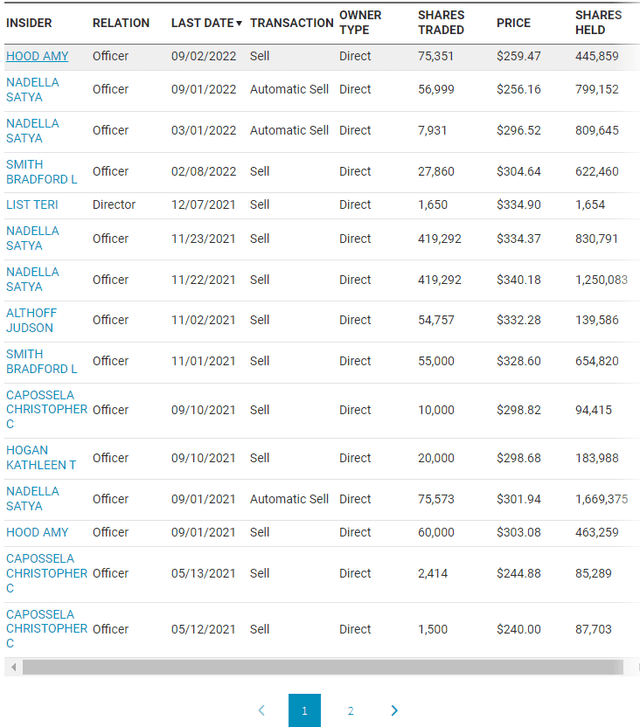

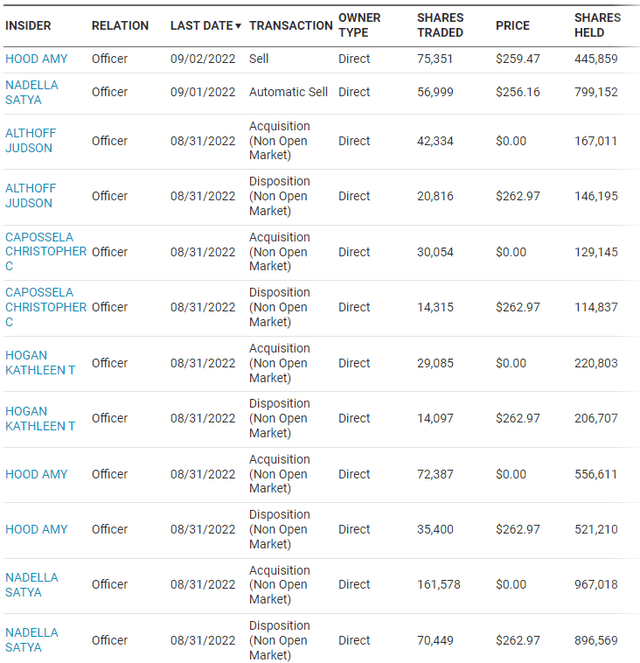

Insiders Are Selling Hand Over Fist

Back in November 2021, Satya Nadella (Microsoft’s CEO) sold roughly half of his Microsoft shares for around ~$340, which as of today, looks like him nailing the exact top on the stock.

And then, since late August, Satya has been at it again, selling ~167K shares [disposing of all of his latest stock grants and some additional shares]. Moreover, Amy Hood (Microsoft’s CFO) joined in the fun last week and sold many of her shares, cashing out millions of dollars.

With C-suite executives cashing out, it is fair to ask, “Is it time for retail investors to get out of Microsoft?” Let’s find out.

Where Do We Stand And How Much Lower Could MSFT Go From Here?

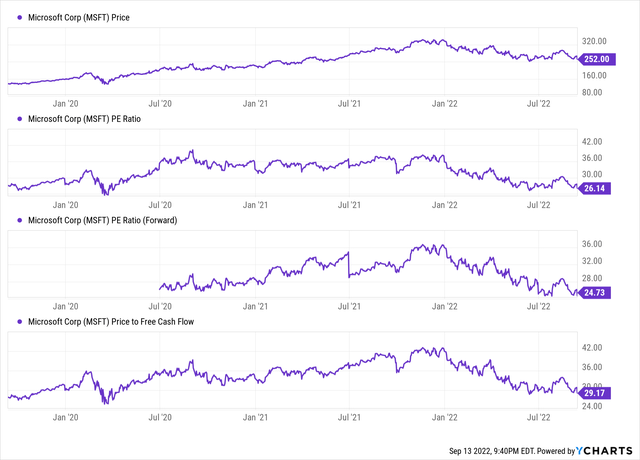

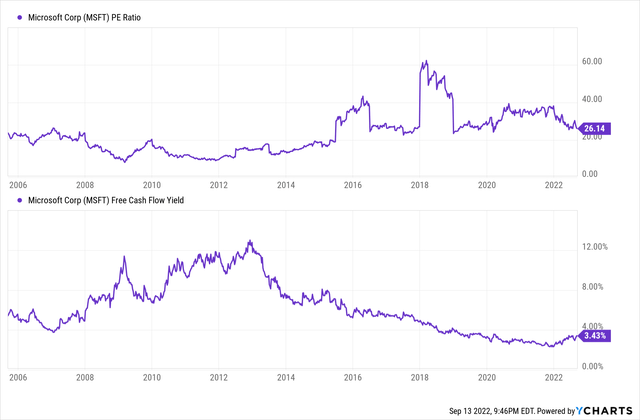

After fading its latest rally, Microsoft’s stock is hovering right above its June lows of ~$240 per share. Over the last year or so, Microsoft’s trading multiples have been normalizing. With a P/E ratio of ~26x, Microsoft stock is far from cheap, especially because in a high-inflation environment, index multiples tend to go far lower than historical P/E averages of 15-20x. Even if Microsoft were to simply go down to 20x P/E, that would mean a 25-30% correction in the stock (& that is only mean reversion).

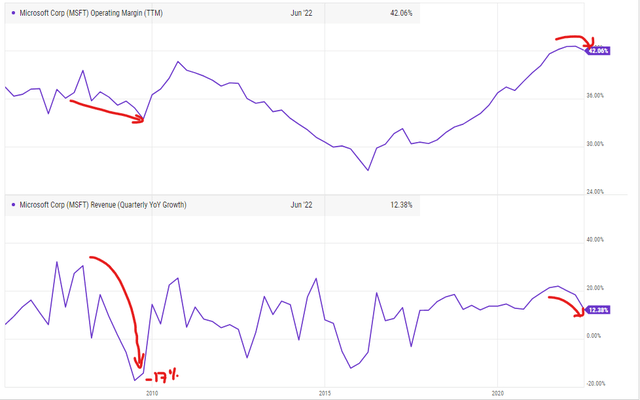

Furthermore, if Microsoft’s earnings moderate over the next few quarters like they generally do at this stage of the cycle for technology companies, its stock may have much more downside risk than what has been priced at this moment. During the 2007-09 recession, Microsoft’s FCF yield rose to ~11%, and if we were to end up going that high, the stock would probably need to fall by more than 50%.

Comparing Microsoft’s free cash flow yield (of 3.43%) with treasury rates (>3.5%), you can easily see the lack of risk premium attached to Microsoft’s stock, i.e., the market is telling us that Microsoft is safer than treasuries. While this may be true to some extent, Microsoft’s business is not immune from broader macro, and it certainly doesn’t have the liberty of printing money.

Treasury Rates on 13th September 2022 (CNBC)

Persistent inflation, surging interest rates, and a potential economic recession are set to bring several headwinds for Microsoft, and the stock may continue to underperform for the foreseeable future. Let’s discuss some business fundamentals of Microsoft to ensure we are on the same page here.

Business Fundamentals Are Deteriorating

Microsoft’s latest quarterly results met street expectations. Since these numbers have been widely discussed, we won’t explore them today. Rather, I think we should look at the bigger picture by zooming out a little. In Q4 FY22, Microsoft’s revenue growth rate continued decelerating, with operating margins also decreasing.

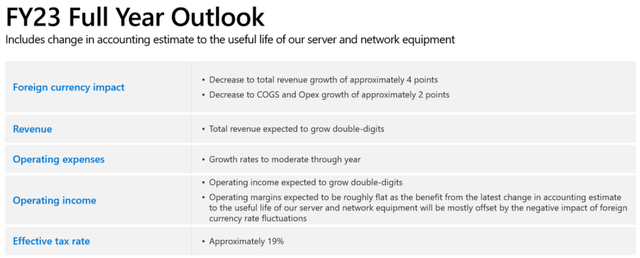

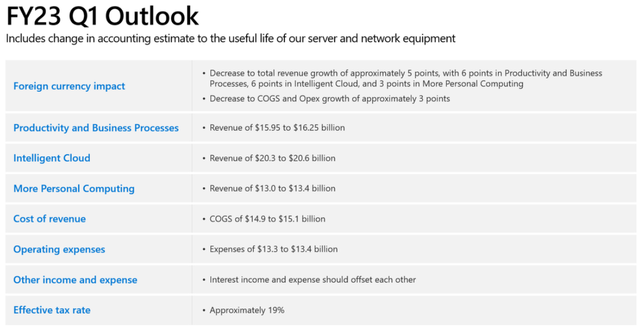

For FY-23, Microsoft’s management expects double-digit growth in revenues and operating income [despite operating margins projected to remain flat]. While this guidance seemed to have buoyed analysts and investors alike [with MSFT’s stock rocketing up to $290 per share], I don’t think these numbers would be achieved in a recession [that’s looking likelier by the day]. Back in 2007-09 (during the global financial crisis), Microsoft’s revenues and operating margins declined significantly, which shows that Microsoft is not immune to the economy.

Microsoft FY2023 Outlook Microsoft FY2023 Outlook

During Microsoft’s Q4-FY2022 earnings call, the company’s CEO and CFO made it clear that the tech giant is not immune to the macroeconomic environment and that its FY2023 guidance was based on the current macro environment. Here’s an excerpt from the latest earnings call transcript (the must-read parts are highlighted in bold):

MARK MOERDLER, Bernstein: Thank you very much, and congratulations on the quarter. I’d like to follow up a little bit on that. With all the concerns about macro recession, everyone’s trying to understand how cloud, and from Microsoft’s case more specifically, IaaS, PaaS operates in a slowdown recession. How do you think about Azure’s resiliency? How do you think about Azure’s exposure to advertising business, consumer Internet and SMB if we do see a real recession? Thank you.

SATYA NADELLA: Yeah, maybe I’ll start, and Amy, feel free to add. I mean, overall, we’re not immune to what’s happening in the macro broadly, right, to Keith’s question and your question Mark. I think I’d say I’d start there, because whether it’s on the demand side with consumers or SMBs, I think Amy in her remarks talked about some of that, even in our results in the quarter. But what’s happening with it in Azure, though, is in some sense, businesses trying to deal with the overall macroeconomic situation and trying to make sure that they can do more with less.

For example, moving to the cloud is the best way to shape your spend with demand uncertainty, right, because in fact, if anything, one of the things that we’re seeing is an increased shift towards the cloud, and then of course, optimizing your bill. We are incenting even our own field to ensure that the bills for our customers come down. And that, in fact, even shows up in some of the volatility in our Azure numbers, because that’s one of the big benefits of the public cloud. And that’s why I think, coming out of this macroeconomic crisis, the public cloud will be even a bigger winner, because it does act as that deflationary force.

So, that’s sort of what we are seeing in the Azure numbers. We will be exposed to consumer driven businesses and SMBs, but at some level, our strength as a company is much stronger in the core commercial. So, I think that will do fine there.

The other one is also people building new applications that are completely new frontier. I mean, there are two numbers that I talked about. One is the triple digit growth in Cosmos DB, and triple digit growth in Container App Services. You take those two things, and you say, what are people doing? People are writing applications at a completely different frontier of efficiency, which is a cloud-native, serverless, container-based types of applications.

And so, to me, that’s another way for you to make sure that your IT spend goes a long way in a time like this.

BRENT THILL, Jefferies: Amy, great to hear the double-digit guidance. I guess many are asking are you embedding a worsening macroenvironment or a similar environment that we’re in to get to that type of growth?

AMY HOOD: Thanks, Brent. As I said, it’s trying to take into account the current macroenvironment. And as I said, I took what we saw in June, applied it as best we thought we could through the course of the fiscal year. And if you think about how the… and if you try to look over the course of the year with some of my comments, you’d say, okay, in H1 vs. H2, I would point out three things that changed a bit over the course of that time.

First, of course, if we’re talking about USD, it would be FX. It’s a bigger headwind in H1; it’s less of a headwind in H2. The second thing I would point to would be OpEx. As we’ve talked about in H1, we’ve obviously added .2% headcount this quarter. We still have 11,000 hires that we have started in Q1. We’ve still got Nuance and Xandr in acquisitions, and we anniversary, a lot of that as we focus our hiring and focus on the productivity of all the hiring we’ve done over the past year, and then the OEM comparables obviously get a lot different when you get from H1 into H2. And so, as you’re trying to think about the shape, and how did I consider it, I sort of took those things into account, thought about the trends we’ve been seeing in June and applied them as best we can.

While we might very well be in a recession already, enterprise spending is generally the last shoe to drop in a cycle, and we have not seen any signs of that so far. The FED is tightening into a slowing economy due to red-hot inflation; however, the probability of a recession is rising rapidly. This is why I fear that Microsoft may fail to meet its FY2023 guidance. I may be wrong here, but it is pretty clear that Microsoft’s business could come under pressure if the macro worsens from here, which is very likely to happen.

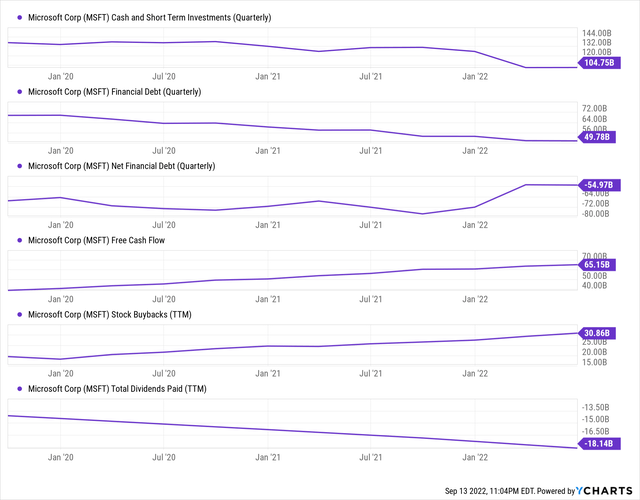

Microsoft’s balance sheet is truly a fortress with ~$55B of net cash; however, things may change quickly if the $68.7B deal to acquire Activision Blizzard (ATVI) goes through in the next 9-12 months (as per timeline). After this deal closes, Microsoft would still have ~$35-40B in cash (negative net cash, unless the company reduces its capital return program). And this cash position, combined with free cash flow generation, make Microsoft’s dividend safe. However, if operating margins were to decline a lot, we may see a temporary suspension of Microsoft’s stock buyback program.

Overall, Microsoft is a fantastic company, and the fact that it is growing at this scale is truly astounding. With that said, Microsoft’s business fundamentals are deteriorating – slowing revenue growth, flattening operating margins, and a worsening balance sheet. Considering all of this information, let’s evaluate Microsoft’s absolute fair value and 5-yr expected returns.

Microsoft’s Fair Value And Expected Returns

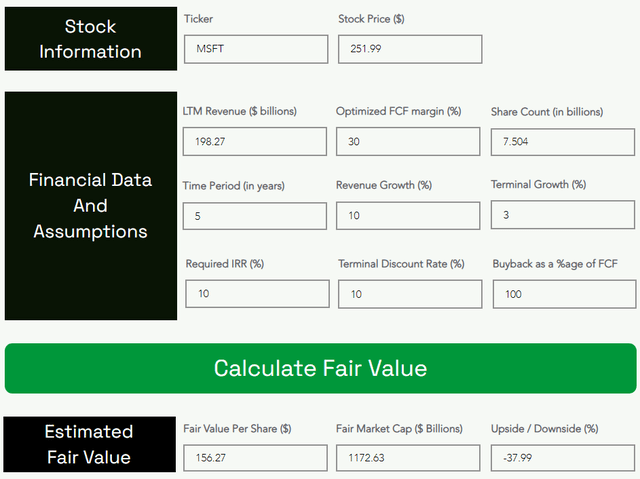

The exercise starts with simple data collection for inputs such as stock price, TTM revenue, and share count. To approximate the future free cash flows for Microsoft, I have used a two-step growth model: 10% CAGR growth for the first five years, followed by terminal growth of 3% per year.

As you know, Microsoft is highly profitable, with operating margins consistently above 30% over the years, and hence, assuming a 30% optimized FCF margin at maturity is quite reasonable in my view. Despite Microsoft spending big on Activision, I think the tech giant will persist with its shareholder-friendly capital return policies.

Lastly, I used a 10% discount rate (required IRR) for Microsoft, which happens to be the next best alternative (S&P 500’s historical return) for long-term investors.

According to our valuation model, Microsoft’s fair value is ~$156.27 per share (or $1.17T). With the stock trading at ~$252 per share, I think it is still trading at a hefty premium to its intrinsic value.

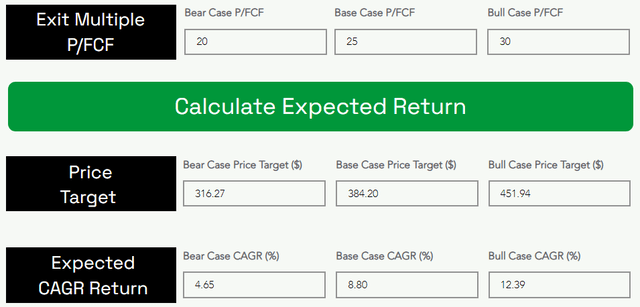

Predicting where a stock would trade in the short term is impossible; however, over the long run, a stock would track its business fundamentals and obey the immutable laws of money. If the interest rates were to stay depressed, higher equity multiples would stay here. However, I work with the assumption that interest rates will eventually track the long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x. Since Microsoft’s scale and quality of business deserves a premium, I assigned a base case exit P/FCF multiple of ~25x.

By 2027, Microsoft could grow from ~$252 to ~$384 at a CAGR of 8.8%. Since Microsoft’s expected returns fall short of our required IRR of 10%, it is not a buy. However, long-term investors who are willing to accept single-digit returns in exchange for greater stability (lower volatility) can continue to hold the stock.

Remember, the intrinsic value and price targets we determined in this exercise are approximations of my expectations for Microsoft’s business, which may differ materially in reality down the line. The purpose of performing this exercise is not to nail down the precise valuation of a business; it is to generate a good approximation of what a business can do for us. If we find that the current odds are favorable for long-term investors (us) even with conservative assumptions [& margin of safety], then and only then, we take a long position!

As an analyst and an investor, I always strive to generate the best possible approximation for all companies under research. Despite all the due diligence I perform, I could be wrong, and this is why I always try to buy stocks with a margin of safety (at a discount to intrinsic value).

Concluding Thoughts

Despite being down more than ~28% from its 2021 highs, Microsoft’s stock continues to trade at a steep premium to its intrinsic value. With revenue and operating income growth slowing down in the face of a potential economic recession, Microsoft looks ripe for further normalization in trading multiples.

Another 12% price decline and Microsoft would be trading at multiples last seen during the heights of the COVID-19 pandemic sell-off. However, a mover of this magnitude may not be enough, as inflation remains red hot, and the FED continues tightening its monetary policy despite the rising likelihood of an economic recession. As we saw today, Microsoft is not immune to macro, and any downward earnings revisions or guidance cuts could lead to a big sell-off in Microsoft’s stock. On an absolute value basis, I believe that Microsoft is worth ~$156.27 per share, which means there may be more pain to come for MSFT shareholders. An old adage in investing goes like this – “Don’t Fight The Fed” – and this quote is apt for today’s market conditions. With important insiders also selling shares of Microsoft, I find it really, really hard to justify a new purchase at these elevated multiples. That said, long-term DGI investors could continue to ‘Hold’ at this price. If Microsoft gets down to ~20x P/E, I will look to add more shares at that time.

Key Takeaway: I rate Microsoft a ‘Neutral / Avoid’ at $252.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

In addition to today’s discussion, members at my marketplace service received TQI’s Quantamental analysis, capital allocation plan, and risk management strategy for Microsoft [along with a special merger arbitrage trade idea].

Be the first to comment