franckreporter/iStock via Getty Images

By Joseph Nelesen

Each time SPIVA® results are released, we are naturally asked to explain why a certain portion of active managers underperformed in any given fund category. Sometimes, management strategies and market moves defy simple explanations, but at other times, an explanation can be plain as day. For actively managed equity funds in Canada, a recent turn to outperformance seems to be attributable to one single, simple and highly creditable example of stock selection.

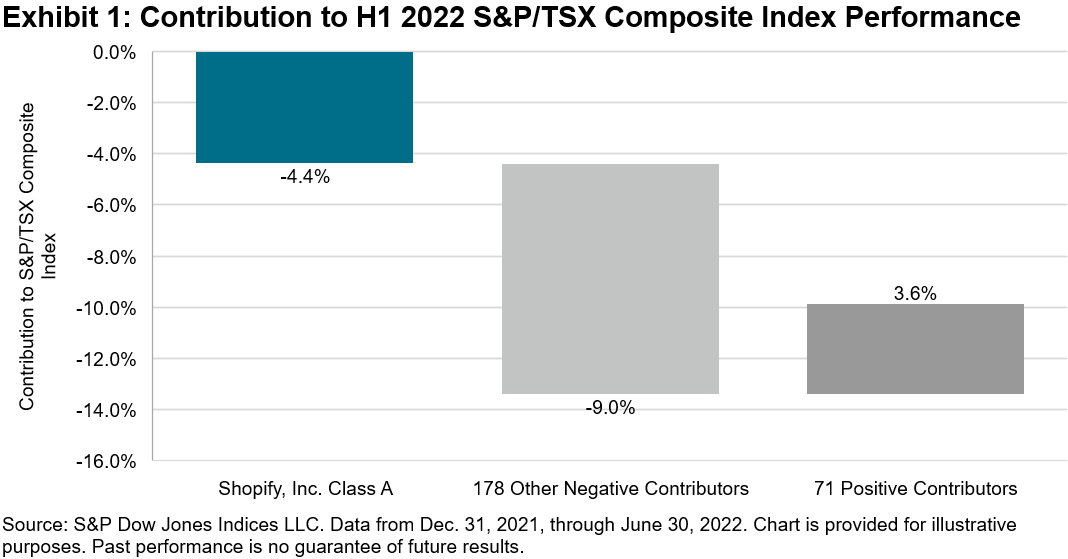

For context, as of June 30, 2022, 43% of active Canadian equity funds underperformed over the previous 6- and 12-month periods; the best 12-month result since 2013. As shown in Exhibit 1, we find that one large-cap stock alone contributed nearly half (-4.4%) of the S&P/TSX Composite Index’s 9.9% H1 2022 decline.

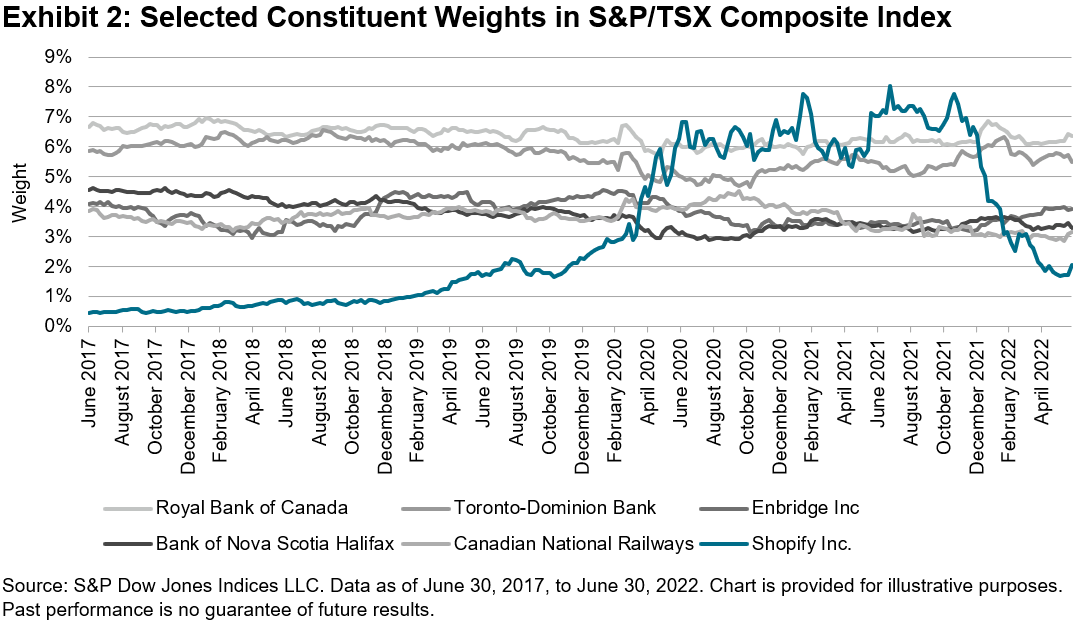

The culprit was online retailer Shopify, which declined by 76% in the first half of 2022. Shopify’s rise and fall was unusually rapid, surging from a 1% weight in the S&P/TSX Composite Index to 8% – then becoming the largest issue in the index – in just two years ending December 2021. It then fell to a position outside the top 10 in just 6 months. As shown in Exhibit 2, other large weights in the S&P/TSX Composite Index have been relatively stable over time: the exact same names that comprised the top five in June 2017 were again the top five in June 2022.

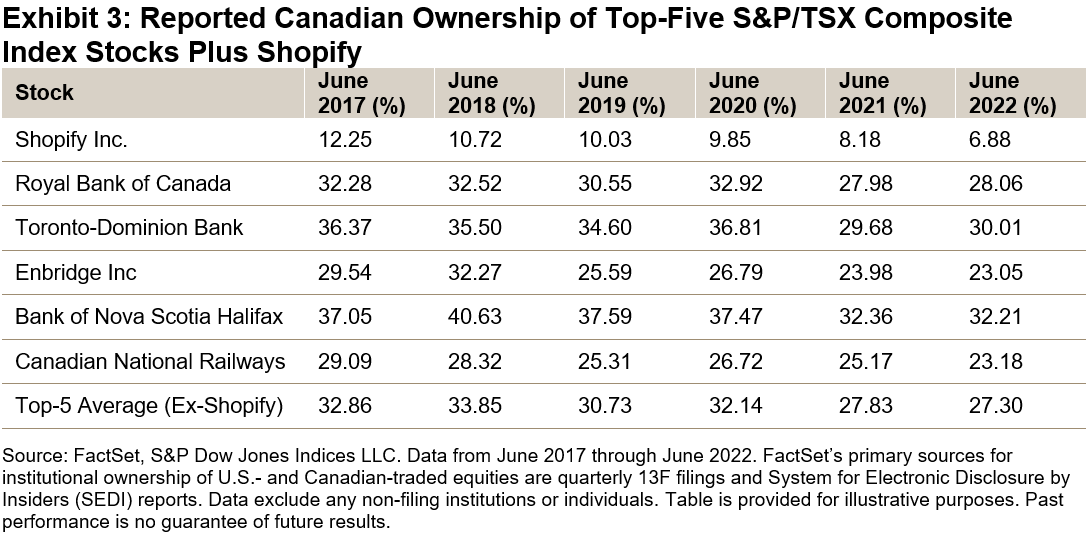

Actively managed Canadian equity funds might have been forgiven for hopping on board Shopify’s rise and then consequently suffering during its downturn (they would not have been alone). However, previous experiences with the infamously precipitous rise and falls in market cap for Nortel and Blackberry-maker RIM may have taught them a valuable lesson. Exhibit 3 shows that Canadian market participants owned an average of 30% of the other largest constituents’ shares from 2019 through 2021, but Shopify was relatively under-owned, with less than 10% of its shares held by Canadians.

A judicious reluctance to join in on the exuberance over a single Internet-related security may also explain the higher rates of active fund underperformance in Canada observed in during the later stages of Shopify’s ascent.1 Of course, its smaller market weight today means that there is a less material opportunity to benefit from the exact same trick in the remainder of 2022.

1 Our SPIVA Canada Year-End 2021 Scorecard reported 89% of actively managed Canadian Equity funds underperformed the S&P/TSX Composite Index over the three years ending Dec. 31, 2021.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment