SweetyMommy

Introduction

John Deere (NYSE:DE) is a company that plays a unique role in a key industry. Few companies enjoy brand value recognition and an undisputed leadership in the market as the Moline-based company does. Deere’s market dominance has been carefully sought for and built throughout the whole history of the company which has made it part of its key strategy to buy competitors when they become threatening or to give its dealers strong financial incentives to acquire tractors from competitors on trade-ins. It is reported that recently Deere has done so with Fendt tractors, AGCO‘s premium brand that is rapidly expanding in the U.S. Deere is also a technological leader in autonomous and precision agriculture which, as we will see in a moment, is a key business with strong prospects of future growth.

In this article, I would like to go over a few facts that I gathered from Deere’s main peers that make me think Deere’s upcoming quarterly release is going to be above expectations.

Agriculture macro trends

Before we turn towards Deere’s peers, let’s recall a few trends that are having an impact on agriculture equipment manufacturers.

First of all, farmer net income is forecasted to be high in the upcoming years thanks to high crop prices. It is true that the agri-food sector is highly-energy intensive and that rising energy and fertiliser prices are translating into higher production costs, but this also leads to higher food price which makes farmer offset, at least partially, the bite of inflation.

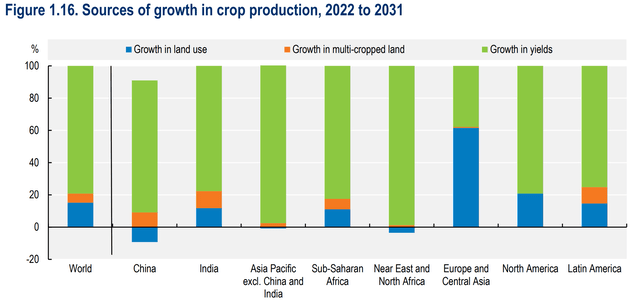

Secondly, precision agriculture is gaining traction and it will boost crop yields while helping farmers save on input costs. In other words, the trend is that agriculture is more and more required to do more with less. This is important, since the major source of growth in crop production for the future decade is not forecasted to come from growth in land use, but rather from growth in yields. It will be a growth fostered by innovation and technology, as the figure below explains.

OECD-FAO Agricultural Outlook 2022-2031

In third place, there is strong demand for replacement equipment that comes from the fact that pent-up demand and supply chain constraints combined together and hindered the normal equipment replacement cycles. Because of this, many farmers have seen their tractors and combine age more than expected and are now filling order books with their requests and their need to have newer and more technological equipment.

Overall, according to the OECD-FAO Agricultural Outlook 2022-2031:

Global food consumption, which is the main use of agricultural commodities, is projected to increase by 1.4% p.a. over the next decade, and to be mainly driven by population growth. […] Over the next decade, global agricultural production is projected to increase by 1.1% p.a., with the additional output to be predominantly produced in middle- and low-income countries.

As a consequence, the same report states that:

Investments in raising yields and improved farm management are foreseen to drive growth in global crop production. Assuming continuing progress in plant breeding and a transition to more intensive production systems, yield growth is projected to account for 80% of global crop production growth, cropland expansion for 15%, and increasing cropping intensity for 5%. Cropland expansion is expected to be regionally concentrated in Asia, Latin America, and Sub-Saharan Africa.

In particular, the report forecasts that notable increases in yields should come from Brazil, India and China. As we will see, South America as a whole is performing quite well in terms of machinery demand.

How Deere’s peers are performing

Let’s get to the part that gives the title to the article: Deere’s peers and their recently reported earnings.

AGCO

AGCO achieved very good results, particularly when looking at top-line growth. The company is trying to expand in the North-American market, especially thanks to its premium brand Fendt. However, the company is about one tenth of Deere’s size and it has been lagging behind its peers in terms of margins. However, in the past quarter, AGCO was finally able to reach an operating margin just shy of 10%. As I explained in a recent article this past quarter may have been the turnaround long expected to see the company take a clear direction towards profitability.

During the earnings call, AGCO’s CEO Eric Hansotia, confirmed that:

despite the global supply bottlenecks and inflationary pressures, farmer economics are very healthy. Global end market demand remains at high level and demand for our products continues to be strong. Our team is working hard to mitigate these challenging conditions to serve our customers and maximize our full year results.

The company also reported that its:

order bank is still extended well into the second half of or at least into the second half of 2023.

Finally, is worthy of a particular mention the fact that South America is performing at an incredible pace with improving margins, as Mr. Hansotia said:

We have also made significant progress with our efforts to optimize our South American operations and improved margins there. Through the third quarter, our year-to-date South American operating margins hit 16.5%. That’s over 700 basis points of improvement from last year. […] In South America, net sales grew approximately 50% compared to the third quarter of 2021.

So let’s recap what we have found so far: healthy farmer economics, extended order books, 50% growth in South America.

CNH Industrial

CNH Industrial (CNHI), aside from the stock, has been the best performer in terms of financials during this year. In fact, it has been the only manufacturer that has been able to increase margins all throughout this year. I explained the reasons in my last article on the company.

Scott Wine, the company’s CEO, explained during the last earnings call why the company wasn’t hit by inflationary pressure as much as its peers:

agriculture and construction generated positive volume and mix and pricing of 16% more than offset the steep increase in production cost.

In other words, CNH Industrial found itself with an increasing demand for its tractors and this made the company have enough pricing power.

Secondly, Mr. Wine addressed an issue that not always is understood by investors. While speaking of the outlook for demand, he said that:

Trends still indicate a strong AG cycle with sustained demand for most products while we are closely watching for any recession-related shifts in purchasing behavior. I will again stress that historically, our business performance is driven more by the AG cycle than by GDP growth or like thereof.

I think this last sentence was very valuable because it helps us all have in mind that even during an economic recession, the agriculture cycle may be on a surge and that is why companies such as CNH Industrial, AGCO or Deere should keep on achieving good results.

Even for CNH Industrial “demand in South America continues to be impressively strong”, as Mr. Wine said.

Caterpillar

Caterpillar (CAT), after finding itself unprepared to manage inflationary costs, has put into actions several steps that are paying off. After struggling for two quarters and seeing margin compression, the company was finally able to increase its profit margin to 16.2% for the quarter, a 2.8 pts increase YoY. The company also reported an order backlog that increased $9.4 billion YoY and $1.6 billion QoQ. A quarter ago the order backlog YoY was seeing an increase of $10.1 billion and this shows a bit of a slowdown. However, we are still talking about an order backlog that is up by a staggering amount with the advantage that, given the effect of some supply chain bottlenecks still at work, this order backlog can cover a wider timeframe compared to what it would do under normal conditions. Caterpillar, too, confirmed the strong trend in South America, where sales increased by 51%.

Deere’s Q4 Expectations

At the beginning of the year, Deere has some rough quarters with operating margins plummeting from 21% to 8%. During Q3, Deere saw its margins go up a bit, but they still remained below 20%, which is usually the result that Deere achieves. This is why the stock moved down from its peak of almost to $440 a share to $289 a share. However, since July, the stock has recovered quite a bit and with the recent surge in the markets following the CPI release, Deere is back above $400.

Now, if I consider the results published by Deere’s competitors, I expect the company to reach in Q4 at least $13.3 billion in revenues (+30% YoY) with operating margin at least above 16% for the quarter. However, I actually expect Deere to be back with an operating margin above 20%. In fact, we should see price realization fully offsetting the impact of inflation on production costs. If we translate these numbers into metrics per share, we see that Deere should reach a revenue per share of $44.18. From here we can reach EPS of $7.17 for the quarter.

This would make the annual EPS be around $23 which gives us a fwd PE of 17.5. This is above the competitors, but since Deere has a unique role within the industry, it is a well deserved premium. Deere has often traded around this multiple and this makes me think that the market has already priced in very positive news ahead of the earnings report. This is my problem with Deere: it is always on my watchlist, but it has been hard for me to find the opportunity to start a position since the stock rarely trades at a discount. True, this summer the stock had a big dip, but during those months I didn’t have cash at hand to deploy. This has taught me to put aside a cash position dedicated to premium companies that rarely trade at a discount. For these companies, dips are rare and when they take place, investors should be ready to deploy some capital in order to take advantage of sudden volatility.

This is why, for now, I once again rate Deere as a “hold”.

Be the first to comment