AZemdega/E+ via Getty Images

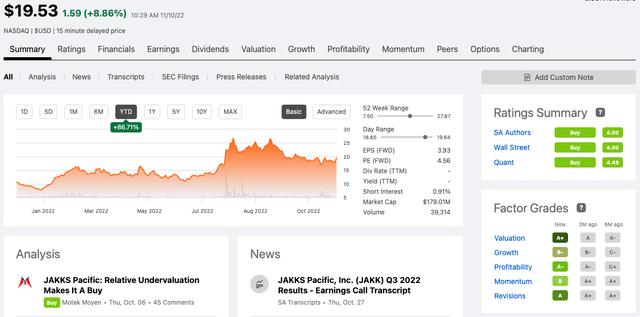

Over the last year, I have been following JAKKS Pacific, Inc. (NASDAQ:JAKK), a small-cap toy company’s compelling growth journey in an industry ruled by giants in the shape of Hasbro (HAS) and Mattel (MAT). Everyone loves a good underdog story, and this year is proving to be an increasingly compelling one for this undervalued and still seemingly under-the-radar stock. Through licensing agreements with much larger companies, JAKK shows that dynamite can come in small packages. The company has produced consistent upward-trending top and bottom-line performance for the last four quarters and has rewarded its shareholders with returns of 86.71% year to date.

YTD Stock Trend (SeekingAlpha.com) Stock Trend YTD and SeekingAlpha Quant Valuation (SeekingAlpha.com)

As we begin the holiday season, and JAKK continues its strategic licensing agreements with Disney, Nintendo and Sega, demand is secured well into Q1 2023 in the shape of sought-after action figures and costumes for children and adults looking to celebrate the Christmas season and extend their blockbuster movies and streaming experiences with Sonic, Super Mario and Encanto characters. Although investors should be wary of the high level of debt, the increase in supply chain costs and general market uncertainty’s impact on consumer buying behaviour, irrespectively, JAKK seems well on producing a record-breaking year. With a stock price that has dropped by 8% over the last month, this could be an exciting moment for investors to take a bullish stance on this stock.

Growth Drivers

JAKK has had back-to-back success with its strategic partnerships to produce toylines and costumes for massive hits, including Encanto and Sonic the Hedgehog, this past year. In Q1 of 2023, Super Mario the Movie, another blockbuster which is already created huge internet buzz, will be released, and we can expect similar success to what JAKK has already delivered this past year. Although JAKK is one of many companies creating products for these toylines, it has a strong reputation and presence in the right places.

Super Mario Toyline created by JAKK (Nintendolife.com)

JAKK works with many offline and online retailers. However, Target (TGT) and Walmart (WMT) are some of its largest customers. Many of the costumes available at TGT and WMT are produced through Disguise, JAKK’s costume business. One of the critical growth factors has been its point of distribution. JAKK has increased shelf space and door visibility at many retailers locally and internationally. There is also a broader lineup of products available, and because of the comprehensive range, JAKK products are more visible throughout the stores. Retailers are also developing their online presence, making it easier for consumers to access offers.

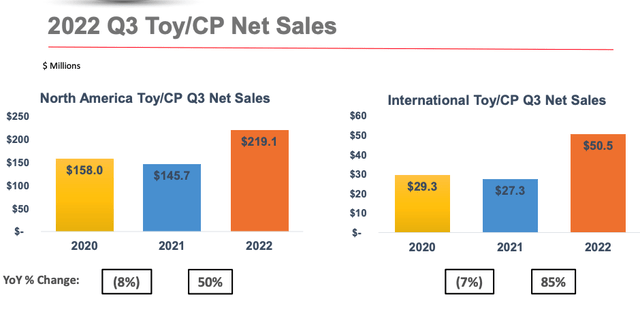

Another growth factor has been the speed at which JAKK has met the surge in demand. Data and stream algorithms have been essential in predicting recurring popular products. The company has also focused on its international growth, and we can already see some impressive numbers if you look at the increase over the last year.

International Growth (Investor Presentation 2022)

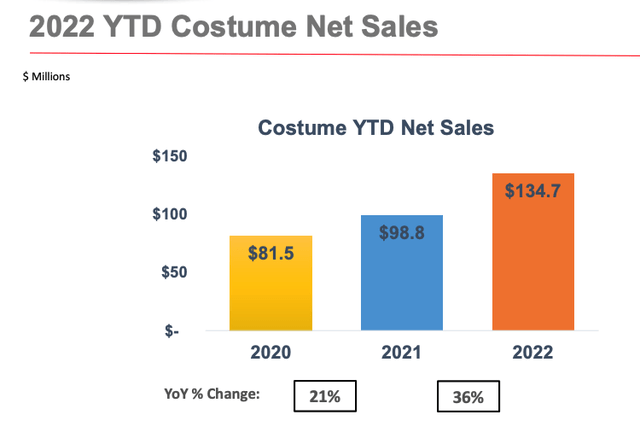

Costumes are a small but growing part of the company that is bound to see a further impact on the company’s performance. This year JAKK has already shipped 25% more customers than in 2021.

Costume Net Sales (Investor Presentation 2022)

Q3 2022 Financials and Valuation

2022 has been an incredible year for JAKK, and Q3 further backs up the performance. Year to date, JAKK has already exceeded 2021 full-year net sales by 6.9% with $621.1 million. It saw net sales for Q3 increase year on year by 36% to reach $323 million. Again we can see the growing importance of the company’s costumes business to its performance, bringing in 16.5% of total sales at $53.4 million. We have seen a decrease in gross margin, at 28.5%, although operating income increased 16.7% of net sales at $53.7 million.

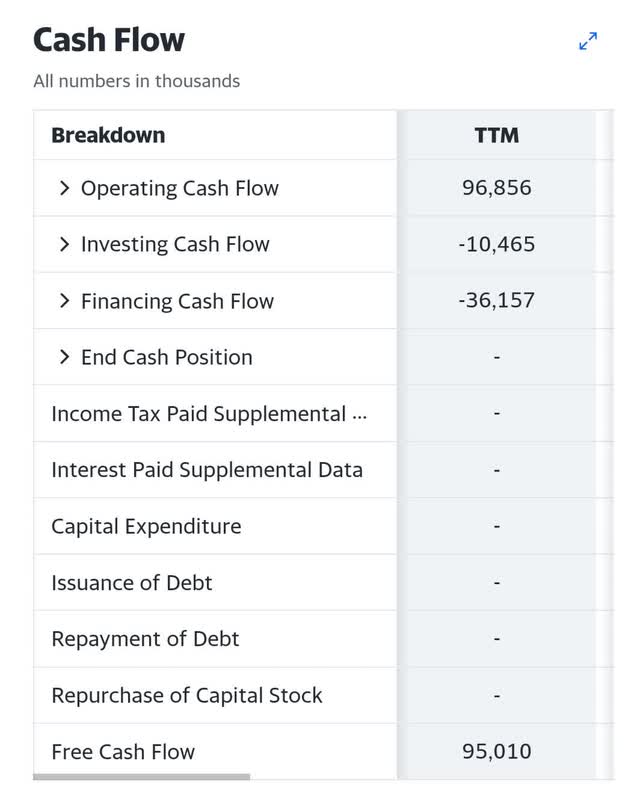

The decline in margin was mainly due to supply chain-related freight expenses. The EBITDA increased 42.4% year on year at $59.4 million. JAKK has a positive free cash flow this quarter. Total cash and equivalents were $76.6 million, almost three times higher than the previous year. This upward trend is a positive sign that the company has money to return to business and reduce outstanding debts.

Cash Overview (YahooFinance.com)

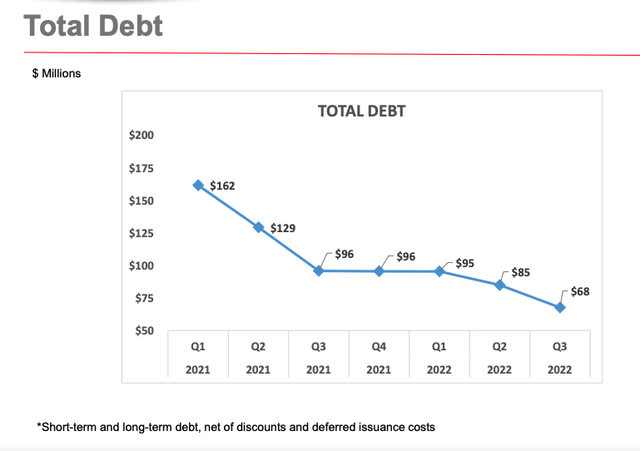

Debt has been something to be wary of if we look at JAKKS’ history and outstanding debt to be paid. The company made an optional payment of $17.5 million towards long-term loans in Q3. Year-to-date principal payments total 29% of the balance with $29.0 million, or 29% of the remaining $69.5 million.

Total Debt Trend (Investor Presentation 2022)

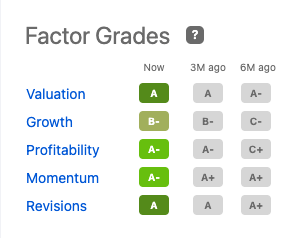

In my previous article, I compared JAKK to more significant players in the market, and these comparisons make it clear that JAKK has much room to grow and could be an attractive takeover target by one of the multibillion-dollar toy and entertainment companies. The company is valued well under its price target of $26.33, and its valuation ratios are much lower than the top companies in the industry. If we look at Seeking Alpha’s Quant Ratings over the last six months, we can see valuation, growth and profitability on an upward trend, and we have yet to hit the company’s historically most robust performing quarter.

6 month Quant Rating (SeekingAlpha.com)

Risks

Although JAKK is a micro-cap stock, it is not new on the market and has gone through many highs and lows over the years in the competitive and ever-changing landscape of the toy industry. An investor who invested in the stock ten years ago would have seen the stock price drop by 84.66%. However, for the next six months, the company is on a solid path to continue bringing in high-performance numbers.

Secondly, we saw that the gross profit margin has decreased. It can highly impact an industry where customers are price sensitive, and many alternatives from larger companies are in the market. These larger companies have greater flexibility in pricing due to the economies of scale. However, JAKK seems to be using data analytics to create highly sought-after products in a timely fashion to compete in the market.

Lastly, there is a lot of market uncertainty, and toys must be considered essential goods. However, historically, the toy industry has been resilient during economic downturns, and JAKK’s pricing is considered affordable, with more than 50% of its products sold at under $25.

Final Thoughts

JAKK is on its way to a record-breaking year. If we compare it to its earnings, it has a strong cash flow, and it’s got an exciting pipeline of toys and costumes pushed along by at-home streaming shows and blockbuster movies. With Christmas just around the corner and four quarters of solid performance behind them, there is much to get excited about for this small company taking on giants. Investors may want to take a bullish stance on this company at a price well under its main competitors.

Be the first to comment