baona/iStock via Getty Images

After five days of selling, the major market averages finally finished in positive territory yesterday, as they continue to consolidate gains from November, while remaining above their respective 50-day moving averages. The recent pullback has been a healthy one, but it will be the upcoming reports on producer and consumer prices that dictate whether this was a pause to refresh or the beginning of a larger decline. Those two reports should weigh heavily on the Fed’s updated policy outlook at next week’s meeting, which is the last major event of 2022.

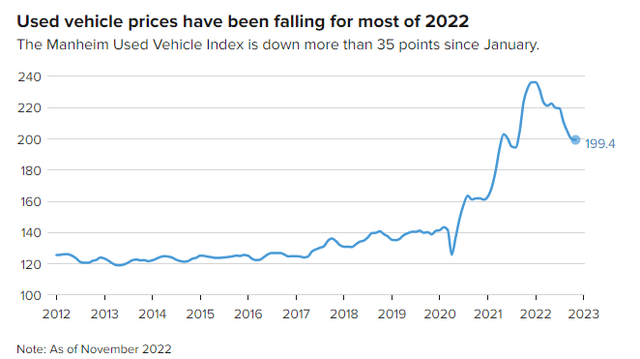

With a high degree of certainty, the Fed will raise its benchmark rate from a range of 3.75-4% to 4.25-4.5%, but it is the “dot-plot” that shows where each member sees the short-term rate in 2023 and beyond that will likely dictate market performance for the remainder of this year. The rate increases to date in combination with the forces of the free markets have put the peak rate of inflation behind us and are clearly leading to a deceleration in prices that should broaden and pick up speed next year. Wholesale used car prices fell to their lowest level in a year last month, according to the Manheim Used Vehicle Index, as interest rates rise and availability improves.

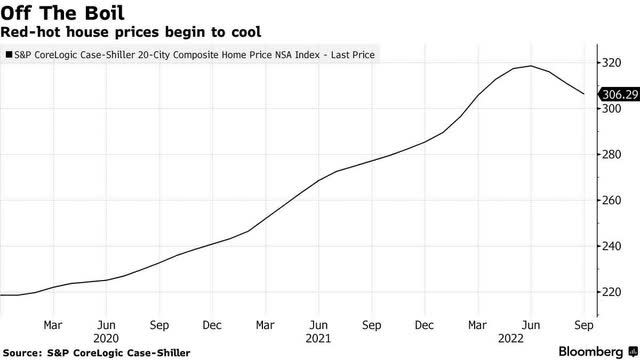

After a more than doubling in mortgage rates, home prices are falling for the first time in 10 years, which also is weighing on new rental rates across the country. Yet this is an orderly decline that does not look to have the same repercussions that we saw when the housing bubble burst in 2008. Banks are much better capitalized and have less leverage, while mortgage credit quality is much improved.

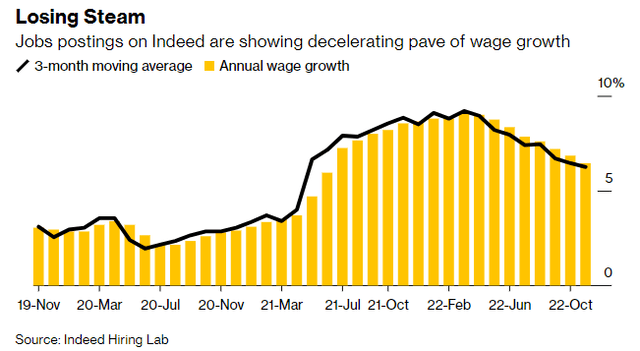

Most important to the Fed, we’re seeing wage growth start to abate, as the jobs platform Indeed is forecasting a return to pre-pandemic levels in its index, which is based on salaries for job openings on its site. Wage growth of 6.5% in November is down from 9% in March of this year, and on track to fall to 3%-4% next year, based on its current trajectory.

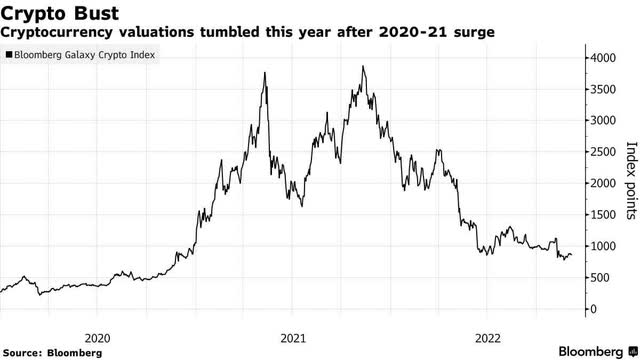

It’s in financial markets where the Fed has been the most effective to date in stemming price increases, as the speculative fervor that ruled markets in 2021 has been wiped out. We no longer hear about meme stocks or SPACS, and what was a $3 trillion cryptocurrency industry has lost two thirds of its value. The wealth effect is no more, but this collapse in speculation and bear market in stocks and bonds did not upend the expansion for one very important reason, which is the ace up the Fed’s sleeve in terms of navigating a soft landing for the economy next year.

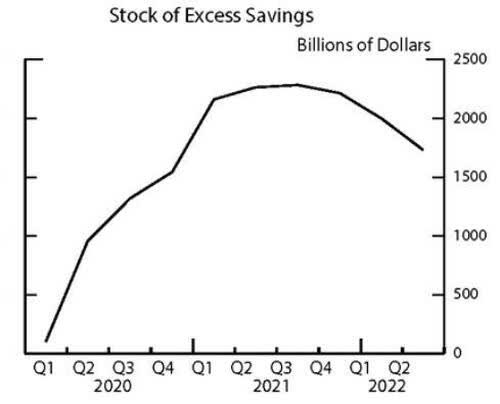

The greatest uncertainty now, as apprehension about inflation shifts to growth, is how high and for how long can the Fed raise interest rates to tame inflation without ending the expansion. Most view the mountain of excess savings that built up from pandemic-related relief programs over the past two-plus years as a part of the inflationary problem, but I think it now serves as the Fed’s greatest asset. This is because it’s serving as a buffer to the Fed’s monetary policy tightening. It may have been inflationary in 2021, as consumers shifted spending from goods to services, but now it’s simply helping to offset the decline in real wages resulting from peak inflation. This is why we have not seen a decline in real consumer spending. The good news for the Fed is that it’s a temporary buffer. As the rate of inflation abates, so too should the excess savings, eliminating it as a future inflationary threat.

Federal Reserve

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment