Sitthiphong/iStock via Getty Images

Since December 2020, Adyen (OTCPK:ADYEY)(OTCPK:ADYYF) has experienced significant earnings multiple contractions – going from approximately 280 to 70 – reflecting Mr. Market’s negative outlook toward high-growth companies. I believe that Adyen has an outstanding business model and value proposition, which enables merchants to cope with the many pain points that characterize the payment industry. At its current valuation, I believe Adyen stock could provide 2.2x-2.6 returns for the patient investor over the next five years. This means that Adyen has a margin of safety in the range of 55%-62.6%, which is a compelling cushion for investors aiming at above-average returns.

The Business

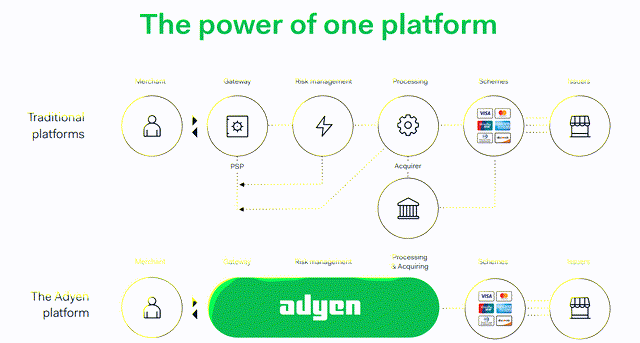

Adyen is a leading payments platform that provides its global and local merchants with a comprehensive technology infrastructure, which enables them to accept and process payments through online, mobile, and POS channels for a total of over 250 different payment methods. Adyen’s infrastructure allows them to integrate payment gateways, risk management tasks, payment processing, virtual and physical card issuing, acquiring processes (e-commerce, mobile, POS, and in-person), settlement, and back-end infrastructure all in the same technology platform. This means that Adyen differs from its competitors as the company can exercise control over its entire value chain.

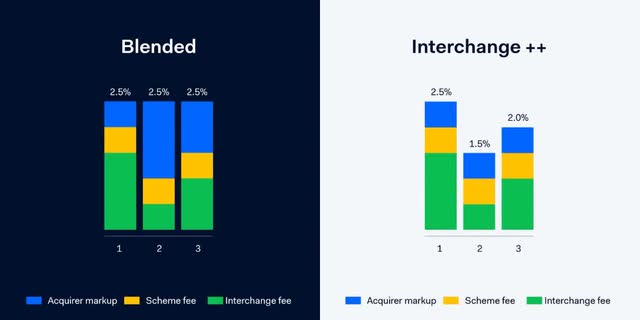

Moreover, Adyen has a volume-tiered pricing offering, which results in a cheaper and more transparent model compared to other alternatives as it breaks down payment card costs (acquirer markup, card scheme fee, and interchange fee). This pricing scheme is called Interchange++ and is broken down by the company in the following way: When a transaction is performed through a card scheme such as Visa (V) or Mastercard (MA), the acquiring bank (the acquirer) needs to pay an interchange fee to the cardholder’s bank.

Then, the business has to pay the same interchange fee back to the acquiring bank. Compared to Adyen’s pricing scheme, its competitors use blended pricing models, which are based on a flat rate ranging between 2.6% and 2.9% plus a fixed fee that depends on the country. As shown below, Adyen’s fees compare favorably to those proposed by the competition:

|

Company |

Fees (Card) |

|

Adyen |

1.2% |

|

Block (SQ) |

2.6% + fixed fee* |

|

PayPal (PYPL) |

2.99% + fixed fee* |

|

Stripe (STRIP) |

2.9% + fixed fee* |

|

Worldpay |

2.9% + fixed fee* |

|

First Data (OTC:FGBDF) |

2.69% for amounts up to $50000 and 2.29% for amounts higher than $50000 + fixed fee* |

|

Global Payments (GPN) |

1.1%-3.3% + fixed fee* |

*Fixed fees depend on the specific country

Segments

The enterprise segment focuses on large multinational businesses, which have a monthly TPV higher than $1 million. This generates most of the company’s growth and Adyen can leverage multiple factors to expand this segment. Since it has been listed as a public company, the vast majority, or 80%, of Adyen’s volume growth has come from organic growth, which is fueled by already existing global merchants that continue to add new channels and expand in new countries adopting the company’s services. This will enable Adyen to continue to grow its transaction volume and strengthen its product offerings. Therefore, when Adyen onboards a new significant merchant it starts servicing only a part of its business, and Adyen will grow its share over time.

Moreover, another growth opportunity is represented by the company’s ability to onboard new merchants, which are targeted by using a direct sale strategy. The enterprise business segment accounts for 97.3% of the overall transaction volume, while the other 2.7% is represented by the mid-market segment, which refers to those merchants that process a volume higher than €25 million. Since the enterprise segment is the business segment where the company directs more of its focus, it has a higher volume growth rate. In 2021 it was equal to 72%, compared to 27% for the mid-market segment.

The unified commerce segment is a unique platform with a holistic approach that is able to process all the different types of payments and channels. Having the same technology infrastructure (risk management, acquiring process, and back-end), merchants are able to have a comprehensive and centralized view of their shoppers’ data. In 2021, this segment was the second fastest-growing one with a 86% increase in processed volume.

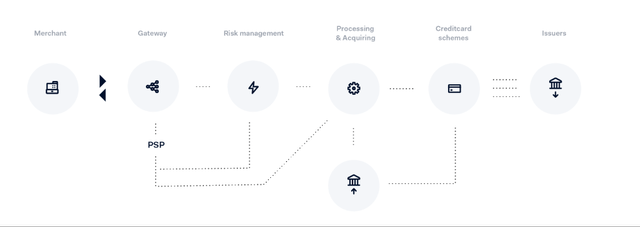

Parts Involved in a Transaction

We can identify five players who are involved in the payment process. The first one is the customer (or the cardholder) who’s paying for a service or a product that he/she has purchased. Then, there is the merchant who’s selling goods and services and accepts payments through a POS terminal (offline) or a gateway (online). The third one is the issuing bank (usually the customer’s bank), which verifies and confirms that the cardholder has enough money to cover his/her purchase.

Then, there are the card networks (i.e., Visa and Mastercard), which are the infrastructures that enable exchange of information between the acquiring bank and issuing bank so that the transaction can be authorized. They are the gatekeepers and set the interchange fees. Also, it’s mandatory to have a license if someone wants to operate on their network. Finally, there is the merchant acquirer (i.e., Adyen), which manages the payment processing phase and enables the money to be transferred from the customer’s bank account to the merchant’s bank account.

Transaction Structure – the Value Chain

The transaction process starts with the customer entering his/her credentials through the payment gateway and then proceeds to pay. Then, the merchant acquirer performs some risk management checks in order to verify that the transaction is not fraudulent and sends the transaction to the card network. The acquiring bank sends the transaction through the card schemes (Visa, Mastercard, etc.) to the customer’s bank in order to validate the customer’s identity and if he/she has enough funds in his/her account. Depending on the response that the payment processor receives from the acquiring bank, it can either proceed by processing the payment or denying it. If the payment has been accepted, the money is sent to the merchant’s bank.

Mr. Market Action

Mr. Market’s mood swings over the last year have resulted in a 50% share price contraction. Over the last two years, Adyen’s earnings multiple experienced a strong compression from its peak of 281 in December 2020 to 73 in December 2022. In the last year and a half, Adyen continued to strongly execute its strategy, which resulted in processed volume growth of 70% in 2021 (101% growth in POS processed volume), and 46% net revenue growth. In the first half of 2022, Adyen’s processed volume experienced a robust 60% growth year over year, while its net revenue base increased by 37% year over year. These results stem from the company’s superior quality business model and the highly competent founder-led management team.

|

Business Drivers |

2017 |

2018 |

2019 |

2020 |

H1 2021 |

2021 |

H1 2022 |

|

Processed volume |

$108.4 |

$159 |

$239.6 |

$303.6 |

$216 |

$516 |

$345.8 |

|

Processed volume growth |

– |

46.6% |

50.7% |

26.6% |

67% |

70% |

60% |

|

POS processed volume |

$8.3 |

$16.6 |

$29 |

$32.3 |

$22.8 |

$64.6 |

$44.9 |

|

POS processed volume growth |

– |

100% |

74.7% |

11.3% |

107% |

100% |

97% |

|

Net revenue |

$218 |

$348.9 |

$496.7 |

$684.2 |

$445 |

$1000 |

$608.5 |

|

Net revenue growth |

– |

60% |

42.3% |

37.7% |

45% |

46% |

37% |

|

Churn rate |

< 1% |

< 1% |

< 1% |

< 1% |

< 1% |

< 1% |

< 1% |

(Note: All figures are in billions, excluding net revenues and percentages.)

Competitive advantage

Adyen

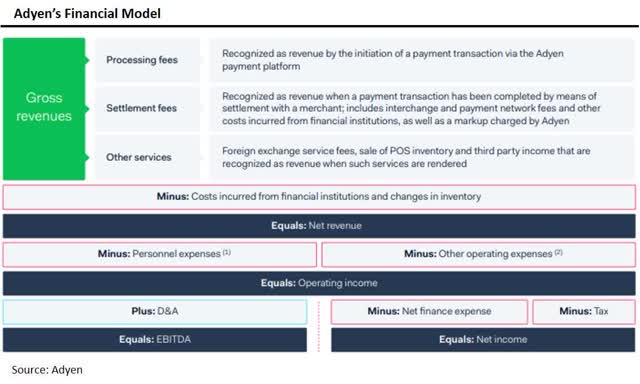

As shown in the image above, Adyen earns a fixed processing fee plus a merchant acquirer settlement fee, which is a percentage of the transaction. Adyen’s take rate decreased from 30 bps in 2015 to 19.4 bps in 2021 as the company increases the volume from clients already on the platform (organic growth).

Being the only company in the industry offering its services through a single platform gives the company a major competitive advantage, as Adyen doesn’t have to rely on the tech infrastructure of legacy partners (i.e., Chase Merchant Solutions, Worldpay, First Data, and Ingenico) and on white label agreements with banks in order to support card payments, substantially simplifying the business of great merchants.

Moreover, the company’s single platform allows it to cut out several software layers and improve functionality, leading to higher conversion rates, more efficient mitigation risk, reduced settlement times, and the ability to provide data insights, with its data-centric approach making shoppers that employ an omnichannel system pay half what others do using fragmented solutions. Also, because Adyen is in control of the entire value chain that allows the company to be fully transparent. As Adyen’s President Brian Dammeir said in the 2018 prospectus: “Adyen is able to leverage advanced technologies and provide intelligence and insights on how to adapt formats, user interfaces, and customer journeys to ensure the highest chance of transaction approval.”

Margins, Returns, and Growth

Despite Adyen being founded in 2006, it’s still experiencing high growth rates and is also improving its margin structure. As discussed above, Adyen’s main advantage is represented by offering its services through a single platform with direct acquiring and processing capabilities. This has enabled and will continue to enable Adyen to further improve its margin structure over the long term. Another point worth mentioning is how Adyen has a lot fewer full-time equivalent employees compared to other competitors, which shows Adyen has higher efficiency as opposed to its peers. Below is a table that highlights Adyen’s margins and returns on its invested capital:

|

KPIs |

2017 |

2018 |

2019 |

2020 |

2021 |

|

EBIT margin |

42.8% |

49.6% |

51.7% |

54.6% |

59.4% |

|

Net margin |

32.6% |

37.5% |

41.1% |

38.1% |

46.9% |

|

ROIC* |

23.6% |

27% |

25.7% |

25.6% |

36.6% |

*ROIC is calculated dividing EBIT by the company’s invested capital, which is the difference between total assets and accounts payable and accrued expenses.

Valuation

Instead of using multiple valuations, which can give us misleading representations of the company’s economic reality, a better procedure when valuing companies is to look at their earning power. I will consider a five-year time horizon with two different free cash flow growth rate scenarios of 30% and 35%. I believe the previous assumptions to be fair considering Adyen’s 76% CAGR over the last four years.

|

Assumptions |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

|

FCF |

€1.76 |

€2.28 |

€2.97 |

€3.86 |

€5.02 |

€6.53 |

|

FCF growth |

– |

30% |

30% |

30% |

30% |

30% |

|

FCF |

€1.76 |

€2.37 |

€3.20 |

€4.33 |

€5.84 |

€7.89 |

|

FCF growth |

– |

35% |

35% |

35% |

35% |

35% |

(Note: Figures are in billions, excluding percentages.)

As shown in the table below, there are two fair value targets for both 30% and 35% free cash flow growth rates. If Adyen can maintain the growth rates outlined above, I think an investment in the business might result in a possible 2.2x-2.6x-bagger. Moreover, this would deliver an attractive margin of safety in the range of 55%-62.6%, which would translate into a significant cushion for the conservative investor.

|

Shares outstanding |

31 |

|

Discount rate |

9% |

|

Terminal growth rate |

4% |

|

Intrinsic value (30% FCF growth) |

€3122/share |

|

Intrinsic value (35% FCF growth) |

€3726/share |

(Note: The shares outstanding figure is in millions.)

Risks

Adyen faces competition from companies that generate higher revenue and are more established in the payment industry. Moreover, Adyen could also face technical problems such as cyberattacks and data breaches, which could result in serious customer dissatisfaction and fewer merchants adopting Adyen’s services. Another factor that should be considered is the fact that Adyen currently has Amsterdam as its primary stock listing. This results in less coverage from financial analysts and lower probabilities for the company to be fairly priced by the market.

Conclusion

I believe that Adyen is a compelling company with an outstanding value proposition and competitive advantages compared to its competitors. The company is constantly innovating and improving its platform by releasing new features and updates to ensure that merchants have access to the latest technology. Moreover, Adyen’s machine learning technology is a powerful tool that enables merchants to improve their business operations by leveraging data from customer interactions and patterns and trends from customer behaviors, which ultimately leads to a better customer experience.

Be the first to comment