peepo

This article was co-produced with Cappuccino Finance.

Investors don’t buy into companies expecting to be treated badly. Obviously.

If anything, they tend to take it for granted that they’ll be treated well. The thought that they’ll be overlooked or, worse, mistreated, doesn’t even enter their heads.

That’s because they’re focused on profit potential. How much money can they get out of the stock?

Admittedly, they’re not completely crazy for expecting to be treated with some modicum of respect. After all, these are businesses. And businesses work best when they’re keeping their customers and backers happy.

However…

The news is filled this year with big-name companies that have forgotten that fact. Kohl’s (KSS) and Disney (DIS) immediately come to mind in that regard, though there are certainly others too.

Those are stories for another article, admittedly. In this one, I simply want to establish that fair treatment by a publicly traded business isn’t a given.

So it shouldn’t be treated as such.

In which case, it stands to reason that we should value companies that do treat their investors well more highly. And those who treat them exceptionally well?

Considering my recent series about management, my regular readers already know my opinion here.

Still, for those who are new or who just need a reminder to stay the course, let’s delve into my stance on the subject… and then highlight three companies that know how to roll out the red carpet for their businesses’ backers.

Dividends: The Corporate Language Of “Like”

There are a number of ways to know – before you buy in – how a company is going to treat you. In the case of real estate investment trusts, or REITs, their dividends are a big giveaway.

Dividends are how mature, “boring,” or value companies show their love to investors. They might not see share price accumulation at the same pace as the market’s hot tamales. But that hardly makes them inferior wealth builders.

As I explained in my latest (but not last) book, The Intelligent REIT Investor Guide:

“In September 2010, Barron’s quoted Ed Clissold, an equity strategist at Ned Davis Research. His research showed that the S&P 500 had delivered average annual price appreciation of 4.92% since the end of 1928. But its average annual total return had been 9.16%.

In other words, dividends provided approximately 46% of those total returns, indicating that they do indeed count. A lot. And we haven’t seen any evidence of that principle changing in the last decade.

“Another related benefit is that REIT shareholders can participate in income reinvestment plans, plowing their dividend income back into their holdings by buying additional shares.

Or, should they so choose, they can invest it elsewhere or spend it on a vacation in Hawaii. Other shareholders don’t have this advantage. They have to accept whatever decisions the board of directors puts in place in this regard.”

Moreover, while corporate bonds can often provide superior yields:

“… bond interest payments don’t increase, whereas the REIT industry has a long-term track record of increasing dividends on a regular basis. The Great Recession and 2020-2021 Covid-19 pandemic both interrupted that run, it’s true. But over time, their dividend action has still proven to outpace inflationary forces.”

How many “hot tamales” can claim that these days?

Consistently Growing Dividends: The Corporate Language of Love

Again, there are other ways you can tell that a company will value its shareholders – including insider ownership, where members of management put their money where their mouths are. But I want to stick with the dividend angle further here.

Because it’s not just offering payout perks that make it more clear management loves you. It’s how likely they are to raise them year in and year out.

As indicated in that last quotation from The Intelligent REIT Investor Guide, sometimes “stuff” happens. Sometimes, REITs have to cut their dividend payouts in order to stay healthy – or flat-out survive.

That doesn’t automatically make them bad investments because they don’t have a flawless track record in this regard. Or, really, any other one.

But, on the flipside, a company that consistently raises its dividend every year through thick and thin means something.

It means that management is focused, for one thing. The C-suite and board members understand both the concepts of growth – as evidenced by the fact they keep paying shareholders more during good times – and savings, as evidenced by the fact they keep paying shareholders more during not-so-good times.

It therefore means their balance sheets are actually balanced, with enough money to fund everything necessary – and then some. To quote Octet.com:

A healthy balance sheet is about much more than a statement of your assets and liabilities: It’s a market of strength and efficiency.

It highlights a business that has the optimal mix of assets, liabilities and equity, and is using its resources to fuel growth. With the right mix and a positive net asset position, a business is in a much stronger position to succeed.

Add dividends into that mix, and it’s in a much stronger position to help you succeed as well.

Realty Income (O)

Realty Income, the Monthly Dividend Company, is a REIT that is a member of S&P 500 Dividend Aristocrats index. They have raised the dividend for 25 consecutive years, and have increased the dividend by an average of 5.6% each year over the past 10 years.

Realty income has a very diversified portfolio with over 11,000 properties (most of them are single-client properties) located in all 50 U.S. states, the United Kingdom, and Spain.

The weighted average remaining lease term is about 9 years, and their clients operate in 79 different industries.

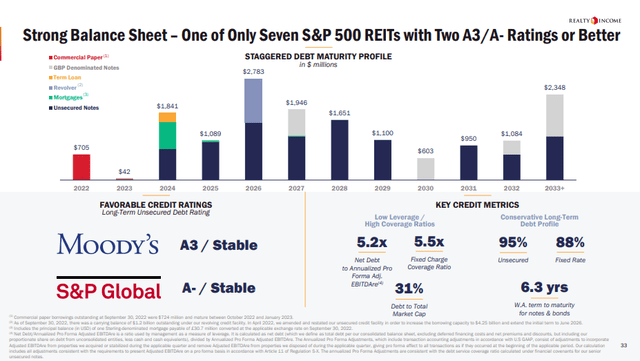

Realty Income has a very strong balance sheet to support its strong operation and the growth. Their debt maturity profile is nicely spread out beyond 2033, and their key credit metrics are favorable.

Fixed charge coverage ratio is 5.5x, and debt to total market cap is 31%. The weighted average term to maturity for notes and bonds is 6.3 years. The excess liquidity is at $2.5 B.

Looking at the balance sheet and liquidity, it is not really surprising to see that Realty Income is one of seven S&P 500 REITs with two A3/A- ratings or better from Moody’s and S&P Global.

The current valuation metrics show that Realty Income is undervalued. P/AFFO of 17.45x and P/FFO of 15.2x are significantly lower than their 5-year average.

Also, their dividend is safe at this point. Their cash dividend payout ratio is 74.99%, and FAD payout ratio is at 78.52%.

Right now, Realty Income offers a 4.7% dividend yield, and I expect the company to maintain their long streak of dividend increases.

W.P. Carey (WPC)

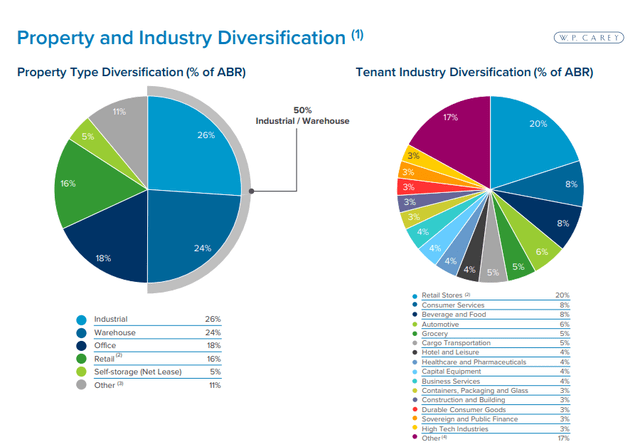

W.P. Carey is a REIT and leading owner of commercial real estate located in U.S. and Europe. Their diversified real estate portfolio consists of single-tenant industrial, warehouse, office, retail, and self-storage facilities. Their tenants include U-Haul, the Spanish government, Marriott, and Advance Auto Parts.

W.P. Carey’s portfolio is in high demand, demonstrated by their high occupancy rate (98.9%).

W.P. Carey has a strong balance sheet and favorable capital structure. Their Pro Rata Net Debt to Adjusted EBITDA ratio is 5.6x, and Pro Rata Net Debt to Enterprise Value is 34.8%. Weighted average debt maturity is 4.6 years, and the weighted average interest rate is 3.0%. They have ample liquidity of $2.2 B to support their growth plan.

Their current valuation metrics show that they are undervalued. P/AFFO of 15.74x and P/FFO of 14.98x are lower than the 5-year average values.

W.P. Carey’s 5.4% dividend payment is reassuringly safe. The cash dividend payout ratio is 80.74%, and AFFO payout ratio is at 79.55%. Furthermore, W.P. Carey is committed to raising its dividend and has done so for the past 8 years.

Mid-America (MAA)

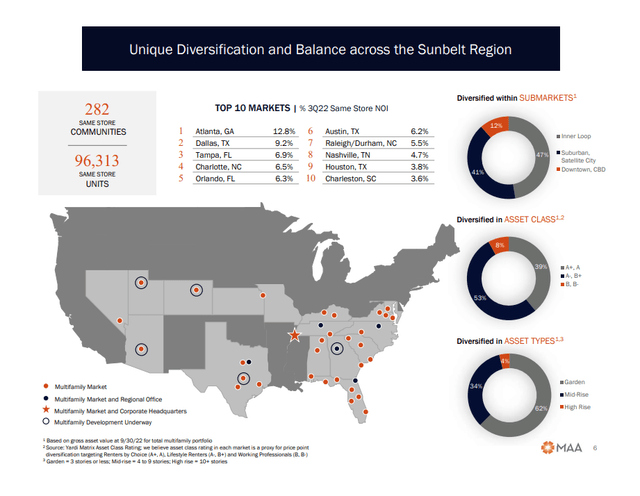

Mid-America Apartment Community is a multifamily focused REIT that owns, operates, acquires, and develops apartment communities in the Southeast, Southwest, and Mid-Atlantic regions of the U.S. Their top markets include Atlanta, Dallas, Tampa, and Charlotte.

Mid-America has over 100 K apartment units and has consistently grown in the past several years. Mid America’s same store NOI growth since 2008 (182.7%) has been substantially higher than the peer’s (162.7%)

Mid-America has been investing consistently to improve the quality of their portfolio and to increase shareholder returns. They have several active development projects going on in Austin, TX, Phoenix, AZ, and Atlanta, GA, and they also have 14 K units of opportunities in their portfolio.

To support portfolio growth, it is important to maintain a strong balance sheet, and Mid America certainly has that. Their Net Debt to Adjusted EBITDAre is 3.97x, and they have $1.25 B available credit facility and $625 M on commercial paper program. 97.2% of their debt is fixed rate.

CEO Eric Bolton commented on the strength of their balance sheet in an iREIT Podcast earlier this week,

Frankly in terms of debt capacity we could probably deploy something around $750 to a billion dollars worth of capital, do that completely on the existing capacity we have in the balance sheet today, and not put our credit ratings at risk at all and not have to go to the equity markets for that capital. And so that just gives us tremendous comfort at this point in the cycle as we’re looking out over the next few years of uncertain times.

S&P rating services rate their credit at A- (Stable), and Moody’s investors service rate them at Baa1 (Positive).

The 3.0% dividend yield may be a little lower than the previous two REITs, but it is very safe at this point. Cash dividend payout ratio is 50.3% and FFO payout ratio is 57.86%.

Mid-America has paid a dividend for the past 24 years, and has increased that dividend for the past 12 years at a growth rate of 6.1% annually over the past 5 years.

(We interviewed MAA’s CEO, Eric Bolton this week for iREIT on Alpha members)

Risk

Finally, the Federal Reserve chair delivered some good news. Even though he and his committee think their work on inflation is not done, they expect to increase the interest rate by smaller increments starting as early as December.

This is great news for the stock market, but, as he mentioned, the inflation rate is still very high. No one knows how long it will take to come down to the targeted 2-3% level. Until then, there is always a strong possibility of market volatility and recession pressure.

Due to the high interest rates and mortgage rate, the real estate market has been struggling in the past several months. The higher interest rates and uncertainty also introduced some spread between the buyers’ and the sellers’ valuation. These spreads could slow down the transaction volumes, and that trend could interrupt disposal and acquisition plans of the REITs.

Conclusion

Investing in companies with a history of strong dividend payments is a great way to construct your portfolio. Once the great Warren Buffett said, “If you don’t find a way to make money while you sleep, you will work until you die.”

Investing in dividend companies is one of the best ways to make your money work for you while you sleep. Dividend companies don’t care whether you are working, sleeping, vacationing, or drinking. They just keep depositing money into your account.

The three REITs above are great options with strong track records, solid balance sheets, and great growth prospects. These might just be the ticket to help you enjoy retirement!

Be the first to comment