chaofann

Right now, one of the most frequent questions that I receive is:

“Why would you buy REITs in a rising interest rate environment?”

Most investors appear to believe that REITs should be avoided when interest rates are rising because it lowers the profitability of real estate investments and may cause the value of properties to decline.

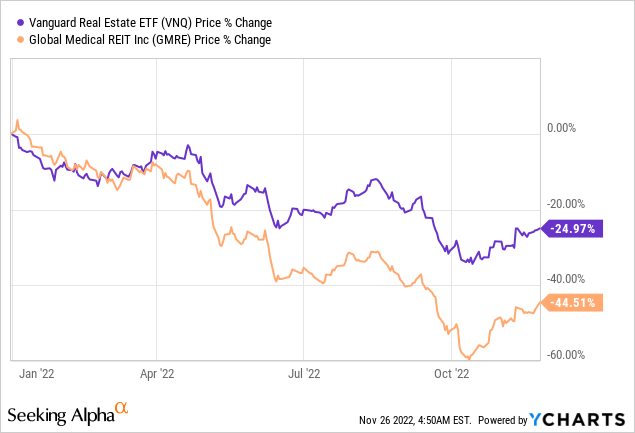

This explains why investors have run away from REITs in 2022, causing their share prices to collapse. The Vanguard Real Estate ETF (VNQ), which invests mainly in large investment-grade rated REITs, is down by 25%, so can imagine that there must be lots of smaller less creditworthy REITs that are down far more. Some are down closer to 50% in 2022. Global Medical REIT (GMRE) is a good example:

Investors fear that if the previous rate hikes caused REITs to drop by this much, then further rate hikes will likely cause them to drop even more. Add to that the threat of a recession and you have a recipe for even greater losses.

Despite all of that, I have over half of my net worth invested in REITs and other similar real estate investments and I am aggressively accumulating larger positions every month with new savings.

I think that the bearishness of the market has led to a historic opportunity that we may not see in years and so I am taking full advantage of it while it lasts.

What am I seeing that other investors are missing in REITs?

It is actually quite simple.

I think that the market has widely overreacted to fears of rising interest rates, not understanding its limited impact, all while ignoring other important factors like inflation, which is highly beneficial for REITs.

Below I summarize the opportunity in 3 concise points and I then also highlight some of my favorite opportunities to buy today:

Point #1: REITs are priced at huge discounts due to rising interest rates, but the real impact of rising rates is meaningless in most cases

The market thinks that the impact of rising rates will be significant and this is why it is pricing REITs at such low valuations.

But it is wrong.

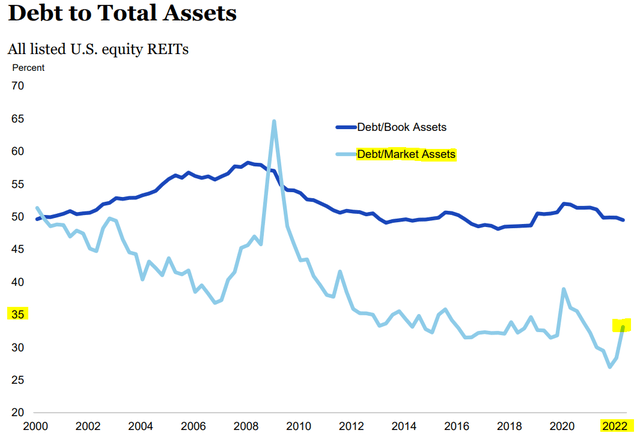

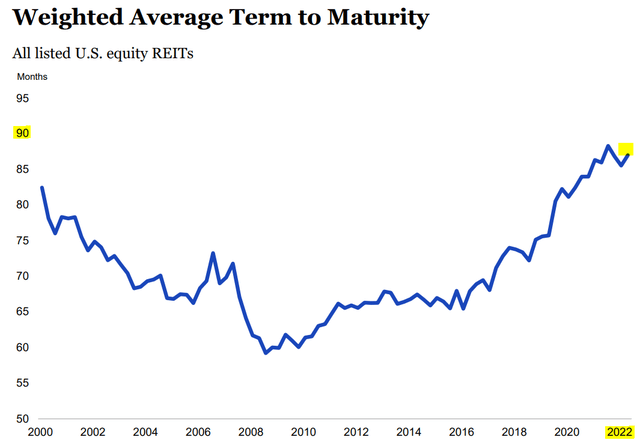

REIT balance sheets are today the strongest ever with just 35% debt, nearly all of it is at a fixed rate, and the maturities are long at 8 years on average.

Debt is at an all-time low:

Maturities are the longest ever:

Lots of REITs don’t have any maturities in years. A good example would be Alexandria Real Estate (ARE) which has no debt maturity until 2025. But even those REITs that have some maturities won’t be heavily impacted since the debt is low and maturities are well-staggered. To take another example: Mid-America (MAA) has a 35% LTV and only about 1/8 of that debt matures each year. As such, the higher rates will only impact about ~4% of the balance sheet (1/8 of 35%) each year.

That’s negligible even if rates are a lot higher.

Actually, the impact could be even lower than that because REITs also have the flexibility to pay off some of that debt if they decide to do so. The payout ratios are today at a historic low of 70%, which means that 30% of the cash flow is retained by REITs to pay off debt or reinvest in growth.

So all in all, the annual impact of rising rates is very limited, and in some cases, it is literally zero for years to come. By then, inflation will have likely cooled down, and interest rates will have again returned closer to where they were before the burst in inflation.

Therefore, it makes little sense to discount REITs so heavily based on today’s rising interest rates. The near-term impact is often minimal and the long-term impact should be even less significant.

Point #2: REITs benefit heavily from inflation, and these benefits have been almost entirely overlooked so far

The sell-off in REITs makes even less sense when you consider that interest rates are rising because of high inflation and this inflation has significant benefits for REITs.

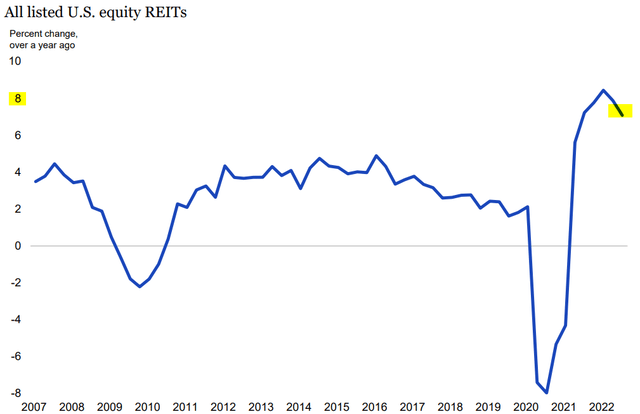

Firstly, it leads to rapid growth in rents. Today, rents are growing the fastest in many years as you can see from the chart below:

Inflation leads to rent growth because properties cannot be inflated away. It only leads to higher replacement/construction costs, less new supply, and growing demand from a larger renter pool that now cannot afford to buy or build real estate anymore.

There are many REITs that are able to grow their same property NOI by over 10% at the moment. A few examples include industrial REIT Terreno (TRNO), apartment REIT Camden (CPT), and self-storage REIT Extra Space (EXR).

Earlier, we explained that rising interest rates only impact a very small portion of the balance sheet annually because the debt is low and maturities are long. But the inflation impacts 100% of the balance sheet each year as it leads to growing rents, rising replacement costs, and it also deflates the value of the debt in real terms.

And here comes the best part…

Point #3: Eventually, interest rates will come back down, but rents won’t, and this will cause a shift in market sentiment and push REITs to new all-time highs

The benefits of inflation will not disappear. Even if inflation cools down, the previous rent hikes won’t be reversed. The future cash flow generation potential of properties has risen forever and so have their replacement values.

But interest rates will more than likely come back down.

Today, rates are relatively high and rising because the pandemic and the war in Ukraine pushed inflation to a 40-year high. But these are temporary factors and the best cure for high inflation is inflation itself.

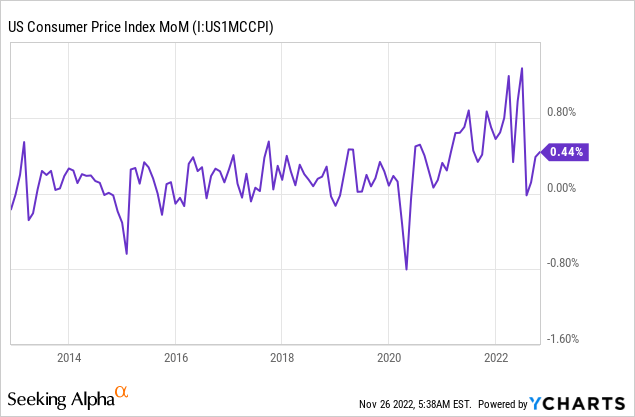

Now inflation is already starting to moderate as the economy cools down. In fact, we can see that the month-over-month inflation has already returned to near pre-pandemic levels:

Investors are quick to extrapolate recent trends far into the future and this is why they are so scared of rising interest rates, but what they tend to forget is that the overall trend for interest rates has been lower for the past many decades.

We have had many temporary surges in interest rates, and investors were always quick to assume that low rates were gone forever, but each and every time, they have been wrong and rates have eventually dipped lower.

Why is that? As we explain in a recent article, the world is dealing with significant deflationary pressures that are likely to keep interest rates trending lower for longer. These include:

- Aging Demographics

- High Debt Loads

- Income Inequality

- Technological Innovation

- Globalization

The short-term inflation may be disrupted by things like Russia invading a neighboring country and causing a global food and energy crisis, but the long-term trend has not changed, and sooner or later, we expect inflation to cool down and interest rates to trend back to where they used to be.

As this happens, I expect the market sentiment to shift drastically for REITs.

Suddenly, investors will realize that they overreacted to the fears of rising interest rates. They will realize that the negative impact that they had predicted will not materialize. This will cause them to rush back into REITs, hoping to rebuild positions before their valuation multiples recover.

But here comes the best part:

REITs will not just get back to where they were before the crash in late 2021. They will now need to rise a lot higher because cash flow has grown considerably in 2022 in large part due to inflation.

So the higher multiples will now be applied to higher cash flows, which will result in significant upside.

How much upside exactly?

It depends on the REIT of course.

But there are many REITs that offer 50-100% upside potential as our thesis plays out, and they will also pay you a 5-10% dividend yield while you wait, and their cash flow will also keep growing.

A few good examples include:

EPR Properties (EPR), Global Medical REIT (GMRE), and Uniti Group (UNIT). They are all down very significantly due to concerns of rising interest rates and offer 50-100% upside just to get back to where they were in early 2022 and they pay an ~8-9% dividend yield while you wait.

TopGolf facility owned by EPR Properties:

EPR Properties

Medical office building owned by GMRE:

Global Medical REIT

Each of these companies has unique risks as well of course, but you can diversify these by building a diversified portfolio.

I invest about 50% of my net worth in a portfolio of 24 REITs that we present at High Yield Landlord. I invest so heavily in these opportunities because I think that they offer the best risk-to-reward in today’s market.

- They generate significant cash flow that’s rising due to inflation.

- They are resilient to recessions because they have long-term leases.

- They are also relatively resilient to rising interest rates because their debt is reasonable and well-structured.

- They are heavily discounted due to temporary fears that won’t last.

- They offer significant upside as the sentiment shifts and pay you generously while you wait.

Be the first to comment