adventtr

Introduction

With annual silver production of 50 million ounces, Fresnillo plc (OTCPK:FNLPF) is one of the world’s largest primary silver producers. Today the company operates seven mines, all located in Mexico. The eighth one, Juanicipio (a Mexican project where Fresnillo plc has a 56% stake; the remaining 44% belongs to MAG Silver), is at its final stage of development.

Investment thesis

In my last article on Fresnillo plc I suggested avoiding this stock. The main three factors supporting this thesis were:

- High CAPEX

- Lower production

- Shrinking reserves

In my opinion, these factors are still intact. What is more, a closer look at the data delivered by the company and MAG Silver (MAG) makes me quite cautious about the newest project, Juanicipio. If I am correct, the company can face a serious problem overshadowing its future.

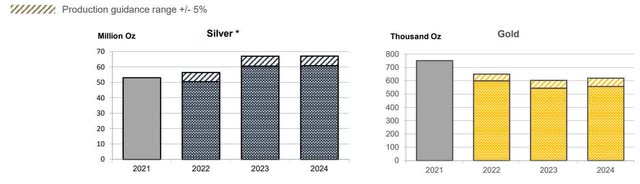

Juanicipio is a key driver for silver production

According to the latest technical report, at the production peak the Juanicipio mine should deliver approximately 11 million ounces of silver and 28 thousand ounces of gold a year (all these figures are attributable to Fresnillo plc). To remind, last year the company produced 50 million ounces of silver so it means that the new mine should increase silver production by 22% (an increase in gold production is marginal). Hence, Juanicipio is a very important asset for the company’s silver segment. The two charts provided by Fresnillo plc support this thesis:

Note that the Juanicipio mine is a key driver for the growth of the silver segment. On the other hand, its contribution to the gold business line is negligible (in fact, due to other factors, the company expects gold production to go a bit down over the next two years).

The Juanicipio project is delayed

Since Juanicipio is a key element of Fresnillo’s strategy, it is obvious that it should be put online as quickly as possible. However, at the end of 2021 Fresnillo plc announced that the project would be delayed by six months. The main reason behind was a problem with connecting the Juanicipio processing plant to the national power grid:

However, the ‘Comisión Federal de Electricidad’ (“CFE“), the state-owned electrical company, has just notified Fresnillo, the Juanicipio Project operator, that approval to complete the tie-in to the national power grid cannot yet be granted and the mill commissioning timeline will therefore be extended by approximately six months. This is directly related to knock-on effects of the pandemic on the CFE’s operations, predominantly related to a lack of CFE staff which limits its ability to oversee three key tasks to: review the existing installation; supervise physical connection to the active power grid; and approve required blackout prevention devices.

Well, problems happen but… we are now at the end of 2022 and the processing plant is still not connected to the grid.

Despite this problem, Juanicipio is partly-working…

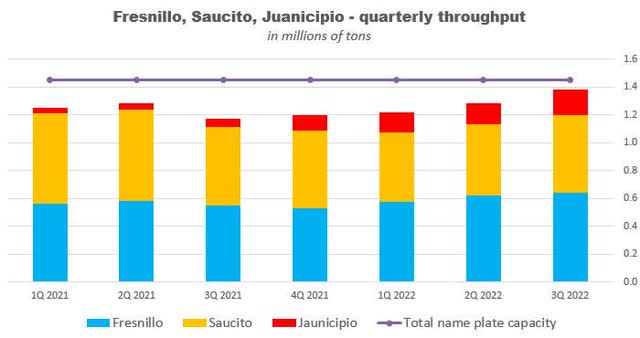

Fortunately, Juanicipio is very close to the two active mines operated by Fresnillo plc., i.e. Fresnillo and Saucito. Another positive – the ore mined at Juanicipio is very similar to the ore delivered by these two mines. In addition, there is spare processing capacity at these mines. As result, it is possible to process the rock mined out from Juanicipio at Fresnillo and Saucito processing plants. Here is how it works:

Note: “Total name plate capacity” consists of two elements:

- Fresnillo – this processing plant has name plate capacity of 8 thousand tons of ore a day

- Saucito – name plate capacity of 7.8 thousand tons a day

It means that the total name plate capacity is 15.8 thousand tons of ore a day or approximately 1.45 million tons per quarter. However, the Fresnillo and Saucito deposits deliver only 1.1 – 1.2 million tons of ore per quarter so there is some room to process the ore coming from Juanicipio. And that is what happened. For example, last quarter the Fresnillo and Saucito mills processed 0.18 million tons of ore hauled from Juanicipio. Quite much because the Juanicipio plant is expected to process 0.35 million tons of ore per quarter when fully operating.

Recoveries are well below expectations

However, there is a problem. I have collected all the data published by Fresnillo plc and MAG Silver and here is what I found.

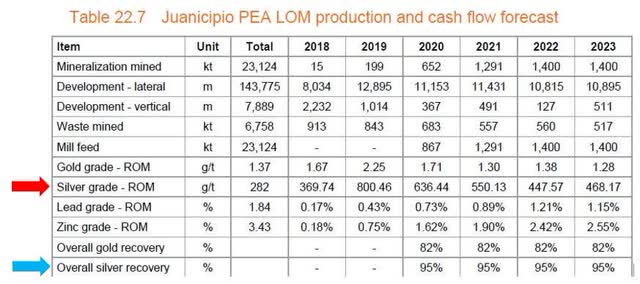

Firstly, a quick look at a few figures taken from the latest economic study for Juanicipio:

The red arrow indicates that the life of mine average silver grade should stand at 282 grams of silver per ton of ore. However, over the first years of mining the grades will be much higher, which is a typical pattern at underground primary-silver mines in the Fresnillo district in Zacatecas. And yes, according to the data delivered by Fresnillo plc, between 1Q 2021 and 3Q 2022 the average silver grade stood at 525 grams of silver per ton of ore. So far so good.

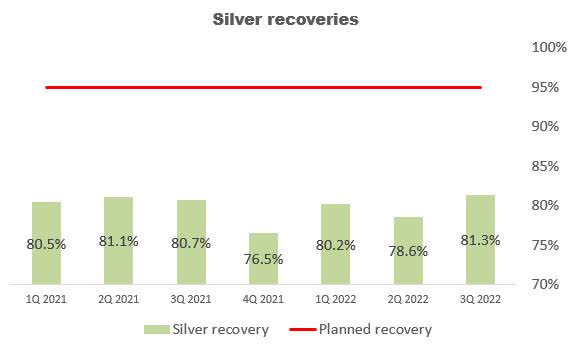

Now look at the row indicated by the blue arrow. This row shows recovery ratios to be reported by the Juanicipio processing plant. And it is easy to spot that Fresnillo plc expects a fixed recovery ratio of 95% over the life of the mine. However, the actual recoveries have been much lower, i.e. 79.7%, on average. For those interested in the subject – look at the chart below:

Simple Digressions

Of course we have to keep in mind that the actual recoveries were reported at the Fresnillo / Saucito processing facilities. It means that we have to wait and see what recovery ratios will be reported at the Juanicipio plant when it is fully operational. However, we also have to keep in mind that, geologically, Juanicipio, Fresnillo and Saucito deposits are similar so…I do not expect sudden improvement when the Juanicipio plant is online. And it is quite obvious that production results reported so far are a failure:

- Since the beginning of 2021 the Fresnillo / Saucito processing plants delivered 9.8 million ounces of silver extracted from the Juanicipio ore (5.5 million attributable to Fresnillo plc)

- As discussed above, the average recovery was 79.7% instead of 95.0%

- If the average recovery was 95% (as planned), Juanicipio would have delivered 12.4 million ounces of silver (6.9 million attributable to Fresnillo plc)

- It means that, due to poor recoveries, Fresnillo plc “lost” 1.4 million ounces of silver so far

And here is my main thesis:

If Juanicipio actual recoveries do not differ too much from the current ones, Fresnillo plc investors will be negatively surprised. Over the last three quarters the Fresnillo / Saucito mills were able to recover only 79.7% of silver contained by the ore mined out at Juanicipio. Compared to the planned recovery of 95%, it means a drop of 16.1%. In other words, Juanicipio could produce 9.2 million ounces of silver at the production peak instead of 11.0 million as planned.

Finally, I have no idea why neither Fresnillo plc nor MAG Silver did not report recovery ratios in their reports. Fortunately, it is very easy to arrive at the figures discussed above. It is very simple math – you just have to know silver grades, the amount of ore processed and actual silver production. And these figures are available in the reports.

A quick look at Fresnillo plc strategy

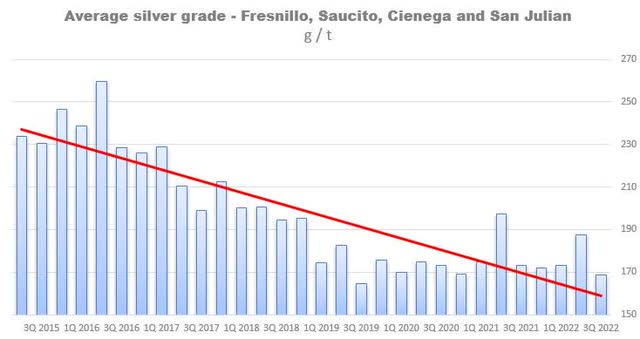

Apart from the issues attributable to Juanicipio, it looks that the company has a fundamental problem with its underground complex (Fresnillo, Saucito, Cienega and San Julian). Simply put, silver grades are in a long-term downward trend. For example, look what happened to these grades since the beginning of 2015 (look particularly at the red trend line):

It is easy to spot that the grades dropped from a peak of 230 – 250 g/t in 2016 to 170 g/t in 3Q 2022. To be honest, I am not surprised because falling grades are a typical pattern at underground mines in Mexico (it is a well-known geological phenomenon). To mitigate this negative pattern any miner has a few options:

- increase throughput

- build a new mine

- buy new assets on the market

- implement an aggressive exploration program

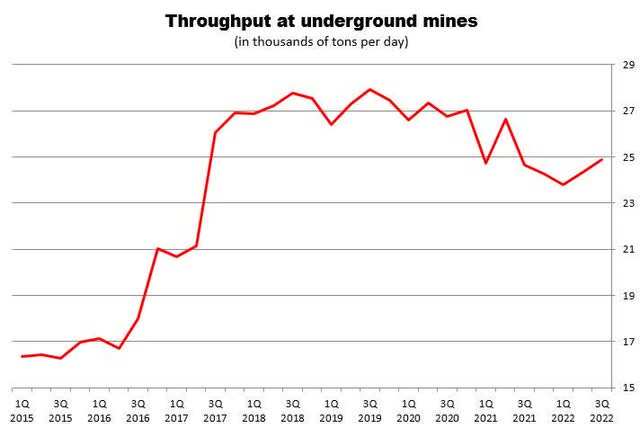

As for the first option, I guess it is not a solution in our case. As the chart below depicts, starting from 2017 the company did not increase throughput. In fact, it cut it a bit:

Ad. 2 – apart from Juanicipio there are two additional projects in the pipeline: Rodeo and Orisyvo. The company wants to put them online in 2025 and 2026 but no details have been released so far.

Ad.3 – this option is always available so who knows…

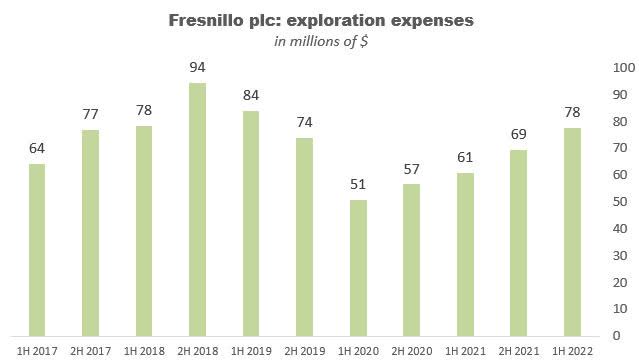

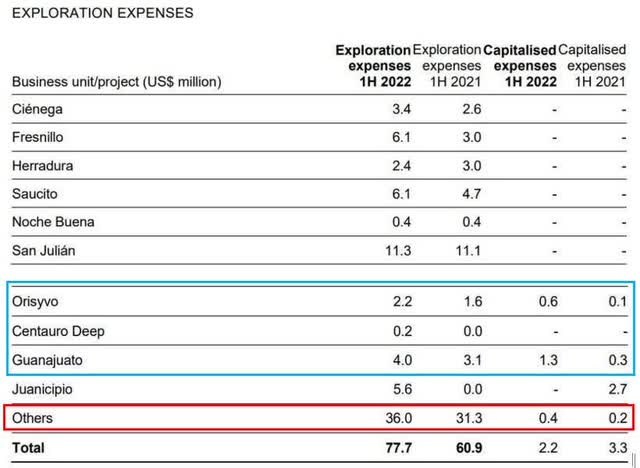

Ad. 4 – most recently this option has become a key one. As the chart below shows, since 1H 2020 Fresnillo plc has been steady increasing exploration expenses:

Simple Digressions

Interestingly, in 1H 2022 as much as 55% of exploration expenses were attributed to new projects (look at the blue and red rectangles below):

What is more, Fresnillo plc actively explores the properties located in different (than Mexico) locations, i.e. Chile and Peru:

An intensive field-based program is being carried out at several promising prospects in Mexico, Peru and Chile, where teams of our geologists are advancing mapping and geochemical surveys at a regional level, followed up by detailed analysis of targets identified using remote sensing and geophysical techniques. Drilling is scheduled at some of these projects in the second half of 2022 and during 2023, confirming our commitment to continuously strengthening our asset portfolio across metal price cycles using a disciplined “milestone completion”-based approach for budget allocation.

Summary

In this article I tried to identify an additional risk factor associated with development of Juanicipio, a new silver project located in Mexico. In my opinion, recovery ratios reported by Fresnillo plc are well below those disclosed in the latest economic study. If I am correct, Juanicipio will produce less silver than the company initially planned. In such a case, this new mine will be a negative surprise for Fresnillo plc investors.

As a result, I maintain my “SELL” recommendation for the stock.

Last but not least. Between 2Q 2017 and 2Q 2020 Fresnillo plc shares underperformed GDX, one of the most popular gold miners ETFs. I guess the main reason behind was the ongoing depletion of the company’s mineral reserves:

However, since 3Q 2020 the stock performed in line with GDX, as if investors expected a new, positive impulse delivered by Juanicipio. If my thesis presented in this article is correct, a new period of underperformance may start soon.

Be the first to comment