Mikhail Sedov/iStock via Getty Images

It’s been about 3 months since I recommended investors continue to avoid Trinity Industries, Inc. (NYSE:TRN) in an article with the very creative title “Continue To Avoid Trinity Industries Inc.” Since then, the shares have returned about 10.5% against a gain of 8.2% for the S&P 500. The company has reported financials since, so I thought I’d review the name yet again. I’ll decide whether or not it makes sense to buy based on the most recent financial results, and the current valuation.

We’re all busy. I’m sure that all of you are busy working out which supermodel you’re going to take out this weekend, or which high end resort you’re going to move to over the winter. For my part, I’ve got hours of “Days of Our Lives” to catch up on. For that reason, I want to offer you this time saving “thesis statement” paragraph, where I offer the gist of my thinking in a quick, easy to read summary. I think investors would be wise to continue to eschew Trinity Industries. The company has performed well in 2022 relative to 2021, but performance is soft when compared to the pre-pandemic period. Although the shares are cheaper, they’re not objectively cheap and that matters in a world where investors are offered alternatives. I think this stock is an “also ran” when compared to the cash flows of the 10-year Treasury Note, and the exposure to the freight car refit of FreightCar America. Additionally, in my prior work on this name, I concluded that the dividend is barely covered, and that management wasted over $833 million of investor capital on a buyback, and nothing’s happened in the interim to change my views on these scores. In the domain of investing, everything’s relative, and I think Trinity remains a relatively poor choice for investors at the moment.

Financial Snapshot

Before getting into the financial summary proper, I think it would be helpful to summarize my take on this company so far. In my most recent article on this name, I determined that the shares were less attractive on a risk adjusted basis than a 10-year Treasury Note, as the latter offered virtually identical cash flows to the dividends, at far less risk. I also concluded that the dividend is barely covered. Finally, I decided that the $833.4 million of investor capital spent on buybacks was an inferior use of capital, and it would have been better if management used that cash to pay down debt. That brings us up to speed in general, and I would point readers to my two most recent articles on this name for more detail.

Turning to the most recent period, it’s obvious that the company is improving in some ways. For instance, compared to 2021, revenue for the first six months of 2022 was ~43% higher, and operating profit is up by just under 17%. Additionally, income from continuing operations has swung from a loss of ~$6.7 million to $35.2 million. All that said, net income was off by $13 million, or 81%. The chief culprit for the turnaround in net income is the fact that net income from discontinued operations swung from a $13.9 million positive in 2021 to a $10.3 million negative in 2022. Additionally, the company took a $5.7 million net loss on the sale of discontinued operations during the most recent period. Thus, I don’t think the drop in net income from last year to this represents a pernicious, ongoing problem for the firm.

At the same time, the capital structure has continued to deteriorate, with long term debt up by 4.75%, or $250.9 million.

Also, I’ve begun to compare the most recent period to the pre-pandemic periods in order to offer greater context. After all, it’s one thing to be stronger than a period beset by a global pandemic. It’s another to be stronger than the pre-pandemic period. When we expand our view and compare the most recent six months to the same period in 2019, a much different picture emerges. Revenue during the first half of the current year is about 34% softer than it was in 2019, and net income is off by $63.9 million, or 95%. At the same time the capital structure has improved, as evidenced by the fact that long term debt is about $923 million higher now than it was in 2019. In my view the company has not fully recovered from the pandemic, as evidenced by the fact that 2022 performance is far softer than 2019 performance.

Given all of the above, I’d need to see the shares trading at a significant discount before I buy.

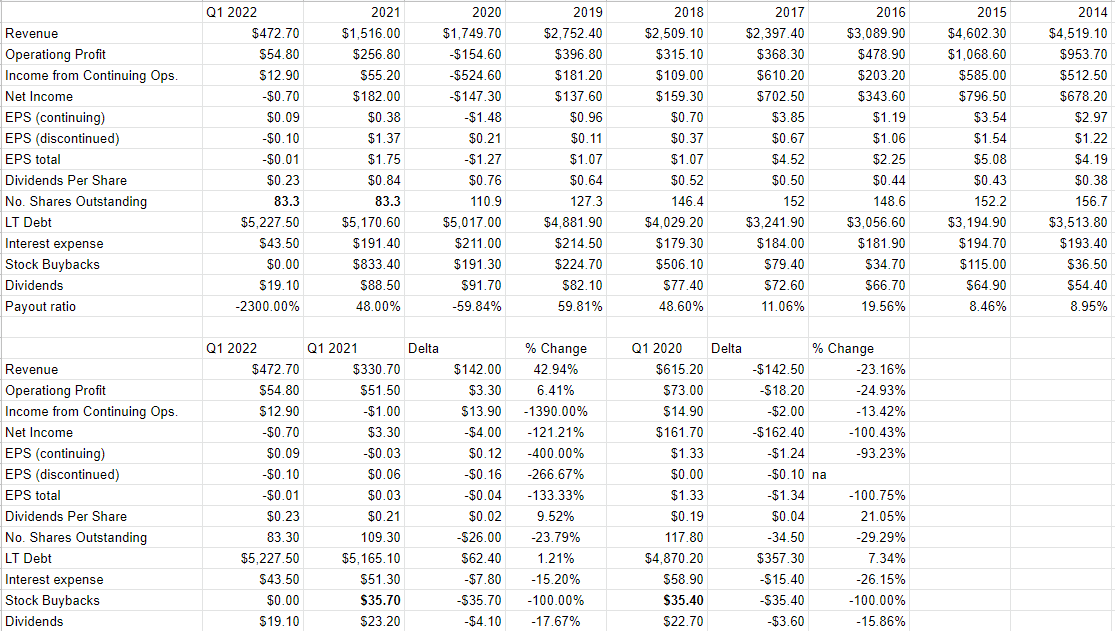

Trinity Financials (Trinity Industries investor relations)

The Stock

Since last I checked it seems that I’ve just experienced yet another bump in followers, which is simultaneously flattering and confusing. Anyway, welcome. You new people haven’t been exposed to my thoughts about the difference between a company and a stock, so welcome to the party. I am of the view that the business and the stock are very different things, and as such, we need to consider each of them separately when making a buy or sell decision. I’m of the view that a reasonably strong company can be a terrible investment at the wrong price, while a struggling company can be a decent investment if you pick it up at a sufficient discount to intrinsic value.

Another way to conceive of this idea is that business is an organization that buys a number of inputs, performs value-adding activities to those, and sells the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company. If you’ve invested in stocks previously, you may have noticed that the crowd can be capricious and has a tendency to drive prices up and down relatively frequently. Added to that is the volatility induced by the crowd’s views about a given sector. Greenbrier, FreightCar America, and Trinity, may go up and down together, for instance, after an analyst offers commentary on only one of these. Additionally, a company’s stock can be buffeted by our collective view about “stocks” as an asset class, and we see that the stock is often a poor proxy for what’s going on at the firm. This is frustrating in some ways, but it also represents opportunity for us. If we can spot discrepancies between the price and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. In my world, “down in the dumps” means “cheap.”

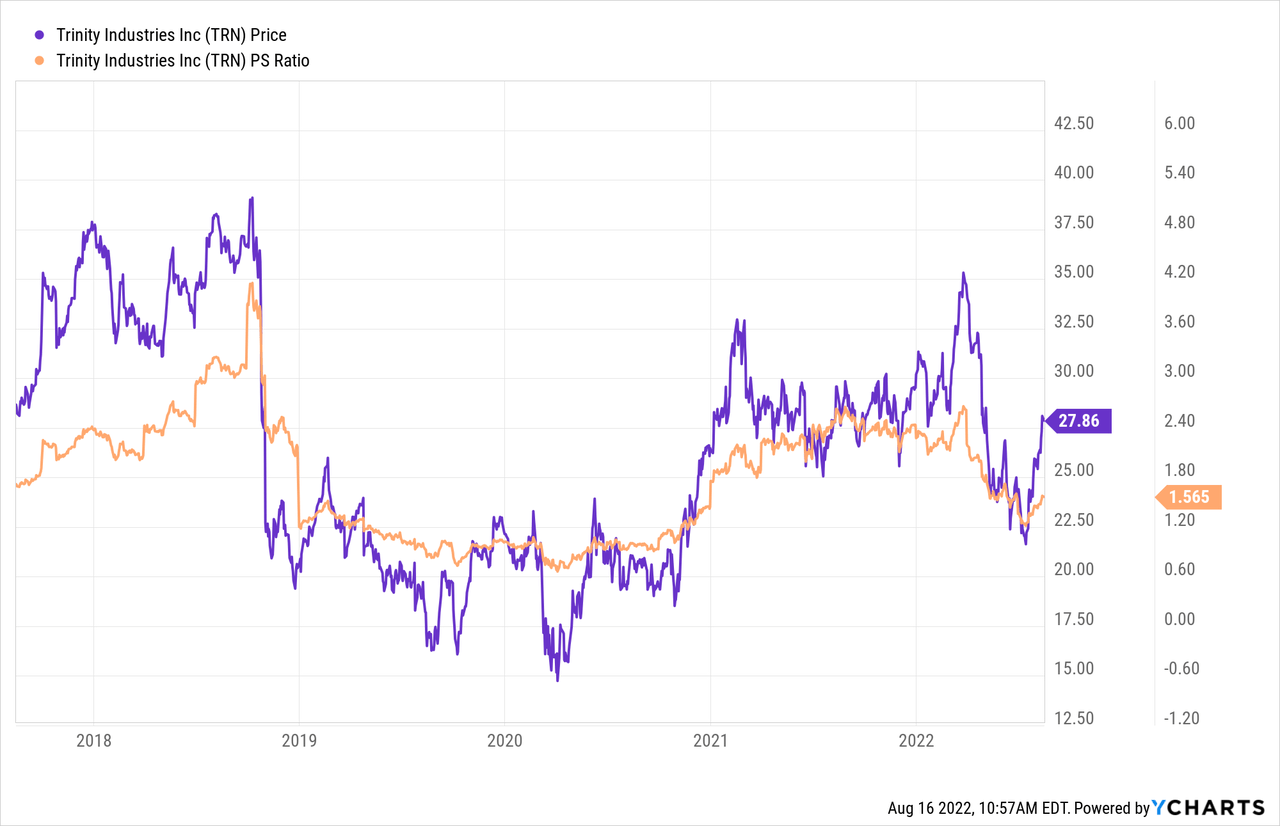

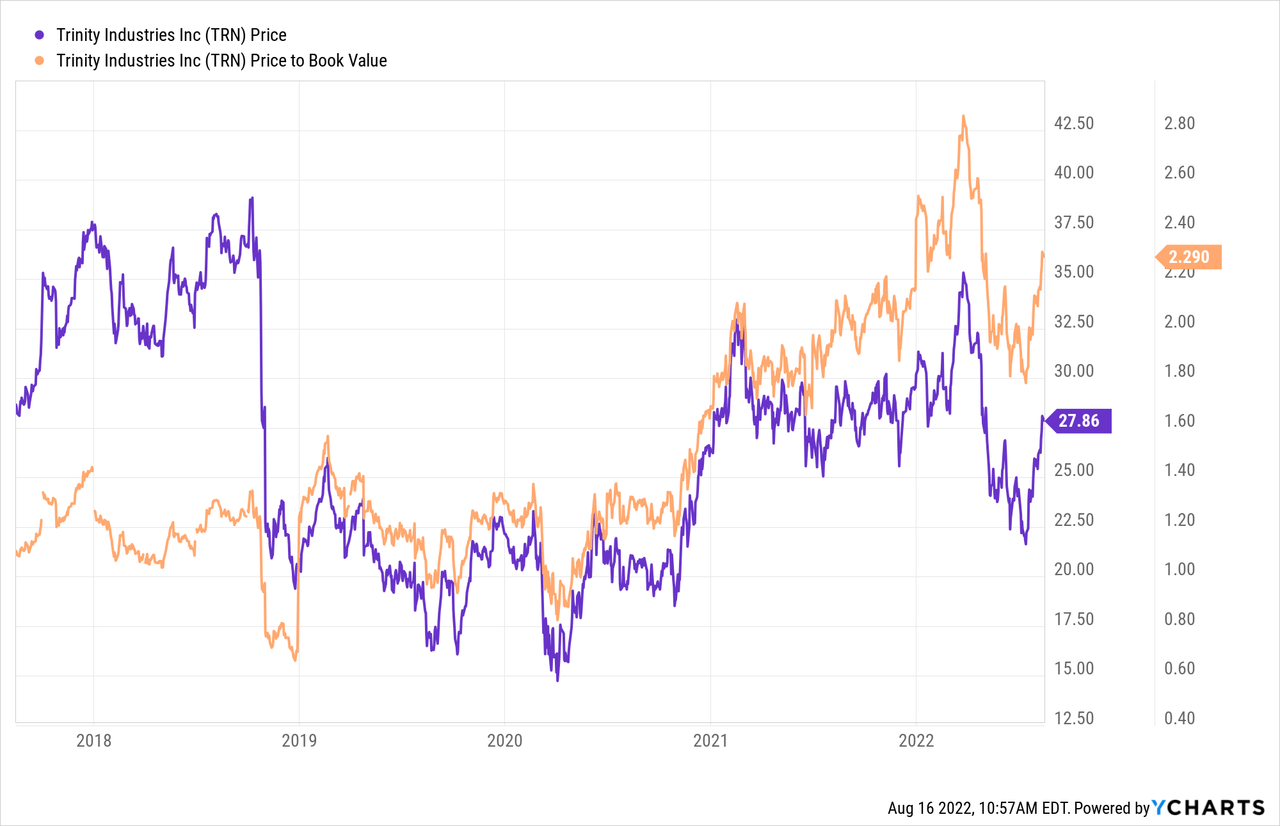

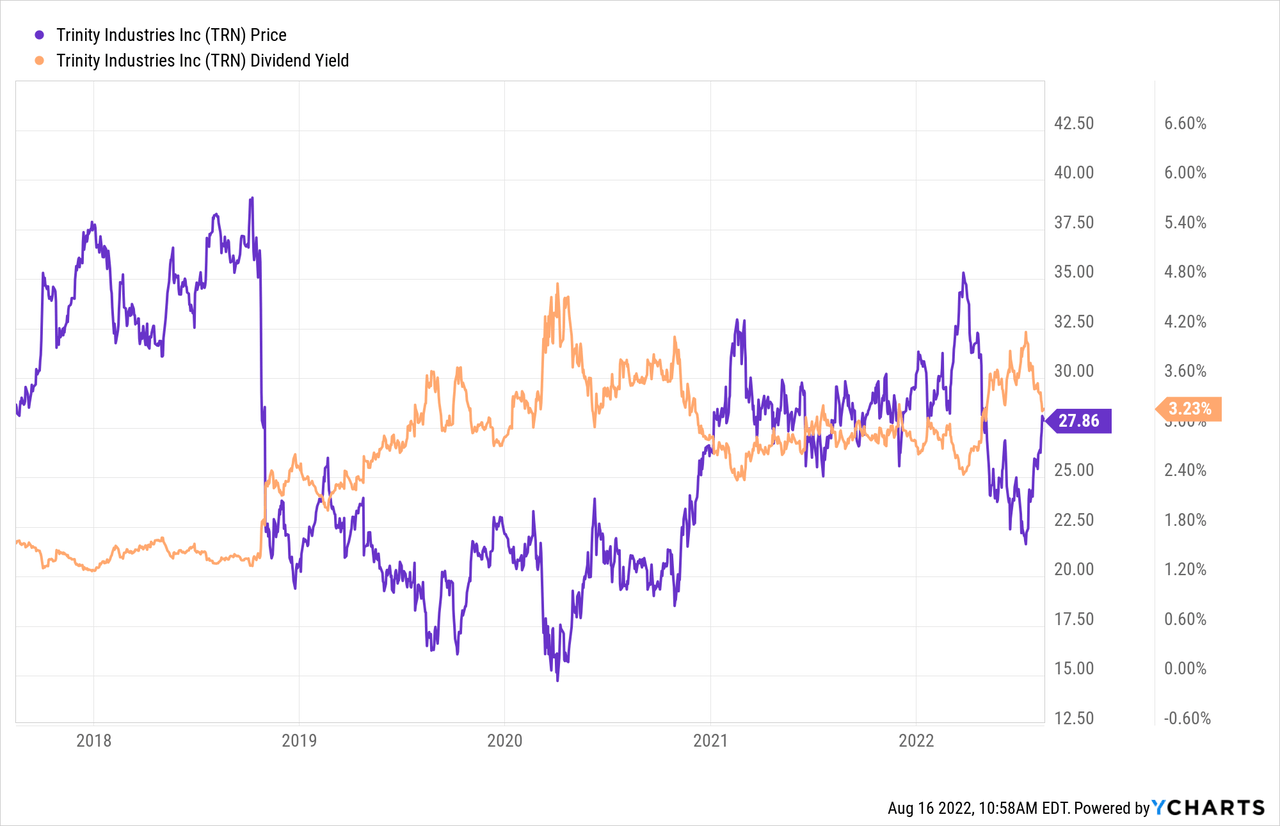

Those who read my stuff regularly know that I measure the cheapness of a stock in a few ways, ranging from the simple to the more complicated. On the simple side, I track multiples of price to some measure of economic value, like earnings, free cash flow, book value, and the like. Ideally, I want to see a company trading at a discount to both the overall market and its own history. When I last reviewed Trinity, I complained about the fact that the stock was trading at a price to sales ratio of about 2.15 times, price to book of 2.55 times, and sported a dividend yield of about 2.73%. Fast forward to the present and things look slightly better at the moment, per the following:

So, the shares are much more attractively priced now than they were. The question is whether they’re attractively priced enough.

Everything’s Relative

In the domain of investing, everything’s relative. If we buy X, we definitionally eschew countless Ys. With that in mind, in a world where we have limited capital, and we want exposure to the “railcar manufacturing space”, some investments are going to be superior to others. Given that I think it’s fairly plain that Trinity is a less attractive option relative to other investments, and for that reason I think it would be best to continue to avoid the name.

Conclusion

I think Trinity has improved fairly dramatically relative to 2021. The problem is that 2021 is not particularly representative. When compared to 2019, the most recent performance is unimpressive in my view. Additionally, while the shares are cheaper now than they were when I last reviewed this name, they’re not cheap enough in my estimation. This is driven home by the fact that there are better risk adjusted alternatives out there. If an investor wants stable cash flows, a 10-year Treasury Note is still a great option. If an investor wants exposure to the “railcar space”, FreightCar America is a superior option on that score. Thus, I think Trinity is an “also ran” type investment until performance improves and/or the stock drops massively in price from current levels.

Be the first to comment