Onfokus

Retirement is the one of the most important decisions anyone will make during their lives. The classic movie Wall Street (1987) has a famous quote:

“Life all comes down to a few moments. This is one of them.”

Retirement is one of those moments. So that means planning ahead, double and triple checking your plan, reading and learning about the latest information, and making sure you’re not doing anything silly. What does silly mean in this context? Something that’s not mathematically proven to help out.

In this context, we want to discuss some assumptions of a recent Seeking Alpha article, titled “Why Millennials Should Aim For $4 Million For Retirement“, specifically for the 85% of the population who does make the $100k/year that’s assumed in the article.

We do want to highlight that this article isn’t a negative opinion on the original article, but mainly a focus on some aspects we feel are essential for retirement.

Inflation

It’s been the rage recently to talk about the recent bout of inflation.

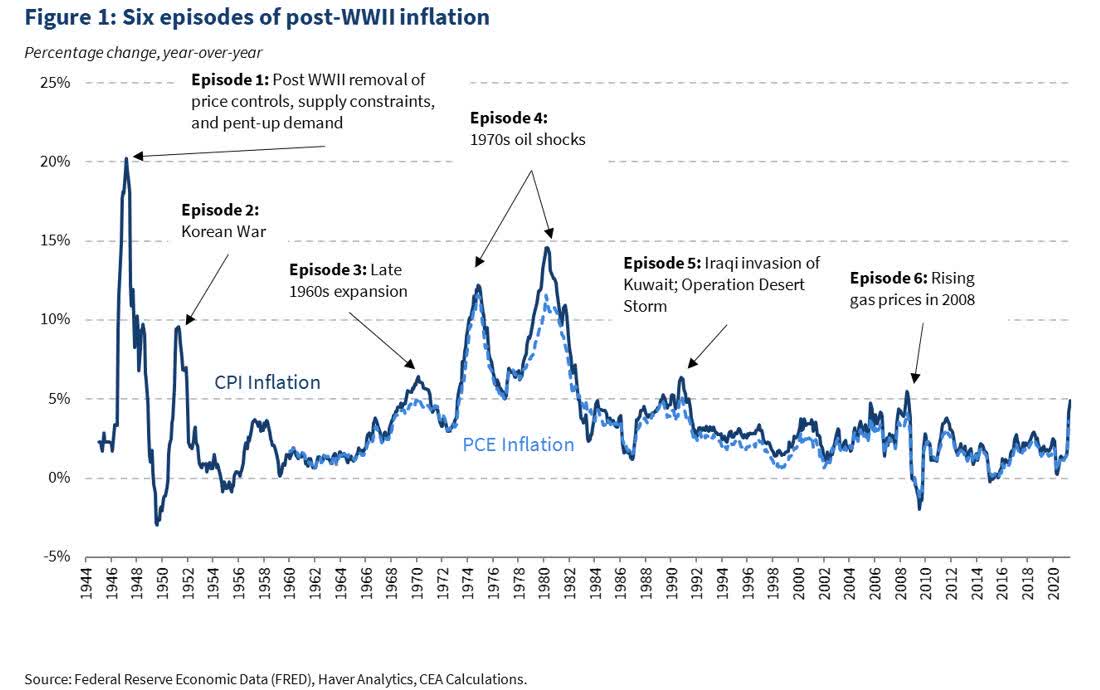

White House

That’s despite the rate of inflation being historically much more volatile than many remember in a 1-2 decade time period. In fact, from a historical perspective, the inflation that existed in the markets from 2008-2021 was abnormally low in most regards. It’s also worth noting that many major inflationary contributors in 2022 are seen as transitory.

Used-car prices were a major contributor to inflation, heavily driven by the new car chip shortage, and are now seen to be calming down. Similarly Brent, which peaked at more than $120 from the Russian invasion of Ukraine, has also started to settle, partially as a result of an expected recession from rising interest rates.

The Bird Flu has pushed up the price of eggs, although that’s also settling down. Similarly, incredibly high rates of international shipping have also slowed down substantially. There are many signs that inflation rates are slowing down, and we expect that trend to continue. However, regardless of what happens, inflation fears have been cemented into a generation.

The $4 million saving implied is $4 million in inflation-adjusted dollars in the article which at assumed 3% 30-year inflation rate is more like $1.65 million in today’s dollars. That’s a much more manageable number. We don’t feel that the inflation rate is invalid, but it’s worth noting that it’s perhaps more worth to pay attention to the S&P 500’s long-term inflation adjusted returns of 6.5%.

Early Investment and Free Money

There is one thing that we’ll highlight.

The other article already does a great job of discussing the importance and benefits of an early retirement. We’ll skip over the math of that besides a brief point. Assuming 6% in annual returns, $1 saved and held for 40 years is worth $10.28. The same amount for 20 years is worth $3.28. That’s because the extra 20 years is not your $1 growing, it’s your $3.28 growing.

That math is important to keep in mind.

The second part is that whenever you start investing, and especially if your funds are limited, it’s important to do whatever you can to take advantage of free money. That means if you don’t have enough money to max out your 401k, don’t ignore it and avoid saving. Instead, if your company offers a corporate match, invest just enough to take advantage.

The same is true for tax-advantaged accounts such as a triple-tax advantaged account like an HSA, especially if your company offers a match. It’s the only triple-tax advantaged account there is. And if you don’t spend the money by retirement, it essentially becomes a 401k account that you can take advantage of.

Social Security and Medicare

The other aspect worth paying important attention to is that there’s plenty of benefits in this country for retirees.

71% fear that social security will run out, including many in the younger generation. There is a risk that social security will run out if Congress doesn’t make changes, especially in the use of current fundings to fund future spending. However, even in that case, retirees will still receive 77% of their promised benefits, a sizable sum.

Additionally, while the United States has continued to fight against socialized healthcare, it does already run socialized healthcare for retirees in the form of Medicare.

Infographic![How U.S. Healthcare Spending Per Capita Compares With Other Countries [Infographic]](https://static.seekingalpha.com/uploads/2022/11/27/saupload_0x0.jpg)

Given the U.S.’s massive healthcare spending per capita, a side effect of a major for-profit system, we expect the U.S. to eventually move to a Medicare-for-all system at least as a baseline insurance on top of private insurance that’s provided. Especially with the young already paying taxes for the old through Medicare.

This remains unpopular but support is growing especially among the younger generation. This is important given that healthcare is one of the most difficult to plan for expenses for retirees.

The Past Doesn’t Guarantee The Future

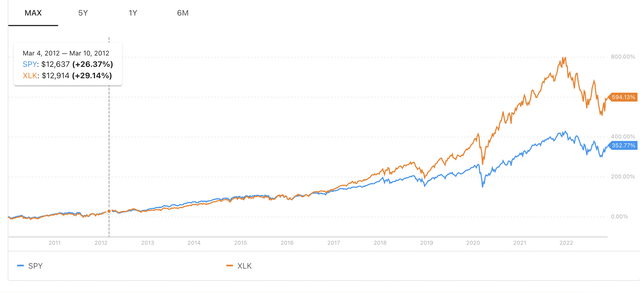

One thing we want to highlight is the past doesn’t guarantee the future. This was evident in the other article with a 15% weighting towards technology stocks.

The above graph shows the S&P 500 versus XLK performance difference during the most recent bull market. Once the divergence hits in early-2017, it continues even with the recent decline, primarily as a result of multiple expansion. That era, in our view, is over. Especially in an environment where interest rates are rising.

Despite the popular lore of including an extra technology weighting in a portfolio, even with recent underperformance where large technology companies have outperformed the market, we see this as a recipe to underperform going forward. Stick with the tried and true when investing in a total market fund.

And any time shiny other opportunistic investments appear, keep in mind, the past doesn’t guarantee the future.

Our View

As a young person looking to retire, the world is convoluted and confusing.

Despite an older generation that thinks that things are just as hard as they were when they were a kid, it’s clear that the market has changed substantially. We’re guilty of the same assumption.

Medium

Housing costs have more than doubled as wages have stagnated. College tuition costs have skyrocketed despite a degree being required for an average job. It’s easy to feel disenchanted with the system especially when that meager income gets taxed for social security for a generation that didn’t bother to set aside enough money for themselves.

It’s also easy to feel disenchanted when retirement advisement articles are assuming $100k in average income as a starting point, more than 85% of your peers. Despite all this, there’s a number of concrete steps one can take for retirement. First, stick to the tried and true. Second, invest even smaller amounts but take advantage of market discounts, etc.

That combination can help retirement outperformance. Let us know your thoughts in the comments below.

Be the first to comment