vuk8691/iStock via Getty Images

This is my first look at Mirati Therapeutics (NASDAQ:MRTX), a stock with multiple catalysts. Mirati boasts a $5.6 billion market cap. It has no FDA approved products, nor any product revenue (10-Q, p. 50). It does have several important collaboration agreements and several late-stage trials with key upcoming catalysts.

Here I assess Mirati’s near-term investment prospects.

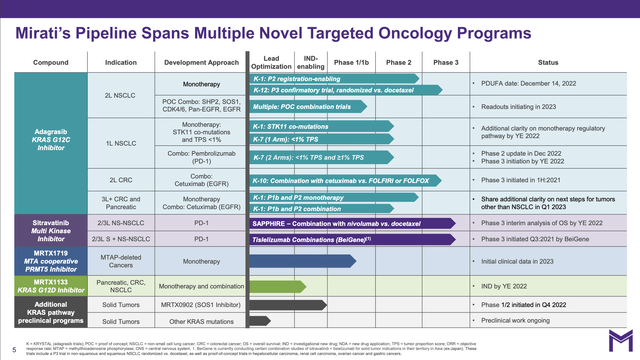

As revealed by its pipeline, Mirati has several late-stage oncology trials.

Mirati’s Q3, 2022 earnings presentation slides (the “Presentation”) includes the following pipeline slide:

This pipeline includes four therapies in phase 3 studies. Its lead therapy is adagrasib for treatment of non-small cell lung cancer, “NSCLC” discussed in detail below. Its other three phase 3 level therapies include:

- sitravatinib (MGCD516) in combination with Bristol Myers Squibb’s (BMY) OPDIVO in treatment of patients with NSCLC who have experienced documented disease progression following treatment with a checkpoint inhibitor;

- sitravatinib in combination with tislelizumab, BeiGene’s (BGNE) anti-PD-1 checkpoint inhibitor being developed in certain Asian territories in collaboration with BeiGene, which is evaluating sitravatinib, in a number of advanced solid tumors;

- adagrasib in combination with cetuximab in second-line colorectal cancer with KRAS G12C mutation.

During Mirati’s Q3, 2022 earnings call (the “Call”), founder and president Baum discussed item 1 above, combination sitravatinib in treatment of patients with NSCLC. Mirati will report interim results for overall survival from this SAPPHIRE registrational trial this quarter. He characterized the trial as well-designed and adequately-powered.

If the results are positive, Mirati will file for full approval in the US and the EU in mid-2023. He characterized the market for second or third-line non-squamous non-small cell lung cancer in the US and EU as including up to 70,000 people.

Mirati is launch ready in the event of a favorable response to its 12/14/2022 adagrasib PDUFA in treatment of NSCLC.

In 02/2022 the FDA accepted Mirati’s NDA for adagrasib as a second line treatment for certain patients with non-small cell lung cancer (NSCLC). It set a PDUFA date of 12/14/2022. It announced that the approval was:

…being reviewed by the FDA for Accelerated Approval (Subpart H), which allows for the approval of drugs that treat serious conditions, and that fill an unmet medical need based on a surrogate endpoint. In addition, the application is being reviewed under the FDA Real-Time Oncology Review (RTOR) pilot program, which aims to explore a more efficient review process that ensures safe and effective treatments are made available to patients as early as possible. Adagrasib has also achieved Breakthrough Therapy Designation in the U.S. as a potential treatment for patients with NSCLC harboring the KRASG12C mutation who have received at least one prior systemic therapy.

The FDA initiated its RTOR program in 2017. Based on early returns, there are indications that participation in it enhances the likelihood of favorable FDA response.

During the Call, it reported that it was fully primed for a favorable ruling. It cited a four-pronged preparation that was a ready to roll, including:

- a fully integrated team of market access, sales and medical affairs supported by a unique digital platform,

- team focus on delivering adagrasib to the oncologists, HCPs and people living with cancer that we serve,

- team interaction with nearly all of the top payer plans across the country, receiving positive feedback on a unique profile of adagrasib,

- work on market development opportunities such as increasing both testing and identification of KRAS G12C-eligible patients, particularly in the community setting where over 40% of our pivotal study was enrolled with a best-in-class distribution and patient assistance program.

Management is optimistic that adagrasib’s clinical profile will ensure positive reception to its marketing initiatives. During the Call, it cited several positives including a 44% response rate coupled with 14.1 months of median overall survival, attributes demonstrated in the pooled analysis presented at ASCO. Importantly, these were coupled with low treatment related discontinuation rates.

Beyond an imminent FDA decision on the pending PDUFA, Mirati is actively pursuing its first line NSCLC treatment. Its approach here is a combination therapy of adagrasib at 400 milligrams twice daily with full dose pembrolizumab. It is evaluating its preliminary data on the safety and tolerability of this combination with a full rundown at next month’s ESMO IO.

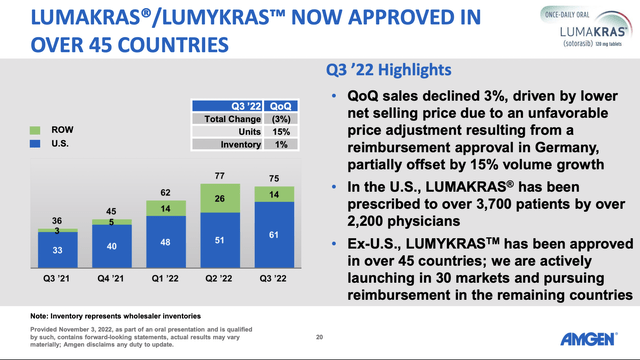

In response to a question during the Call as to how an adagrasib rollout might compare to Amgen’s (AMGN) LUMAKRAS, CEO Meek noted that LUMAKRAS had an 18-month head start. As second to market, certain early access patients would not be available to adagrasib. He expects adagrasib’s early launch metrics to trail those of LUMAKRAS but for it to assume market leadership over time.

With this introduction, the following slide from Amgen’s Q3 2022 slide deck gives a helpful preview of adagrasib’s likely early revenue:

During the Call, CCO Hickey described how Mirati hoped to differentiate itself positively in its launch compared to LUMAKRAS. However, initial adagrasib sales will likely be significant, but on their own will fall far short of supporting Mirati’s hefty current market cap.

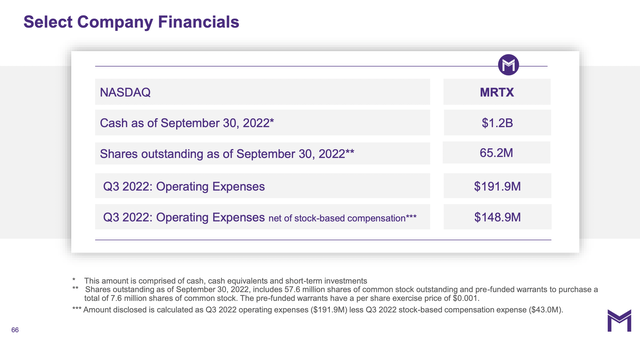

Mirati’s finances are solid for the immediate future.

The Presentation slide captioned “Select Company Financials” provides a good overview of Mirati’s financial posture:

Its aggregate operating expenses of $191.9 million whittle its $1.2 billion down to a liquidity runway of a comfortable, but not luxurious, ~6.3 quarters. It does have occasional income inputs from sporadic collaboration deals, as described in the Call. For example, during Q3, 2022 it recognized a $5 million milestone from Zai Lab based on a pivotal clinical study for adagrasib.

In Q3, 2021 its income inputs were more significant; they included:

…revenue of $71.8 million in third quarter of 2021, …[including] $66.6 million of revenue associated with the transfer of the license and know-how of adagrasib as part of our agreement with Zai Lab and a $5 million milestone payment from BeiGene associated with the start of the first pivotal sitravatanib clinical study in the BeiGene-designated territories.

As for both its R&D and SG&A expenses, these have both been growing significantly on a quarter over quarter basis as reflected during the Call:

Research and development expenses for the third quarter of 2022 were $131.1 million compared to $116.1 million for the same period in 2021. The increase is primarily due to an increase in salaries and other employee-related expenses, including share-based compensation expense associated with an increase in head count to support our growing pipeline.

General and administrative expenses for the third quarter of 2022 were $60.8 million compared to $35.2 million in the same period in 2021. The increase is primarily due to an increase in commercial readiness costs in preparation for a potential product launch, an increase in salaries and other employee-related expenses, including share-based compensation expense, as we grow our sales, marketing and G&A staff and an increase in facilities and IT costs to support the organization.

Ouch, the launch preparedness that Mirati bragged about during the Call has not come cheap. With general and administrative launch readiness costs of ~$25 million a quarter, it is easy to see how an approval for adagrasib’s initial indication may fall short in terms of earnings.

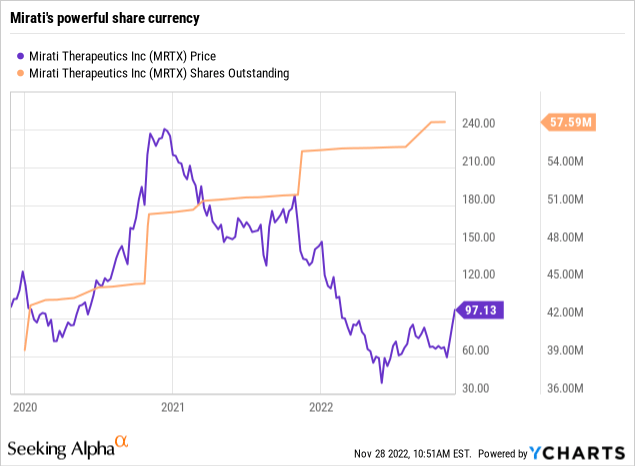

Mirati’s shares have provided it with a significant liquidity buffer, as reflected by its price chart below:

In 10/2020 it sold 4 million shares at $202 per share. Its latest 10-Q (p. 26) reports net proceeds of $474.7 million from public offerings in 2021. In 2022, it has sold 1,880,097 shares for net proceeds of $155.0 million, averaging ~$86 a share.

Shareholders would be well served if a buyout as rumored actually occurred.

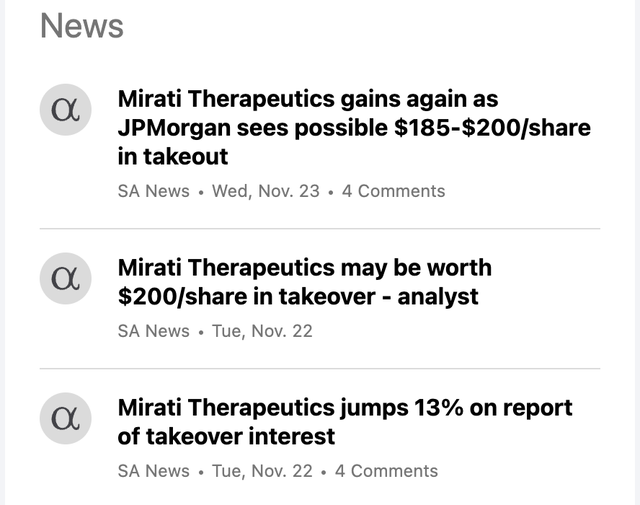

As I write on 11/28/2022, Mirati’s Seeking Alpha news feed is rife with buyout rumors, as shown below:

These articles cite a paywalled Bloomberg report that Mirati has been weighing strategic alternatives, implying that it might welcome such a result. Its founder and initial CEO Baum is transitioning to president and retiring in Q2, 2023. Although his share ownership is modest, his pending retirement nonetheless marks a time for corporate evaluation.

Conclusion

Mirati has built an impressive franchise of therapeutic cancer molecules in various stages of development. Unfortunately, its nearest term opportunity with its fast approaching 12/14/2022 PDUFA looks to be an economic dud even if the FDA gives it a green light when measured by Amgen’s LUMAKRAS launch.

Its next nearest opportunity, sitravatinib in combination with OPDIVO, has potential for FDA submission in mid-2023. If all goes well, it might reach the market in mid-2024. We have no indication of its market potential; except, we do know that it:

- is a combination therapy which creates special challenges, and

- it has a potential patient user group of 70,000.

Accordingly, Mirati’s near term market price will likely continue to be hard to peg. During 2022 it has moved from a high of $151 on 01/02/2022 (0.344 million shrs sold) at the start of the year to a low of ~$33 (12,888 million shrs sold) on 05/27/2022, back up to a high of ~$99 (0.926 million shrs sold) on 11/28/2022.

The low in May coincided with a data readout showing similarity of full dose LUMAKRAS and adagrasib monotherapy. The price has recovered and is moving sporadically up and down in response to the latest news reports (data readouts, earnings reports, analyst reports).

It will likely continue to bounce until it is able to show significant revenues to support its outsized market cap.

Be the first to comment