Peter Macdiarmid/Getty Images News

Introduction

Amazon.com, Inc. (NASDAQ:AMZN) is betting big on “The Lord of the Rings,” possibly pouring more than $1 billion into the upcoming series. How much is this investment worth for Amazon, and what is the benefit it will gain from this? In this article, I will try to put together the available date to give a valuation of Amazon’s investment and its possible returns.

The series

The Lord of the Rings: The Rings of Power series will premiere on Friday, September 2, 2022, on Amazon Prime. The premiere will be available in 240 countries, with new episodes released weekly for a total of 8 episodes.

The series was announced back in 2017. It was supposed to be released last year, but the shooting was slowed down due to the covid-19 pandemic.

The expectations for this series are high, and Amazon declared that its Super Bowl teaser trailer broke every viewing record and became the most watched super bowl trailer, with 257 million views in the first 24 hours.

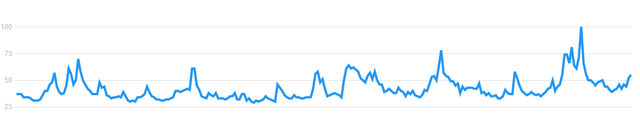

Google Trends, too, registered a peak during the last Super Bowl. It is now showing that, over the past month, the interest for “The Lord of the Rings” seems to be moving upwards once again. We can expect the interest to further increase as we approach the premiere.

“Lord of the rings” searches on Google from 2017 (Google Trends)

Tolkien fans have waited a long time for new movies that would take them back to Middle-Earth. However, fears of another disappointment after The Hobbit trilogy are making many fans more cautious about the new series, waiting to view it before celebrating its release.

The Lord of the Rings deal and production costs

The rights

One note: Amazon is notoriously wary about giving detailed information about its investments and the breakdown of its returns. This is why, on one side, I researched as thoroughly as possible to find correct data, while on the other, I will still have to make some assumptions. I will make them as conservatively as possible, to convey a realistic idea of the deal.

At first, we had no idea how much Amazon bid to purchase the television rights. However, as some news came out, it became known that Amazon spent $250 million to buy the rights from the Tolkien Estate.

The second problem, which is still somewhat unresolved, has to do with the sources the rights give access to. At first, it was thought that Amazon only had the rights to the appendixes of The Lord of the Rings. However, as some news was released, one of the main websites of the Tolkien fandom, theonering.net, theorized that Amazon seemed to have rights to The Silmarillion and The Unfinished Tales, contrary to what had been previously believed. Theonering.net said that there were elements and passages that could come only from these books and not from the appendixes. The article also reported that Amazon had to work closely with the Tolkien Estate to make sure the series didn’t wander astray from the real inventions of Tolkien and that, so far, the Tolkien Estate had been very happy with Amazon Studio’s work, to the extent that it has widened the horizon of the purchased rights. Furthermore, it was reported that Amazon also acquired merchandising rights.

None of this has been confirmed. Recently, Vanity Fair interviewed the writers of the series, Patrick McKay and J.D. Payne. When asked about the sources of the series, Payne gave a clear answer:

We have the rights solely to The Fellowship of the Ring, The Two Towers, The Return of the King, the appendices, and The Hobbit. And that is it. We do not have the rights to The Silmarillion, Unfinished Tales, The History of Middle-earth, or any of those other books.

We will have to wait for the series to reach full certainty about this, but I think it is fair to assume that Payne told the truth.

There is also uncertainty on how long the series will last. For sure, we know that Amazon is already working on the second season. However, it is widely believed that Amazon will produce five season for about 50 hours of content, as J.D. Payne seems to have told to Empire, revealing the length of the show and that the showrunners already know what the final shot of the last episode of the series will be. Thus, each season should have 8 episodes of about 1hr 15 minutes apiece. From the premiere date, episodes will be released weekly, keeping viewers’ attention up and hungry for the unveiling of the story.

In any case, let’s start keeping track of our numbers. So far, we have a cost of $250 million. We can assume that its amortization will be evenly split among the five seasons, so that we can account a $50 billion rights cost for each season.

Production costs

Amazon has done a lot to keep things as secret as possible about the production of the series. Leaks were not allowed, upon penalty of being laid off; false shootings were arranged to further throw off journalists and fans who wanted to sneak around.

The shooting and the production cost of the first series have also been uncovered through some information leaked from New Zealand, where the first season was shot. Thanks to a deal Amazon and the New Zealand government signed, we know that Amazon spent $465 million just for the first season.

As announced last summer, Amazon is relocating season two’s production to the UK, where at the beginning of this year pre-production has already started. I think this will allow Amazon to spend over the next four seasons a bit less, since it is going to use its studio space across the U.K, thus scaling its investment. However, I would still expect a production cost of $400 million per season, given the huge efforts Amazon is pouring into this endeavor.

Since we know for sure Amazon is already working on the second season, we can assume that, so far, Amazon has deployed around $865 million for production.

So, here is our second cost: $865 million. The total budget for five seasons, however, could be something around $2 billion, making the series, by far, the most expensive in history.

For the sake of comparison, 20 years ago The Lord of the Rings Trilogy had a budget of $400 million and grossed almost $3 billion. The following trilogy The Hobbit, although disappointing, still earned another $3 billion on a $750 million budget.

Even though Amazon’s spending seems – and actually is – huge, if we put it into the more general context of Amazon spending on content, we see that, although it is a major bet, it is just a part of a more general investment on content that in 2021 saw Amazon spending $13 billion. This is getting close to the $17 billion spent by Netflix (NFLX) in 2021.

Investment return

How is Amazon going to earn a return on this huge investment? There is only one way Amazon will get directly paid for this series: Amazon Prime subscription fees. So, the question now becomes: how much does Amazon earn from each Amazon Prime member?

How Amazon understands Prime

Amazon’s managers have explained over and over to investors how they see Prime. In particular, it has been explained more than once why the company is spending an increasing amount of money on Prime Video. For example, Brian T. Olsavsky, Amazon’s CFO, during the Q3 2017 earnings call (at that moment, Amazon was bidding for the rights to the series but it still hadn’t disclosed the deal, which would have been signed just a few weeks later) said (bold is mine):

We’re going to continue to invest in video and increase that investment in 2018. And why are we going to do that? It’s because the video business is having great results with our most important customer base, which is our Prime customers. It continues to drive better conversion of free trials, higher membership renewal rates for existing subscribers and higher overall engagement. We’re seeing the engagement go up year-after-year in video and also music and a lot of the other Prime benefits. We also know Prime members who watch video also spend more on Amazon.

And we have a lot of data where that’s the advantage we have is that we see the viewing patterns, and we also see the sales patterns, so we can tie the two together and understand which video resonates with Prime members, which video doesn’t, and make mid-course corrections. So we always do that. We’re always changing the emphasis and looking for those more impactful shows, more shows that resonate better with our customer base, and things they want to see. So that will always be an important part of our Prime offer, and we’ll continue to use the data that we have to make better and better decisions about where to invest our dollars in Prime Video.

Amazon will not give us the numbers to understand what better conversion rate, higher renewal rate and higher engagement mean. Nor will Amazon tell us how much Prime members who watch Prime Video spend. However, the size of the investment Amazon is making suggests that we are talking about a double to triple-digit return in billions.

Just to stress this point, Dave Fildes, Director of IR at Amazon, explained that Prime is indeed thought as a program where members get more and more involved and, consequently, spend more as they learn to benefit from all the features. These are his words during Q4 2017 earnings call:

We continue to see that as Prime members sign up and engage into the program, their purchasing patterns of change and they do spend more as they move into the program.

That Prime members progressively shop more often with larger basket sizes was highlighted once again by Brian T. Olsavsky, during the Q2 2020 earnings call:

We’re seeing good pickup in frequency and basket size for new members in Prime as well, certainly not the same as people have been Prime members for a number of years.

Again, as the pandemic had been around for about a year, Amazon continued reiterating this point, stating during the Q4 2020 earnings call that:

Prime members continue to shop with greater frequency and across more categories than before the pandemic began. Prime members also continue to expand their usage of Prime’s digital benefits including Prime Video and Prime Video channels.

Just a quarter afterwards, David Fildes, in the Q1 2021 earnings call, explained that the role of Prime Video is to attract new customers into the program and increase the already high retention rate. In other words, when Amazon loses just one Prime member, it is one too many:

Just in terms of strategy, I think there’s probably nothing new or surprising, but just to reiterate it, we look at Prime Video as a component of the broader Prime membership and making sure it’s driving adoption and retention as it is.

This is why Amazon has started to spend a lot on content to the point that Brian T. Olsavsky, in the Q4 2021 earnings call, declared that since 2018, Prime Video has tripled the number of Amazon Originals.

The Lord of the Rings series is thus both the peak of an intensive investment and the foundation to build an even broader base.

Amazon Prime subscriptions

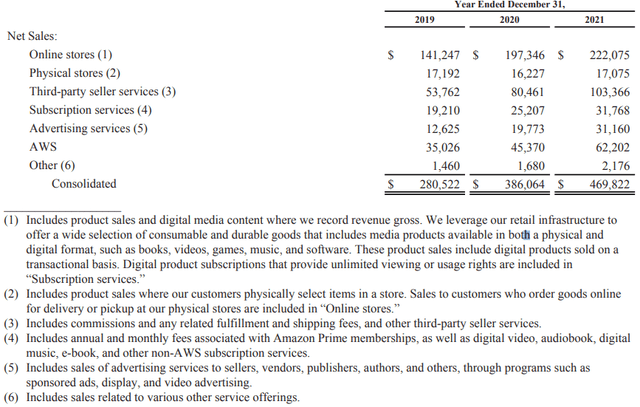

Once again, Amazon is quite jealous of its numbers and doesn’t provide exact breakdowns of more general accounting voices. In 2021, Amazon reported a total subscription net sales of $31.77 billion, even though we don’t know exactly the percentage that comes from Prime. However, since subscription doesn’t account for AWS services, we can be close enough when we think that the majority of this revenue comes from Prime membership fees, since there are not many people who subscribe only to e-book or audible or digital music without being Prime members, too.

So, we don’t know the exact number of Prime subscriptions, even though we know that at the end of 2021 there were more than 200 million members, as said in the shareholder letter. About 175 of these members use Prime Video. More than 75% of Prime members are in the U.S., with around 160 million American users. The remaining 40 million are international users.

Starting this year, in the U.S. Amazon charges $139 annually for Prime membership, while in other countries fees are lower, since the program is still at its early stages and needs to grow. The numbers show us one thing: while the U.S. market seems almost saturated and so the likelihood of Lord of the Rings fans not being Prime members is low, there is ample space for Amazon to grow internationally. Now, with the Lord of the Rings fan base spread all over the world (The Lord of the Rings books has been translated into around 40 languages and has sold more than 150 million copies), the likelihood that these fans aren’t yet Prime subscribers is higher.

How much is a Prime member worth for Amazon? Again, we don’t have much information from the company, but a recent survey reached the results that a Prime member spends on average $1400 on Amazon, versus the $700 spent by non-Prime members. So, we can say that every time Amazon gains a Prime member it is gaining its annual fee plus an extra $700 in spending that will be deployed during the year.

At the same time, Prime is sticky because it creates value for its members too. In his last letters to the shareholders before resigning as CEO, Jeff Bezos estimated that Amazon created a $630 value for every Prime member, after subtracting Prime costs.

So, we can see that the membership is a win-win situation. Customers save a little less than what Amazon earns as a result of the use of Prime.

We can now draw a first number on the income side: $700 per Prime user. However, this is a revenue and we will need to go deeper to reach the real profit Amazon earns from this number.

Amazon Prime members lifetime value

Let’s imagine that Amazon were to repay its Lord of the Rings investment through Prime fees. Let’s assume that new members will come only from outside the U.S. and that the average annual fee is around $80. In this case, Amazon would need 12.5 million new subscribers in one year to cover the current cost of $1 billion.

Even though the series has a large fan base, I doubt Amazon will be able to gain 12.5 million new subscribers just with the release.

However, Amazon is not focused on immediate return, as Josh Tarasoff explained ten years ago in a key essay I use to understand Amazon. In fact, the company has an outstanding track record to deploy capital that is able to generate huge returns over the long-term. When Amazon gains a Prime subscriber, it is not thinking about additional income for the current year, but it is giving a value to the subscription over a longer time frame.

As per statista.com found, Amazon’s Prime member retention rate after 1 year is 93%, 98% of which renew for a second year. This means that, for every 100 new members, Amazon will still have 91 subscriptions after two years, which are then likely to become loyal Prime members.

Now, with the available data from Amazon annual report, I tried to give an estimate of the value of a current Prime member and the one for a newly added member.

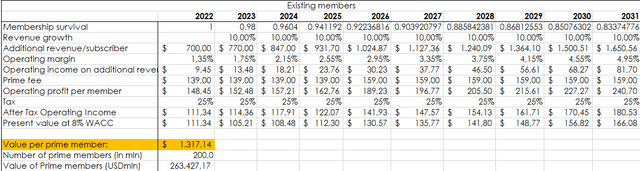

I started from the additional revenue per subscriber that Amazon earns for every member. I assumed the churn rate provided by Statista and then a yearly revenue growth of 10% for Prime members (given both from inflation and increased spending). The operating margin is very conservative and is very low due to the huge amount of money Amazon is spending to build up its business. I assumed that the margin will grow by 0,4% per year, knowing that this is one of the most unreliable assumptions that depend a lot on Amazon’s decision to switch or not into profit mode. To the operating income I then add each year the membership fee, which is earned money that goes directly to the bottom line. Regarding the membership fee, I assumed that Amazon will raise it once again in four years by $20. I probably could plug in another $20 hike after another 4 years, but I am staying conservative. Finally, I calculated an operating income after tax to reach the present value of a Prime member. I repeated this for the next decade and discounted the future value at an 8% WACC.

Author with data from Amazon 2021 Annual Report

With this forecast, I reach a value that seems fair enough. A present member’s value for Amazon is $1.317,14. This means that just with 759k actual members, Amazon is receiving a value close of $1 billion, enough to cover the current investment. However, we may assume that current Prime members are already paying for other investments and that Amazon needs to increase its membership to cover the Lord of the Rings series.

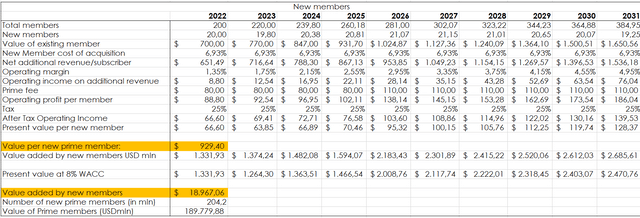

So, what about new members? In my forecast, I expect Amazon to grow its subscribers by 10% this year. I then decrease the percentage by 0.5% every year. I subtract from the additional value brought to Amazon by a Prime membership the cost of acquisition, whose percentage I reached by calculating the weight of marketing costs on total sales. I also assumed that the membership fee is around $80, to then increase by $30 as the international markets mature. As I did above, I summed up the operating income on the additional revenue to the fee. I then subtracted a 25% tax and reached the present value per new member. I then projected the value over the next decade, discounting it at an 8% WACC.

Author with data from Amazon 2021 Annual Report

The present value of a new Prime member for Amazon is around $930. Just to get an idea of what this means, you can see that at the bottom of my chart I calculated the total value that the new Prime members would bring to Amazon in the next decade. If Amazon grows at my forecasted rate and adds another 200 million subscription in the next decade, the total value that new Prime members will bring to Amazon will be around $190 billion. The question is: how will Amazon keep on adding new subscribers? Here is where the Lord of the Rings plays a role. Bear with me, I am not saying that Amazon will add 200 subscribers because of the series. But the series has indeed the power to attract some new subscribers. Along with the series, Amazon will need to add new benefits and promote its Prime features to gain new members.

Let’s go back to our topic. In fact, we can use this forecast for our purpose: understanding if Amazon can repay its Lord of the Rings investment. Now, if the value of a new Prime member is $930, Amazon needs just a little more than 1 million new subscribers to repay its initial investment for the rights and the first two seasons because the value of 1 million non-U.S. subscribers is $930 million for Amazon.

This scenario assumes that the new members will use Prime regularly, without an extra spending, as we could expect, on The Lord of the Rings merchandising on Amazon, which would clearly increase the value of their membership for the company. In any case, the real value of a new Prime member is about 11.6x its first annual fee paid. This is the key to understand what Amazon is doing.

I believe the series can easily gain 1 million new subscribers worldwide, given its appeal and its fan base. It will then depend on the quality of the first season if this number can increase greatly or not. However, I do expect that many fans will stick to watch the entire series, just like they did with The Hobbit, although they were finding it disappointing.

Thus, what seems a huge investment, is actually very easy to cover with the advantage of introducing many new members into the Prime ecosystem. We also have to keep in mind that since Amazon is going to release the eight episodes of the first season weekly, new members who want to watch the series will have to convert the 30-day free trial into an annual subscription.

Conclusion

I think that through the perspective of Amazon’s investment on the Lord of the Rings we can grasp a clearer understanding of how Amazon runs its business. Huge returns ahead thanks to the building of a big ecosystem.

In this article, we didn’t focus on AWS, which makes up an ever-increasing part of Amazon’s revenues and profits. Even though in this article we focused only on one action Amazon is undertaking, I consider the company as a whole a buy. With this article, I wanted to use the “all in a fragment” way of getting to know something, considering one particular aspect of the company to get a better grasp of the whole picture. Amazon’s investors should applaud the company’s aggressive investment policy because it is really building streams of future cash flows that will have a stability and a profitability not seen very often.

Be the first to comment