Elif Bayraktar/iStock via Getty Images

Introduction

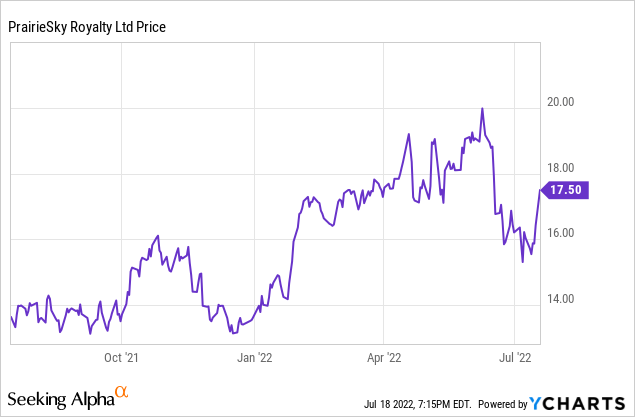

The easiest way to gain exposure to the oil price is by buying royalty companies as they get a cut of the revenue of the actual producers without having to deal with production costs and other operating issues. Sure, the torque on the oil price is lower but that also makes these royalty companies a more defensive idea to get exposure to the oil price. I have discussed PrairieSky Royalty (OTCPK:PREKF) a few times before here on Seeking Alpha. I was already happy with the company’s Q1 performance but the strong oil price in the second quarter resulted in the company reporting very strong quarterly results.

PrairieSky’s most liquid listing is on the Toronto Stock Exchange where it’s trading with PSK as its ticker symbol. The average daily volume is just under 650,000 shares per day, which clearly provides superior liquidity compared to the sub-25,000 shares changing hands on a daily basis on the OTC listing. Additionally, the TSX listing has options available which could be interesting to some categories of investors. I will use the Canadian Dollar as a base case throughout this article, unless otherwise indicated, as that’s the currency of PrairieSky’s main listing and the currency it reports its financial results in.

An excellent second quarter rapidly improves the balance sheet

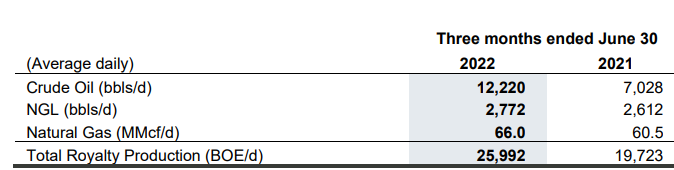

PrairieSky Royalty usually is the first royalty company to release its financial results and as the oil and gas prices are very high, I was looking forward to seeing the company’s Q2 report. During the quarter, PrairieSky reported a total oil-equivalent production of just under 26,000 boe/day. Perhaps I shouldn’t call PrairieSky an oil royalty company as less than 50% of the oil-equivalent production actually consists of oil. Just over 10% consists of NGLs but the remainder, about 40% of the oil-equivalent production rate, actually is the equivalent calculation of the natural gas production.

PrairieSky Investor Relations

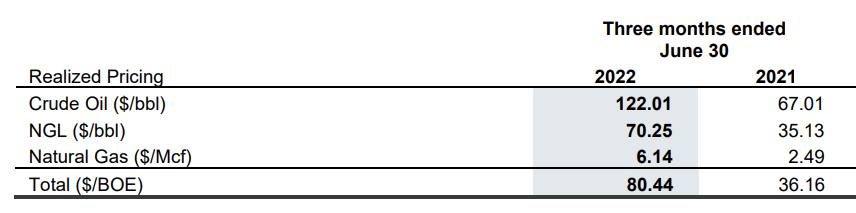

The average received oil price exceeded C$120/barrel while the average natural gas price more than doubled to C$6.14/Mcf compared to just C$2.49/Mcf in the second quarter of last year. The combination of the higher prices caused the average realized price per barrel of oil-equivalent to more than double from C$36.2 to C$80.44.

PrairieSky Investor Relations

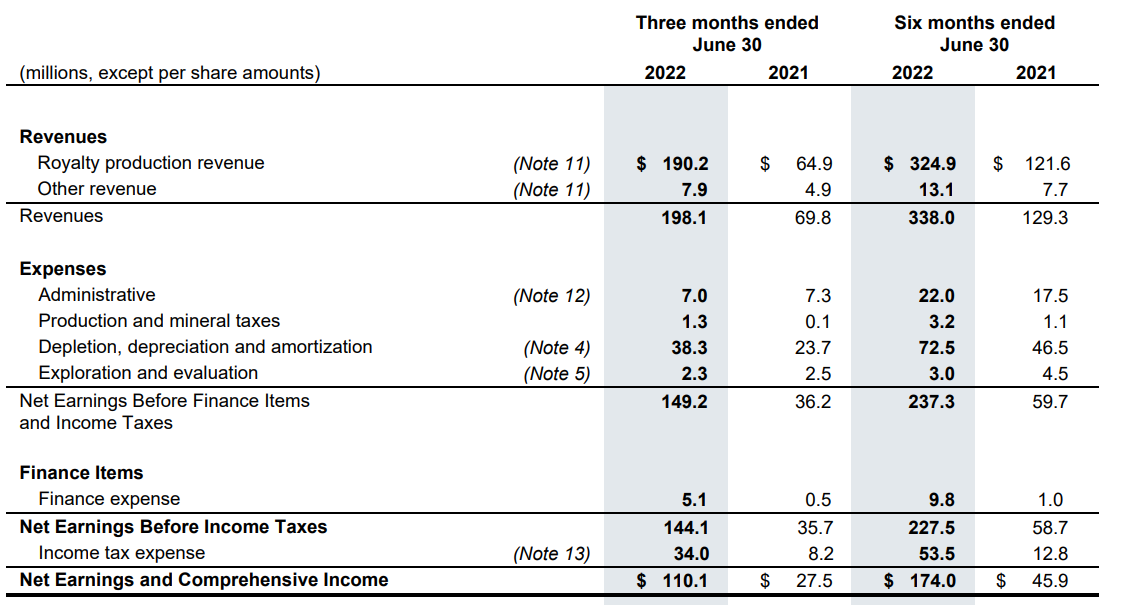

The total revenue in the quarter was approximately C$198M resulting in a pre-tax income of C$144M and a net income of C$110M which represents C$0.46/share.

PrairieSky Investor Relations

Operating a royalty business requires a lot of upfront capital but zero sustaining capital expenditures or investments: it is the operator’s responsibility to run the oil and gas fields. This has an important consequence for the royalty companies: the income statement has to incorporate the depreciation of the assets as the initial investment is depreciated over several years. But that also means the operating cash flow equals the free cash flow result (of course excluding new acquisitions) which traditionally means the free cash flow result is stronger than the reported net income.

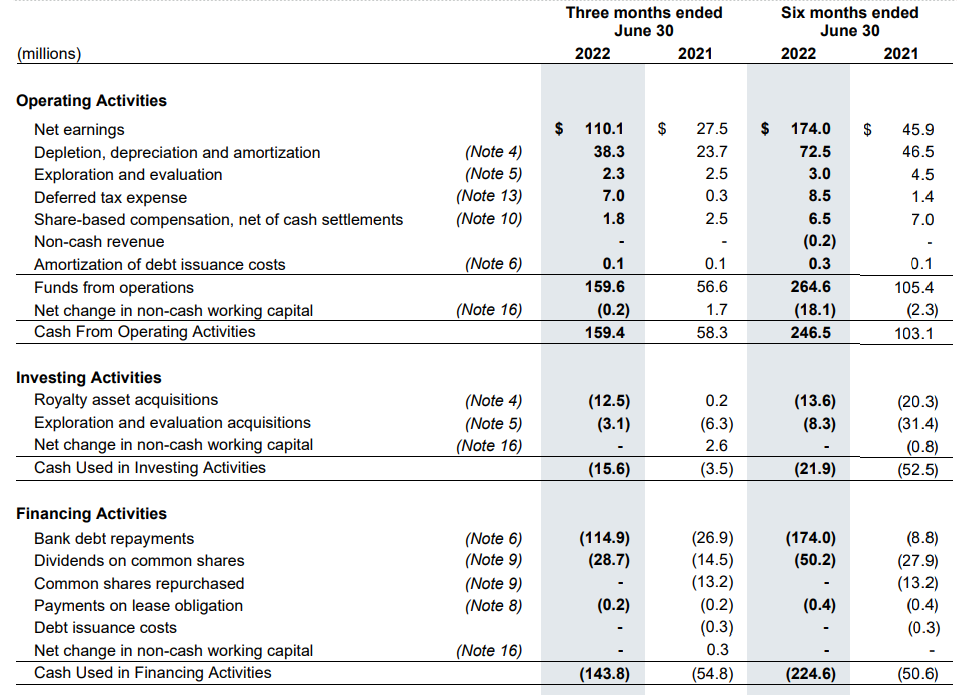

That obviously is also the case at PrairieSky Royalty. As the following image shows, the operating cash flow was approximately C$159M and the only capex were additional acquisitions of royalty assets and exploration and evaluation acquisitions (these are for instance the acquisition of databases).

PrairieSky Investor Relations

The free cash flow was C$159M and divided over the current share count of 239M, the free cash flow per share was C$0.665. This means the annualized free cash flow result was approximately C$2.66/share. Of course, that’s a best case scenario based on the realized oil and gas prices of C$120/barrel and C$6/Mcf, respectively.

Looking at the average realized prices in H1 of C$111/barrel (based on US$101/barrel WTI) and C$5.21/Mcf, the H1 free cash flow result was approximately C$264M or C$1.10/share. As PrairieSky is paying a quarterly dividend of just C$0.12/share, the vast majority of the free cash flow is retained on the balance sheet and that has helped to rapidly reduce the net debt which came in at C$470M as of the end of June compared to in excess of C$640M as of the end of December. This means that at this moment, the net debt has already dropped below the 1X FFO mark and will likely fall to less than 0.5 by the end of this year (using US$95 WTI oil and C$5 natural gas).

The sensitivity analysis below also shows the company will generate about C$260M per year in free cash flow using a natgas price of C$3.50 and a WTI oil price of US$50/barrel (a discount of 40% and 50% versus the Q2 results) and an average production rate of 26,000 boe/day. So even at those lower prices, the average annual FCF per share would be approximately C$1.1. At US$70 WTI this already increases to almost C$1.5/share.

PrairieSky Investor Relations

Investment thesis

PrairieSky Royalty remains one of the better royalty companies out there and in the past eight years, it has more than tripled the acreage it has a royalty on (to in excess of 18 million acres). The net debt is now decreasing very fast which could pave the way for additional royalty acquisitions.

I missed an excellent opportunity last week to add to my position below C$16/share but I intend to further increase my exposure to oil royalty companies as I need to get a bit more defensive when it comes to my energy exposure. The easiest way to reduce my risk is by taking some cash off the table from investments in pure producers and reinvest in the royalty companies.

Be the first to comment