zakokor

The court case between Twitter (NYSE:TWTR) and Elon Musk aired a lot of dirty laundry and a particular exchange of texts between Mr. Musk and Jack Dorsey made me realize that Jack Dorsey had no business being the CEO of Twitter, let alone two different public companies.

CEOs sitting around in their ivory towers of idealism need a reality check. I am certainly glad Elliott Management got involved in Twitter in early 2020, got a board seat and replaced Jack Dorsey with Parag Agarwal in 2021.

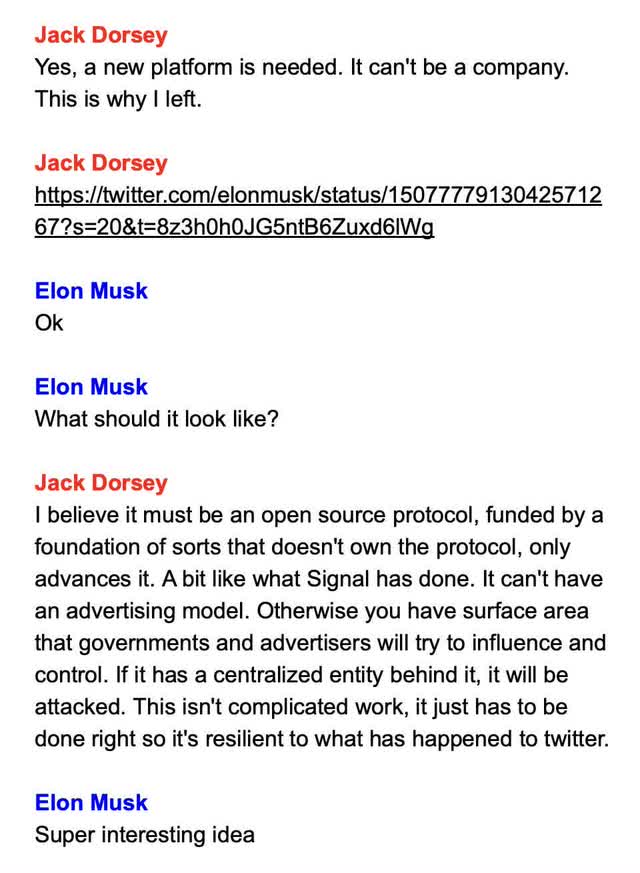

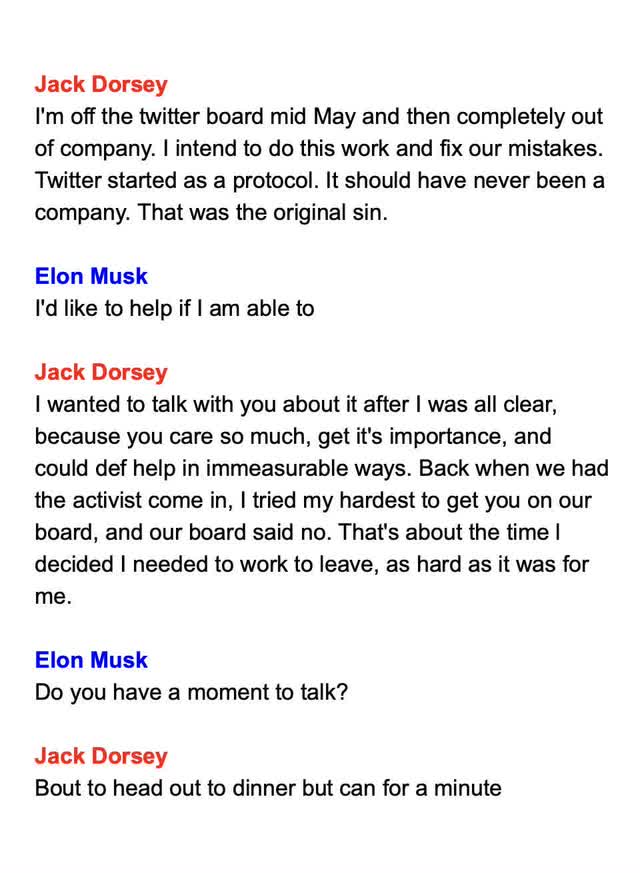

The specific text messages I am referring to are given below,

I have reviewed and followed over a thousand mergers during the last decade and I don’t think I have ever seen a saga as crazy as Elon Musk’s on again/off again acquisition of Twitter. The drama started even before a definitive merger agreement was inked where Mr. Musk wanted to purchase Twitter but Twitter was not interested in selling itself and adopted a poison pill provision. In an article on Seeking Alpha titled Battle For Twitter: Musk Is Offering A Fair Price three days before the merger was announced, I wrote that Elon Musk was offering a fair price for the company and concluded that article as follows,

The silver lining for long-suffering Twitter investors is that the stock is holding up well on account of this potential deal despite most technology stocks taking a big hit in recent days. Twitter is a unique property that has a lot of untapped potential. I think shareholders will do well to stay for the ride and see if a deal comes to fruition. Given current market conditions and the Fed’s plan to raise interest rates aggressively in the near future, Twitter’s stock can drop significantly if a deal does not materialize.

Jack Dorsey was not a fan of the Twitter board and was keen on Elon Musk acquiring the company. Twitter is an amazing concept and a very valuable social network that I have used every day for the past decade. I discussed the platform’s strengths in a 2017 article titled 10 Things Worth Celebrating About Twitter and was a shareholder long before the deal with Elon Musk was announced.

Unfortunately for us long-term shareholders, Twitter’s true potential was never realized. And how could it when its founder and CEO had ideas of running a public service non-profit instead of a company that served all stakeholders including its shareholders. If Jack Dorsey and team were interested in running a company only for its employees and to express their idealism, they should have founded a non-profit instead.

Private investors that participated in one of Twitter’s seven funding rounds from June 2007 through July 2011 did very well when the company went public in November 2013. However, public market investors have not been so fortunate. The stock went public at $26 per share and closed its first day of trading at $44.90. The price at which Twitter will once again go private is essentially around 20% more than where it closed on its first day of trading as a public company. This translates to a 20.7% return in nine years or a compound annual growth rate (CAGR) of just 2%.

Activist investors play a vital role by rattling the cages when management does not have the best interest of shareholders in mind. I wrote about this relegation of shareholders to the back seat while discussing Qualtrics (XM) earlier this year when I wrote,

Unfortunately while catering to customer and employee stakeholders, management teams sometimes forget that they’re running a for-profit company for the shareholders who invested in the company at various stages of its development. This is especially the case with public companies where the shareholder base turns over very frequently and shareholder interests are not adequately represented by the board of directors.

This relegation of shareholders to the back seat manifests itself in the form of very high management compensation, reporting of results using non-GAAP metrics that obfuscate what is happening underneath the surface, switching metrics used to measure the business from one quarter to another and more importantly stock-based compensation (SBC) that sometimes completely wipes out any profits the company may have generated.

There was so much that came to light as the Twitter acquisition saga unfolded and one of my key takeaways was to pay special attention to the work of activist shareholders. If anything, we need more activist involvement in small and micro-cap companies where mismanagement does not get the attention it deserves.

The drop in Twitter’s price today increased the spread on the deal to 5.65% if the deal closes at its agreed-upon price of $54.20. The court case is still active because neither party has filed a motion to halt the proceedings. If the deal gets done before the October 17th trial start date, it would make this spread one of the more attractive opportunities in merger arbitrage land.

A Combination Of Tools And Analysis For Event-Driven Strategies.

For over a decade we built tools to help event-driven investors that focus on strategies like merger arbitrage. The Inside Arbitrage service provides the best combination of tools and analysis for various event-driven strategies like risk arbitrage, spinoffs and SPACs.

We also track insider purchases and companies that are buying back their own stock while their insiders are making open market purchases. We use these strategies for idea generation and then do detailed work to identify opportunities for our model portfolio and personal portfolios. Click here to learn more.

Be the first to comment