marrio31/iStock via Getty Images

Inflation is the buzzword of the year, maybe even prized with back-to-back years. But inflation is not just a buzzword – it’s a reality. Recall experts and pundits repeating the narrative of “transitory inflation” and then supply chains touted as the number one cause of inflation. And now you’re hearing a war in Eastern Europe will pressure inflation further with oil at 14-year highs. If you don’t remember these things, you haven’t logged on to an Internet-connected device in 15 months. The truth is, these narratives are red herrings. They’re intended to distract from reality – it’s not as bad as it seems, the narrative goes, or simply, it’s “out of our hands.” Nevertheless, investors would be wise to prepare for continued elevated inflation since these narratives have driven poor policy.

My point of this article is to explain there’s only one reason and one reason only for inflation, and there’s only one way to curb it.

Before I go any further, you might wonder why I’m opining on a topic I have no formal expertise in. I’m a tech guy who writes about tech stocks. What would I know about macro monetary and financial policy?

The thing is, it doesn’t take an expert in economic theory to explain what’s going on. In fact, Fed Chair Jerome Powell just admitted as much last Monday when he said:

…how could economic forecasters have been so far off?

In my view, an important part of the explanation is that forecasters widely underestimated the severity and persistence of supply-side frictions, which, when combined with strong demand, especially for durable goods, produced surprisingly high inflation.

The experts were wrong.

Why? They were always looking in the wrong place. My personal opinion is they were either “hoping” it wasn’t as bad as it seemed for political reasons or were blatantly ignoring history and economic theory to twist us into an economic reality they desire.

In either case, they don’t deserve the title of economic forecaster or expert.

But furthermore, even Jerome Powell keeps peddling the narrative that supply chains are the cause of inflation. The truth is there’s only one reason for inflation, and that’s printing money without increased economic output.

I haven’t forgotten the slick-worded Internet pundits who thought they knew better as we began the pandemic printing spree. They told us printing money is a good thing in the long run, and deflation was the real worry, if anything. Printing should be used far more, the ideologues prescribed. There’s no cause for concern; you’re just being silly if you think inflation will be a problem, they hammered.

These are people you run away from. They intend to harm, not aid, their readers.

But their wording veils that.

That sounds harsh because it is harsh, but unless you understand how the world works, you could fall for their egotistical rantings under the guise of “all is well, I have the answers.” The NY Magazine article I linked to two paragraphs ago is a prime example.

Inflation Is An Equation

Some believe inflation doesn’t work the same today as decades ago because of how advanced we have gotten with transacting debt and financial instruments. But there are still two significant components to the economy: The monetary base and the economic output (or, at minimum, the confidence in future economic growth).

Let’s start with the monetary base.

Over the last two years, the US Federal Reserve has printed 80% of all US dollars in existence. This printing started at the onset of the COVID pandemic to provide stimulus checks to every American and other relief efforts. This occurred three times – April 2020, December 2020, and March 2021. These packages varied in size, with the first in March 2020 at $2.2T and the 2021 bill signed into law at $1.9T.

These packages and acts were not funded with balanced budgets and taxes. Instead, they were majorly funded by turning on the “dolla printa.” If you factor in QE (quantitative easing) to support the markets, $13T is the total bill for COVID relief, infrastructure, and economic stimulus. But only $1T of it was sent to Americans.

But this is just one of the two variables in the inflation equation – a whole lot of new dollars printed and then injected into the economy by the Fed buying debt.

The other variable is the expected or realized productivity from said printing.

Did those dollars spur on the economy?

Well, when you send a little bit of money to everyone, it doesn’t produce a larger output for the economy. Let’s face it, $3,200 to those making under the income thresholds across 11 months wasn’t going to start or expand a business and hire more people; it didn’t go to a more productive economy. No, Americans saved it because they were out of work or didn’t know if they would maintain their job if they were employed.

But lest we forget the massive unemployment benefits tagged onto this. That money was merely to keep Americans afloat. It didn’t spur the economy on any more than if they were working; it was a net-neutral output. So instead of the economy producing something and, in turn, paying those employees, the money was printed out of thin air and handed out in place of productivity.

Don’t get me wrong here. When the government puts people out of work because of lockdowns, they should foot the bill. The problem is thinking this wouldn’t have repercussions down the road and, more to the point, not getting ahead of those consequences to ease the pain on the other end – pain we’re now experiencing.

If you can’t quite grasp the concept of this economic equation, think about it this way. The more supply in the market of dollars, the less the dollar is worth, all else being equal. But if the economic output is boosted because of it, those dollars are chasing an ever-growing basket of investments (a growing economy), not all the same ones. However, when the economy isn’t pushed to grow, the dollars chase the same assets, and the dollar’s value falls.

If this is still a mystery to you, think about it in terms of shares of a company – something we can all understand. When a company issues more shares, it devalues the shares you already have. That’s an easy enough comparison to the dollar’s value; the more there are, the less they’re worth. Now move to the effects of that. The stock of this company will be worth less because the valuation is diminished; it’s now dividing profits among more shares, bringing the P/E ratio up (EPS is lessened). The stock reacts by falling, and shareholders are left with a sinking asset.

How To “Fix” Inflation

Now we come to the fork in the road about how to curb inflation because, as we know, there isn’t a benefit to the average American if their dollar is worth less and their everyday needs cost more if their income doesn’t grow as fast or faster than it. So the idea is to reign in the monetary base – the money supply. There’s a direct way to do that: Lend less. And how does the Fed lend less? It raises interest rates to deter lending (cause borrowing to cost something).

The problem is the pundits and so-called experts are doing everything but mentioning this key detail. Instead, they point to supply chains, the pandemic, oil, and various other things. All of these things influence free-market pricing, but none of them directly affect the dollar’s value.

But if raising rates is the answer to inflation – reiterated several times by Powell last week – and is what brings it back under control, why would the Fed do such a thing when the answer, according to some “experts,” is to simply increase the supply of goods? The answer for rates would then be to keep them low and dole out as much lending as possible to expand the supply of key commodities and goods. If the supply chain is what causes inflation, then the answer is more supply. If more supply is the answer, then more lending is the answer. If more lending is the answer, the lowest interest rates possible is the solution.

Raising rates is meant to reign in lending and shrink the money flow into the economy, reducing borrowing and leading to a reduction in inflation. If supply chains are the sole reason for higher inflation, then simply let them borrow as much as they need to expand supply. The answer should be to print more in the twisted logic of the experts!

And it has been the answer – and failed.

Going In Circles Avoiding The Elephant In The Room

Remember when they said things would moderate past the holiday season when demand moves beyond peak buying? Well, we’re past the seasonal high demand, yet inflation, according to the CPI, continues to increase.

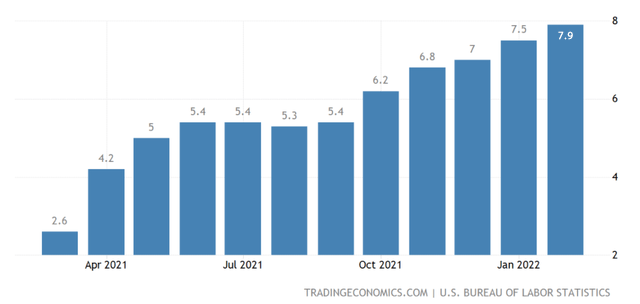

CPI readings from March 2021 to February 2022 (Trading Economics)

How is that?

For starters, supply chains don’t dictate inflation. If the theory of balanced supply and demand will reign in inflation was true, we would have seen lower readings in January and, for sure, February as holiday demand tapered off.

Let’s look at a direct example.

Why didn’t demand for lumber and other commodities in the immediate wake of the pandemic shutdown in 2020 not lead to inflation?

Think about it this way: Inflation didn’t start creeping in until April of 2021 – I’ll even say March 2021 – when it exceeded the “target rate” of 2%. But supply chains were more rattled in mid-2020 than today. I’m old enough to remember when the shelves were bare of meat, chicken, and pork in 2020. Inflation readings were at sub-2% and lower than March 2020, through all of 2020!

CPI readings from March 2020 to April 2021 (Trading Economics)

In comparison, lumber prices were up over 162% from the beginning of 2020 to their peak in September.

Lumber Prices (Trading Economics)

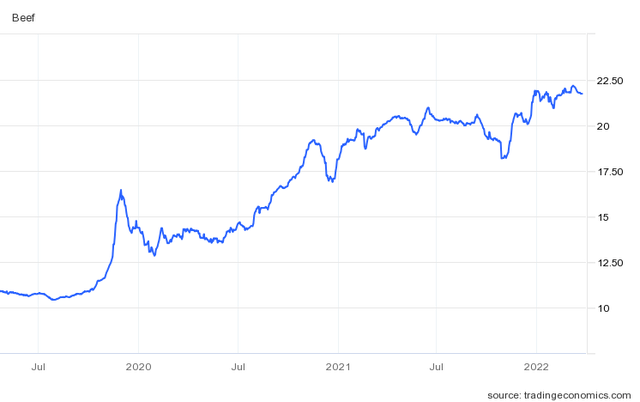

Beef was up 34% from January 2020 to its peak in November. In comparison, beef is up 13% since November 2020, but inflation, well…

Beef prices 2020 (Trading Economics)

Are you getting the picture? Supply chains were at some of their worst in 2020, yet inflation rose roughly only 1%.

There’s A Large Problem Looming, However

So why the delayed inflation response?

Inflation lags money printing by anywhere from 12 to 23 months. So when the Fed starts printing and buying up debt to inject the new money into the economy, inflation will take many months and sometimes over a year-and-a-half to rise.

Therefore, what we saw as the first spike in inflation in April 2021 was caused by the printing under President Trump in April of 2020 with the first stimulus package. This was a lag of 12 months. Notice the next leg up in inflation was in October of 2021, 10 months from the second package. The third package was in March of 2021. This means we’re on the cusp of experiencing further inflation.

Both the Trump and Biden administrations are equally at fault for higher inflation. My caution today is we are now approaching the inflation caused by the printing for the $1.9T package under Biden. The resolution to this requires idling the printer and spending in other ways while at the same time having the Fed reign in its monetary policy by raising rates and unwinding its balance sheet. However, this must be done carefully to not push the economy into a recession because the same scalpel meant to save can also be used to kill.

The interesting part is we’ll be coming up on lapping the higher readings from 2021. This means if things continue at the level they have been, the readings will naturally decrease. This is just like a company’s revenue growth rate slowing after lapping a period of high growth the year before. So the headline CPI numbers might look “better” come April and May, but the month-over-month numbers should be watched closely for changes in the growth rate.

But to get back to fixing inflation, the Fed is now doing the right thing. But analysts are questioning if it’s too little too late. During Jerome Powell’s press conference last week, a few journalists asked this question either directly or indirectly.

“Can the Fed stay ahead of the curve?” was the overarching question.

This is difficult to answer, but raising rates and running off the balance sheet is the process to attack high inflation. The problem is this can push the economy off its stilts. Less lending means less investing in economic expansion, but at the same time, it reduces the number of dollars chasing the same investments. The scalpel requires skill.

The risk is real in fixing this problem we’ve caused, but there’s only one way out of it: Rates must rise. But caution must be taken to achieve the Fed’s “soft landing.” Inflation will continue its upward pressure because we haven’t seen the end of the lagging effects from 2021. Therefore, the new phase of monetary policy will appear like it has little effect. But it may be much worse if the Fed didn’t act, even though I find their actions to be woefully behind in terms of timing.

Just be ready for round two and the market to wince when the time comes.

Be the first to comment