MF3d

Note:

I have covered Plug Power (NASDAQ:PLUG) previously, so investors should view this as an update to my earlier articles on the company.

Last week, Plug Power added another chapter to its decade-long story of over-promise and under-deliver:

Plug Power Inc., a leading provider of turnkey hydrogen solutions for the global green hydrogen economy, provides revenue expectations update for 2022. The company believes that its prior full year 2022 revenue guidance of $900-$925M could be 5% -10% lower for the year. The revenue impact reflects some larger projects potentially being completed in 2023 instead of 2022 due to timing and broader supply chain issues. While revenue could be lower than previously anticipated in 2022, demand for the fuel cell applications and electrolyzer business remains robust.

The Company recently became aware of the potential impact to its full year 2022 revenue and believes it is prudent to update stakeholders. It is important to note that the company expects the completion of the projects no later than 2023. Plug is excited to communicate in more detail on its near, medium and long-term guidance as well as path to profitability during the Plug Symposium on October 19th, which will be hosted and broadcast from its Gigafactory in Rochester, New York.

Quite frankly, investors would be well-served to scrutinize management’s explanations for the shortfall and claims of “robust” customer demand as disclosures made in the company’s most recent quarterly report on form 10-Q actually point to substantially reduced customer demand in the company’s core fuel cell systems and hydrogen infrastructure segments which mostly represent Plug Power’s material handling solutions:

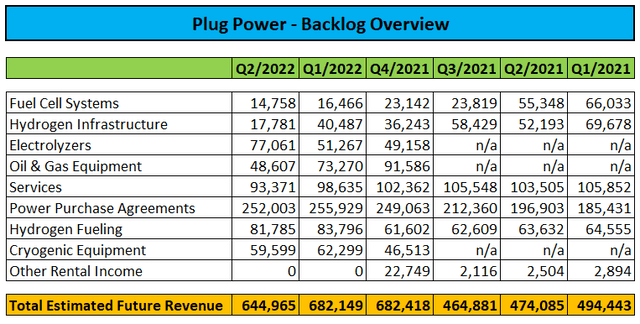

Even backlog increases in the much-touted electrolyzer segment have been nowhere near the levels required for the company to come even close to the $140 million revenue number projected by CEO Andrew Marsh for the second half of this year.

In combination, backlog in the core fuel cell systems and hydrogen infrastructure segments was down 43% sequentially and 70% (!) year-over-year. In fact, this was the fifth quarter in a row with declining backlog in these segments.

Keep in mind that key customers like Amazon (AMZN) and Walmart (WMT) have been experiencing massive COVID-related tailwinds for most of the past two years but elevated inflation and resulting higher interest rates have caused consumers to cut back on spending in recent months.

Amazon alone has reportedly paused, delayed or canceled more than 40 sites this year after heavily expanding its distribution network during the pandemic.

Investors should also note that Plug Power does not intend to continue sales of engineered oil and gas equipment (the former Frames Group business) beyond current commitments which represents an annualized $100 million revenue headwind.

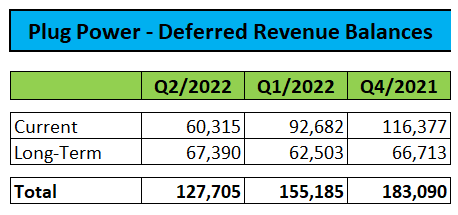

The poor condition of the business is also visible in the massive reduction in short-term deferred revenue balances over the past two quarters:

Company SEC-Filings

Quite frankly, given the apparent weakness in the core material handling business and still insufficient electrolyzer backlog, I have no idea how Plug Power would come even close to the low end of the revised guidance range.

For example, achieving $825 million in full year revenue would require second half sales to increase by more than 80% over H1 despite core fuel cell systems and hydrogen infrastructure backlog being at multi-year lows and headwinds from substantially reduced deferred revenue balances.

Also keep in mind that adjusted for recent acquisitions, Q2 revenues were actually down by 16% year-over-year. While growing electrolyzer sales might offset some of the material handling segment’s declines, it is still difficult to envision 80%+ growth over H1.

Even generously assuming the core business to remain stable year-over-year, a $90 million contribution from recently acquired businesses and the company achieving $100 million in electrolyzer sales in H2 (despite backlog of just $77 million at the end of Q2), would result in full-year revenue to come in below $800 million.

In fact, this number would be below the $825-$850 million range provided by management for 2022 before last year’s acquisitions of Frames Group, Applied Cryo Technologies and Joules Processing.

But assuming the 16% year-over-year decline in the core business witnessed in Q2 to persist and electrolyzer sales being more in line with the disclosed backlog number at the end of Q2 (which might still prove to be a generous assumption), the company’s full-year sales number might end up closer to $700 million.

Bottom Line

Based on management’s abysmal track record and contradicting disclosures in the company’s regulatory filings, investors should scrutinize the explanations provided for the projected shortfall in revenues.

Judging by recent movements in core backlog numbers and deferred revenue balances, the company’s is clearly experiencing weak customer demand which won’t be offset by anticipated growth in electrolyzer sales.

Given the apparent weakness in the core material handling business and still insufficient electrolyzer backlog, it is difficult to envision Plug Power’s full-year revenues coming even close to the revised guidance range.

That said, I still expect management to paint the usual rosy picture on the company’s annual symposium this week and largely keeping long-term profitability projections intact.

Speculative investors looking to get short the shares should wait until the symposium has passed as the company tends to announce new orders and collaborations going into the event.

Be the first to comment