Justin Sullivan

Article Thesis

Growth stocks have come under pressure this year, which has made many of these companies more attractive than they were a couple of months ago. This also holds true for The Trade Desk, Inc. (NASDAQ:NASDAQ:TTD) and Roku, Inc. (NASDAQ:NASDAQ:ROKU), two media tech companies that have experienced a lot of business growth in recent years. In this article, we’ll pit them against each other to see which one comes out on top.

How Are The Trade Desk And Roku Different?

Both are media tech companies, but their business models differ considerably. The Trade Desk is a digital advertising technology provider that allows customers to create and manage digital advertising campaigns for computers, mobile phones, and connected TVs. This includes video formats, audio, display advertising, and so on.

Roku is a TV streaming platform provider that lets its user watch a wide range of video content, including live television, movies, TV episodes, and so on. It also licenses Roku-branded TVs and other hardware and offers digital advertising services as well as billing services to customers.

Even though their business models are different, there’s some overlap in the advertising space. Both companies benefit from the rise of streaming and more personalized media that comes along with more personalized advertising and similar trends.

The Trade Desk And Roku Stock Key Metrics

Both companies have showcased compelling growth in recent years, but there are important differences:

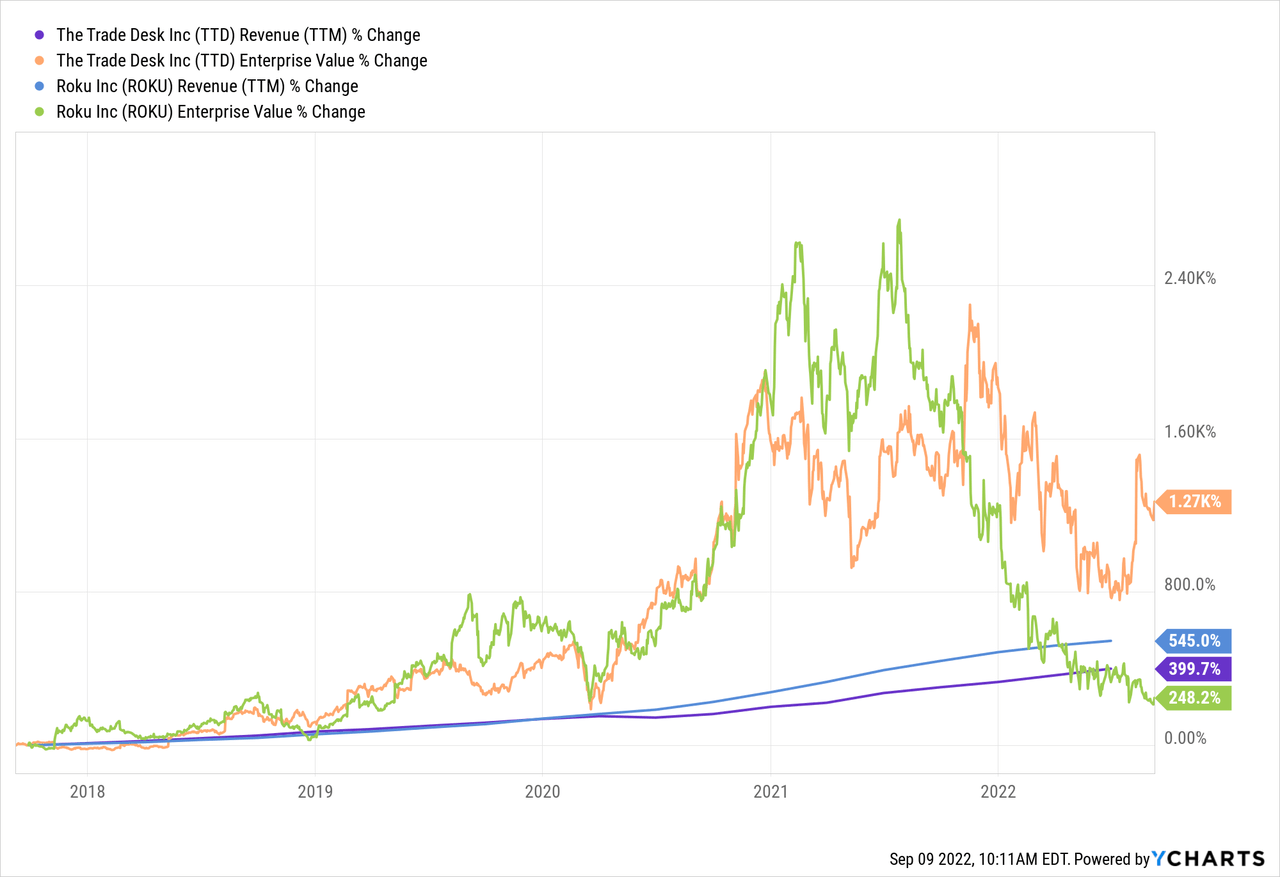

ROKU has grown faster than TTD over the last five years, reporting a 550% revenue gain versus a still-strong 400% revenue gain from The Trade Desk. At the same time, The Trade Desk saw its enterprise value (market capitalization plus net debt) rise way more than Roku did over the same time, as growth totaled 1,300% and 250%, respectively. We can thus say that ROKU became cheaper over the years, at least on an enterprise value to sales basis, as its revenue expanded way more than its EV. Meanwhile, The Trade Desk became more expensive, as its enterprise value rose around 3x as fast as its revenue, resulting in considerable expansion of its enterprise value to sales multiple.

During the most recent quarter, The Trade Desk saw its revenues grow by 35% year over year, which beat estimates easily. That was a little less than its growth during the previous quarter, but overall sales growth remained very compelling in H1, at 39%. The Trade Desk is profitable on an adjusted basis, although the company had to report a small net loss on a GAAP basis. The difference can be attributed to items such as share-based compensation expenses that were excluded in the adjusted/non-GAAP numbers. Profits also improved on a year-over-year basis, as some margin compression was more than offset by the higher revenues that were generated during the more recent period.

Roku Inc. saw its revenues rise as well, but at only half the rate TTD achieved. Roku’s revenues rose by 18% year over year, which was worse than what the analyst community had forecasted. Roku saw its margins drop as well, as gross profit rose by only 5% year over year despite a more than 3x higher revenue growth rate. Roku reported a net loss for the period, again missing estimates. During the previous year’s period, Roku had generated a net profit.

We can thus say that even though ROKU had the better 5-year performance, its more recent results were considerably worse than those of The Trade Desk. Not only did ROKU grow at a much slower pace, but its margins also fared worse and the company underperformed expectations. Meanwhile, TTD continued its history of beating estimates — the company has done so during every quarter since it went public, which is a very strong feat that suggests that Wall Street is perpetually underestimating TTD.

Looking at the near term, TTD also seems to be better-positioned. TTD is forecasted to grow its revenue by 28% and 29% over the next two quarters, respectively. Considering the company’s history of outperforming expectations, growth in the low-30s range seems achievable. Roku is forecasted to grow its revenue by just 3% and 6% in the next two quarters. And unlike TTD, ROKU has recently been missing estimates, thus the risk of a downside surprise is more pronounced, I believe.

Roku is also forecasted to see its losses grow during the next two quarters, whereas analysts are predicting that TTD will generate some earnings growth in the same time frame. That makes sense, as TTD’s better gross margin performance in recent quarters and its stronger revenue growth rate allow for better operating leverage. ROKU, with its rather meager sales growth, will likely not do the same, and since costs have recently been exploding at the company, it seems realistic that losses expand. Roku’s guidance for the current quarter sees the company generate an EBITDA loss of $75 million — that does not yet factor in interest expenses, depreciation, amortization, and it’s a non-GAAP/adjusted number, thus share-based compensation and the like are excluded as well. When Roku can’t even break even under those conditions, that doesn’t paint a rosy picture about its profitability in the foreseeable future.

Are TTD And ROKU Stock Overvalued?

In retrospect, it is very clear that Roku was extremely overvalued in the past. Its shares have dropped by 79% over the last year, meaning that some investors would need a 400% share price increase just to break even. TTD is down versus its 52-week high as well, but its fall has been way more benign — it’s down 17% over the last twelve months.

Whether these two companies are overvalued today is a different question, however.

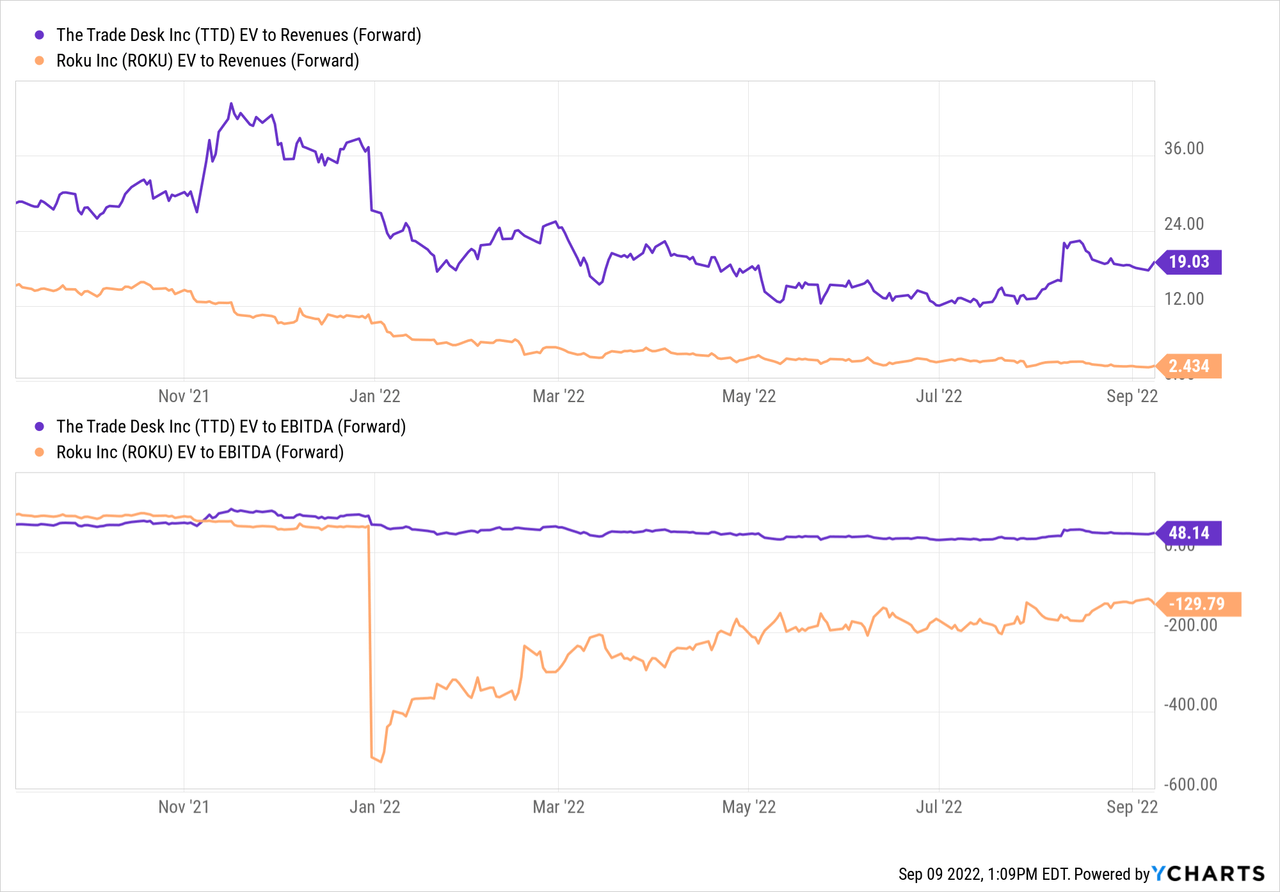

On an enterprise value to sales basis, Roku seems cheap, while TTD seems expensive. That being said, investors want earnings, not sales — if sales aren’t profitable, there’s no potential for dividends and share price appreciation seems unlikely.

TTD is at least slightly profitable, but its valuation is pretty high, as it trades for 48x forward EBITDA. Roku is forecasted to be unprofitable on an EBITDA basis, which aligns with management’s guidance, thus we can’t calculate a (meaningful) EBITDA multiple. The same holds true for Roku’s net profits, while TTD trades at 55x next year’s expected earnings per share.

When it comes to TTD, I’d say it is a pricey stock today. On the other hand, its market position is strong and it experiences compelling business growth. If that can be maintained, improving scale could lead to rising profits over the next couple of years, which is why the current valuation could be justified. If TTD doubles its profit between 2023 and 2026, which seems achievable, then its earnings multiple drops to the high-20s. That’s still not low, and we are talking about 2026, but TTD would arguably still be a fast-growing company then.

Roku hasn’t grown much in the recent past and the near-term outlook is worse. Its profits are moving in the wrong direction, as losses are increasing. I also do not see any immediate catalyst for the company to become more profitable and reverse recent trends. If the company can reverse course and generate meaningful profits eventually, it might be a solid investment. But as long as that is not materializing, I think that Roku does not seem like a solid investment at all.

Is The Trade Desk Or Roku A Better Buy?

Roku was a great pick for those that bought it at the lows and rode it to its highs. On the other hand, many investors have lost a lot of money buying it at a massively inflated price. But even today, following an 80% share price drop over the last year, Roku does not seem like a great value at all. With business growth slowing down and profitability issues growing, it’s not a stock I’m interested in at all.

The Trade Desk does not look cheap, but things are at least moving in the right direction here both when it comes to profitability and when it comes to business growth. If the company can maintain its growth trajectory for a couple of years, the current share price could be justified. I personally am not buying here, but I do believe that it looks like a stronger growth story and better pick from a fundamental basis, relative to Roku. If I had to buy one today, I’d pick TTD over ROKU.

Be the first to comment