Khanchit Khirisutchalual

The following segment was excerpted from this fund letter.

The Trade Desk (NASDAQ:TTD)

The Portfolio first purchased The Trade Desk in Q4’17. The Trade Desk is a software platform that helps advertisers filter, value, and purchase the supply of digital ad inventory (display, mobile, social, connected TV, connected audio) available across the world. There is a long-term secular trend of more media moving online, providing the advertisers the ability to use data to reach targeted consumers. The Trade Desk provides price discovery for advertisers by using data (programmatically) to value inventory for an advertiser’s specific goals.

In the digital advertising value chain, there is a marketplace where ad inventory is bought and sold. Sellers of ad inventory called sell side platforms (SSPs) run auctions for publisher’s inventory through ad exchanges, selling it to the highest bidder. Buyers of ad inventory, called demand side platforms (DSPs) like the Trade Desk, have to “look” at the auctions being run in order to potentially bid on the inventory for their advertising customers. Programmatic advertising provides the ability for one-to-one targeting using granular data to determine ROI on ad spend.

Trade Desk’s competitive advantage comes from its high operating leverage and economies of scale. In order to be effective, DSPs must look at all available auctions being run. Looking at each auction costs money even if no bid is made. The only way for the DSP to monetize “looking” is to win the auction. However, the more an advertiser pays for inventory, the lower the ROI on ad spend, but too low of a bid would risk losing the auction. Therefore, The Trade Desk helps the advertisers determine how much specific inventory is worth for their specific goals.

The Trade Desk picks inventory for its advertising customers from over 500 billion digital ad opportunities every single day, which is expected to cost over $300 million in platform operation expenses this year. If another DSP had half as much ad spend as the Trade Desk, to be as effective they would still have to look at all 500 billion ad opportunities, but platform costs per ad dollar would be twice as much. This makes it very difficult for a subscale DSP to be profitable.

Alternatively, the smaller DSP could just look at half of the ad opportunities, therefore cutting their auction expenses in half. However, they would have less premium inventory to choose from so advertisers would get a worse return on their ad spend. This naturally gravitates advertisers to the DSP with the greatest scale. Essentially, there is a minimum level of cost that a DSP must incur by looking at all available inventory in the world in order to provide a similar value proposition. This dynamic only increases as programmatic ad inventory proliferates in the future.

There is also a two-sided network effect. It costs SSPs money to send an impression out to bid to each DSP. SSPs only get paid if the impression is sold. Therefore, SSPs only want to send impressions to the DSPs that are most likely to win the auction. They concentrate bid requests to the scale DSP buyers like The Trade Desk. Then The Trade Desk can pick through all the available inventory, bid on the highest-return impressions, and refine its bidding based on historical prices, which improves return on ad spend and attracts more advertising dollars from its customers.

Advertisers want to use the DSP that has access to the most ad inventory because it increases the chance they will get access to the best inventory for their campaign goal. Having the most advertising customers attracts more inventory, which attracts more advertising customers.

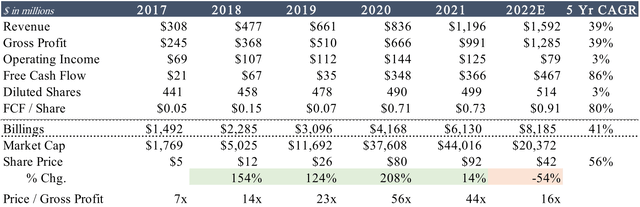

While The Trade Desk has established itself as the dominant independent demand side platform, growing its relative advantage each year, it does trade for a high multiple based on recent fundamentals. When valuing The Trade Desk, question is how many ad dollars would have to go over The Trade Desks platform to justify a $20 billion market capitalization?

Long-term, global ad spend will continue to grow in line with the global economy, digital ad spend will grow as a proportion of total ad spend, and all digital ad spend will be allocated programmatically. For market perspective, global advertising spend was $780 billion in 2021, digital advertising made up nearly $400 billion of it, and programmatic advertising made up nearly $45 billion of digital. The Trade Desk is expected to have ~$8 billion of ad spend in 2022.

Over the next five years, programmatic ad spend is expected to grow at a 15% CAGR, reaching ~$120 billion by 2028. The Trade Desk should continue to take share of programmatic ad spend going forward rising from an expected ~16% share in 2022 to 25% share in 2028. That would provide gross ad spend on The Trade Desk of $30 billion and assuming a 20% take rate provides $6 billion in revenue, growing at a 30% CAGR.

Operating margins near end state are expected to be ~40% which seem possible given their relative competitive advantage to smaller competitors and the cost structure of their platform business model, providing $2-$3 billion in operating income.

Growing revenue 25-30% from a $1.6 billion base is not the norm when it comes to most businesses. Few have accomplished such feats. However few businesses have had a globally scalable platform like the Trade Desk that benefits from winner take most dynamics. Unlike most linear businesses, it does not get weighed down by size. The bigger The Trade Desk gets, the stronger its business gets. It has high operating leverage which requires nominal costs to support increasing ad dollars to go over its platform.

While the above scenario would result in a highly favorable outcome to shareholders, the big returns will not come from owning The Trade Desk over the next five years, but over the next 5-20 years. $25-$30 billion in ad spend in 2028 is still a drop in the global ad spend bucket. There is a potential future where all digital advertising is allocated programmatically over a single platform and that platform could very well be The Trade Desk, in which case it would be one of the most valuable businesses in the world.

But let’s not get ahead of ourselves, for that to happen the major digital media company walled gardens Alphabet (GOOG, GOOGL), Meta (META), and Amazon (AMZN), which control about 2/3rd of digital advertising, would have to come down and be part of the open internet, but that is a topic for a different letter. For now, we are happy holding on tight to our shares for what is bound to be a volatile but likely very lucrative journey.

|

Source: Company filings, Factset, Saga Partners Note: 2022E values are Factset consensus expectations, market cap and share price are as of 6/30/22. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment